The Background to the Sharp Rise in Accommodation Charges: Simultaneous Implementation of Travel Assistance and Lifting of the Ban on Accepting Foreign Travelers, and the Impact of Post-COVID-19

January 25, 2024

R-2023-061E

Amid the post-pandemic recovery of Japan’s tourism industry, accommodation rates have risen sharply. Yasuyuki Komaki, senior fellow at the Tokyo Foundation for Policy Research and professor at Osaka University of Economics, investigates the background and ongoing industry trends to identify causes and implications for the future.

* * *

Introduction: Accommodation Charges Rising Significantly

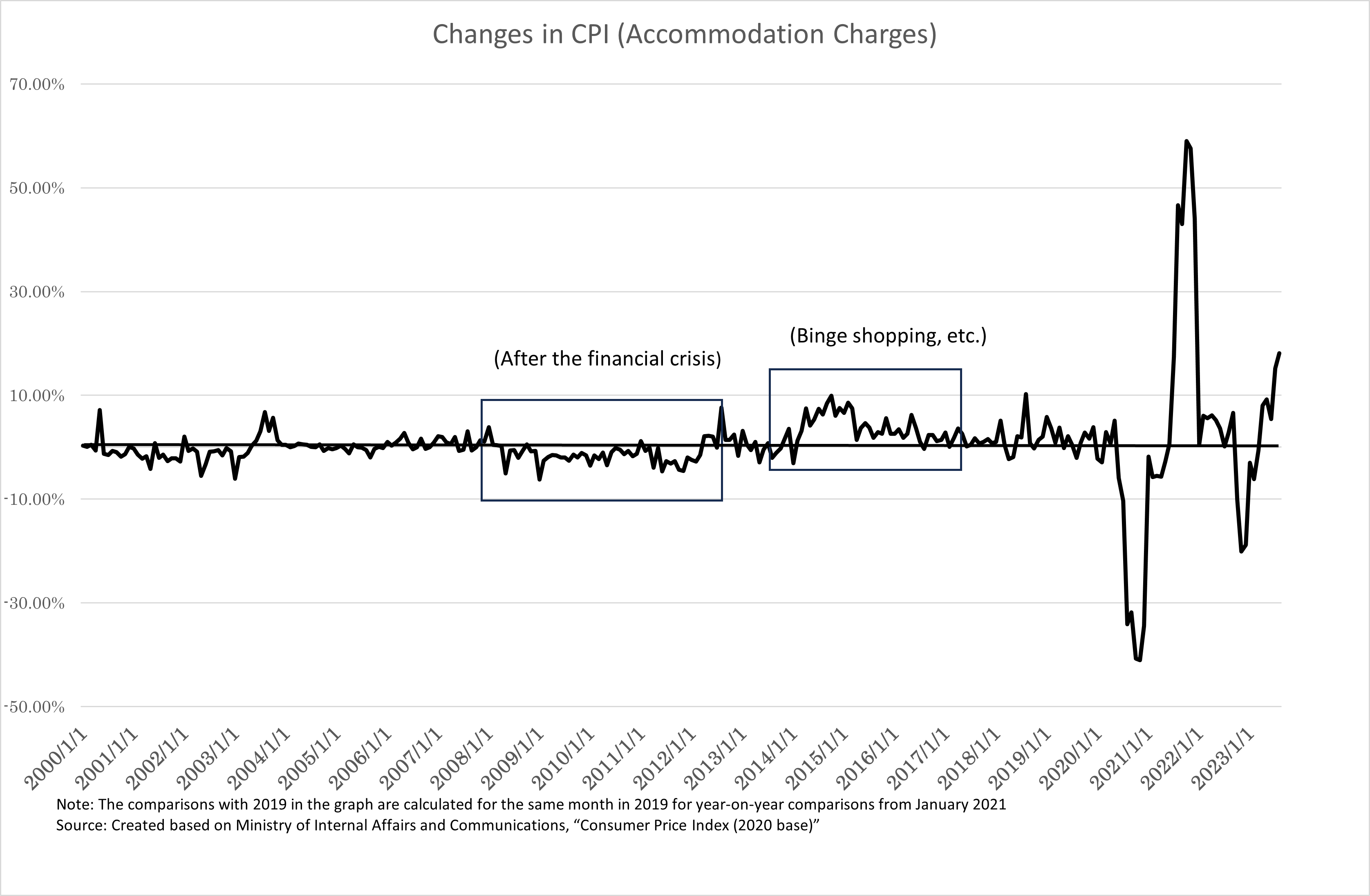

Looking at the period since 2000, accommodation charges have generally fluctuated slightly, with a small decline at the time of the 2008 financial crisis, while they have been on the rise since 2015, when “Bakugai” (binge shopping)[1] by visitors from China became a hot topic. However, they started to fall when COVID-19 infections began to spread, and fell sharply from July 22, 2020, when the discount on accommodation charges offered by the Go To Travel campaign was implemented. They began to rise again after December 28, 2020, when Go To Travel was suspended, and then rebounded sharply after July 2021. A sharp rise in global energy and food prices has been ongoing since the beginning of 2021, and accommodation charges also increased by around 5 to 6% from the beginning of 2022 through September of that year. Subsequently, with the introduction of the National Travel Assistance program from October 11, 2022, accommodation charges then fell again. However, since the beginning of 2023, they have been trending upward even with the continuation of National Travel Assistance.

In particular, the rate of increase has risen since April 2023. Looking at the consumer price index (CPI) rate of increase (average of April to July 2023, year-on-year growth rate), there has been a significant increase of 11.2% for accommodation charges, compared to 4.9% for energy and food prices (Figure 1).

Figure 1: Changes in Accommodation Charges (CPI, Based on Year-on-Year Growth Rate)

