Be Prepared for New Tax Competition: Impact Assessment of Two Minimum Taxes of the OECD

March 30, 2022

R-2021-077

In October 2021, the 141 member countries of the OECD/G20 Inclusive Framework on BEPS reached a historic international agreement (“the Agreement”) to introduce a 15% global minimum tax. The 137 countries committing to the Agreement, including Japan, are expected to legislate laws in 2022, with enforcement beginning in 2023.

The international community has been plagued by tax avoidance by large multinational enterprises (MNEs) manipulating their books[1] and using tax havens (low-tax countries), resulting in a race to the bottom on corporate taxes (OECD 2018, p. 3). The latest Agreement is a long-awaited turnaround in this trend.

The essence of the debate leading up to the Agreement, known as BEPS 2.0, was a fierce struggle among countries to include the earnings of large MNEs in their tax base. This article will examine the impact of the 15% minimum tax on international taxation and the geographical attribution of the tax base.[2]

Global Minimum Tax and Domestic Minimum Tax

A news article in the daily Nikkei on October 20, 2021, about the challenges being faced by prominent tax havens reported that there are signs of corporate relocation from Bermuda. It quotes a local expert as saying that Google did not hire a single employee in Bermuda. If, the article notes, companies turn to posting profits and paying taxes in countries where there is employment and actual economic activity—instead of in tax havens like Bermuda—then the OECD Agreement is right on target.

On January 25, 2022, Canada’s Financial Post raised issues with the “Model Rules” for the minimum tax published by the OECD in December 2021, saying:

In an astonishing development, the rules put tax havens—the countries that have long helped large corporations avoid tax—first in line to charge the tax. If tax havens take the OECD up on its offer, Canada’s revenue from the tax could be reduced from $3.5 billion annually to little more than pocket change.

As both articles point out, the 15% minimum tax is designed to tax profits in countries where real economic activities take place on a tax base that has been eroded by profit shifting to low-tax countries. The OECD calls this a right to “tax back.” Taxing profits in high-tax countries where economic activities take place will hopefully put an end to tax competition once and for all.

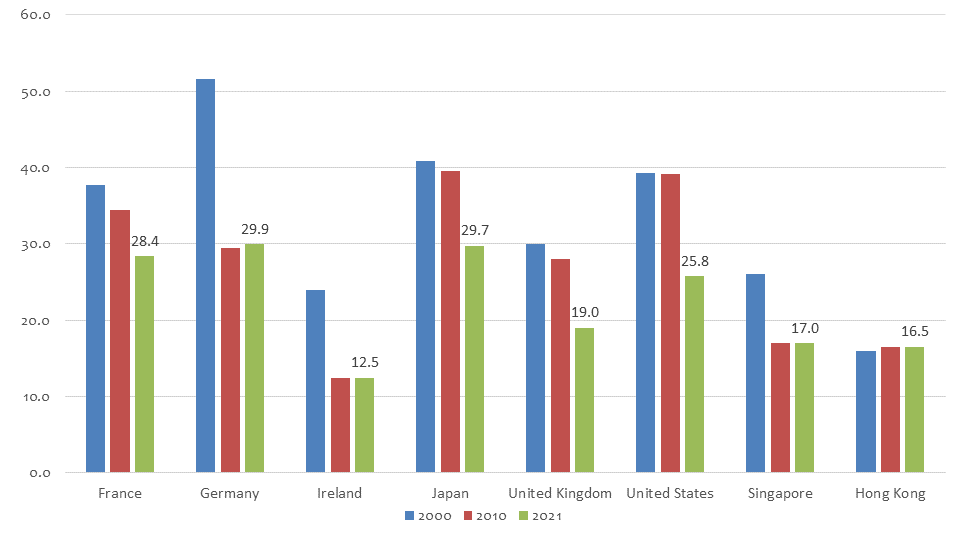

Figure 1. Race to the Bottom: Statutory Tax Rates, National plus Local

Source: Created by the author based on OECD corporate tax statistics.

