Economic Policy Thinking since the Great Recession (2): The Pandemic and the Search for a New Consensus

November 16, 2023

R-2023-040-2E

In part 2 of his sweeping survey, the author spotlights the resurgence of fiscal activism and other post-neoliberal trends accelerated by the COVID-19 pandemic.

* * *

In the first article in this series, I surveyed the rise of a neoliberal policy regime in the industrially developed world, starting in in the 1980s, and the disillusionment with those policies that grew after the global financial crisis of 2007–08.[1] I noted three major sources of that dissatisfaction. The first was the realization that deregulation, tax cuts, and other neoliberal policies had done little to boost growth over the long term, with overreliance on monetary policy to stabilize the economy setting the stage for the financial crisis and the Great Recession. The second was the problem of growing economic inequality, that is, the concentration of income and assets in the hands of the wealthy. And the third was the threat posed by climate change and other negative externalities, which had mounted to intolerable levels amid government policies prioritizing economic growth.

In part 2, my focus shifts to the era of the COVID-19 pandemic, which saw signs of progress toward consensus on a new policy regime.

COVID and the Financial Markets

The global economy escaped any major crises in the second half of the 2010s, but economic performance was generally lackluster (especially in Japan, which entered a mild recession in 2018). It was a time of rising concern over the so-called Japanification of the industrially developed world, a phenomenon characterized by chronically sluggish economic growth and negligible inflation amid ultra-low interest rates. Such was the state of the world economy when the COVID-19 pandemic struck in the spring of 2020.

The epidemic originally broke out in Wuhan, China, near the end of 2019, but the Chinese government was dilatory in reporting the outbreak to the World Health Organization and taking action to prevent its spread. Before long, the coronavirus was racing around the globe (with Japan recording its first case in January 2020), and by the spring of 2020, the world was in the grip of a major health crisis. The shock to the economy was enormous.

First came chaos in the financial markets. With investors anticipating a dramatic business downturn, prices plunged on the world’s stock markets. (Trading on the New York Stock Exchange was halted multiple times in March 2020.) The corporate bond market was hard hit as well, as investors rushed to unload lower-rated, high-yield bonds. As during the 2007–08 crisis, it became extremely difficult for financial institutions to secure dollar funding. In response, the major central banks expanded and strengthened the dollar swap lines they had established in 2008.

In many countries, interest rates were already at or near the zero lower bound, rendering traditional monetary policy useless.[2] Instead, the central banks focused on providing emergency funding to shore up cash-strapped businesses.[3]

Revival of Fiscal Activism

Thanks to this nimble response by the central banks, order was soon restored to the financial markets, and by April, stock prices were making a strong recovery. In the real economy, however, the situation was dire, as governments imposed lockdowns and other strict measures to slow the spread of the virus. (Even in Japan, where restrictions on movement were relatively lax, pedestrian traffic all but vanished from the cities’ shopping and entertainment districts in April and May 2020, during the first quasi state of emergency.) In the April–June quarter of 2020, real gross domestic product shrank at an unprecedented, annualized rate of roughly 30% in the United States, 40% in the eurozone, and 28% in Japan.