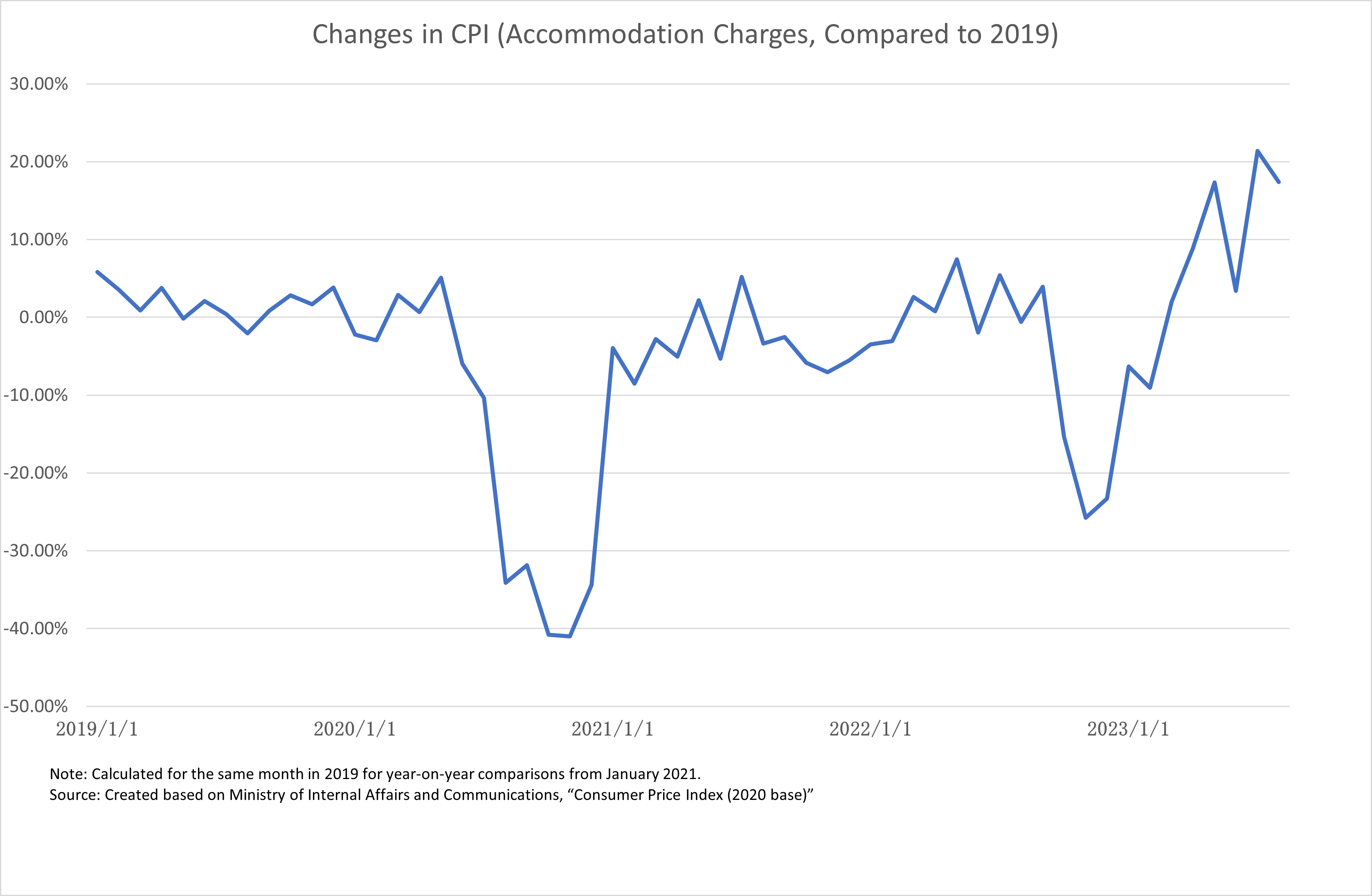

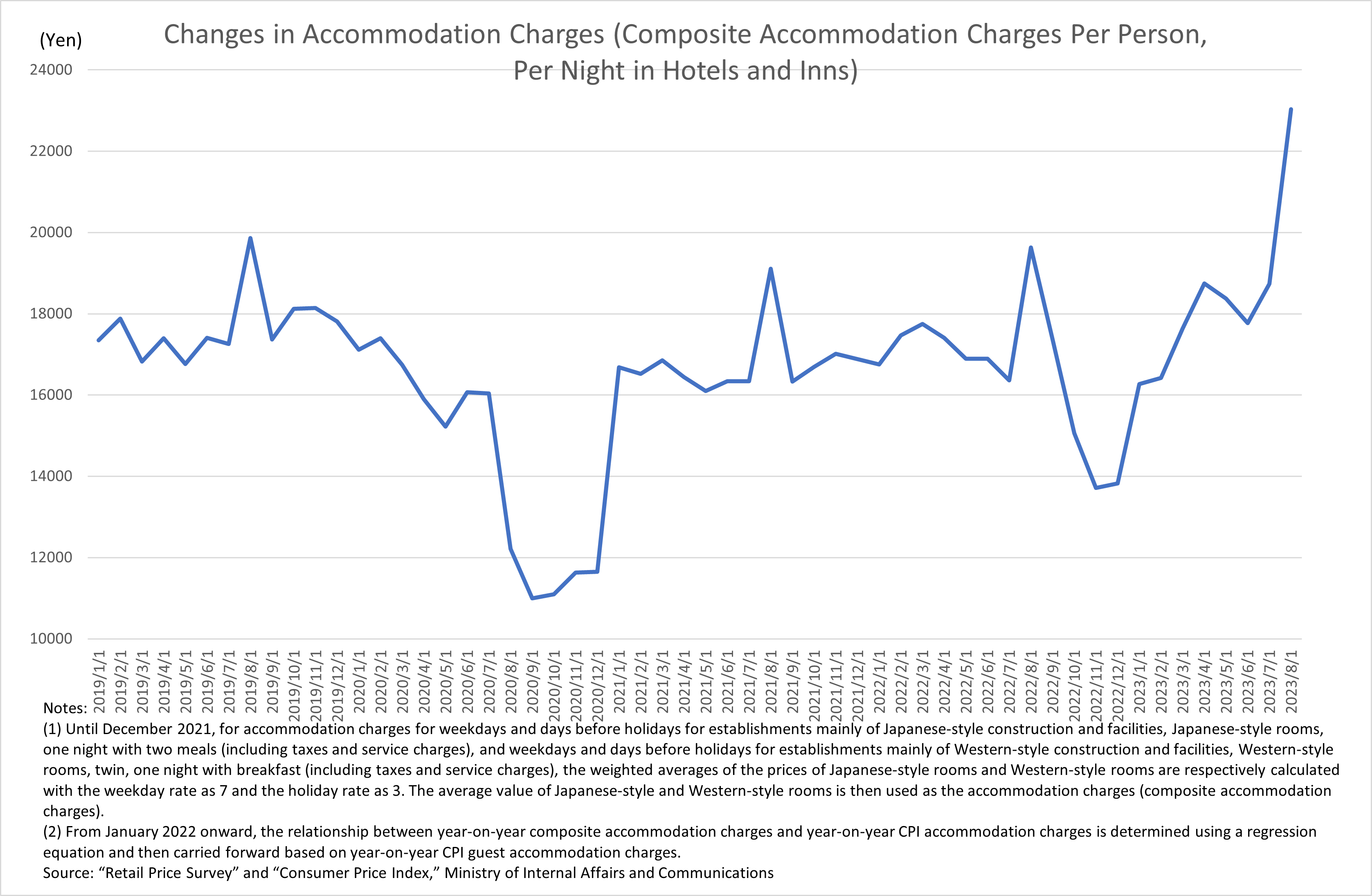

However, looking at the year-on-year growth rate, it has been difficult to tell since July 2021, with the rebound increase of discounted accommodation charges due to Go To Travel. Regarding the rate of changes in accommodation charges, looking at the year-on-year growth rate with 2019 as the base year[2] and the year-on-year growth rate of CPI accommodation charges carried forward based on the Retail Price Survey,[3] we can confirm that the most recent rate of increase in accommodation charges has been a large increase not seen in the past (see Figures 2 and 3).