Rule Order

The 15% global minimum tax will be implemented as a “top-up” tax to increase the tax burden of MNEs to at least 15% in countries where the tax burden of MNEs, on a country-by-country basis, is less than 15%.

The OECD Model Rules (OECD (2021b)) indicate the following order for the geographical attribution of additional tax revenue.

First: The Model Rules offer that Qualified Domestic Minimum Top-up Tax (QDMTT) can be levied in a low-taxed country where a subsidiary of MNEs is located.

Second: The home country of the MNEs (where the ultimate parent company is located) can apply a global minimum tax of 15% through the Income Inclusion Rule (IIR), the function of which is similar to that of the Controlled Foreign Corporations (CFC) rule.

Third: In an exceptional circumstance where the global minimum tax is not charged under the IIR, other high-tax countries where members of MNEs are located can apply UTPR.[3]

The tax base for the minimum tax is excess profits, namely, net profits in a country minus the Substance-Based Income Exclusion (SBIE) in that country. The SBIE is calculated mechanically as a percentage of tangible assets and payroll in the country where the target subsidiary is located. In essence, the SBIE represents the ordinary/routine profits in the country where subsidiaries of MNEs are located.

Estimated Tax Revenue from Two Types of Minimum Taxes

To which countries does the additional tax revenue from the 15% global or domestic minimum tax belong? A simplified estimation based on the OECD’s Country-by-Country Report (CbCR) (2017) was carried out to answer this question.

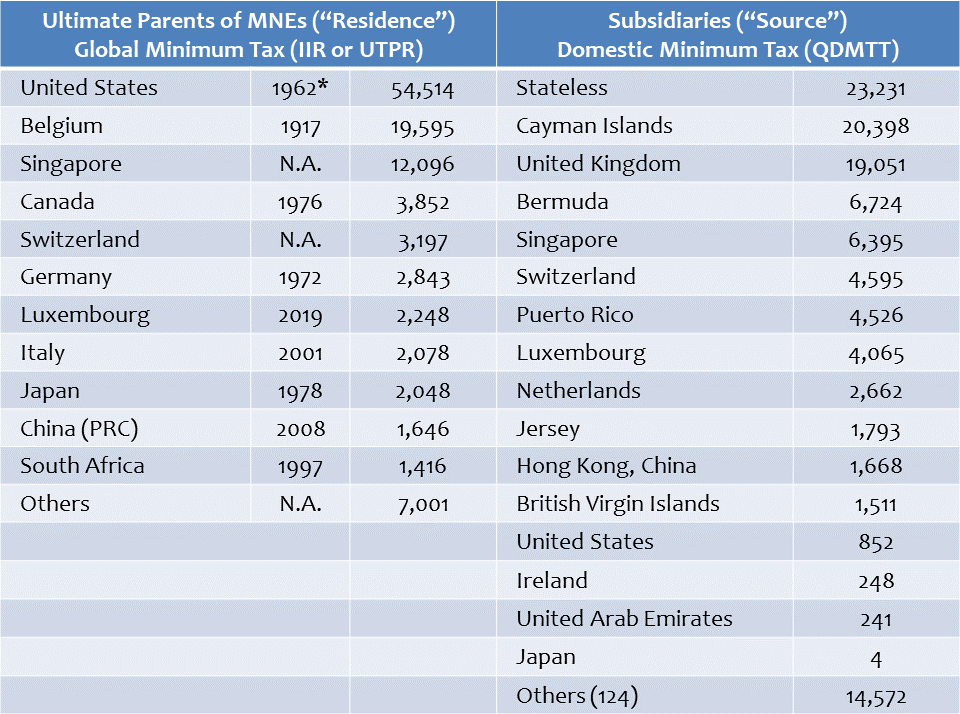

The table below shows the results. The left column shows the additional tax revenue in the home countries of MNEs (“residence” countries) obtained by applying the global minimum tax (through IIR or UTPR).

In 2017, this amounted to US$112.5 billion globally. The main sources of this increase are, in order of size, the United States ($54.5 billion), Belgium ($19.5 billion), Singapore ($12 billion), and Canada ($3.8 billion). Japan is estimated to gain $2 billion.