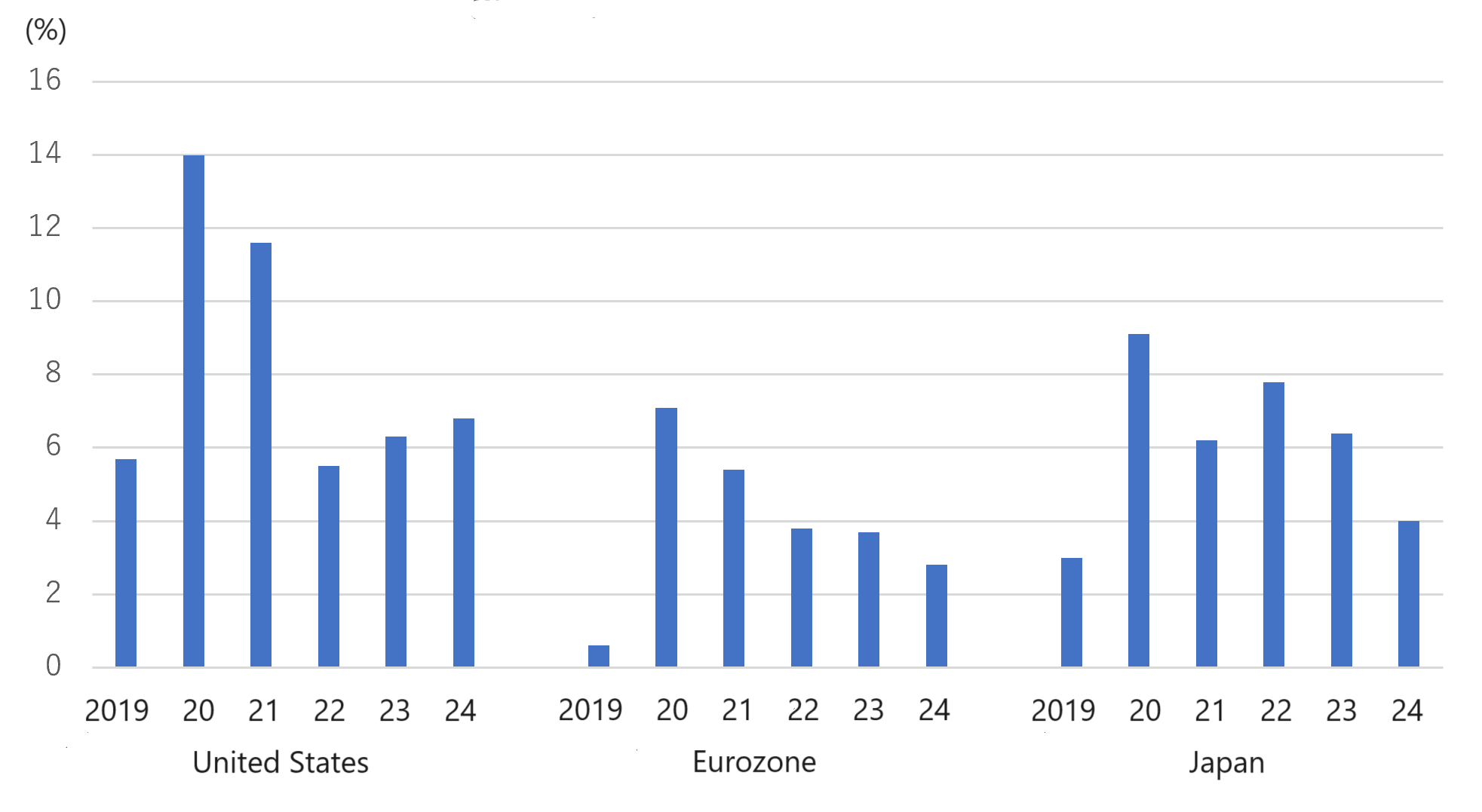

Governments responded with emergency spending. A salient feature of these packages was their focus on direct aid to households, whether through expansion of unemployment benefits (as in the United States), uniform cash payments to individuals (as in Japan), or other forms of financial assistance.[4] Public works projects were avoided at this stage, not only because they would take time to bolster the real economy but also because construction would have been difficult in the midst of lockdowns, quarantines, and self-isolation. Another noteworthy feature of these fiscal packages was their immense scale. Between 2019 and 2020, the deficit-to-GDP ratio soared from 5.7% to 14.0% in the United States, from 0.6% to 7.1% in the eurozone, and from 3.0% to 9.1% in Japan (see Figure 1).

Figure 1. Annual Budget Deficits, US, Eurozone, and Japan (percentage of GDP)

Source: International Monetary Fund, World Economic Outlook Database.

Bolstered by massive government spending, the world economy began to recover from the COVID-19 recession more quickly than anticipated.[5] Such an aggressive fiscal response was possible because resistance to deficit spending was much weaker than in the heyday of neoliberalism, as discussed in part 1.