Figure 2: Changes in Accommodation Charges (CPI, Based on Growth Rate Compared to 2019)

Figure 3: Changes in Accommodation Charges in the Retail Price Survey

This article examines the impact of the simultaneous implementation of the National Travel Assistance program and the lifting of the ban on accepting foreign travelers in October 2022, after setting out the state of demand and supply in the hotel and inn industry, with regard to the factors that showed significant changes in accommodation charges after 2020. In particular, it is possible that the hotel and inn industry is in a situation where dynamic pricing has been introduced in setting accommodation charges, easily reflecting the supply and demand situation.

Situation of the Hotel and Inn Industry

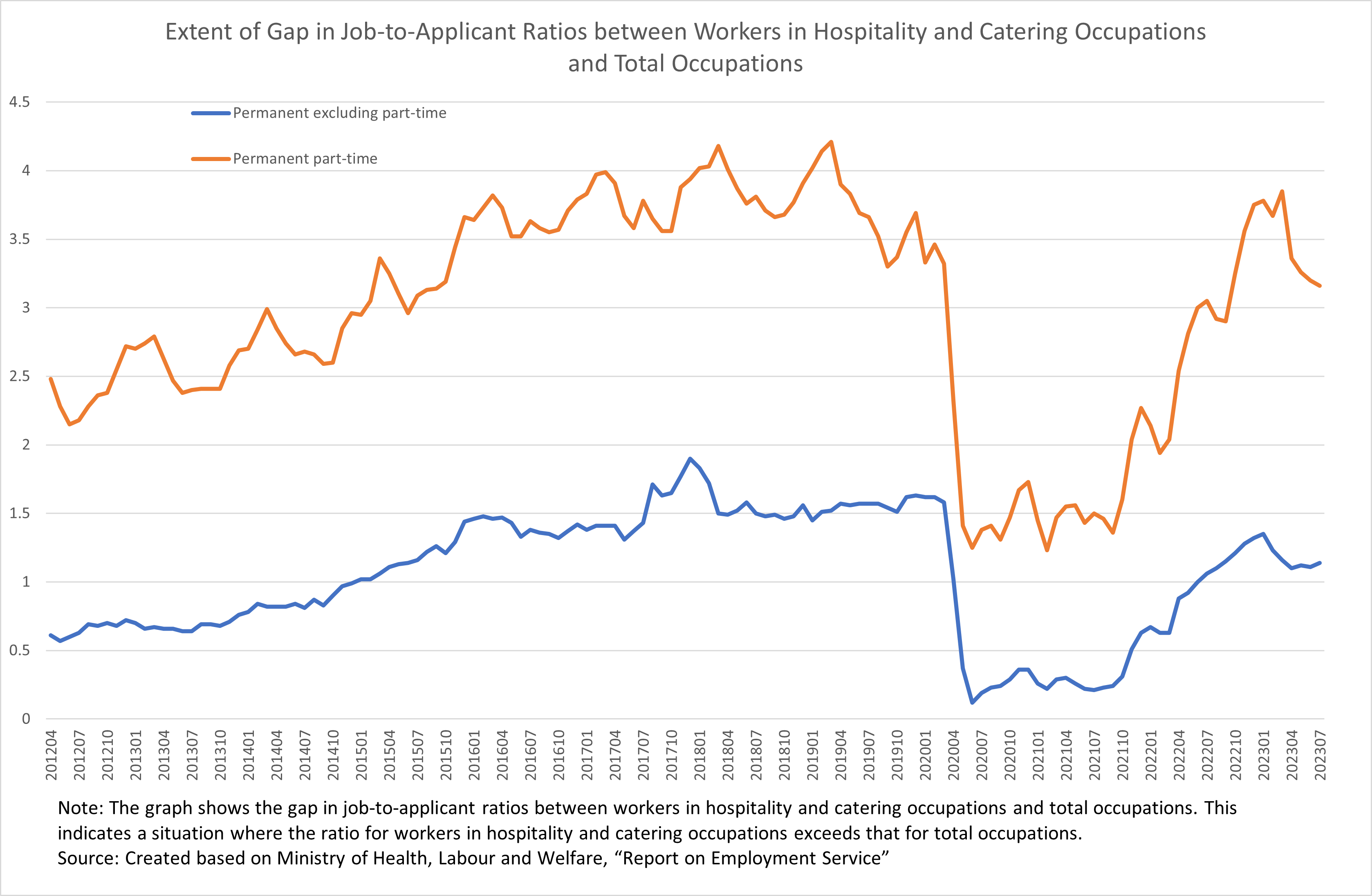

The hotel and inn industry had been facing a shortage of workers even before the outbreak of COVID-19 (Japan Finance Corporation, 2020). Subsequently, the sense of a shortage of workers weakened with the spread of COVID-19, but as the COVID-19 pandemic has drawn to a close, the sense of a labor shortage, especially of non-regular employees, has been rising (Teikoku Databank, 2022). In addition, the shortage of workers in the hotel and inn industry is quite large compared to other industries. In the Report on Employment Service (by occupation),[4] the job-to-applicant ratio for workers in hospitality and catering occupations is significantly higher than that for total occupations. In particular, the part-time multiplier is more than three times higher than total occupations (Figure 4).

