Perspectives on Revisions to Crypto Asset Taxation Rules

June 20, 2025

X-2025-009E

Approaches to regulatory frameworks and tax systems for crypto assets are attracting attention.

On April 10, 2025, the Financial Services Agency published “Discussion Paper on Review of Regulatory Frameworks for Crypto Assets”. In an answer given in the Diet, Minister of Finance, Minister of State for Financial Services Katsunobu Kato indicated that the Financial Services Agency is examining its approach to regulatory frameworks after taking into account the 2025 Tax Reform Outline of December 2024 and hopes to summarize courses of action from the review by June or thereabouts.[1]

Crypto assets are generating new technologies and forms of use on a daily basis, having evolved from so-called virtual currencies (payment instruments and investment assets) to tokens (platforms for innovation) associated with the blockchain technology that forms the core of Web 3.0[2], which has led to them also becoming a frontier in the sense of tax systems.

Below we will put the focus on the taxation issues surrounding virtual currencies such as Bitcoin, which are a subcategory of crypto assets, and after considering the regulatory experience and status of crypto asset usage in various countries, set out the key arguments pertaining to taxation rules.

Moves toward tax reform in FY2026 and beyond

On April 10, 2025, the Financial Services Agency published the “Discussion Paper on Review of Regulatory Frameworks for Crypto Assets”.

The paper shows a contemporary awareness of the increasing presence of crypto assets for the purpose of investment and of the importance of the healthy development of Web 3.0 and discusses various options such as industry regulation primarily from a perspective of user protection, and measures to prevent insider trading. There is no mention of taxation, but there is a consensus that this move will lead to a revision of taxation on crypto asset transactions from the current comprehensive taxation (with a maximum tax rate of 55%) to separate taxation (20%).

There is an antecedent to this discussion. The LDP/Komeito FY2025 “Tax Reform Outline” (p.106) published on December 20, 2024, addresses the taxation of crypto asset transactions as follows.

|

Investigate revisions to taxation of crypto asset transactions based on the following assumptions: · Make certain crypto assets financial instruments that can make a broad contribution to asset formation by citizens (establish in Financial Regulatory Act) · Regulate (for investor protection) in the same way as financial instruments for which special taxation has been established · Establish a duty of reporting by business operators, etc. to tax authorities |

In addition, in March 2025, the “Web 3.0 Working Group” of the LDP Headquarters for the Promotion of a Digital Society made specific proposals that crypto assets be subject to separate taxation in the same way as other financial instruments.

|

Gist of the Liberal Democratic Party’s Urgent Proposal (March 2025) As indicated in the 2025 Tax Reform Outline that was published on December 20, 2024, after the necessary legal steps have been taken for crypto assets, they should be subject to separate taxation in the same way as other financial instruments. In other countries, including the United States, the rate of taxation is generally lower than that of Japan due to capital gains treatment. From the perspective of ensuring international competitiveness, the disparity in terms of tax systems should be eliminated. |

Source: excerpted from “Crypto assets as a new asset class: outline of proposal for crypto asset regulatory framework reform (draft),” Web 3.0 Working Group, LDP Headquarters for the Promotion of a Digital Society, Policy Research Council , March 2025

Taxation systems for crypto assets in various countries

The regulatory frameworks in each country (taxation method, tax rate, and information obligations of exchanges to ensure appropriate taxation) are summarized[3] in the table.

Table 1: Outline of taxation on crypto asset transaction for major countries [4]

|

Country |

Legal status of crypto assets |

Taxation method and maximum tax rate* |

Information obligations of exchanges |

|

|

To taxpayer |

To tax authorities |

|||

|

Japan |

Payment instrument (1) |

Miscellaneous income 45% (progressive) |

None (requested by NTA) (2) |

None (individual inquiries) |

|

US |

Digital asset (3) |

Short-term 37% (progressive) |

Information obligation (4) 1099-DA |

Information reporting (4) 1099-DA |

|

Germany |

Asset |

Short-term capital gains 45%+ (5) Long-term (currency) Not taxed |

Information obligation |

CARF (6) |

|

France |

Investment asset |

Income tax 12.8% + social insurance 17.2% (7) |

Information obligation |

CARD (6) |

|

UK |

Intangible asset |

Capital gains 20% |

Information obligation |

None (individual inquiries) |

|

Italy |

Digital asset |

Capital gains 26% ⇒ 33% (tax rate raised in 2025) |

Information obligation |

None (individual inquiries) |

|

Singapore |

Digital asset |

Capital gains not taxed |

NA |

NA |

Note: Tax rates are for national/federal taxes. In some cases, systems for the small-amount income tax exemptions may be applied. For references to (1), etc. in the table, see footnote [4].

