As tensions mount over tax avoidance by US-based multinational tech giants, resident tax expert Shigeki Morinobu reports on multilateral efforts to modernize international tax rules and warns against provoking a backlash against “America first .”

* * *

The rise of the digital economy has dramatically altered the global business landscape, creating new challenges for tax policymakers and administrators. Trade in goods is being replaced by services, as digital information transferred over the Internet takes the place of paper books, music CDs, and other tangible goods. The Internet is displacing newspapers and magazines as the dominant advertising medium. Amid these developments, platform-based businesses, which harness digital networks to facilitate transactions between other businesses and users, are expanding rapidly in scale, scope, and influence.

With international tax rules still mired in twentieth-century concepts of business, the digital economy has opened up unprecedented opportunities for tax avoidance. In the following, I examine the disconnect and discuss efforts to find a solution.

Tax Challenges of the Digital Economy

One reason digital businesses can escape taxes is that they need no factories, stores, or other fixed places of business in order to sell their services to consumers in a particular country. Since current international tax rules still rely on the old brick-and-mortar concept of a permanent establishment (PE) to assign tax jurisdiction, the digital economy makes it possible to operate a thriving cross-border business virtually tax-free.

Another reason is that corporate value is increasingly concentrated in intangible assets, such as patents and copyrights on software and digital content. Such assets are easily transferred to tax havens in order to minimize the business income taxable in higher-tax jurisdictions.

The business models pioneered by such US-based tech giants as Google, Apple, Facebook, and Amazon.com are predicated on this sort of international tax avoidance. They rely on today’s digital technology, borderless economy, and outdated tax rules to avoid taxes in the jurisdictions where they do business (countries of consumption) and shift profits to low-tax countries.

Why should digital tax avoidance concern us? For one thing, it is depriving governments of much-needed tax revenues. For another, it gives foreign-based digital businesses an advantage over their tax-paying domestic competitors. A study by the European Commission found that the average effective tax rate for tech businesses was only 9.5%ーless than half of the 23.2% for traditional businesses.

Since around 2012, tax experts and negotiators from countries worldwide have been working to hammer out an international solution to these issues. But addressing the disconnect between tax jurisdiction and the location of value creation means reallocating taxing rights among the “countries of residence” (primarily the United States), the tax havens, and the “countries of consumption” (including Japan and the high-tax jurisdictions of Western Europe). Negotiating such a consensus has become even trickier now that the administration of President Donald Trump has sided with the US tech industry against a European proposal for fair taxation of the digital economy.

Groping Toward an International Consensus

In June 2012, more than 110 countries and jurisdictions came together to grapple with these and other international tax issues under the aegis of the OECD/G20 Base Erosion and Profit Shifting (BEPS) project. Unfortunately, the BEPS project’s “final report,” released in the fall of 2015, fell short of a concrete agreement on measures to address the tax challenges of the digital economy. Since then, talks have continued under the OECD/G20 Inclusive Framework on BEPS, with the goal of issuing another final report in 2020.

The Inclusive Framework’s interim report, “Tax Challenges Arising from Digitalization,” was released in mid-March this year and presented to the G20 finance ministers and central bank governors at their March 19-20 meeting. While none of the fundamental long-term taxation solutions advocated by the “countries of consumption” found their way into the report, the members did agree to review the “nexus” and “profit allocation” rules for determining tax jurisdiction and assigning business income, raising hopes of a decision that would substantially broaden the definition of PE and facilitate the taxation of business profits where they are generated. It was also agreed that any indirect taxes on digital services imposed by individual jurisdictions in the interim should be compliant with existing tax treaties and the rules of the World Trade Organization.

Europe versus Big Tech

The countries of the European Union, meanwhile, have been under intense political pressure to crack down on digital tax avoiders. Thus far, the European Commission has attempted to discipline companies like Google and Apple by mobilizing competition statutes (targeting state aid and other anti-competitive practices), along with privacy laws. But on March 21, immediately following the G20 meeting of finance ministers, the EC released two far-reaching proposals for “fair taxation of the digital economy.” Proposal 1 calls for a major overhaul of the EU’s rules for taxing income from digital business activity. Proposal 2 outlines the shape of an interim sales tax on certain digital activities to begin generating revenue immediately.