Figure 4: Extent of Gap in Job-to-Applicant Ratios between Hospitality and Catering Occupations and Total Occupations

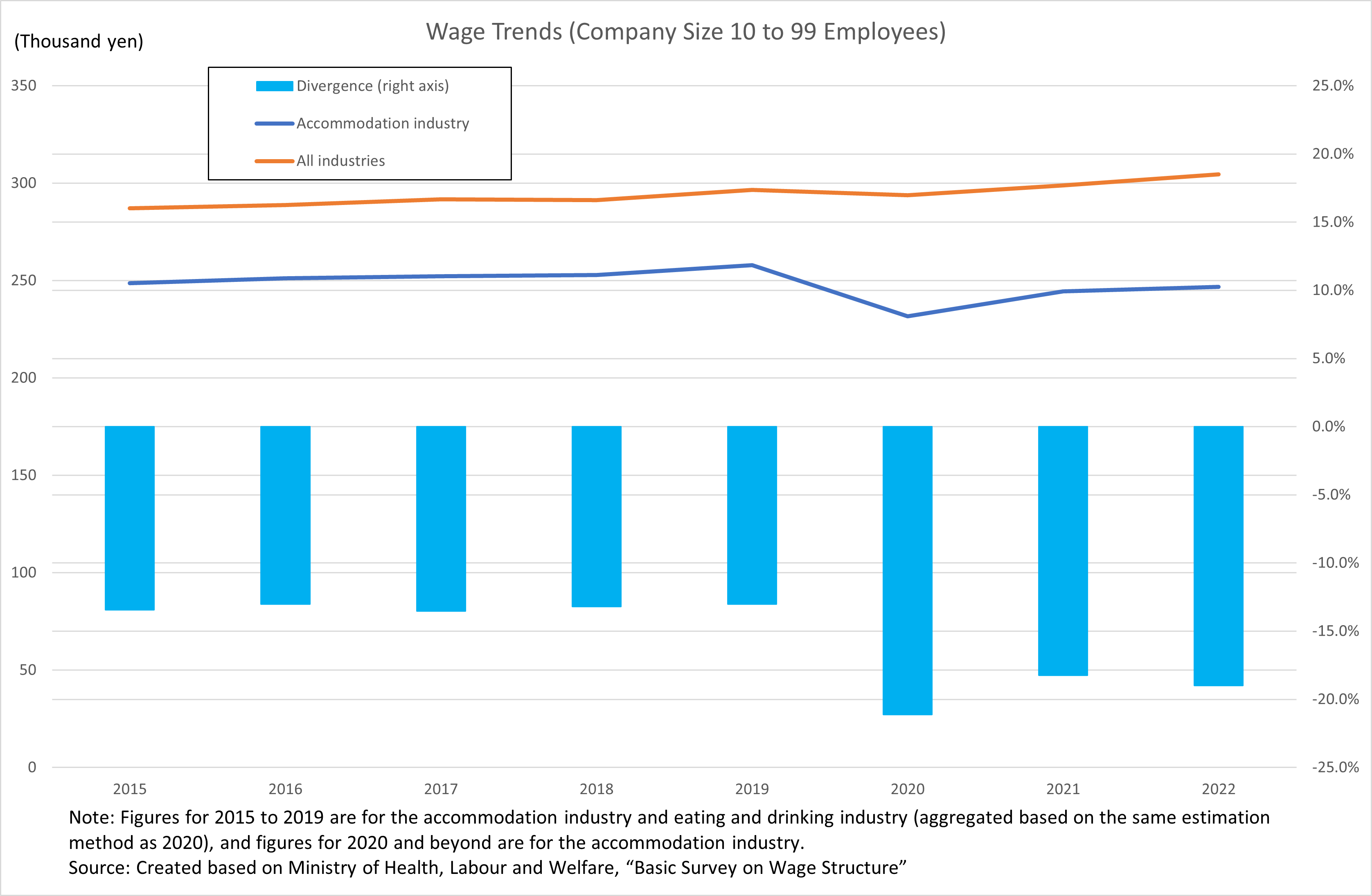

This is due to the employment environment in the hotel and inn industry (Japan Tourism Agency, 2021). If we look at wage levels, wages are lower than in industries as a whole. In particular, wages in the accommodation industry with 10 to 99 employees have continued to decline since the COVID-19 pandemic, resulting in a wage gap of over 15% compared to other industries (Figure 5). It is also related to the unique system of employment in the hotel and inn industry. The work system of staff in charge of guest rooms, such as bed-making staff and so on in hotels and staff responsible for guest rooms in inns, is in the form of guest assistance shifts or midday-gap shifts.[5] In this employment environment, the hotel and inn industry is facing a labor shortage that is further exacerbated by the fact that employees, particularly non-regular employees, who left once due to COVID-19 have not returned to their original positions.