Source: Prepared by the author with reference to Japan Cryptoasset Business Association “Materials 1: Comparison of cryptocurrency tax systems in various countries,” and the websites of the IRS, BMF, DGFiP, HMRC, Agenzia delle Entrate, and IRAS. Regulatory frameworks are those existing as of 2024.

Separate taxation (capital gains) or comprehensive taxation (miscellaneous income)?

As can be inferred from Table 1, many countries other than Japan have made crypto-asset transactions the subject of capital gains taxation. The previously mentioned LDP Urgent Proposal (March 2025) asserts that Japan’s tax burden is heavier than that of other countries, and that this is impairing its international competitiveness. However, maximum tax rates for short-term holdings (of one year or less), which include 37% for the United States and 45% for Germany, as well as 30% for France and an increase to 33% for Italy, do not give the impression that Japan’s tax rates are head and shoulders above those of other major countries.

What is the reason for the United States taxing crypto assets as capital gains, while Japan categorizes them as miscellaneous income? We will look at this below.

Japan

According to the Income Tax Act, capital gains are income derived from the transfer of assets, excluding inventories (Article 33 of the Income Tax Act). However, cash does not fall into the category of an asset generating capital gains[5]. This is because cash is a scale for the measurement of the value of things, and so there can be no concept of increases and decreases in the price of cash itself. If we compare this to the property of “payment instruments” possessed by crypto assets as provided for in law (Article 2-5 of the Payment Services Act), it corresponds to the interpretation in the Income Tax Act, and crypto assets have been bestowed with the same meaning as cash (currency).

United States

For the purposes of federal taxation, virtual currencies (crypto assets) are treated as property (IRS Notice Q1), and accordingly the general principles of taxation applied to property transactions (recognition of income and losses from exchange of property, etc.) are applied.

In cases where a virtual currency is a capital asset of the taxpayer (Q7), capital gains taxes are applied to such transactions (purchases and sales, etc.). Capital assets are typically assets that do not include inventories (IRC §1221).

Have crypto assets reached the stage of a financial instrument that contributes to asset formation by citizens?

The previously mentioned LDP Urgent Proposal (March 2025) points out that crypto assets are widely used for the purpose of investment by citizens.

“As of the end of October 2024, more than eleven million crypto-asset accounts had been opened, with user deposits exceeding 2.9 trillion yen. When compared to the situation that obtained in 2005 when foreign exchange transactions were made subject to the previous Financial Futures Trading Act (approximately 800,000 accounts as of 2007), it can be seen that there are more citizens engaging in crypto-asset transactions for the purpose of investment.”

