Making Work Pay for Japanese Women: Toward a Smarter Approach to Tax and Social Security Reform

May 30, 2023

X-2023-002E

The Foundation’s senior tax expert seeks to reframe the debate surrounding structural barriers to women’s full participation in the labor force.

* * *

The Japanese tax and social-insurance systems have long been under fire for discouraging fuller workforce participation by married women. Now, in the wake of the COVID-19 pandemic, such systemic flaws are threatening Japan’s economic recovery, as services tied to the tourism industry struggle to secure the labor they need to meet booming demand. In the following, I review the impact of various income thresholds, critique the government’s plan to use subsidies to neutralize one such barrier, and explain the need for more fundamental reform.

Income Thresholds and Their Impact

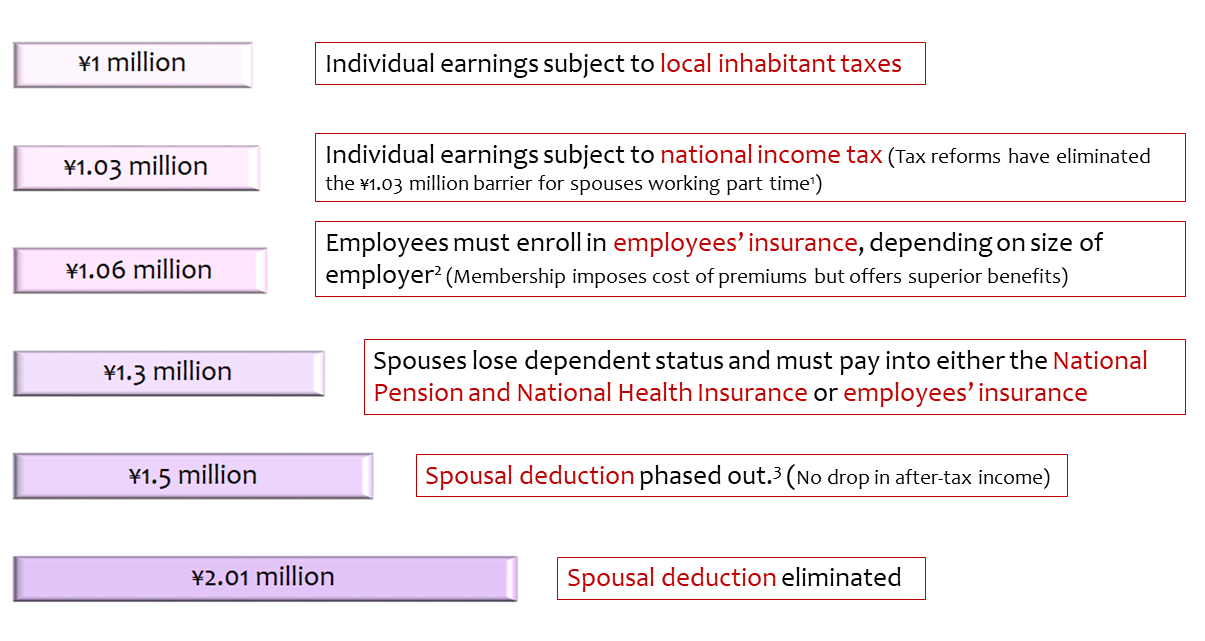

According to the Cabinet Office’s Gender Equality Bureau, there are six key income thresholds at which new tax and social-insurance burdens kick in, potentially discouraging secondary earners from working and earning more. These thresholds are widely referred to as “barriers,” but in some cases the term is inappropriate and can perpetuate serious misunderstandings, I explain below.

Income Thresholds Linked to Women’s Workforce Participation

1. ¥1.03 million was also the cutoff for the old spousal deduction (or exemption). However, that tax break was replaced with the special spousal deduction, which decreases incrementally, and the threshold for the maximum deduction was raised to ¥1.5 million in 2018.

2. Part-time workers must be enrolled in employees’ insurance if (1) they work 20 or more contracted hours per week for a given employer, (2) their contracted monthly pay is ¥88,000 or higher, (3) they have been employed by the business for at least two months, and (4) they work for a business with more than 100 employees. Beginning in October 2024, the requirement will extend to all businesses with more than 50 employees.

3. The deduction is reduced for primary earners with an adjusted income of more than ¥9 million but no more than ¥10 million (annual earnings over ¥10.95 million but less than ¥11.95 million) and eliminated for those whose adjusted income exceeds ¥10 million.

Source: Created by the Tokyo Foundation for Policy Research based on material published by the Gender Equality Bureau, Cabinet Office (December 22, 2022).