Exemplifying this change of heart was the establishment of the European Union recovery instrument. Europe’s economic integration is still a work in progress. Monetary union was accomplished with the creation of the euro as a common currency and the establishment of the European Central Bank, but each member state manages its fiscal affairs individually. The limitations of this arrangement were on vivid display in the aftermath of the 2007–08 financial crisis. In 2009, Greece found itself facing a sovereign debt crisis, triggered by revelations of unreported deficits. This, in turn, raised questions about the ability of other fiscally fragile EU countries, such as Italy and Spain, to meet their debt obligations, and sovereign bond yields soared.[6] Germany, which had long stressed fiscal discipline, was unwilling to bail out “irresponsible” governments, and as a result the crisis dragged on for years.[7]

This time, however, Germany was far more willing to pitch in. In July 2020 the European Council reached agreement on the creation of a recovery plan (known as NextGenerationEU) financed with low-interest borrowing in the form of recovery bonds issued by the European Commission. The program, which creates a viable means of shoring up the fragile public finances of countries like Italy and Spain, is viewed as an important first step toward Europe’s fiscal integration.

In the United States, the resurgence of fiscal activism was embodied in three recovery and stimulus packages floated by President Joe Biden in the spring of 2021, his first year in office: the American Rescue Plan (ARP), American Jobs Plan (AJP), and American Families Plan (AFP). Together, they were worth a whopping $6 trillion. The ARP was essentially an extension of rescue measures (expanded unemployment benefits, cash payments to households, assistance to small businesses, and so forth) adopted under the previous administration of Donald Trump. The AJP focused on long-term growth strategies (infrastructure investment, support for research and development, etc.), while the AFP contained programs targeting economic inequality (expanded educational opportunities, tax cuts for low-income households, and so forth).[8] In the end, with the economy recovering and inflation on the rise, Biden was unable to muster sufficient congressional support for the AJP and AFP. However, the Inflation Reduction Act passed in 2022 incorporated many elements of the AJP and AFP, albeit in scaled-down form.[9] It was clearly a vote for “big government,” heralding the end of the neoliberal era.

Trends in Trade and Antitrust Policy

On the international stage, the age of neoliberalism had witnessed a major push toward the liberalization of trade and investment, a development embodied in the establishment of the European Union, the North American Free Trade Agreement, and the World Trade Organization. But economists’ assurances that free trade would benefit everyone had proved hollow (at least over the short and medium term), and the backlash against free trade gathered momentum in the aftermath of the 2007–08 financial crisis. Epitomizing this trend were the protectionist policies of President Trump, who announced America’s withdrawal from the Trans-Pacific Partnership as one of his first acts on taking office and later slapped tariffs on steel and aluminum, as well as a whole range of imports from China (with Beijing retaliating in kind). The Japanese government and others had hoped for a course correction under the Biden administration, but thus far it has upheld Trump’s policies and has moved further toward decoupling with China.

The pandemic highlighted the complexity of trade and economic-security issues. As international commerce ground to a virtual halt, Japan and other countries faced acute shortages of such critical goods as masks, protective gear, and respirators. This experience underscored the vital importance of international trade, while also driving home the danger of becoming overly reliant on imports for essential goods.

One of the encouraging developments of the pandemic era was the speed with which effective COVID-19 vaccines were developed using messenger RNA technology. But the pandemic also threw into relief the problem of unequal global access to drugs and vaccines. It was clear that, without considerable assistance, many developing countries would be unable to purchase and distribute the vaccines in sufficient quantities, which raised the risk of those countries’ becoming breeding grounds for more virulent variants that could then spread around the world. To address the issue, the WHO teamed up with other organizations to launch COVAX, which aims to “guarantee fair and equitable access” to COVID-19 vaccines for every country in the world. Although worthy of praise as a groundbreaking initiative, COVAX clearly did not achieve that lofty aim.