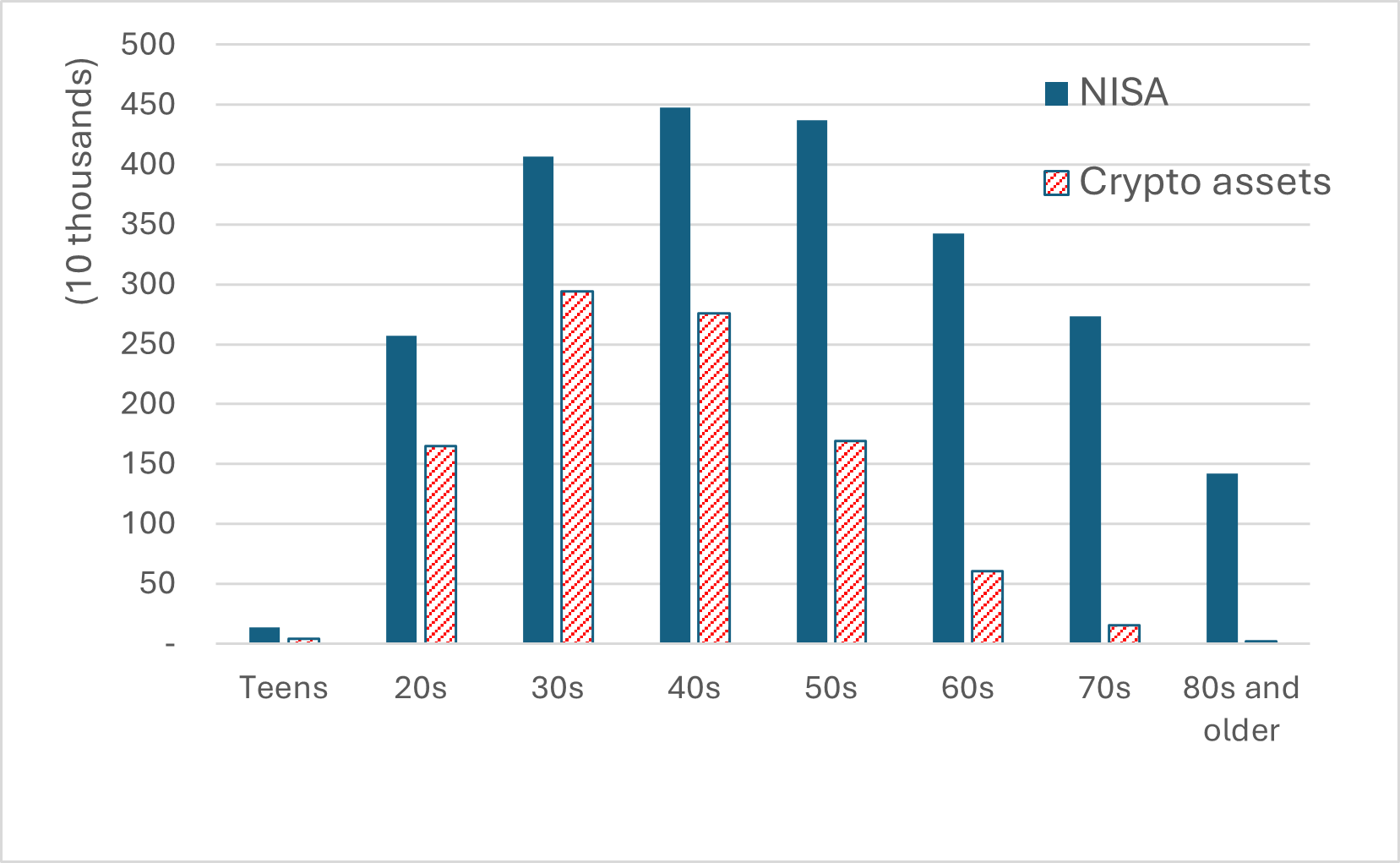

As indicated, crypto assets have a growing presence in society. When comparing the characteristics of crypto assets at the investment level with stocks and bonds[6] that are typical financial assets (holding amount per person, breakdown by age), the following points can be made.

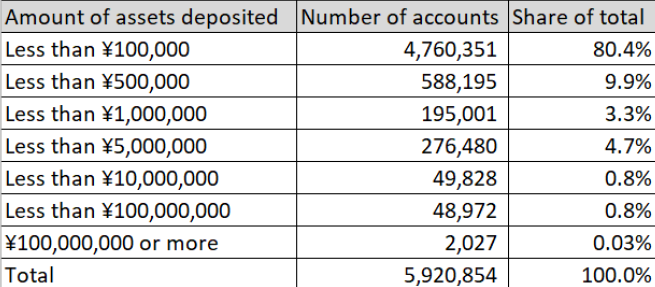

- The number of crypto-asset accounts opened and the amount of crypto-asset deposits are increasing, but compared to accounts for stocks and bonds, whether viewed in total or by individual investors, the amounts are relatively small. (Table 2)

- Small accounts comprising holdings of less than 100,000 yen (deposit amounts) account for 80% of the total. (Table 3) (It is possible that these crypto assets are used as a means of making small payments.)