The first two thresholds, ¥1 million and ¥1.03 million, represent the minimum taxable income for (local) inhabitant taxes and the (national) income tax, respectively. In the case of the income tax, ¥1.03 million is the sum of the basic deduction of ¥480,000 (designed to guarantee basic living standards) and the ¥550,000 employment income deduction (intended to cover the job-related expenses of employed persons, including those working part time).

Beyond these thresholds, each additional ¥10,000 in earnings results in ¥1,000 in inhabitant taxes and ¥500 in the income tax, but since one’s after-tax income continues to grow after one passes the thresholds, they cannot be considered barriers in and of themselves. However, as I explain below, the use of the ¥1 million threshold as a cutoff for certain welfare benefits could very well have the effect of disincentivizing work, and this is an issue that needs to be addressed.

The next thresholds, ¥1.06 million and ¥1.3 million, are currently the most controversial. They are the levels at which social-insurance premiums must be paid. In the following, I will examine the implications of these thresholds more closely, drawing from a recent paper by economist Kazuhiko Nishizawa.

Under the Employees’ Pension Insurance Act, any company with more than 100 employees is obligated to enroll its employees in the Employees’ Pension Insurance (EPI) system. The requirement applies to any employee who works at least 20 scheduled hours a week at monthly wages of at least ¥88,000 a month—that is, ¥1.06 million or more annually. For those employed in smaller businesses, the annual income threshold is ¥1.3 million. The ¥1.06 million threshold is based on contracted wages (excluding overtime pay and benefit allowances), whereas the ¥1.3 million threshold is based on gross income from all sources, including overtime, commuting and other allowances, dividends, real estate income, and so forth.

For a married woman working part time to supplement her husband’s income, crossing the threshold can be costly, at least in the short run. As long as she makes less than the threshold, she is classified as a dependent spouse, or Category III insured person. As such, she is covered by the Basic Pension of the National Pension system and her husband’s health insurance plan, both at no cost. Beyond the threshold, she shifts to Category II and must contribute half of the 18.3% EPI contribution and half of the health insurance premium, roughly 10% (the rate varies by plan). The employer pays the other half. With approximately 14% of her earnings going to social-insurance premiums, she now takes home substantially less than she did when her income was just below the cap. Indeed, according to our calculations, her annual net income drops by about ¥160,000. To recover the lost income, the woman’s earnings would need to increase an additional ¥270,000, to ¥1.33 million. Because of this, many women limit their hours in order to keep their annual employment income under the cap and remain dependent spouses. (According to the government, there are some 4.73 million Category III insured persons who work part time.)

Thus far, the government’s efforts to rectify the situation have focused on expanding EPI coverage to more part-time employees. Initially only companies with more than 500 employees were required to enroll part-time employees (working at least 20 scheduled hours a week) who earned ¥1.06 million or more. In 2022, the policy was extended to businesses with more than 100 employees, and in October 2024, it will apply to those employing more than 50. The thinking is that, once the same rules apply to all companies regardless of size, the ¥1.3 million barrier will disappear. This approach is fundamentally sound.

A Problematic Subsidy

That said, the ¥1.06 million and ¥1.3 million income thresholds remain controversial as barriers to women’s full participation in the labor force.

At a March 17 press conference, Prime Minister Fumio Kishida announced plans to address this issue through “support for measures” that would prevent a drop in take-home pay. He also promised to “undertake a review of the system itself.”

At this point, however, the government panel tasked with addressing barriers to women’s full participation is focusing on the quick fix. According to reports, the idea is for businesses, supported by government subsidies, to partially compensate married part-time employees for any loss in take-home pay triggered by an increase in hours or wages. The compensating payments would continue until the women’s additional earnings covered the added burden of social-insurance premiums.

The proposal has come under considerable criticism. Some have questioned whether it makes sense to provide subsidies to companies instead of the individuals affected. More fundamentally, the plan fails the fairness test.

Under the current system, women who earn under the threshold (including full-time homemakers) receive free social-insurance benefits as Category III insured persons, at the taxpayers’ expense. Now the government is also offering to foot the social-insurance bill for those who earn more. This seems particularly unfair to Category I insured persons—including sole proprietors, independent contractors, and short-term contract workers—who must pay their own social-insurance premiums. Another basic question is whether it is appropriate for the government to contribute to employees’ pensions, given that they will receive the pension benefits after they retire.

Overcoming the “Barrier” Mindset

It is important for people to realize that there are considerable advantages to crossing the income “barrier” and enrolling individually in Japan’s social-insurance schemes.