Growing calls for stronger antitrust policies were another significant trend during this period. In the era of neoliberalism, the prevailing view—supported by economists like George Stigler of the Chicago school—was that there was no need to break up monopolies and oligopolies unless there was clear evidence that lack of market competition was harming consumers.[10] In recent years, the tide has turned. One factor behind that trend is the influence of a group of scholars—dubbed the neo-Brandeis movement—who maintain that big-tech companies like Apple, Facebook, Google, and Amazon are holding back economic growth by continually buying out potential competitors. In fact, Biden tapped Tim Wu and others of this school to craft his administration’s competition and antitrust policies.[11]

The Road to Decarbonization[12]

Concerns about climate change are nothing new; it is, after all, more than 25 years since the adoption of the Kyoto Protocol. However, it is only in the past decade or so that a real sense of crisis has taken hold. Deadly heat waves, wildfires, torrential rains, and other extreme weather events have been occurring with increasing frequency, driving home the imminent risks of climate change. Under the Paris Agreement, adopted in December 2015, the 196 parties agreed to submit a succession of nationally determined contributions (NDCs) geared to limiting the rise in global temperatures. Moreover, unlike the Kyoto Protocol, the Paris Agreement mandated commitments not only from the industrially developed world but also from developing and emerging countries like India and China, which are among the world’s top greenhouse gas emitters.

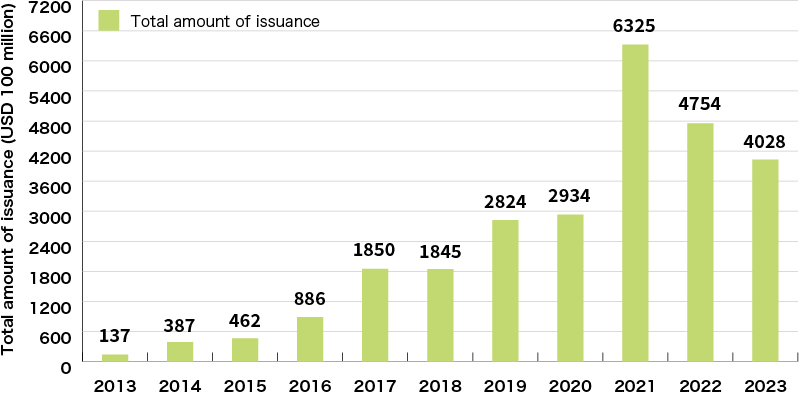

Even prior to that, businesses had been taking significant steps toward reducing GHG emissions—spurred by the trend toward sustainable investment and financing.[13] The key impetus for that trend came in 2006, when a group of the world’s largest institutional investors came together to sign the Principles for Responsible Investment under UN leadership. Centering on a commitment to “incorporate ESG [environmental, social, and governance] issues into investment analysis and decision-making processes,” the PRI expanded rapidly. One outcome was a rapid increase in the issuance of sustainable bonds, whose proceeds are used to address ESG issues (Figure 2). As corporations realized that ESG performance affected the cost of raising business capital, they naturally began to place more emphasis on ESG policies and initiatives, particularly reduction of their carbon footprint.[14]

ESG investing, which worked through capital markets, was intended to influence the behavior of big businesses. But as financial supervisors at the national level turned their attention to the risks of climate change, environmental considerations began to have an impact on bank lending and smaller companies as well, giving the corporate sector an incentive to go green. A seminal development in this context was the 2017 launch of the Network for Greening the Financial System, a global framework of central bankers and financial supervisors committed to promoting green finance.

Trends in Global Issuance of Green Bonds

Source: Created by the Japanese Ministry of the Environment based on data on the Climate Bonds Initiative “Climate Bonds Partner Zone” database (data as of October 21, 2023). See https://greenfinanceportal.env.go.jp/en/bond/issuance_data/market_status.html.

These developments in industry and finance have been paralleled by a surge of public support for decarbonization, galvanized in part by the activism of Greta Thunberg. Interestingly, that mood actually seemed to intensify after the pandemic hit, and government policy has reflected that trend. It was October 2020 when Prime Minister Yoshihide Suga announced Japan’s commitment to achieve net zero carbon emissions by 2050. A month earlier, President Xi Jinping of China—the world’s largest emitter of CO2—had embraced the target of carbon neutrality by 2060. With the election of Democrat Joe Biden to the US presidency in November the same year, Washington also began taking action on climate change, calling for emissions reductions through a shift to electric vehicles and green power. (The IRA includes substantial funding to promote these shifts, albeit less than envisioned under the AJP.) At the 2021 UN Climate Change Conference in Glasgow (COP26), the participating state leaders announced ambitious new decarbonization targets.

