Economic Policy Thinking since the Great Recession (3): Post-Pandemic Pandemonium

December 1, 2023

R-2023-040-3E

In the third and final article in this series, former BOJ executive director Hideo Hayakawa offers a preliminary assessment of recent policy trends against the background of the war in Ukraine, inflation, and other post-pandemic challenges.

* * *

In the previous article in this series, we saw how the COVID-19 crisis shaped economic policy thinking during the pandemic.[1] In the third and final installment, we explore recent policy developments driven by the economic and security challenges—new and old—of the post-pandemic world.

Invasion and Inflation

As discussed in my last article, one conspicuous policy trend during the pandemic was a surge in international harmonization and coordination, notwithstanding ongoing economic tensions between the United States and China. Prime examples are (1) the coordinated response to the financial crisis of March 2020, including expansion of dollar-swap arrangements; (2) the establishment of the European Union recovery instrument (NextGenerationEU), a step toward European fiscal integration; (3) the COVAX initiative to make COVID-19 vaccines widely available in developing countries; (4) stepped-up decarbonization commitments and initiatives; and (5) progress toward international tax coordination, such as the agreement on a minimum corporate tax rate and digital taxation. The global challenge of COVID-19 and a rising awareness of the risks of climate change were among the key factors driving this trend.

The cooperative mood did not last, however. After Russia launched its invasion of Ukraine in February 2022, global divisions deepened dramatically, with the United States, Europe, and Japan on one side and Russia and China (its implicit supporter) on the other. This hostile climate limited the possibilities for effective policy coordination.

Meanwhile, persistently high inflation, particularly in the United States and Europe, caught policymakers by surprise and triggered a shift in focus from fiscal to monetary policy. In the following, we will look at recent policy trends against the background of these new challenges to economic stability.

Monetary Policy Resurgent

As noted in the previous article, the world’s major economies responded to the COVID-19 crisis with extremely aggressive fiscal and monetary policies. In terms of the latter, there was little or no room for lowering interest rates, but the central banks’ balance sheets expanded dramatically as they injected funds into the financial system to support troubled businesses. At the same time, government spending on relief and stimulus packages reached unprecedented levels. Almost no one seemed concerned that these expansionary policies would trigger an inflationary spiral, in part because the pandemic-induced contraction seemed so severe and also because the developed world had been afflicted for so long by stubbornly slow growth and low inflation amid rock-bottom interest rates.