On the other hand, if low-tax countries and tax havens opt for a domestic minimum tax and effectively prevent the application of the IIR in high tax countries, the estimated revenue increase is shown in the right column.

Table. Impact of Global and Domestic Minimum Taxes: Residence vs. Source

Notes: Years indicate when a national CFC (anti-tax-haven) legislation was introduced. Money amounts are in US$1 million. Methodology used to make estimates is found in Annex 1 at the end of this article. See Annex 2 for the geographical impact of so-called digital taxation rules (“Amount A” taxation rule for the world’s top 100–200 largest and most profitable multinationals).

Source: Created by the author based on Table 1 of the OECD Corporate Tax Database, CbCR.

As shown in the right column, if a domestic minimum tax is imposed in the “source” countries where subsidiaries are located, a number of prominent tax havens will receive a substantial windfall of additional tax revenue. In reality, havens might not opt to get all the extra tax revenue. For many tax havens, corporate income taxes are an effective tool for tax competition. Tax havens may be able to selectively apply domestic minimum taxes to match individual MNEs’ circumstances.

On December 22, shortly after the Model Rules were published, the European Commission proposed a draft directive for national legislation to be introduced by the Member States. It states that the domestic minimum tax is intended “to preserve the sovereignty of Member States.” Furthermore, it clearly states that the purpose of the tax is to attribute the right to tax to the “source” country, rather than the “residence” country where the ultimate parent company is located.

The top-up tax is charged and collected in a jurisdiction in which low-level of taxation occurred, instead of collecting all the additional at the level of ultimate UPE.

According to the Corporate Tax Haven Index (2021) published by the Tax Justice Network,[4] the European Union has a number of prominent tax havens in its area. Therefore, the abovementioned provision might be required to achieve a political agreement. Low levels of taxation occurred because the source country provided tax relief for MNE with no or low level of real activity in its territory. Thus, for low-tax source countries to claim that the use of a domestic minimum tax is a means of preserving their “sovereignty” is somewhat out of balance with the tax sovereignty of countries whose tax base has been deprived by the low-level taxes of another country.

Similarities between the Designer Rate Tax and Domestic Minimum Tax

As the proposed EU Directive argued, the aim of the domestic minimum tax is to avoid all top-up taxes from being attributed to the MNE’s home country (“residence”). Therefore, there will be no need for a low-tax country (“source”) to implement a domestic minimum tax if the MNE’s home country does not implement and apply a global minimum tax. Minimum taxes have the status of “a common approach,” under which countries are not required to adopt the rules in their national law (OECD 2021a, p. 3).

The UK has a statutory rule to counteract the use of designer rate tax provisions to prevent the application of its CFC regime. In a Japanese court case[5] over a dispute regarding whether this type of tax constituted a foreign corporation tax under Japanese tax law, the court held that, in general terms, it was “incompatible with the basic concepts of taxation in developed countries, such as mandatory, fair, and equitable taxation.” A shared feature of the domestic minimum tax and the designer rate tax is the prevention of taxation in other countries. As the Japanese courts have pointed out, the “basic concepts of taxation” may thus at least partially be lacking in the domestic minimum tax. (This issue might affect the eligibility of the tax for foreign tax credits under Japanese corporation tax law).

Will the Domestic Minimum Tax Help Developing Countries’ Fisks?

Citizen organizations urged in a letter to the OECD[6] in December 2020 that the global minimum tax discriminates against developing countries by prioritizing residential country rules. It would be fair to say that this is only half true. Indeed, as shown in the table’s left column, a few large economies can expect a big increase in tax revenues by applying a resident country global minimum tax. But, on the other hand, by applying a domestic minimum tax and prioritizing it in the source country, as shown in the right column, a large portion of additional tax will go to prominent tax havens, not the typical developing country.

According to this estimate, most developing countries can expect to gain US$1 million or less (omitted in the table). Moreover, as discussed below, the minimum tax regime is difficult to administer and might add an unreasonable burden compared to the expected revenue gain for the tax administrations of developing countries.