Agreement on a Minimum Corporate Tax Rate

As we have seen, disillusionment and dissatisfaction with neoliberal policies in the wake of the financial crisis has created pressure on policymakers to make more aggressive use of fiscal resources and address the problem of growing income disparities. Taxation is the government’s basic tool for financing programs and redistributing income. But globalization has compromised governments’ ability to levy taxes fairly and progressively.

Ever since the 1980s, the trend among developed countries, Japan included, had been to lower the maximum income and corporate tax rates while raising value-added taxes like the consumption tax to pay for the rising cost of social security. Neoliberal economists argued that income tax rates should be lowered to give people incentive to work, and that high corporate taxes—which constitute double taxation—should be lowered to spur capital investment. In fact, there is little evidence to suggest that income taxes erode the work ethic of the wealthy, and lower corporate taxes appear to have encouraged stock buybacks rather than capital investment. The biggest reason for the cuts was that, as globalization progressed and capital moved more freely across borders, the wealthy were shielding their assets in offshore accounts, and companies were moving their operations overseas to low-tax jurisdictions. To compete, other countries lowered their own tax rates, eroding their revenue-raising capacity in the process. It was a classic “race to the bottom.”[15]

In recent years, the problems of tax evasion and avoidance have taken on greater urgency than ever, especially given the increased demands on government. Multinational tech firms in particular have come under intense scrutiny for devising complex schemes to exploit various loopholes and shield their profits from taxation, resulting in absurdly low payments.[16] Concerns over this phenomenon prompted the Organization for Economic Cooperation and Development to launch the BEPS (base erosion and profit shifting) project and subsequently establish an “inclusive framework” to negotiate international solutions.

Progress was slow, however, and hopes for a workable agreement had dimmed when negotiations suddenly began to make headway in 2021. In October that year, the OECD countries signed a historic agreement on a global 15% minimum corporate tax and adoption of a digital tax. Whether these terms can be successfully implemented remains to be seen, but the agreement itself represents a giant step forward.[17]

As the foregoing suggests, the outlines of a new economic policy regime emerged during the pandemic, characterized by active use of fiscal policy tools to achieve macroeconomic stabilization, stronger measures to fight climate change (especially via decarbonization), and efforts to address economic inequality, as through international coordination on taxation. However, this developing consensus has receded amid the challenges of unexpectedly high inflation (particularly in the West) and heightened tensions between the United States and China, fueled by the latter’s position on the Russian invasion of Ukraine.

In the third and final article in this series, I will attempt to characterize and assess the most recent trends in economic policy thinking, which have emerged against this turbulent background.

[1] Hideo Hayakawa, “Economic Policy Thinking since the Great Recession (1): The Backlash against Neoliberalism,” October 21, 2023, https://www.tokyofoundation.org/research/detail.php?id=959.

[2] The United States was the exception, with federal fund rates hovering between 1.5% and 1.75%, which the Federal Reserve lowered to near 0% in March 2020. However, that rate drop was clearly nowhere near sufficient to counter the economic impact of the pandemic.

[3] In the United States, for example, the Fed instituted the Main Street Lending Program (MSLP) to support lending to small and medium-sized businesses, while the Bank of Japan launched Special Funds-Supplying Operations to Facilitate Financing in Response to the Novel Coronavirus. For a detailed comparison of such programs, see Sayuri Kawamura, “Korona-ka ni okeru Bei Ei no kin’yu men de no kiki taio to wagakuni no kadai” (Monetary Policy Responses to the COVID-19 Pandemic in the United States and Britain and Challenges for Japan), JRI Review, 2021.

[4] In Japan, the government distributed uniform cash payments to everyone, regardless of income, causing critics to complain that much of the stimulus ended up in savings accounts. In fact, that was the outcome in many countries, even when means tests were applied. Cash benefits were provided in the form of one-time payments, and given the limited opportunities for spending on recreation and travel during the pandemic, some degree of “forced saving” was probably inevitable.

[5] Of course, other factors contributed to the relatively short duration of the COVID-19 recession, including the rapid development of vaccines and the decision by major Western countries to normalize economic activity as soon as possible once vaccines became available. However, in the early stages of the pandemic, before vaccines were available, cash benefits and other emergency spending programs played a critical role in averting a much deeper and more lasting recession.