Figure 5: Wage Trends in the Accommodation Industry

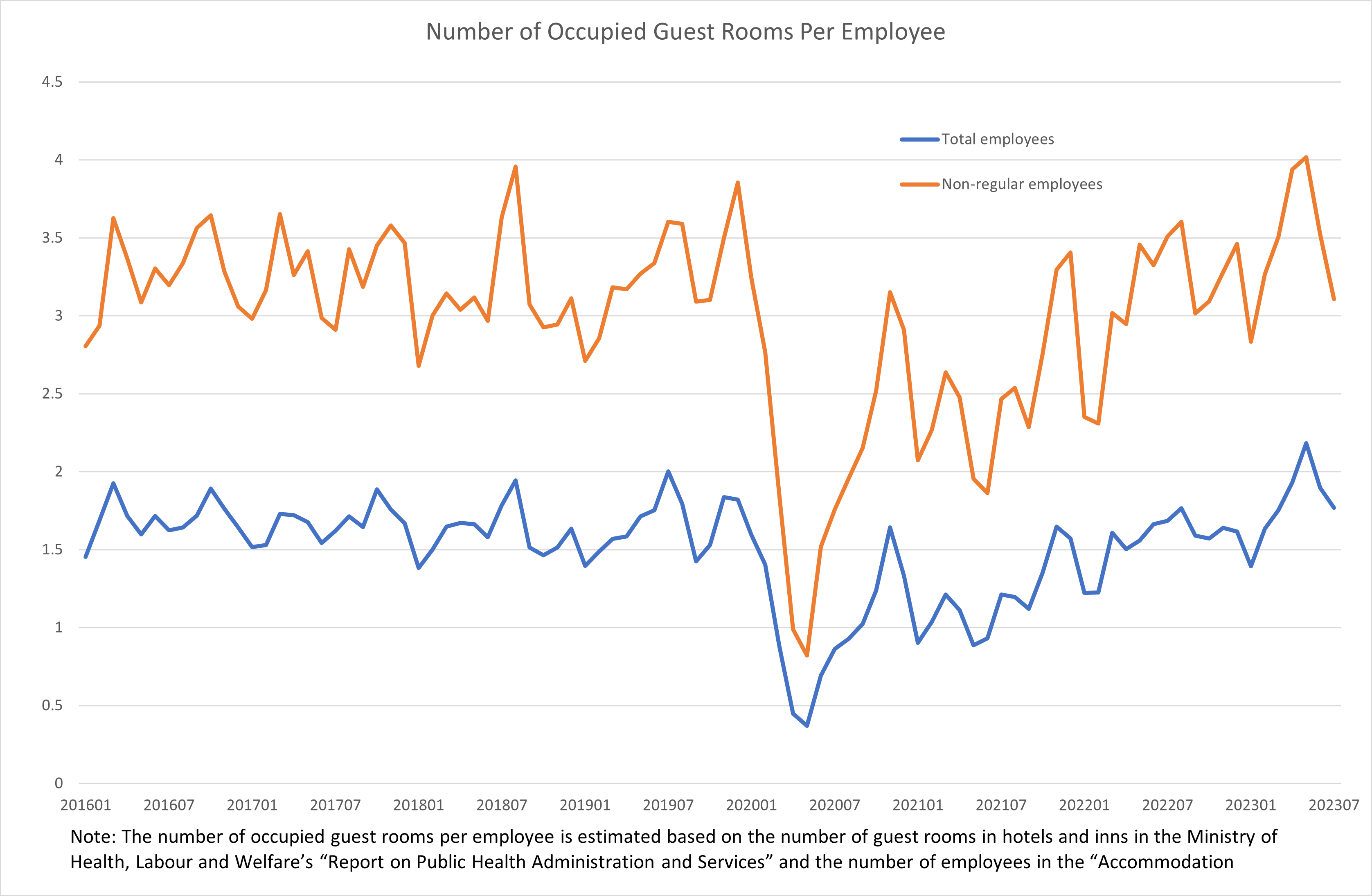

In addition, temporary closures and dissolutions of hotels and inns have been at a high level since the COVID-19 pandemic (Teikoku Databank, 2023). This indicates that in the hotel and inn industry, the number of available guest rooms itself has been declining. The supply of guest rooms is confirmed from the number of occupied guest rooms per accommodation industry employee (total employees, non-regular). For the number of guest rooms estimated here, if the number of guest rooms increases, it means that the number of rooms handled by staff responsible for guest rooms will increase. In other words, it indicates an overburden on the staff responsible for guest rooms, resulting in a potential reduction in the number of rooms being offered. In terms of employees overall, in June 2023, the number of guest rooms has risen to its highest level in several years. The situation is similar when looking at non-regular employees (Figure 6).

Figure 6: Number of Occupied Guest Rooms Per Employee

These data indicate that the hotel and inn industry is facing a challenging supply-side situation, both in terms of employees and in terms of the number of guest rooms that can be provided.

Traveler Trends and Effects of Travel Assistance Measures

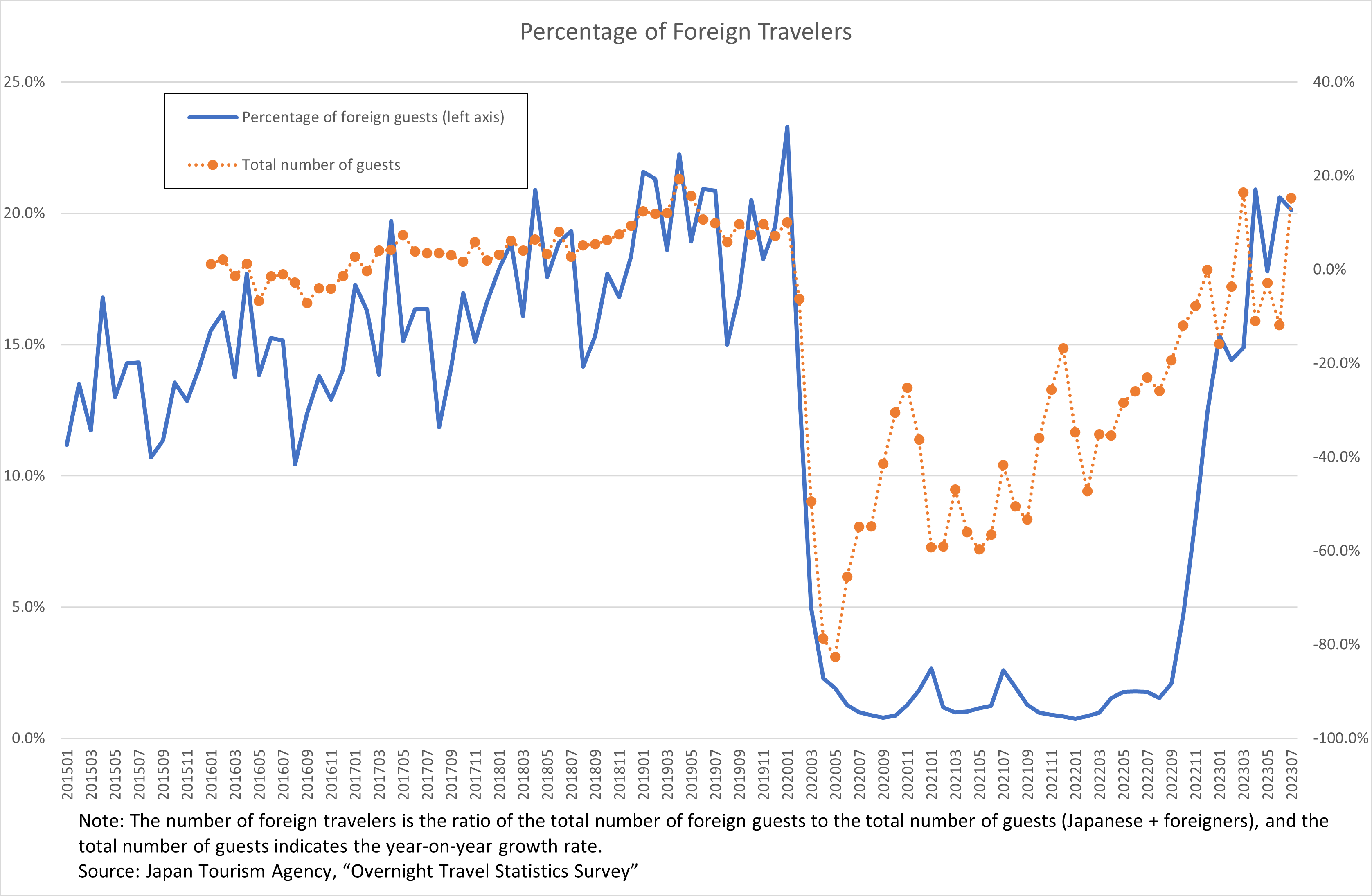

Regarding demand in the hotel and inn industry, as confirmed by the total number of guests, the number of travelers was trending upward before the COVID-19 pandemic in 2020, supported by an upward trend in the number of foreign travelers. However, following the spread of COVID-19, the total number of guests declined sharply, and in this context, accommodation charges also showed a downward trend.