Under Proposal 1, business income generated by a company within an EU member state would be taxable by that state as long as the company had a “virtual permanent establishment” thereーeven if it had no physical presence. A business would be deemed to have a virtual PE if it earned revenues of more than 7 million euros in an EU jurisdiction. New rules for calculating the allocation of business income among jurisdictions would take into account such factors as the residence of users to better reflect the location where value was generated. Ultimately, these measures could be integrated into the Common Consolidated Corporate Tax Base initiative currently under deliberation by the EU.

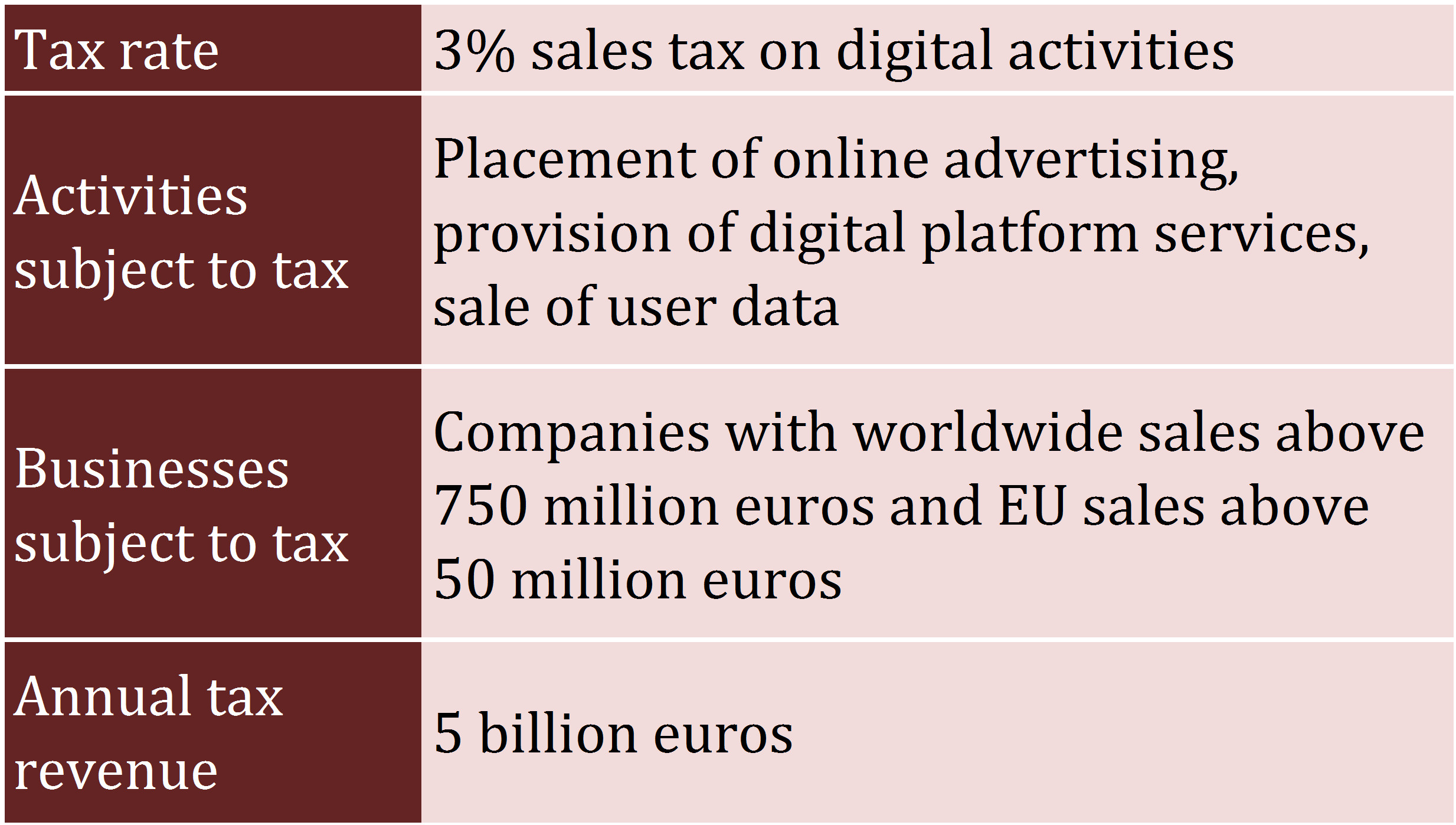

Meanwhile, Proposal 2 calls for an interim revenue-raising measure in the form of a 3% indirect tax on sales of online advertising space, digital platform services, and user data (see table), with tax jurisdiction based on the location of the user. The tax would apply only to businesses with annual worldwide revenues of 750 million euros and EU revenues of 50 million euros.

Proposed Interim EU Tax on Digital Activities

A detailed proposal along these lines has been submitted to the Council of the European Union, but it would have to be approved unanimously in order to become EU law. Given the resistance of tax havens like Ireland and Luxembourg, the prospects for passage are slim. But it is conceivable that a significant subset of countries, including such powerhouses as France and Germany, will decide to adopt the proposals anyway.

Japan’s Delicate Position

Under pressure from the IT industry, the Trump administration has come out firmly against the EC initiative. In the words of US Secretary of the Treasury Steve Mnuchin, “The US firmly opposes proposals by any country to single out digital companies.” This statement sets the stage for a full-blown conflict if any EU states move to adopt the EC’s digital tax.

Japan also has a major stake in the effort to curb international tax avoidance, but it cannot succeed in this effort without the cooperation of the US government. Antagonizing the United States at this point could jeopardize our chances of winning US approval for the inclusion of concrete, long-term reform recommendations in the 2020 final report of the Inclusive Framework. The Japanese government is wary of throwing its full support behind the EU proposal, given the fact that the proposed changes could adversely affect Japanese tech firms. (They could also impact Japanese manufacturers pursuing growth strategies linked to the Internet of things.)

