Policy Package to Sustain a Virtuous Cycle of Wages and Prices

July 15, 2025

X-2025-028E

Impact from the Trump Tariff Shock

After U.S. President Donald Trump announced reciprocal tariffs on a country-by-country basis on April 2, 2025 (which he termed “Liberation Day”), Japan’s management of its economic and fiscal policy was plunged into a radically changed environment. The prior, exceedingly generous expectation that Mr. Trump would develop strong economic policies due to his background as a businessman was betrayed, and his high tariff policies, which defy conventional economic principles, have led to an increasing risk of a stalled global economy. Although there have been signs of a course correction with the concurrent decline in stocks, bonds, and currencies, the unpredictability that Mr. Trump considers the secret to "deals" is deeply unsettling to the business community, and the global economy will continue to face the significant downside risks that result. In this context, the Trump tariffs have presented a situation that is truly troubling for Japan. The unexpected shock came at a critical juncture, amid the beginning of a long-awaited escape from years of troublesome deflation, and amid the budding virtuous cycle of wages and prices, which is a precondition for economic, fiscal, and social security reconstruction.

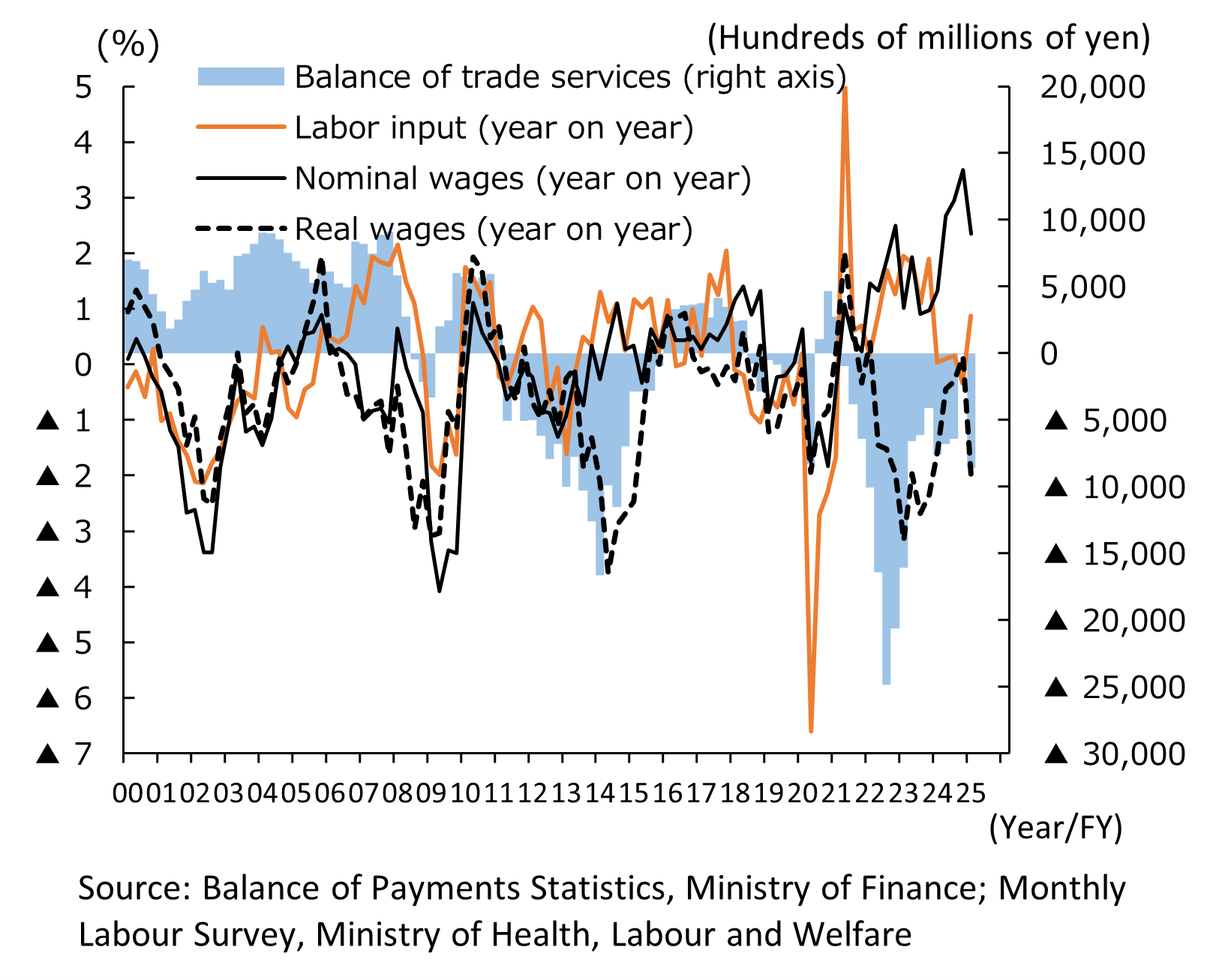

In retrospect, the global surge in prices that followed the onset of the pandemic, combined with structural factors such as the underlying trade balance deficit and intensifying labor supply constraints, significantly mitigated the deflationary norm that had plagued Japan for decades, and enabled the restoration of a natural economy in which prices and wages rise in tandem. Japan had emerged from an anomaly where base salary increases were less than one percent; by 2023, the spring wage increases were at the highest in 30 years. In 2024, the growth rate recovered to bubble-era levels, and leading into 2025, this was poised to soar even higher. The shock of the Trump tariffs came just as expectations were rising that nominal wage growth would steadily increase and that real wages, which had been negative for some time, would finally turn positive (see appended chart).

(Chart) Japan's trade balance, labor input, and nominal wages

Virtuous cycle of wages and prices: A prerequisite for fiscal and social security system reconstruction

In the current situation in Japan, where enormous budget deficits have become the norm, establishing a simultaneously positive trend in both nominal and real wages is a crucial prerequisite for rebuilding a sustainable fiscal policy and social security. The current state of Japan's public finances, with its unprecedented national debt, is unsustainable, making the nation's social security system also unsustainable. To restore the sustainability of Japan’s social security systems, natural revenue increases will hardly be sufficient; it will require either spending cuts or an increase in the public burden. When it comes to spending cuts, an increase in defense spending is inevitable given the current state of international affairs, and cuts in social security, which accounts for the largest share of spending, are unavoidable. However, there is a limit to this, as casually cutting social security will fuel public unrest and worsen consumer spending, ultimately causing the economy to decline. A recession would reduce tax revenues, resulting in a negative impact on public finances. In other words, in such a heavily indebted country, sustained