Increased Compliance Burden

For MNEs, if the total amount of taxes paid remains the same, they may say that it makes no difference to which country the additional tax revenue from the minimum tax is attributed. However, businesses would want to avoid an increase in the administrative burden.

According to a report by a study group of the Ministry of Economy, Trade, and Industry (METI 2021, footnote 29), the administrative burden of the CFC tax in Japan tripled the number of CFC subsidiaries and increased four to five times the administrative work after the FY2016 revision. On the other hand, the CFC regime will not bring sizable revenue increases to the government.[7]

According to the Model Rules, minimum taxes are applied after the application of national rules, including CFC.[8] Therefore, it is first necessary to determine whether the national CFC rules are applicable. If so, MNEs must calculate the income and tax amounts of the subsidiaries subject to taxation in Japan by CFC rules. However, this calculation is not easy and automatic. In practice, MNEs do not actively opt for applying CFC rules to include the income of foreign subsidiaries, except in limited cases where foreign subsidiaries incur a foreign tax, which can be credited in Japan by CFC inclusion.

The United States is the only country to administer a global minimum tax (the GILTI regime introduced in 2017) with a mechanism similar to the OECD minimum tax. A US tax textbook describes GILTI (global intangible low-taxed income) as “a complicated provision for students to understand, taxpayers to comply with, and the IRS to administer.”[9]

The Banner of “Alignment of Economic Activity with the Tax System”

Discussions known as BEPS 2.0 to redefine the tax base has been a fierce struggle among countries with divergent interests. The guiding principle of the process has been the realignment of the place of economic activity with the place of taxation.

Weaknesses in the current rules create opportunities for base erosion and profit shifting (BEPS), requiring bold moves by policymakers to restore confidence in the system and ensure that profits are taxed where economic activities take place and value is created. (OECD 2018, p. 3)

The recent Agreement should have been an answer from the international community to this question.

The 15% global minimum tax and the “invention” of substance-based carve-outs, which are mechanically calculated as an objective measure to determine levels of substantial activity in the source country, will achieve alignment of the place of economic activity with the place of taxation. Only by preventing the leakage of a tax base to low-tax countries where no or limited real economic activity takes place will we be able to prevent a race to the bottom of corporate taxation.

The OECD’s offer of a domestic minimum tax, though, may at least partially alter this conclusion.

In addition to the aforementioned EU Commission, Switzerland, the United Arab Emirates, Singapore, and the United Kingdom have reportedly begun contemplating institutionalizing a domestic minimum tax. Furthermore, the UK is currently contemplating the tax in order to protect British MNEs enjoying tax breaks in the UK from being targeted to a minimum tax in foreign countries (HMRC 2022, para 12.19).

Applying a domestic minimum tax may be a plausible strategy from the perspective of the national interest of individual countries, as it would contribute to additional tax revenues. But this could mean relying on a tax base lacking economic substance. An illustration of this would be taxation by tax-haven countries on letterbox companies to prevent the use of the global minimum tax in the home country of the MNE (where presumably real economic activities take place).

This is hardly a situation that achieves a realignment of the place of taxation and place of economic activity and the creation of value that the international community has been pursuing in the BEPS project. And it can hardly be said to put a stop to a race to the bottom on corporate taxation.

In addition, if low-tax countries selectively impose additional domestic minimum taxes only where low-level taxation occurs for subsidiaries of foreign MNEs, the administration of the regime may lead to a lack of transparency.

A New Type of Tax Competition?

The tax base for the minimum tax is limited to the portion of excess profits over normal profits. For this reason, the Oxford University Policy Brief (2022, p.10) suggests that a rational strategy for future tax competition might include an option to abolish the corporate income tax (applicable to normal profits) and replace it with a domestic minimum tax (applicable to excess profits).

Both incentives point towards the substitution of the Corporation Tax with the QDMTT, at least in certain countries for companies above the Pillar 2 size threshold.

The Republican members of the US Senate Finance Committee referred to this point in a February 16 letter expressing concern to Treasury Secretary Janet Yellen.