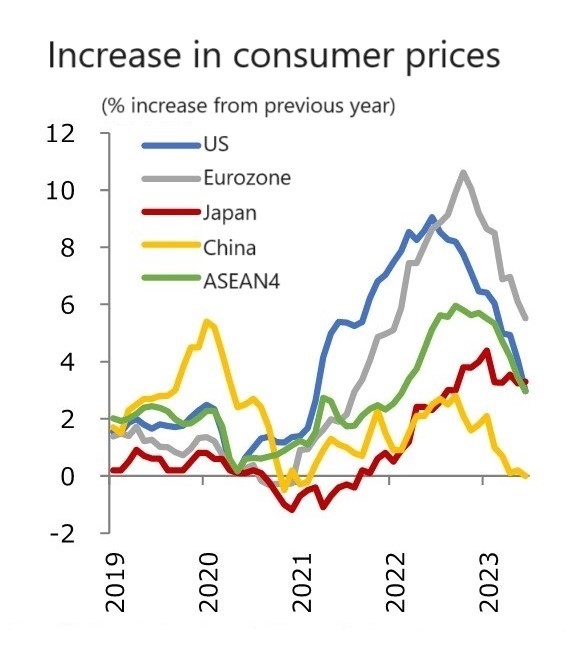

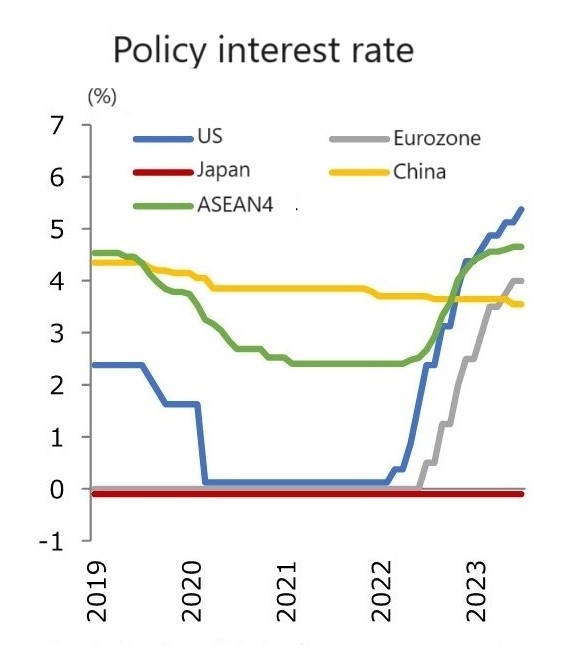

Be that as it may, the cost of living began to climb rapidly in the spring of 2021, first in the United States and then in other countries around the world. By the middle of 2022, inflation had hit a 40-year high in the West, peaking at 9% in the United States and double digits in the eurozone. The impact was delayed and also somewhat less severe in Japan, which had struggled with deflation for years, but the 4% increase in consumer prices registered here in early 2023 also marked a 40-year high.

Figure 1. Trends in Inflation and Policy Interest Rates by Country/Region

Note: “ASEAN4” denotes Indonesia, Malaysia, Philippines, and Thailand.

Source: Mitsubishi Research Institute, “Posuto-korona no sekai/Nihon keizai no tenbo” (Post-COVID Outlook for the Global and Japanese Economy), August 2013, https://www.mri.co.jp/knowledge/insight/ecooutlook/2023/20230816.html.

A number of factors were at play. One was the fact that the economy had begun to recover quite rapidly in the second half of 2020, thanks not only to the abovementioned stimulus measures but also to the speed with which vaccines were developed and deployed and the decision by Western countries to reopen their economies as soon as possible. In 2020, global economic growth was −2.8%, substantially better than the −4.9% forecast by the International Monetary Fund in June that year, and in 2021 the world economy grew at an impressive rate of 6.9%.[2] But while demand was rising, the pandemic’s negative impact on supply lingered. The labor force had shrunk owing largely to an exodus of older workers and women, and supply-chain disruptions were pushing prices up. Moreover, just as prices on the international commodity markets were rising in response to the economic recovery, war broke out between Russia, a major energy supplier, and Ukraine, one of the world’s top exporters of wheat, causing food and energy prices to soar. In March 2022, immediately after the outbreak of the war, the price of crude oil (WTI) on the New York Mercantile Exchange briefly jumped to a shocking $130 a barrel.

The central banks were behind the curve in their response to rising prices. Although former US Secretary of the Treasury Lawrence Summers warned of the risk of inflation as early as the spring of 2021, Federal Reserve Chair Jerome Powell continued to insist that the price increases were “transitory.” It was not until the fall of 2021 that he acknowledged widespread and persistent inflation, and it was only in March 2022 that the Fed moved to raise interest rates.[3] Subsequently, as if to make up for lost time, the Fed shook up the markets by raising the federal funds target rate 75 basis points (0.75%)—instead of the usual 25 bps (0.25%)—four times in a row between June and November 2022 (Figure 1, right). As a result, inflation began to subside (though remaining well above the 2% target rate), but that sharp rise in interest rates is regarded as an important factor contributing to the collapse of Silicon Valley Bank and several other regional US banks in March 2023.[4] [5]

Fiscal Activism in Retreat

The experiences of the pandemic and post-pandemic era taught policymakers some important lessons regarding the utility and limitations of fiscal policy. On the one hand, they confirmed the efficacy of fiscal stimulus as an anti-recessionary tool. Without the massive relief and stimulus packages adopted by governments around the world after the pandemic hit, the global recession would surely have been far worse. On the other hand, once runaway inflation had been ignited, it took monetary tightening to bring the flames under control. The proponents of modern monetary theory had argued that a dose of fiscal restraint could curtail inflation in the (unlikely) event that it occurred, but no one was taking that advice seriously now.