economic growth will be essential to restore the fiscal health of social security. To achieve such growth, a recovery in personal consumption will be required, as the country cannot rely as heavily on foreign demand as it once did due to the trade balance deficit. In this regard, bolstering public confidence in the social security system is a prerequisite. To achieve this, it is essential not to cut social security spending casually, but instead to qualitatively enhance social security and raise taxes and social insurance premiums in a way that is acceptable to the public.

The funding source to sustain increases in both taxes and social insurance premiums is, ultimately, household income. The largest source of this household income is employer compensation, and since the number of employees cannot grow in a society with a declining population, higher wages will be essential. From the perspective of households' ability to bear financial burden, it is important to have sufficient positive real wages, but it is also essential to have positive nominal wages. To streamline the fiscal structure, including the social security portion, the concept of reducing spending in certain areas and shifting this excess to necessary areas has consistently met great political resistance, leading to many failures of structural reforms designed for a deflationary economy. However, if nominal wages are positive and inflation is moderate, resistance can be reduced by distributing funds significantly to areas where growth is preferable, without reducing those areas that would be better downsized.

In this sense, the first milestone for the reconstruction of the economy, public finances, and social security becomes a simultaneous positive growth rate of both nominal and real wages through a virtuous upward cycle of wages and prices. As the Trump tariff shock hit Japan precisely when the country had begun to put these conditions in place, the Japanese government should focus all its efforts on sustaining the virtuous cycle of wages and prices that has finally begun to take hold.

Policy package to sustain a virtuous cycle

The most significant immediate risk that could derail this virtuous cycle is uncertainty. A lack of clarity about the future will lead companies to cut costs, curb capital investment, and suppress wages. In reality, overtime and bonuses will be reduced over the next year or so, and a decline in the average nominal wage growth rate at the macro level will be inevitable. What is essential, however, is to maintain the upward trend of base salary increases.

If this topic is considered from a dispassionate standpoint, it is in fact a rational decision for corporate management to sustainably raise wages over the medium to long term. There are three reasons for this. First, with various costs are on an upward trend, increasing sales is essential for a company's survival, and raising wages is the only rational decision to make to this end. Second, though optimism may be difficult to accept, Mr. Trump has no intention of significantly worsening the U.S. economy, and the U.S. economy is expected to pick up in 2026, when the country is to hold its midterm elections, with the global economy expected to turn upwards in kind. Third, while maintaining distance from the U.S. and China, it is possible to expand a large-scale free trade zone in the form of the Trans-Pacific Partnership and partnerships with the EU. To cultivate growth industries based on the above, aggressive investment in human resources and wage increases in these fields will be necessary.