The Model Rules appear to open the door to another form of tax competition—to further reduce corporate tax rates and provide exemptions for tax subsidies in an effort to remain internationally competitive while still operating within the confines of the Model Rules.

Be Prepared for New Tax Competition

The Canadian article cited at the beginning of this article concludes with a scathing critique of the domestic minimum tax offer, saying, “The minimum tax was designed to reduce tax competition among nations, but this new model rule is quite different from that.” It would be difficult for citizens of countries losing their tax base to accept the possibility that a minimum tax would generate additional tax revenue for a country with no or limited real economic activity.

One way to solve this problem based on international coordination might be to limit the applicability of the domestic minimum tax to a certain range (say, up to 5%). This option would, on the one hand, prohibit “source” countries (that is, tax-haven countries that do not require real activity in their countries) from completely blocking the use of the global minimum tax by the “residence” countries of MNEs and, on the other, preserve the right of source countries to apply legitimate tax breaks for real inward investment.

Suppose the argument that tax havens have “tax sovereignty” in taxing subsidiaries with little or no real economic activity and such taxation is given precedence under the agreed OECD rule is considered true at face value. Then, what are the citizens of other countries whose tax bases are threatened by such taxation to do?

(1) Retaliatory tariffs, as Thomas Piketty’s collaborator Gabriel Zucman once proposed and US President Donald Trump has practiced (although this may be too radical)

(2) Apply the CFC regime more effectively to tax at the domestic law rate—29.7% in the case of Japan (a more moderate and realistic approach)

As a Japanese Supreme Court decision of October 29, 2009, stated, “In general, the establishment of a so-called anti-tax-haven system as a means of countering another country’s system that may have a detrimental effect on the fairness and neutrality of the tax burden in one’s own country is understood to fall within the content of the right to taxation, which is at the core of national sovereignty” (provisional translation).

A 250-page commentary published by the OECD on March 14 (OECD 2022a) states that the CFC tax regime takes precedence over minimum taxes (p. 96) and that there is no need to replace the anti-tax-haven tax regime with the introduction of a minimum tax (p. 191). Therefore, by applying the national CFC regime, profits of subsidiaries will be geographically attributed to the home countries of MNEs.

According to this commentary, in order to calculate the subsidiary’s effective tax burden as the basis for minimum tax calculation, (1) first, the amount of tax under the CFC rules of the MNE parent’s domestic law is calculated, and (2) then, the subsidiary’s effective tax burden is based on the sum of this amount (allocated to the subsidiary in a prescribed manner) and the amount of tax imposed in the country where the subsidiary is located. Simultaneous application of the CFC rule and domestic minimum tax in another country would complicate the compliance burden. It would negatively affect the international competitiveness of the MNEs in the home country.

Then, as a third conceivable option, what about choosing not to introduce minimum taxes in national law?

Pillar 2 rules (minimum taxes) are positioned as a “common approach,” meaning that countries are not obliged to adopt them. According to OECD statistics, the majority of countries do not have CFC rules.[10] Some in European industry are concerned about European companies’ relative loss of competitiveness if Europe implements a global minimum tax while the United States does not. This might imply that non-adoption of minimum taxes might make sense for home countries of large MNEs.

It is clear that the international community has had to overcome many difficulties and conflicts of interest to reach the Agreement, and the efforts of all involved are to be applauded. That said, the final shape and detailed design of the new system and the institutional reactions of the various countries are still unknown, and we may need to prepare for a new type of tax competition.

References

Her Majesty’s Revenue and Customs (2022), “OECD Pillar 2—Consultation on Implementation,” https://www.gov.uk/government/consultations/oecd-pillar-2-consultation-on-implementation.

Ministry of Economy, Trade, and Industry (2021), “International Taxation in the Digital Economy (Interim Report of the “Study Group on International Taxation,” https://www.meti.go.jp/english/press/2021/0819_002.html.

OECD (2018), “Tax Challenges Arising from Digitalisation—Interim Report 2018,” http://dx.doi.org/10.1787/9789264293083-en.