In the climate of ultra-low interest rates that persisted after the 2007–08 financial crisis, economists had tended to downplay the risks of rising deficits, but in today’s inflationary climate, that way of thinking is in retreat, and some have even placed the blame for inflation squarely on deficit spending.[6] So far, the budget hawks have gained little momentum, largely because inflation has pushed up nominal growth rates, preventing the ratio of public debt to nominal GDP from rising substantially. But if the United States or Europe were to experience another economic downturn anytime soon, macroeconomic policy would most likely have to focus on monetary easing rather than budgetary expansion.[7]

Back when I was a student learning Paul Samuelson’s principles of macroeconomics, it was widely agreed that fiscal stimulus was the tool of choice for kick-starting a stalled economy, while monetary tightening was best for controlling inflation. Later, in the era of neoliberalism, monetary policy held sway, and subsequently the pendulum swung to fiscal activism.

I have a feeling that the consensus will gradually revert to the conventional wisdom of the 1960s. In retrospect, macroeconomic theory may have been less sophisticated in those days, but it contained a core of common sense.

Trade Restrictions and Industrial Policy

Economic relations between the United States and China had already deteriorated under Donald Trump’s presidency. But the main issue for Trump was the US trade deficit with China, and his administration responded in typical protectionist fashion by slapping new tariffs on Chinese imports beginning in mid-2018.[8] Most of these tariffs have remained in place since Joe Biden took office, but the current administration has also imposed separate restrictions on trade and investment in the name of national security.[9] This trend accelerated after the Russian invasion of Ukraine, as Beijing showed its implicit support for Moscow, further straining ties between the United States and China.

Unlike Trump’s tariffs, Biden’s curbs on trade are clearly not aimed at reducing America’s trade deficit. Their goal is to prevent China from gaining access to sensitive technologies with military applications, particularly semiconductors and chip-manufacturing equipment. Washington has also tightened its regulation of US investment in sensitive Chinese industries. (In addition, there are new restrictions on the trading of Chinese stocks by American investors and on Chinese businesses’ ability to raise funds in the United States.)

Moreover, while Japan and the EU were free to ignore Trump’s anti-Chinese tariffs, this time Washington has pushed its friends and allies to adopt comparable measures. In July this year, Japan began restricting exports of cutting-edge chip-making equipment to China, for example.[10] The problem is that, unlike the Soviet Union during the Cold War, China is a major global player, deeply embedded in the world economy. Aware of the challenges posed by “decoupling,” Washington has substituted the term “de-risking,” but the distinction is unclear. Meanwhile, the increasingly assertive and influential countries of the Global South, following India’s lead, have refused to take sides in the standoff between the Group of Seven on the one hand and China and Russia on the other, hoping instead to profit from the situation. (This is one reason the sanctions against Russia have been less effective than initially anticipated.)

Another noteworthy trend of the post-pandemic era is a return to industrial policy in the developed world. In the heyday of neoliberalism, it was viewed as unfair and anti-competitive for governments to target certain industries for special support. (Japan came under harsh fire from the United States in the 1980s for such “unfair” practices.) But today, when free trade has lost some of its earlier luster, industrial policy has begun to stage a revival.[11] One factor has been the increasingly important role of business sectors with large positive externalities, such as health care and decarbonization technology. Between 2022 and 2023, the US Congress passed three laws—the Infrastructure Jobs and Investment Act, the Inflation Reduction Act, and the CHIPS and Science Act—authorizing massive subsidies targeting semiconductors, electric vehicles, and new drug development with the stated aim of encouraging innovation and “reshoring” key industries.[12] Unfortunately, there is no clear line between such innovation-oriented industrial policies and protectionism.

Decarbonization: Progress Amid Setbacks

As war broke out in Ukraine, the price of oil and other fossil fuels soared. Oil prices subsequently settled down, and Europe was saved from critical shortages of natural gas by an unexpectedly warm winter, but there is no question that the situation caused many countries to rethink their energy policies with a view to ensuring a stable supply of fossil fuels.

Over the short term, the outcome has been a setback for decarbonization. Before the war in Ukraine, momentum had been building for the rapid phase-out of power plants run on coal, the most carbon-intensive fossil fuel, but that drive has since stalled. Because coal is a plentiful and widely available fuel, Japan continues to operate many coal-burning power plants, and China is still building new ones. Nuclear power is another beneficiary of the post-pandemic energy crunch. China, India, and other emerging and developing countries are building new facilities, France remains firmly committed to nuclear energy, and the Japanese government is making every effort to resume operations at plants idled since the Fukushima nuclear accident.