Subsequently, the Go To Travel campaign was implemented, and the total number of Japanese guests began to increase. However, the use of Go To Travel was suspended from December 28, 2020, slowing growth in the total number of guests. Under these circumstances, the total number of guests maintained an upward trend following the implementation of Regional Tourism Business Support (referred to as the “Prefectural Resident Discount” below) from April 1, 2021. Furthermore, the National Travel Assistance program and the lifting of the ban on foreign travelers were simultaneously implemented from October 11, 2022, resulting in a sharp increase in the total number of foreign guests as well as Japanese guests (Figure 7).

Figure 7: Percentages of Total Number of Guests and Total Number of Foreign Guests

Travel Assistance Price Pass-Through Rate

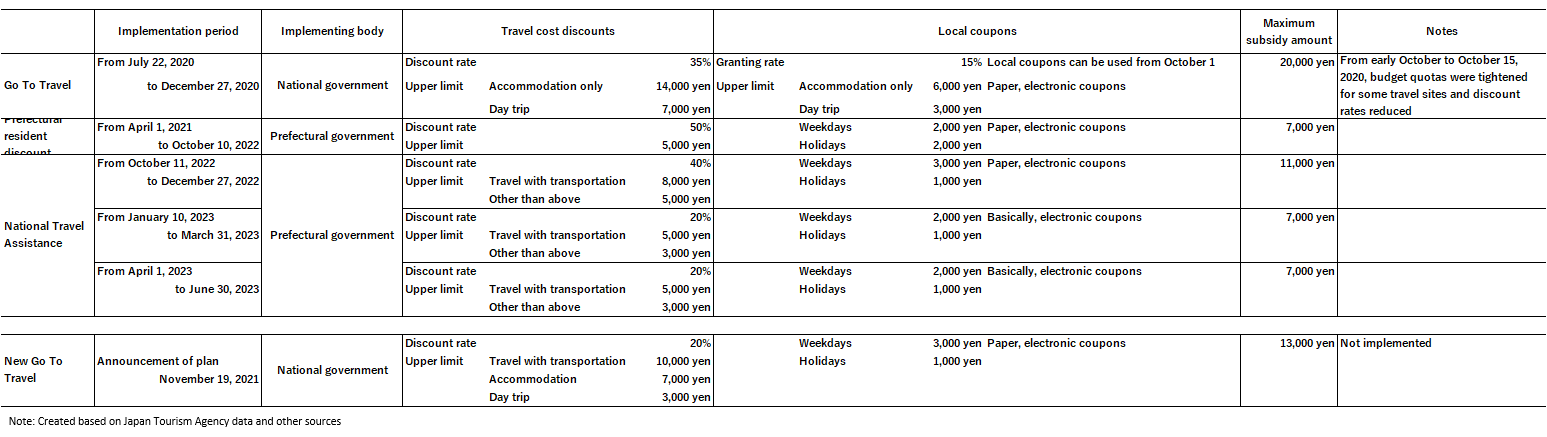

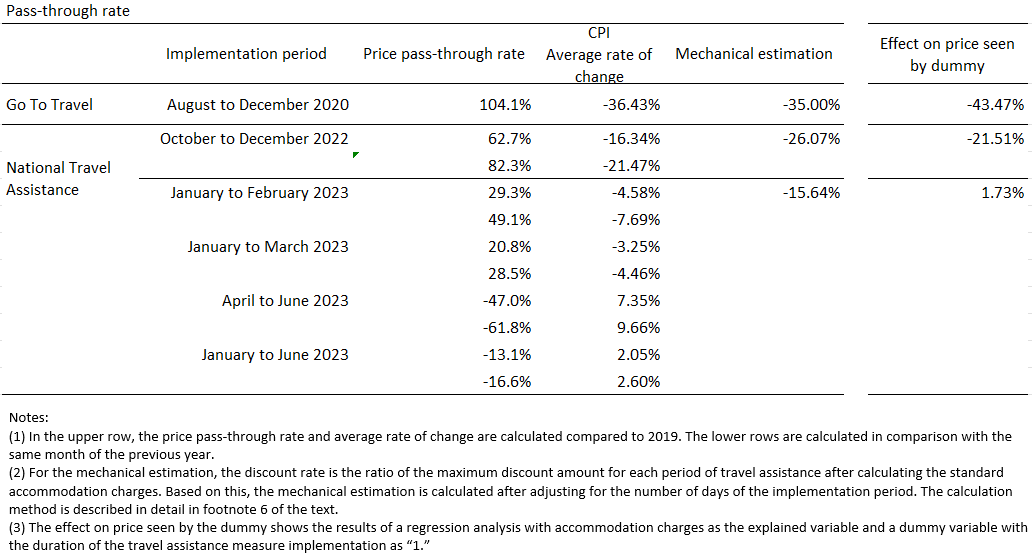

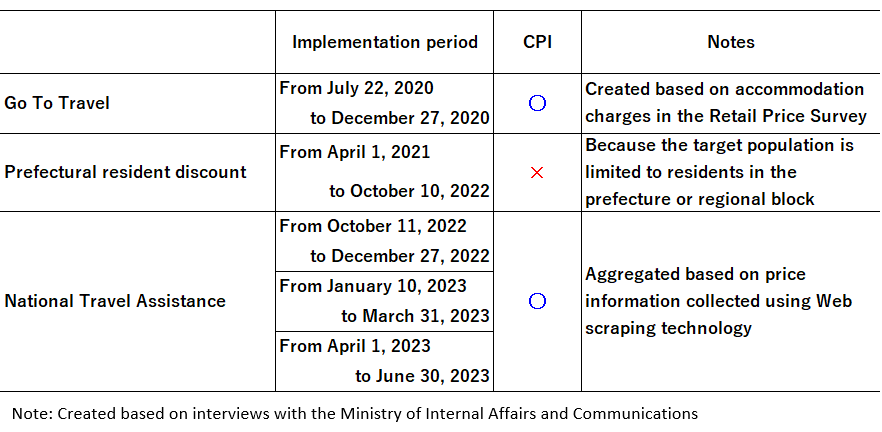

Here, we will examine the extent to which travel assistance has been passed through to CPI accommodation charges. The three periods covered are Go To Travel (July 22, 2020 to December 27, 2022), National Travel Assistance (October 11, 2022 to December 27, 2022), and National Travel Assistance after January 2023 (January 10, 2023 to June 30, 2023) (Figure 8).

Figure 8: Situation of Travel Assistance Measures

With Go To Travel in 2020, accommodation charges fell significantly, which is generally as expected. However, although the National Travel Assistance in 2022 would be expected to have the effect of lowering accommodation charges by -26.07% if estimated mechanically,[6] if we look at the range of the decline in accommodation charges, the pass-through rate remains at 62.7% to 82.3%. Furthermore, from 2023, accommodation charges have started to increase both year-on-year and compared to fiscal 2019, and the situation of how travel assistance is reflected in prices is unclear (Figure 9).