OECD (2021a), “Statement on a Two-Pillar Solution to Address the Tax Challenges Arising from the Digitalisation of the Economy,” https://www.oecd.org/tax/beps/statement-on-a-two-pillar-solution-to-

address-the-tax-challenges-arising-from-the-digitalisation-of-the-economy-october-2021.htm.

OECD (2021b), “Tax Challenges Arising from the Digitalisation of the Economy—Commentary to the Global Anti Base Erosion Model Rules (Pillar Two),” https://www.oecd.org/tax/beps/tax-challenges-arising-

from-the-digitalisation-of-the-economy-global-anti-base-erosion-model-rules-pillar-two.htm.

OECD (2022a), Tax Challenges Arising from the Digitalisation of the Economy—Commentary to the Global AntiBase Erosion Model Rules (Pillar Two) https://www.oecd.org/tax/beps/tax-challenges-arising-

from-the-digitalisation-of-the-economy-global-anti-base-erosion-model-rules-pillar-two.htm.

OECD (2022b), “Tax Challenges Arising from the Digitalisation of the Economy—Global Anti-Base Erosion Model Rules (Pillar Two) Examples,” OECD, Paris, https://www.oecd.org/tax/beps/tax-challenges-arising-

from-the-digitalisation-of-the-economy-global-anti-base-erosion-model-rules-pillar-two.htm.

Oka, Naoki (2021) “Fight against Tax Havens and International Tax Law: New Taxing Right and a Global Minimum Tax,” https://www.mof.go.jp/english/pri/publication/pp_review/ppr17_01_04.pdf.

Oxford University Policy Brief (2022), Michael Devereux, et al., “Pillar 2: Rule Order, Incentives, and Tax Competition,” https://oxfordtax.sbs.ox.ac.uk/pillar-2-rule-order-incentives-and-tax-competition.

ANNEX 1

Methodologies used to make simple estimates of the size of additional tax revenue from global minimum tax and domestic minimum tax (using CbCR data for 2017 published by the OECD).

Obligation to Submit Information Returns by Large Multinationals

MNEs with a global revenue of 750 million euros (¥100 billion in Japan) must submit a Country-by-Country Report (CbCR). In 2020, Japan’s National Tax Administration received CbCRs from 898 MNE groups whose home country is Japan and provided them to 57 countries.

The OECD compiles CbCRs from 38 reporting countries, anonymizes them so that individual companies cannot be identified, and publishes the data. Data for 2016 and 2017 have been published so far.

The OECD emphasizes that various reservations should be made when interpreting the data. For example, six reporting countries do not disclose names of individual countries where subsidiaries are located.

Methodology to Estimate the Amount of Country-by-Country Additional Tax

Additional tax revenue in the country = {(Profit (or Loss) before Income Tax − Tangible Assets other than Cash and Cash Equivalents × 5%) × 15%} − Income Tax Accrued

Excerpts from the Model Rule (OECD (2021b)) on top-up tax (Article 5.2)

- Top up tax percentage = Minimum rate – Effective tax rate

- Excess profit = Net global income – Substance-based income exclusion

- Jurisdictional top-up tax = (Top-up percentage × Excess profit) + Excess profit + Additional current top-up tax – Domestic top-up tax

Note: Substance-based income inclusion was calculated as 5% of tangible assets. The percentage is smaller than the 10% used for the 10-year transition period. In addition, the wage portion is not taken into account here because the information is not available. These limitations would result in the estimated amount being larger.

The amounts of additional tax in this estimation are smaller than that in the similar exercise conducted by the EU Tax Observatory.[11]

ANNEX 2

Taxation of Extra-Large and Profitable NMEs

The international agreement also includes a new tax rule called “Amount A” to ensure that the profits of extra-large MNEs with global sales of more than 20 billion euros and profit margins above 10% are appropriately taxed. In reaching this agreement, a fierce battle for the tax base ensued between giant economies, such as the US and European countries.