In the long run, however, rising prices and uncertain supplies of fossil fuels can only accelerate the shift to renewable energy. To be sure, the issuance of sustainable bonds has faltered of late amid talk of greenwashing[13] and rising interest rates, but more and more companies are embracing the UN Sustainable Development Goals (SDG badges have become popular among Japanese businesspeople) and vying with one another for progress toward SDG targets. Megatrends driven by the power of finance and public opinion are not so easily reversed.

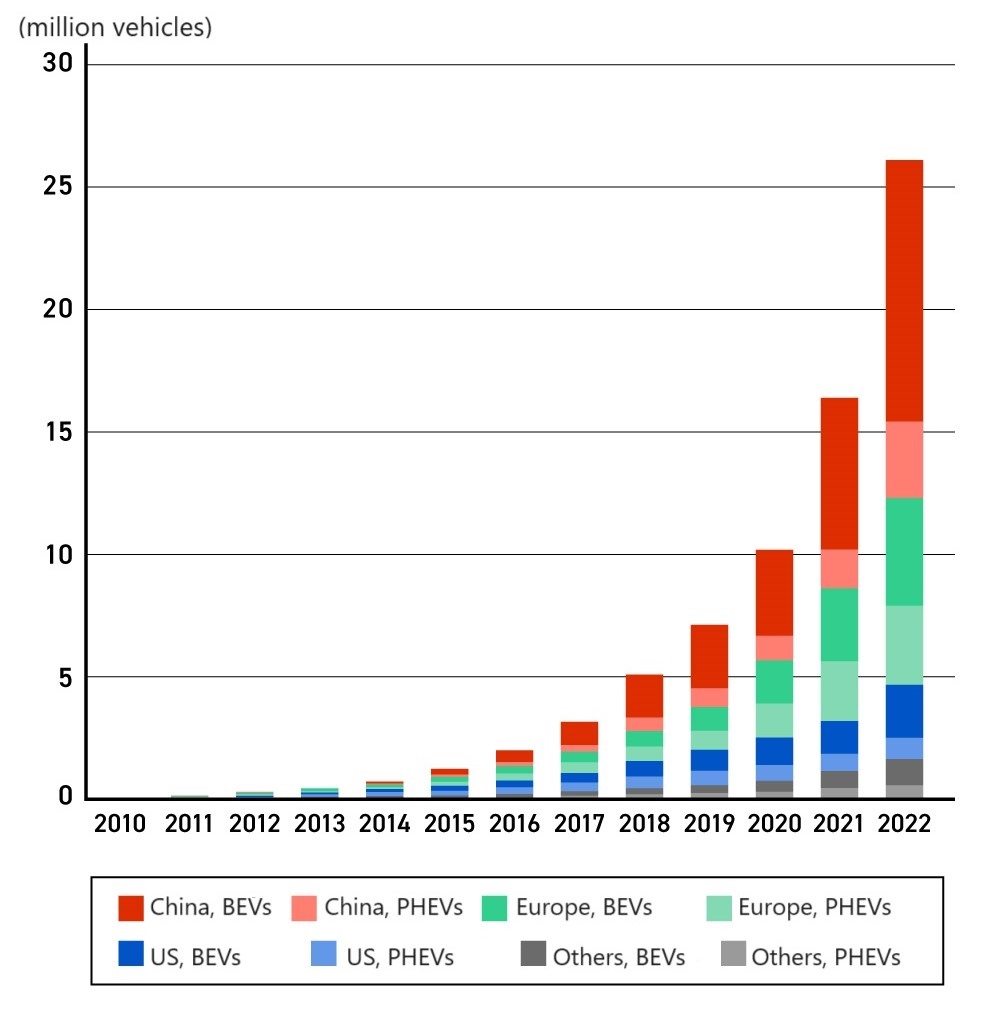

In terms of combating climate change, another noteworthy development is the unexpectedly swift transition to electric vehicles. Up until just a few years ago, any rapid shift seemed unlikely without massive government subsidies owing to the relatively high cost of EVs, and many in the industry were convinced that hybrids would dominate the market for some time to come. But market penetration of EVs has accelerated dramatically in recent years thanks to the successful cost-cutting efforts of American and Chinese manufacturers. Of course, there is only so much that electrification of automobiles can contribute to decarbonization as long the electricity used to recharge the vehicles remains carbon-intensive, as in China. Still, the trend testifies to the power of technological progress.[14]