- Most crypto-asset accounts are owned by people from younger generations (in their 30s and 40s). (Figure 2)

Table 2: Crypto assets and NISA investments

|

|

Crypto assets (March 2024) |

NISA (December 2023) |

|

Number of accounts (Note 1) |

9.901 million |

21.247 million |

|

Balance (Note 2) |

2.7677 trillion yen |

18.3664 trillion yen |

|

Per account (simple average) |

279,000 yen |

864,000 yen |

Source: Prepared by the author based on materials from the Financial Services Agency, Japan Virtual and Crypto Assets Exchange Association

Note 1: For crypto assets, the number of accounts established. For NISA, the total of general and savings accounts

Note 2: For crypto assets, the balance of user deposits. Refers to old system for NISA

Note 3: NISA (Nippon Individual Savings Account) is a tax-exempt investment scheme in Japan that allows individuals to invest in stocks and mutual funds without incurring capital gains tax or dividend tax, up to a specified annual and lifetime limits.

Table 3: Number of crypto asset accounts by type of asset deposited (active accounts)

Source: Japan Virtual and Crypto Assets Exchange Association, Annual Report on Crypto Asset Transactions (FY2023), p.30; column indicating share added by author.

Figure 1: Number of accounts opened by age (March 2024)

Source: Prepared by the author based on materials from the Financial Services Agency, Japan Virtual and Crypto Assets Exchange Association

In conclusion

There are three points that should be made when considering taxation systems.

1. The different aspects of crypto assets

Crypto assets comprise a mixture of elements that as assets have different natures.

- While the basic legal nature of crypto assets is that of payment instruments like so-called virtual currencies (such as Bitcoin), some are also held in the expectation of price increases.[7]

- Various “tokens” that represent the core technologies that comprise Web 3.0 (decentralized systems that lead to innovation), which may fall into the category of crypto assets depending on the form of usage

When forming an overall view of the various approaches to tax systems as they pertain to crypto assets, it is important to pay close attention to these differences.[8]

2. What issues should be considered with regard to tax reform?

In terms of the issues that should be considered with regard to tax reform, the following points[9] raised by former LDP House of Representatives Member Masanobu Ogura may serve as a useful reference.

First, a rational basis that enables a reasonable explanation of the need for revision

Second, clarification of the merits in terms of tax revenue of such a revision

Third, public understanding among the Japanese people of the contribution to asset formation by citizens made by investments in crypto assets (making assets congruent with those recommended by the government for investment subject to separate taxation, etc.)

We will discuss the first point (rational basis for revisions to the system) later, during the process of which we will touch on the third.

On the second point (impact on tax revenue), because many holders of crypto assets have only small accounts (from which it can be inferred that many have low to medium incomes; Table 3), in the event that a separate taxation rate of 20% were to be set, this could lead to an increase in the burden for many taxpayers holding crypto assets.[10] This would result in an increase in tax revenue for the state. On the other hand, it would lead to a decrease in the burden for taxpayers who hold large amounts of crypto assets and generate high amounts of income from capital gains, which would lead to a decrease in tax revenue for the state. Ultimately, in the same way as for the 100-million yen barrier problem in financial income taxation, it would lead to weakening of the progressiveness of income tax system.

Note: The "100-million yen barrier problem" in Japan refers to a tax anomaly where individuals earning over 100 million yen annually pay a lower effective tax rate than those with lower incomes. This is mainly because a significant portion of their income comes from financial income, which is taxed separately at a flat rate of 20%, rather than being taxed progressively like employment income.