Figure 9: Situation of Pass-Through of Travel Assistance Measures

Price Formation of Accommodation Charges in View of Supply and Demand Trends

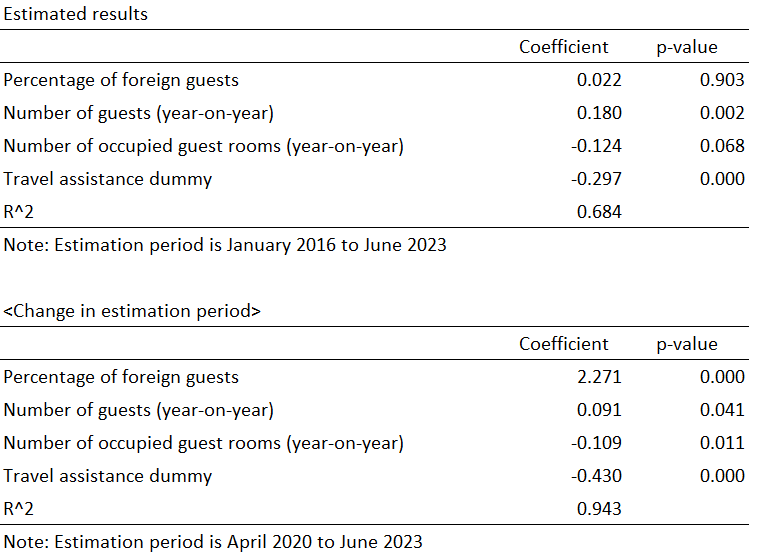

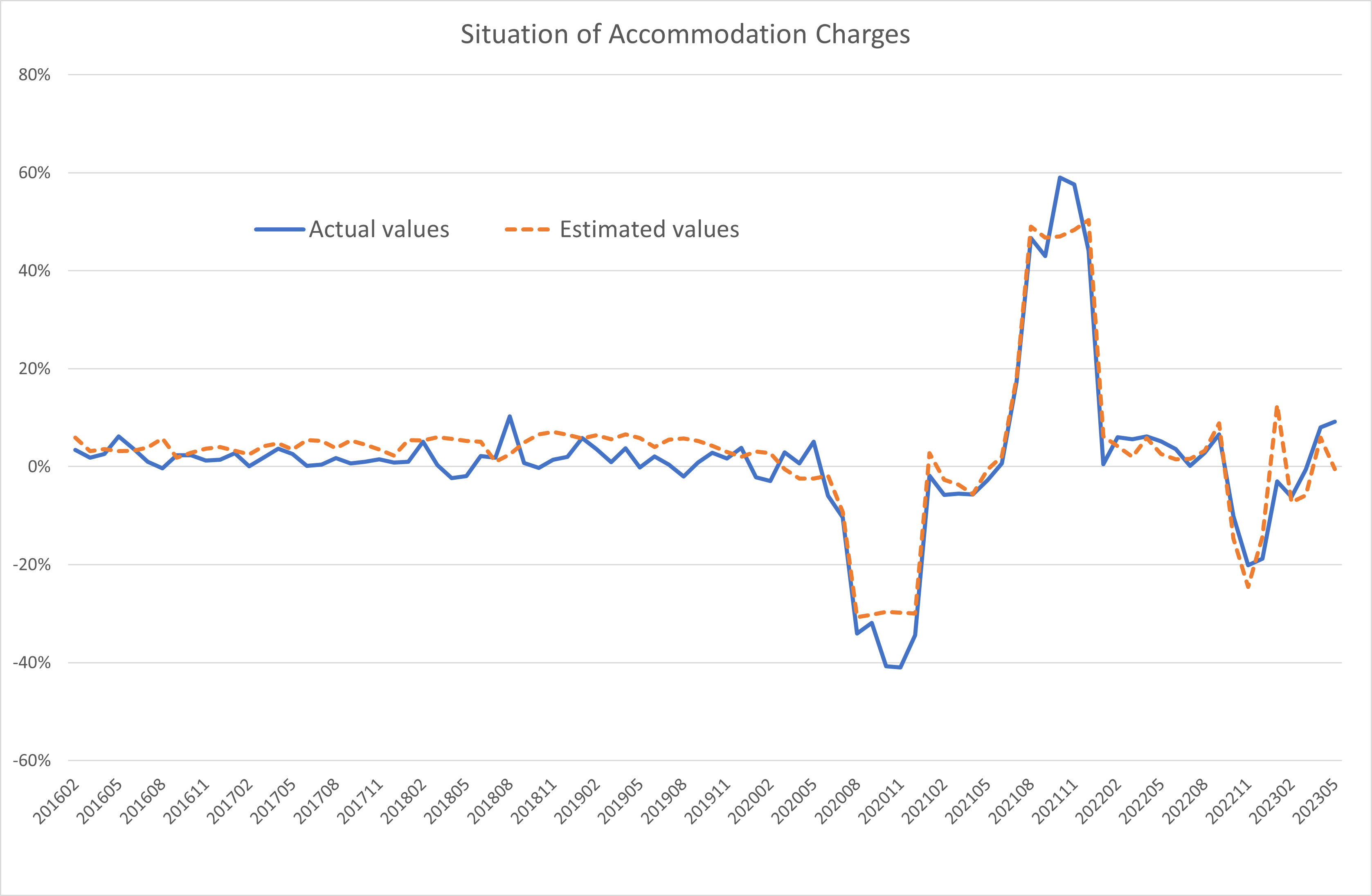

Based on the supply and demand factors in the hotel and inn industry we have seen thus far, we will review the price formation status of accommodation charges. For demand trends, we use the total number of Japanese guests (year-on-year growth rate) and the ratio of total foreign guests (the ratio of foreign guests to the total number of guests), and for the supply side, we use the number of available guest rooms (year-on-year growth rate). Dummy variables adjusted for the number of days of implementation are used for Go To Travel and National Travel Assistance.

Estimates for the period January 2016 to June 2023 show that both supply and demand factors are significant in price formation with respect to accommodation charges. However, we can confirm that the increase in the percentage of foreign travelers has not contributed to the rise in accommodation charges. The background for this is that accommodation charges for foreign travelers are 10,261 yen (Japan Tourism Agency, “Consumption Trend Survey for Foreigners Visiting Japan,” 2023), which is about 3,500 yen lower than the 13,722 yen for Japanese travelers (Japan Tourism Agency, “Travel and Tourism Consumption Survey,” 2023). This is conceivably influenced by accommodations being different from those of Japanese travelers (Figure 10).