[6] Rising long-term interest rates obviously have a chilling effect on business activity. In addition, the resulting drop in bond prices can play havoc with banks’ balance-sheets, triggering financial instability. That leads to even tighter credit and a further slowdown in business activity, which, in turn, impacts government finances, in a vicious circle. When countries issue government bonds in their own currency, it is usually possible for them to repay that debt in the same currency and avoid default. However, in eurozone countries, which no longer have control of their own currency, it is much easier for a government to default on its debt. This is the basic weakness of the EU, which is integrated monetarily but not fiscally.

[7] What ultimately brought the European sovereign debt crisis under control in 2012 were the simple words “whatever it takes,” uttered by ECB President Mario Draghi.

[8] While the ARP was financed by government bonds the Biden administration proposed to fund the AJP with a corporate tax hike and the AFP with higher taxes on the wealthy. For a detailed discussion (in Japanese), see Hideo Hayakawa, “‘Nihonka’ ni aragau Beikoku no jikken (1): Kasoku suru Beikoku no keiki kaifuku” (The American Experiment in Resisting Japanification, Part 1: America’s Accelerating Recovery), Tokyo Foundation for Policy Research, May 11, 2021, https://www.tkfd.or.jp/research/detail.php?id=3749.

[9] In addition, Congress passed separate bipartisan legislation, the Infrastructure Investment and Jobs Act, in November 2021. Together, the three pieces of legislation authorized about $3.5 trillion in spending.

[10] Contestable market theory justified this stance with the proposition that, in an open market, the threat of new competitors serves the same purpose as actual competition. See William Baumol, John Panzar, and Robert Willig, Contestable Markets and the Theory of Industry Structure (Harcourt Brace Jovanovich, 1982).

[11] See Tim Wu, The Curse of Bigness: Antitrust in the New Gilded Age (Columbia Global Reports, 2018).

[12] The Nobel Prize–winning economist William Nordhaus provides an excellent introduction to environmental economics in The Spirit of Green: The Economics of Collisions and Contagions in a Crowded World (Princeton University Press, 2021).

[13] For a detailed discussion (in Japanese), see Hideo Hayakawa, “Datsu tanso no keizaiteki ronri (1): Kin’yu no chikara to yoron, seisaku no sojo sayo” (The Economic Logic of Decarbonization, Part 1: The Power of Finance and the Synergy of Public Opinion and Policy,” Tokyo Foundation for Policy Research, https://www.tkfd.or.jp/research/detail.php?id=3757, and “Datsu tanso no keizaiteki ronri (2): Nihon ga chokumen suru futatsu no konnan” (The Economic Logic of Decarbonization, Part 2: Two Difficulties Facing Japan), Tokyo Foundation for Policy Research, https://www.tkfd.or.jp/research/detail.php?id=3758.

[14] If, as has been suggested, there is a positive correlation between companies’ ESG ratings and their business performance, then the trends toward ESG investment and voluntary decarbonization can be expected to continue. For more on the subject (in Japanese), see Takuto Arao, Ryosuke Shimizu, and Yoshiya Ogawa, “ESG toshi o meguru wagakuni kikan toshika no doko ni tsuite” (Trends in ESG Investing among Japanese Institutional Investors), BOJ Reports and Research Papers (July 2020).

[15] For a discussion of the role neoliberal tax policies have played in exacerbating economic inequality, see Emmanuel Saez and Gabriel Zucman, The Triumph of Injustice: How the Rich Dodge Taxes and How to Make Them Pay (W. W. Norton & Co., 2019).

[16] For more on the use of tax havens for tax evasion (in Japanese), see Sakura Shiga, Takkusu heibun (Tax Havens) (Iwanami Shinsho, 2013). For a discussion of digital taxation (in Japanese), see Shigeki Morinobu, Dijitaru keizai to zei (The Digital Economy and Taxes) (Nihon Keizai Shimbun Sha, 2019).

[17] Mention should be made of the contribution of Masatsugu Asakawa, former vice- minister of finance for international affairs and current president of the Asian Development Bank, who played a key role in the BEPS process as chair of the OECD Committee on Fiscal Affairs.