Under Japan’s two-tiered pension system, Category III insured persons are eligible only for the flat Basic Pension benefit. Those enrolled in EPI receive the Basic Pension plus a compensation-tied benefit, which increases the longer one works. Once one’s annual income reaches about ¥1.33 million, the negative impact on take-home pay disappears, and one can look forward to greater post-retirement security.

It has been estimated, for example, that if someone who had been earning ¥1.05 million annually began making ¥1.10 million and enrolled in EPI, by their early eighties their accumulated EPI benefits would more than cover the previous loss of disposable income. This is generally considered the smart option for women, given their long life expectancy.

In addition, those who reach the income threshold can switch to employees’ health insurance, which offers a number of advantages over National Health Insurance, including an injury and sickness allowance, a maternity allowance, and expanded disability pension benefits.

All of that said, in the real world there is a strong tendency to focus on immediate rewards (take-home pay), especially given the challenge of calculating the costs and benefits over a lifetime. As a result, spouses working part time to supplement household income do tend to treat the ¥1.06 million and ¥1.3 million thresholds as barriers and limit their working hours accordingly. The government could reduce the mental barriers to working beyond these thresholds by more effectively communicating the merits of Employees’ Pension Insurance.

The last two thresholds—¥1.5 million and ¥2.01 million—are less controversial.

The Japanese tax system makes no provision for joint income tax returns. Instead, it allows primary earners to take a “special spousal deduction.” Currently, primary earners with spouses making less than ¥1.5 million can deduct ¥380,000 from their taxable income. Above that, the deduction is reduced incrementally, disappearing entirely for those with spouses earning ¥2.01 million or more. (High-income primary earners are not eligible for the deduction.)

Passing these thresholds has the effect of slowing the increase in a household’s after-tax income, but because the deduction is phased out gradually, there is no “tax cliff” and thus little disincentive to work. (The threshold for the maximum spousal deduction was raised from ¥1.03 million to ¥1.5 million in 2018 with a view to encouraging women’s active participation in the labor force.)

Benefits Linked to the ¥1 Million Threshold

There is still a tendency to view the ¥1.03 million income-tax threshold as a barrier, partly because private companies have traditionally used this figure in their calculations of spouse and family allowances. However, this practice is being abandoned in favor of allowances linked to the number of dependent children.

In my view, the ¥1 million threshold for the local inhabitant taxes is more problematic than either the ¥1.03 million or the ¥1.06 million threshold.

The inhabitant tax obligations begin when an individual’s employment income reaches ¥1 million. With deductions figured in, the threshold is ¥1.35 million for married couples and ¥2.04 million for earners in households with dependent spouses or other relatives.

As noted above, the inhabitant tax itself is not a disincentive to work. The problem derives from welfare benefits linked to this threshold. For example, in a bid to soften the impact of inflation, the government is offering households below the threshold a uniform cash benefit of ¥30,000 along with a ¥50,000-per-child subsidy. This means that a family with two children can receive ¥130,000 as long as it stays just under the ¥1 million threshold. But if it owes even ¥1,000 in inhabitant taxes, it gets nothing at all. Households that stay under the threshold are also eligible for need-based government scholarships for high school and college students. Together, these programs could create a potent incentive for staying under the inhabitant-tax threshold. Since inhabitant taxes are based on the previous year’s income, they can easily influence next year’s employment decisions.

This dilemma is by no means unique to Japan. In other industrial countries, measures have been adopted to eliminate incentives of this sort on the understanding that they contribute to the cycle of poverty. Quite a few countries, including Britain, the Netherlands, South Korea, Sweden, and the United States, have adopted refundable tax credits. Treating social-insurance premiums and taxes as a single burden, these programs assist low-income households while preserving their incentive to work by preventing any drop in disposable income resulting from an increase in earnings.

As I have explained in the past, Japan would benefit greatly from a similar system, but first it must build the necessary tax infrastructure. (See, for example, “Creating a Social Safety Net for the Digital Age” and “Making the New Capitalism a Reality: Hints from Britain’s Third Way.”) Although progress has been slow, the Individual Number Card based on the My Number taxpayer identification system is finally taking hold, with the share of the population having applied for a card now exceeding 80%. We should not delay in utilizing this system to design a fine-tuned “digital safety net” that links benefits to total income, taking into account the tax and social-insurance burden.

As a member of an expert advisory panel in the Digital Agency, I have repeatedly called for action to design and institute such a system. But reforms of this nature face high hurdles in Japan’s highly sectionalized bureaucracy. Today, bureaucratic inertia is the biggest barrier to a fair tax system that encourages women’s full participation in the labor force.