What is required of the government now is to disseminate information so that a rational vision based on such a long-term and dispassionate perspective can be shared by the entire nation, and to present a concrete policy package that will make the realization of such a vision convincing. I believe that the following four pillars should be the mainstay of the specific policies on offer.

The first pillar is to implement a flexible fiscal policy in the event of an economic downturn. As already mentioned, it is expected that the high tariff policy imposed by the U.S., which has an unduly adverse impact on the economy, will eventually be corrected before the midterm elections next fall. However, for the time being, high tariffs will be maintained, and their negative impact on the economy will begin to be felt in earnest. As a result, the Japanese economy faces the risk of a significant downturn from now through the fall, and it is necessary to have policy offerings in place to prepare for this. The Trump tariff shock can be viewed as an incidental external shock, much like the global financial crisis or the COVID-19 pandemic. In light of soaring food prices, we believe that one-time payments to relieve livelihood concerns and cash management measures for companies should be implemented without hesitation. However, a cut in the consumption tax, which has been the subject of smoldering debate in some quarters, should be avoided. From a medium- to long-term perspective, it is essential to present the benefits of social security in an easy-to-understand manner and instill in the public the awareness that it is natural to bear the necessary burden for this. A consumption tax cut would run counter to this logic. Furthermore, once a consumption tax cut is carried out, it is difficult to reverse, threatening instead to negatively affect the economy by creating a hole in public finances over the medium to long term, thereby eliminating confidence in the social security system.

The second policy pillar is vigorous consolidation support measures in anticipation of a declining labor force. These measures are designed to improve productivity, which will be the source of medium- to long-term wage increases. Given that labor shortages are a structural problem, companies that cannot raise wages will soon find it difficult to survive, but such adjustments are expected to occur ahead of schedule going forward. Inept handling could lead to a chain of bankruptcies and trigger a market overshoot that would send the economy into a downturn. To avoid this, in addition to a flexible fiscal stimulus package, it is essential to use this as a lever to stimulate the consolidation of management resources, both human and financial, in companies that are capable of raising wages. Specifically, it would be effective to boost stimulative effect through tax incentives for mergers and acquisitions and business succession, and subsidies for loans when promoted by financial institutions. Furthermore, measures to increase productivity as one aspect of entire specific industries within a specific region are necessary. For example, Japan’s Group Subsidy Scheme could be improved (by improving the small and medium-sized enterprise group subsidy [Nariwai Reconstruction Assistance Grant] provided on earthquake reconstruction), providing support for the creation of regional industrial brands and of joint systems for human resource development (joint use of trainers, etc.), as well as blanket support for joint use of DX promotion consultants, and other efforts.

The third pillar is the stimulation of price shifting, which is key to securing resources for wage increases by small and medium-sized enterprises. The government has already launched various measures, such as Declarations of Partnership Building, Guidelines for the Promotion of Appropriate Subcontracting Transactions, Etc., and Guidelines for Price Negotiations to Appropriately Pass Through Labor Cost, which have gradually led to shifted prices. However, this process is still far from complete, and ultimately a norm needs to be passed on to consumers that if a product or service is valuable, it is natural for its price to rise. It is important to remember that added value is the foundation for passing prices on to consumers, and that companies must work to help themselves as a prerequisite. In this sense, each company needs to clarify the customer value that it can uniquely offer, concentrate its management resources on businesses targeted at customers who are willing to purchase at a reasonable price, and persistently work to raise prices appropriately. The government can provide a boost by collecting and publicizing good practices such as these and certifying products and services that are good for the environment and society as premium products.

The fourth pillar, which is a one-off policy measure, is to increase minimum wages, focusing on sectoral minimum wages. The major issue at hand regarding minimum wages is what to do about the target of 1,500 yen before the end of the 2020s, set by Prime Minister Ishiba. Even if the target is not dropped, an increase of more than 7% in FY2025 is not realistic. Rather, the focus should be on addressing specified minimum wages. Under the current situation where low-wage industries suffer more from labor shortages, a drastic increase in minimum wages combined with enhanced policy support in specific industries in specific regions would be a plus for companies in terms of securing human resources. In particular, the government should step in to raise the wages of essential workers in the nursing and welfare sectors, where public intervention is possible. This will require both direct financial support for wage increases and intensive efforts to improve productivity through the use of digital and robotic technologies.

My hope is that a vision will be established for a policy package that includes the above measures, and that meetings of political, labor, and business management representatives will be held as early as possible, before business sentiment cools, to broaden the common understanding that wage increases are reasonable and to take concrete steps to implement such a package.