Figure 2. Electric Vehicle Ownership Worldwide

Notes: BEVs = battery electric vehicles; PHEVs = plug-in hybrid electric vehicles. “Europe” consists of the EU, Norway, and Britain. “Others” are Australia, Brazil, Canada, Chile, India, Indonesia, Japan, South Korea, Malaysia, Mexico, New Zealand, South Africa, and Thailand.

Source: Tokyo Electric Power Co. (TEPCO), “EV no fukyuritsu” (Market Penetration of EVs), https://evdays.tepco.co.jp/entry/2021/09/28/000020.

Pending Issues

In the foregoing, we have identified several incipient economic policy trends of the post-pandemic era. As we have seen, macroeconomic policy, having swung from the monetarism of the neoliberal era to the fiscal activism of the pandemic years, appears to be swinging back, albeit less sharply, and could well revert to the common-sense thinking of the 1960s, when fiscal measures were viewed as the primary means of stimulating the economy, while monetary tools were preferred for controlling inflation.

Moves toward decarbonization, while dealt a temporary setback in the wake of the pandemic, appear to have survived the war in Ukraine. Going forward, the climate-change policy debate is likely to center on two key questions, as we navigate what UN Secretary General Antonio Guterres has termed “the era of global boiling”: (1) Can countries meet their emissions-reduction targets, many of which (Japan’s included) could be considered unrealistic? (2) Can global warming be halted even if all those targets are met?

One of the biggest issues in this era of intensifying US-China rivalry is our collective vision for the global economic system. Certainly Biden’s security-driven trade controls are an improvement over Trump’s America-first protectionism. But restriction of free trade in the name of security can open the door to protectionism, as can industrial policy. Meanwhile, we need to consider the possibility that China’s emergence as a major player in the world economy was a key factor sustaining the Great Moderation—that is, the long period of subdued economic volatility and low inflation that began in the 1980s. If China’s economy slows and global supply chains become less efficient, we could find ourselves back in a macroeconomic climate conducive to stagflation.

The topic of industrial policy raises vital questions pertaining to artificial intelligence: How will we use it? How will we limit or control its use? A decade ago, Michael Osborne and Carl Benedikt Frey of Oxford University wrote a seminal paper estimating potential job losses from advances in AI and robotics. Those predictions were still being debated when a new threat emerged in the form of generative AI.[15] Clearly there is a need to reassess the possibilities and risks of AI in the light of such developments.

Finally, in the second article in this series, I hailed the international agreement reached at the end of 2021 on a minimum corporate tax rate and digital taxation, stressing the urgent need for such coordination to secure adequate government revenues while ensuring fairness and addressing the problem of growing economic inequality. The agreement was indeed a breakthrough, but it must be effectively implemented and enforced at the domestic level. Whether that can be accomplished remains to be seen.

[1] Hideo Hayakawa, “Economic Policy Thinking since the Great Recession (2): The Pandemic and the Search for a New Consensus,” https://www.tokyofoundation.org/research/detail.php?id=962.

[2] In Japan, which was slower to roll out vaccinations and reopen the economy, the economy shrank by a full 4.2% in 2020 and posted only 2.2% growth in 2021.

[3] For a discussion of the factors behind the Fed’s delayed response, see my article on this website (in Japanese), “Beikoku riage to Nihon no kin’yu seisaku” (America’s Interest Rate Hikes and Japan’s Monetary Policy), April 7, 2022, https://www.tkfd.or.jp/research/detail.php?id=3963.

[4] That said, thanks to the Fed’s decisive rate hikes, the United States is doubtless near the end of its credit-tightening phase. In Europe, meanwhile, inflation remains high, especially in Britain, and it may be difficult to raise interest rates enough to bring it under control without triggering a recession.