Figure 10: Pricing Situation of Accommodation Charges

However, as the COVID-19 pandemic drew to a close, the lifting of the ban on accepting foreign travelers and implementation of the National Travel Assistance program on October 11, 2022 led to a sharp increase in the number of travelers. In particular, the percentage of foreign travelers exceeded 20% in April 2023. Therefore, if the estimation period is based on the period after border control measures were strengthened on March 18, 2020 (April 2020 to June 2023), the ratio of foreign travelers becomes significant, and we can infer that the increase in accommodation charges after 2023 is due to the lifting of the ban on accepting foreign travelers. In addition, for foreign travelers, the level of the yen is significantly weaker than the 2019 average (109.01 yen), as a result of which travel to Japan in yen terms has become less expensive, so we can infer that the price increase is in anticipation of increased demand from foreign travelers.

Moreover, the number of available guest rooms (supply capacity) has not recovered compared to 2019 levels, and this restriction on supply is also likely to be a background factor in the steep rise in prices.

Summary

The recent surge in accommodation prices can be attributed to a sharp increase in demand due to the implementation of travel assistance and the lifting of the ban on accepting foreign travelers from October 11, 2022, amid restrictions on supply in the hotel and inn industry due to labor shortages and other factors in available guest rooms. In particular, regarding the labor shortage in the hotel and inn industry, it was assumed that employers who had once made adjustments with the spread of COVID-19 would return to normal with the end of the pandemic, as in other industries. In reality, however, this has not happened as expected, and instead, the situation has been exacerbated by COVID-19.

Meanwhile, the current spike in accommodation charges is higher than the 2019 level. As shown in Figure 3, when we look at the increase in accommodation charges in monetary terms, the average guest room price (per person) increased by about 1,300 yen from the April to August 2019 average of 17,738 yen to the April to August 2023 average of 19,061 yen.

How to think about such a surge in prices is a major issue. This is because it leads us to ask whether the recent surge in accommodation charges means that there has been a change in pricing behavior in the hotel and inn industry. Until now, as Aoki et al. (2023) point out, Japan has benefited from keeping wages down while reducing markup rates. Ikeda et al. (2023) point to a change in the pricing behavior of firms amid high prices from 2021 onward, as there has been a move to pass on higher costs to selling prices.

It is also possible that guests who were used to the conventional price ranges before the sharp price hikes will place more emphasis on evaluating whether the level of service is commensurate with the price. Furthermore, whether this will lead to changes in the supply structure, such as improvements in wage levels and systems of employment in the hotel and inn industry, also needs to be examined.

Thus, it remains to be seen whether the recent surge in accommodation charges will be one more example of structural change in Japan, which has been described as deflationary. From this point of view, it will be interesting to see how they change in the future.

(Addendum) Accommodation Charges and Travel Assistance in the CPI

Accommodation charges in the CPI have been investigated primarily for inns, with two meals per night stayed, and for hotels, with breakfast per night stayed. In this context, travel assistance is reflected in the price after the discount on the accommodation charges. However, since the program covers nationwide travel assistance with no restrictions on users or destinations, the prefectural resident discount is excluded (Addendum Figure).

The survey methodology differs significantly before and after the 2020 base revision. Until the 2015 base, CPI-based data were created from investigating accommodation charges in the Retail Price Survey, but since the 2020 base revision, prices have been collected using Web scraping technology that collects prices from the Internet. However, until the 2015 base, information on the level of accommodation charges was also available, but after the 2020 base revision, only the index has been available.

Addendum Figure: Situation of Travel Assistance Reflected in CPI Accommodation Charges

References

- Kosuke Aoki, Kosuke Takatomi, and Yoshihiko Hogen (2023), “Price Markups and Wage Setting Behavior of Japanese Firms,” Bank of Japan Working Paper Series, No. 23-E-5

- Shuichiro Ikeda, Yoshiyuki Kurachi, Takuji Kondo, Taichi Matsuda, and Tomoyuki Yagi, Research and Statistics Bureau (2023), “Firms’ Recent Price-Setting Stance: Evidence from the Tankan,” Bank of Japan Review, 2023-E-2

- Teikoku Databank Ltd. (2022), “Special Report: Survey of Corporate Attitudes Towards Labor Shortages” (November 30, 2022)

- Teikoku Databank, Ltd. (2023), “Special Report: Survey of National Corporate Trends Regarding Suspension and Dissolution” (January 16, 2023)

- Japan Finance Corporation (2020), “Labor Shortages in the Hotel and Inn Industry at Record Highs Since Survey Began,” Results of Survey on Employment Trends, February 27, 2020

- Japan Tourism Agency (2021), “Current Situation and Issues Surrounding Tourism,” November 25, 2021

[1]“Bakugai” (binge shopping) won the annual grand prize of the 2015 “The Year Book of the Contemporary Society” U-Can New Words and Buzzwords Awards.

[2]Accommodation charges significantly dropped from July to December 2020 due to Go To Travel. Because accommodation charges returned to normal from July to December 2021, resulting in a large increase in the year-on-year growth rate, the CPI for each month in 2019 was used as the base for the rate of changes for each month in and after 2021.

[3]Value-based figures for inn accommodation charges (one night, two meals, weekdays; one night, two meals, days before holidays) and for hotel accommodation charges (one night, breakfast, weekdays; one night, breakfast, days before holidays) are available from the Retail Price Survey until December 2021. The respective prices of accommodation charges for inns and hotels are weight averaged with the weekday price as 7 and the holiday price as 3, and the average value for inns and hotels is used as the accommodation charges. Those accommodation charges are carried forward by the year-on-year growth rate of accommodation charges in the CPI.

[4]In the Report on Employment Service, the term is expressed as permanent part-time, but in this article, it will be referred to as part-time.

[5]A guest assistance shift is a shift that runs from noon to noon the next day, with the same staff member responsible for guest rooms taking charge of one set of guests from check-in to check-out. A midday-gap shift is defined as a shift in which workers report for work at 6:00 a.m., take a long break away from work from 10:00 a.m. to 7:00 p.m., return to work again at 7:00 p.m., and leave at 10:00 p.m.

[6]The mechanical estimate here is calculated as follows.

(1) Calculate the standard accommodation charges. Here, we calculate simple averages for inns and hotels, after determining average accommodation charges per day for 8 days before holidays and 22 weekdays during April to July 2019. The average accommodation rate is 17,116 yen.

(2) For travel assistance measures, there is a cap on the amount of discounts for accommodation charges. We calculate the ratios (discount rates) of the maximum amounts of Go To Travel (14,000 yen) and National Travel Assistance (5,000 yen from October to December 2022; 3,000 yen after January 2023) in the standard accommodation rates.

(3) The weighted average of the obtained discount rates is calculated by implementation period (on a daily basis) and used as the mechanical estimate.