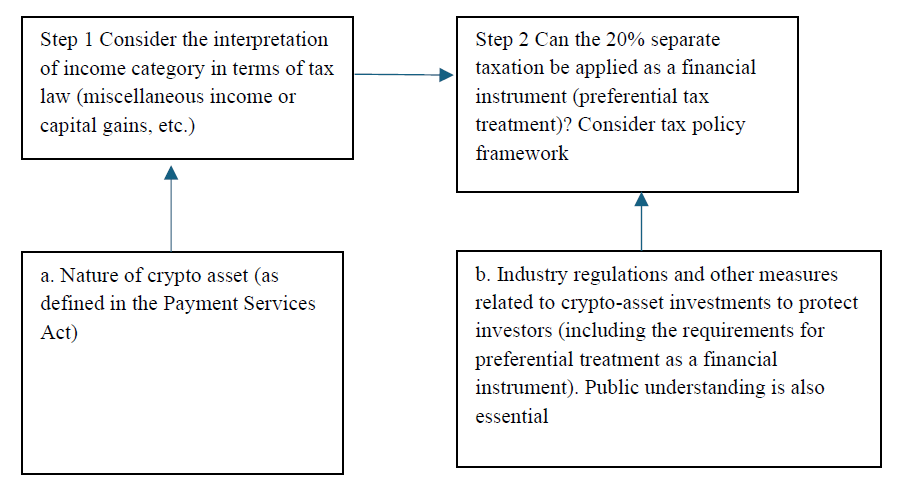

3. Rational basis for crypto asset taxation

In order to impose separate taxation of 20% (preferential tax treatment) on crypto assets, in the first stage (Step 1) it would be necessary to switch crypto-asset transaction income from miscellaneous income, with its progressive tax rate, to capital gains. On that basis, even in cases where it falls into the category of capital gains, in the second stage (Step 2), it would be necessary to investigate whether it is appropriate to impose separate taxation on targeted assets and transactions.

In summary, the following considerations apply to crypto assets (virtual currencies).

The current categorization of crypto-asset transactions as miscellaneous income is due to the interpretation of tax law, and the basis for categorizing crypto assets as assets that do not fall into the category of those generating capital gains is that crypto assets are specified as “payment instruments” in law. (Step1) (a)

Accordingly, even if the approach to regulatory frameworks for crypto assets were revised, and they were made subject to the same financial regulation as financial instruments subject to separate taxation, such as stocks and bonds, if the “payment instrument” nature of crypto coins (such as Bitcoin) were to remain, it would not be possible to immediately tax crypto-asset transactions as capital gains.

On the other hand, if the Payment Services Act were revised and the legal positioning of “payment instrument” were abolished (and it is not clear how far the 2025 Tax Reform Outline goes in this respect), the basis for current taxation as miscellaneous income would be lost, and crypto-asset transactions would be subject to capital gains.

Even in such an eventuality, a separate taxation rate of 20% would constitute preferential tax treatment, and consideration of the issue would need to start from the point of establishing the requirements for considering crypto assets a financial instrument for which preferential taxation treatment is appropriate.[11] (Step 2) (b)

In response to whether virtual currencies could be considered a financial instrument eligible for the shift from saving to investment, Shigeki Morinobu (2019)[12] pointed out that while the yen (foreign exchange) rises and falls to reflect fundamentals and interest rates, there is no economic underpinning for the value of virtual currencies.

Crypto assets have various aspects, such as payment instruments (Bitcoin, etc.), vehicles for investment, and platforms for innovation (Web 3.0, DAO, and DeFi tokens, etc.). With regard to tax issues related to Web 3.0 (tokens, etc.) it may well be necessary to ascertain whether taxation as miscellaneous income (progressive taxation) hinders innovation, to listen to entrepreneurs and the markets, and if necessary to plan a bold regulatory framework predicated on obtaining public understanding.[13]

In a response to the Diet, Prime Minister Shigeru Ishiba commented that the healthy development of Web 3.0 is important from the perspective of resolving social issues and improving productivity, and that he is eager to see the necessary environment established.[14] It will be interesting to see how discussions evolve going forward.

[1] Answer by Katsunobu Kato to member of parliament Akihisa Shiozaki (LDP) on the House of Representatives Budget Committee, January 31, 2025

[2] Glossary of terms

Web 3.0: Decentralized Internet based on blockchain technology. Characteristics include user-driven data management and governance.

DAO (Decentralized Autonomous Organization): An organization whose autonomy is governed by smart contracts. Decision-making is conducted through the votes of those holding tokens (utility tokens).

DeFi (Decentralized Finance): A financial system in which loans and transactions can be conducted without going through intermediary institutions. This is implemented automatically on blockchains.

Security token: An investment token that represents the digitized rights of stocks, bonds, and other instruments. Treated as a security under the law.