The US government is not immune to the downside of digital tax avoidance; there will doubtless come a time when the practices of the IT industry and the US government’s interests come into conflict. Japan’s best strategy is to keep a sharp eye on such developments while working energetically to facilitate a consensus among the OECD countries in preparation for the 2020 report.

The Shape of Things to Come

The digital economy has given rise to platforms and other business models that create economic value from information provided by users. Consumers’ contribution to value creation is growing by leaps and bounds, yet the rules of international taxation essentially ignore that contribution. How will our tax systems adjust to the new realities in the years ahead?

The first task is to develop “nexus” rules that make sense in the digital economy. Put simply, this means expanding the definition of PE to encompass “digital presence” as determined by the location of a service’s users. Next, the formulas for allocating taxable income need to be modified with the users’ contribution in mind (boosting the share taxable by the countries of consumption). The Inclusive Framework is leaning toward recommendations along these lines.

Over the long term, the growth of the digital economy is likely to result in a shift toward consumption-based taxation. The European Commission’s proposal for taxing sales of digital goods and services embodies this orientation, as does the destination-based cash flow tax once contemplated by the Trump administration. The drawback to both of these schemes is that they make no provision for input tax credits and could thus lead to double taxation. This makes them problematical from the standpoint of fairness and economic efficiency.

Ultimately, it should even be possible to devise a system for assessing and taxing a corporation’s digital assetsーalong with the platforms and other intangibles derived from those assetsーand distributing the revenues among jurisdictions. It will take all the ingenuity of our tax experts, leaders, and diplomats to flesh out these ideas and knit them into a fair and efficient international tax system for the twenty-first century.

Translated from “Kazei e tokyoku no chie towareru,” Keizai Kyoshitu, Nihon Keizai Shimbun, May 16, 2018. (Courtesy of Nikkei Inc.)