[5] In Japan, which has maintained its ultra-loose monetary policy amid these hikes, the Bank of Japan responded in late July by lifting the upper limit on long-term interest rates. For my commentary on the BOJ’s policy (in Japanese), see “Infure no tenbo to kin’yu seisaku (2): Bukka uwabure no risuku takamaru” (Inflation Outlook and Monetary Policy 2: Growing Inflationary Risks), Nihon Keizai Shimbun, August 24, 2023, https://www.nikkei.com/article/DGKKZO73817000T20C23A8KE8000/.

[6] Stanford University economist John Cochrane, a prominent spokesperson for this school of thought, expounds his ideas in depth in The Fiscal Theory of the Price Level (Princeton University Press, 2023). Among economists, more attention has focused on Francesco Bianchi and Leonardo Melosi’s “Inflation as a Fiscal Limit,” Federal Reserve Bank of Chicago Working Paper 2022–27 (August 2022), https://www.chicagofed.org/publications/working-papers/2022/2022-37. In this paper, presented at the 2022 Jackson Hole Economic Policy Symposium, Bianchi and Melosi argue that monetary tightening can lead to a vicious cycle of stagflation unless supported by the expectation of appropriate fiscal adjustments.

[7] Initially, many were of the opinion that the developed world would revert to “Japanification” after the pandemic, but these days, amid signs of a rise in the natural rate of interest, fewer economists are predicting a return to zero interest rates. See, for example, Jeffrey Frankel, “The End of Zero Interest Rates,” Project Syndicate, August 13, 2023, https://www.project-syndicate.org/commentary/interest-rates-not-returning-to-zero-in-near-future-by-jeffrey-frankel-2023-08.

[8] Of course, the Trump administration also cited security concerns when it prohibited federal agencies and private companies that did business with the government from using products made by Huawei, ZTE, and other companies with close ties to the Chinese government.

[9] The National Security Strategy released by the Biden administration in 2022 calls China “the only competitor with both the intent to reshape the international order and, increasingly, the economic, diplomatic, military, and technological power to advance that objective.”

[10] The Biden administration’s emphasis on cooperation with Japan, Europe, and the G7 makes for a far more rational foreign policy than Trump’s imperious America-first strategy, but it could also impose a heavier burden on friends and allies.

[11] Given the varying speeds at which resources shift and the efficacy of government policy for the redistribution of income, the idea that everyone benefits from free trade—once routinely parroted by economists—is now widely regarded as a myth.

[12] For example, Harvard University economist Dani Rodrik, a longtime critic of unrestrained globalization, has called for a comprehensive “industrial policy for good jobs.” See Dani Rodrik, Reka Juhasz, and Nathan Lane, “Economists Reconsider Industrial Policy,” Project Syndicate, August 4, 2023, https://www.project-syndicate.org/commentary/new-economic-research-more-favorable-to-industrial-policy-by-dani-rodrik-et-al-2023-08.

[13] Creating a false or exaggerated appearance of sustainability in order to enhance a business’s image, attract investors, or secure tax breaks.

[14] In Japan, where hybrid vehicles have continued to dominate the market, manufacturers have lagged far behind in the development and production of EVs, leaving the Japanese auto industry—the mainstay of the country’s manufacturing sector—very vulnerable.

[15] See Carl Benedikt Frey and Michael Osborne, “The Future of Employment: How Susceptible Are Jobs to Computerisation?” Oxford Martin School Working Paper, September 1, 2013, https://www.oxfordmartin.ox.ac.uk/publications/the-future-of-employment/. In this paper, the authors made the frightening prediction that 47% of American jobs would be replaced by AI and robotics over the next 10–20 years. Needless to say, this was not the last word on the subject, as others pointed out the ways in which automation, including AI, could generate new jobs as well. See David Autor, “Why Are There Still So Many Jobs? The History and Future of Workplace Automation,” Journal of Economic Perspectives, vol. 29, no.3 (Summer 2015).

The debut of such generative AI systems as ChatGPT has rekindled the debate. While offering obvious benefits, these systems also pose serious risks, including the proliferation of “hallucinations” generated by AI, invasion of privacy, and violations of intellectual property rights. Within Japan, public discourse about AI suggests a relatively low awareness of those risks, especially as compared with the EU. See Daisuke Okanohara, Daikibo gengo moderu wa aratana chino ka (Are Large Language Models a New Form of Intelligence?), (Iwanami Shoten, 2023).