[3]The triggers for taxation of a crypto asset are exchange for legal tender, exchange for another crypto asset, or exchange for goods or services.

[4] (1) Article 2, paragraph (5) of the Payment Services Act

(2) While not required by statute, the National Tax Agency requests that cryptocurrency exchanges prepare annual transaction reports and provide them to investors. “Tax treatment of crypto assets, etc. (FAQ)” 2-7.

(3) Crypto assets are treated as property under federal law (IRS Notice Q1). There is no unified definition of crypto assets in the United States, with definitions varying from “securities” to “products,” to “digital assets,” depending on the regulatory authority.

(4) With regard to transactions pertaining to the sale or exchange of crypto assets, operators of exchanges, etc. are obligated to provide information to the IRS and the taxpayer using a comprehensive new form for digital asset transactions (1099-DA), (beginning in the 2025 fiscal year).

(5) In Germany, an additional “solidarity surcharge” of 5.5% of the income tax is imposed.

(6) CARF: Crypto-Asset Reporting Framework System created by the OECD for the automatic exchange of information. Under this regulatory framework, exchanges report customer information, annual transaction amounts, and money transfer histories to tax authorities in accordance with Common Reporting Standards (CRS), with tax authorities automatically exchanging information thus received with the tax authorities of other countries. (Germany and France will introduce this in 2026)

(7) France does not levy taxes at the point in time at which they are exchanged for other crypto assets.

[5] Hideaki Sato “Basic Income Taxation, Third edition” (KOUBUNDOU Publishers Inc.), p.89.

[6] Due to data availability, NISA accounts are regarded as representative of status of financial asset accounts.

[7] According to questionnaire surveys, more respondents were holding crypto assets for the purpose of investment than as a payment instrument. SBI Financial and Economic Research Institute, “Questionnaire survey on general consumer interest and usage of next generation finance,” April 2024, Q29

[8] With regard to tokens, these are already treated in accordance with the nature of the transaction by which they are generated (National Tax Agency Tax Answer 1525-2 “Tax matters in the case of transactions using NFT and FT”)

[9] M. Somekawa “What are the key points of tax reform for virtual currencies, and what will be the approach to filing for separate taxation and the impact of revisions to the Payment Services Act?”

Excerpted from January 4, 2025, edition of COINPOST. “In the opinion of the Deputy Secretary-General of LDP, Masanobu Ogura, there are three key points involved in achieving revisions to the tax system. First, a rational basis that enables a reasonable explanation of the need for revision. Second, clarification of the merits in terms of tax revenue of such a revision. Third, understanding of the contribution made by investments in crypto assets to asset formation by citizens.” In addition, “He notes that assets consistent with those recommended by the government for investment are subject to capital gains taxation, and he emphasizes the necessity of recognizing that crypto assets also contribute to asset formation.”

[10] According to estimates made by the Ministry of Finance on the basis of the 2022 budget, 41.9 million people, equivalent to approximately 80% of taxpayers, received a salaried income of 8.36 million yen or less (using the example of a four-person household in which one person works), and were subject to a tax rate of 10% or less. Ministry of Finance “Distribution of taxpayers (by taxpayer marginal tax rate bracket)”

[11] In response to a question from Satoshi Asano (Democratic Party For the People) on December 2, 2024, during the plenary session of the House of Representatives, Prime Minister Shigeru Ishiba struck a cautious note in the following comment: “There is the issue of whether we can obtain the understanding of the people of Japan in relation to applying a tax rate of 20%, and the issue of whether it is appropriate, as a government, to recommend that households purchase crypto assets in the way that it recommends stocks and investment trusts that are subject to regulations to protect investors, and this is a matter that requires careful consideration.”

[12] Comments made in roundtable discussion between Shigeki Morinobu and Katsuhiko Sakai in Shigeki Morinobu (2019) “Treatment of virtual currencies under tax law,” Accord Tax Review No. 11/12 (2019)

[13] This is not limited to Web 3.0, but the FY2025 Tax Reform Outline introduces a regulatory framework that allows up to 2 billion yen in gains from shares in startup investments to remain untaxed.

[14] Response to a question from Akihisa Shiozaki (LDP) of the House of Representatives Budget Committee on January 31, 2025.