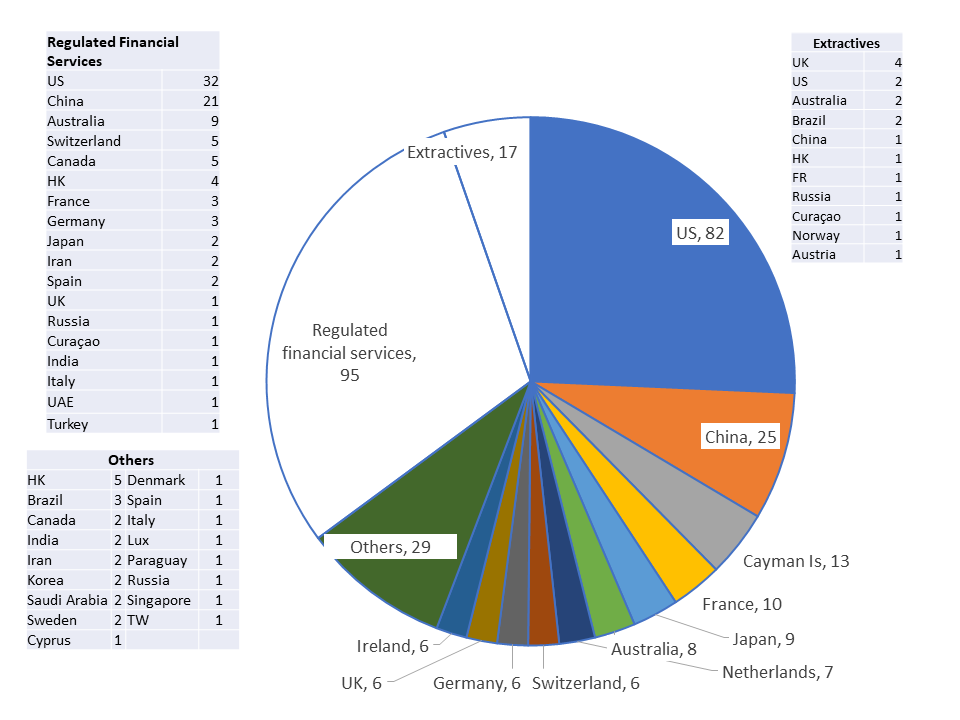

Figure 2. Large and Profitable NMEs: Global Top 200

Source: Created by the auther, adopted from BvD Orbis, most recent financial years (mainly 2019–21). Industry classifications are based on the Orbis database.

[1] Gabriel Zucman, 2015, The Hidden Wealth of Nations, University of Chicago Press, Introduction, “Acting against Tax Havens.”

[2] In this article, countries where the effective tax burden on subsidiaries of multinationals is less than 15% are referred to as low-tax countries or tax havens.

[3] By denying tax-deductibility of expenses, the UTPR will achieve the same effect as applying the 15% global minimum tax on a member of the MNE in low tax countries.

[4] https://cthi.taxjustice.net/en/

[5] Tokyo high court, October 25, 2007.

[6] “Submission to the Public consultation on the Reports on the Pillar One and Pillar Two Blueprints,” December 14, 2020, https://www.globaltaxjustice.org/sites/default/files/Submission%20to%20the%20Public%20Consultation

%20on%20the%20Reports%20on%20the%20Pillar%201%20and%20Pillar%202%20Blueprints.pdf.

[7] According to published data from the National Tax Administration of Japan, enforcement activities of the CFC regime led to an increase of ¥238.1 billion in MNE income in Japan, which generated ¥71.4 billion (estimate) in corporate tax revenue in the 10 years between 2011 and 2020.

[8] OECD (2022a), Article 4.3.2, para 45, and OECD (2022b), Example 4.3.3-1.

[9] Mindy Harzfeld, International Taxation in a Nutshell, 14th edition, West Academic Press.

[10] According to the “Controlled Foreign Company (CFC) Rules” OECD Dataset, 79 of 129 countries do not have national CFC rules.

[11] EU Tax Observatory (2021), “Revenue Effects of the Global Minimum Tax: Country-by-Country Estimates,” Table 2, https://www.taxobservatory.eu/revenue-effects-of-the-global-minimum-tax-country-by-country-estimates/.