- Article

- Macroeconomics, Economic Policy

Prognosis for the Japanese Economy: Recovery and Beyond

September 2, 2021

In his latest look at the economic challenges facing Japan in the coronavirus era, Senior Fellow Hideo Hayakawa suggests that a full-fledged V-shaped recovery could come soon but warns of trouble farther down the road.

* * *

Japan is stuck in a K-shaped recovery that leaves vast swaths of the economy behind. With the pace of vaccination picking up, the economy should be able to transition to a full-fledged V-shaped recovery in the coming months, but sustaining economic growth could prove a much tougher challenge.

Toward a V-shaped Recovery

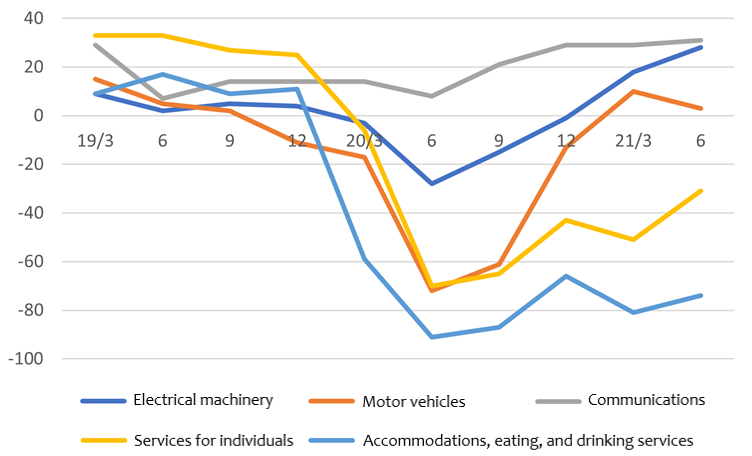

As of this writing, the Japanese economy remains mired in an extremely uneven “K-shaped” recovery. On the one hand, exports are on the upswing, powered by strong growth overseas, especially in the United States and China; in fact, the resurgence of Japan’s manufacturing sector has far exceeded most forecasts. But with COVID-19 continuing its relentless spread—accompanied by emergency declarations and local restrictions on contact and commerce—there is still little sign of life in the restaurant and hospitality industry or high-contact services. The extent of the gap was on vivid display in the results of the Bank of Japan’s June 2021 Tankan (Short-term Economic Survey of Enterprises in Japan), which tracks business confidence (Figure 1).

Figure 1. Business Sentiment among Large Companies in Selected Sectors (Tankan Diffusion Index)

Source: Bank of Japan, Tankan (June), July 1, 2021, https://www.boj.or.jp/en/statistics/tk/gaiyo/2021/tka2106.pdf

The biggest factor delaying a full-fledged V-shaped recovery has been the slow pace of Japan’s vaccination program. As of July 21, 2021, less than 25% of the population had been fully vaccinated, as compared with more than 50% in Britain and Canada and over 40% among all Group of Seven countries.[1]

In the United States, gross domestic product grew at an annualized rate of 6.3% in the January–March quarter of 2021 and 6.6% in the April–June period, according to recent estimates. In the euro area, second-quarter GDP was up by 13.7% from the previous year (according to a preliminary flash estimate), following –1.3% annualized growth in the first quarter. In Japan, by contrast, quarter-to-quarter annualized growth rose to just 1.3% in the April–June period after slumping 3.7% (revised) in the January–March quarter. For some people in Japan, it must be frustrating to watch Western economies returning to life, even as their own continues to stagnate.

The good news is that the pace of vaccination has picked up dramatically here since May, surging past the government’s goal of 1 million shots a day.[2] Observers have noted a jump in business confidence in the West once 40% of the population is fully vaccinated. It remains to be seen whether this applies to Japan, but consumption in the hard-hit service industries could recover once a certain percentage of the population is immunized, with the release of pent-up demand fueling a V-shaped recovery beginning in late 2021.

Post-Recovery Concerns

Looking beyond the recovery phase, however, the mood among investors and forecasters seems increasingly pessimistic. One troubling indicator is the lackluster performance of the Japanese stock market, which peaked last March. The contrast with the US and European markets, where prices have continued to climb, cannot be explained solely by disparities in the vaccination rate.

Of course, there are a variety of factors underlying this pessimism, but here I would like to focus on a few issues in particular.

Moral Hazard of Government Relief

The first concern is the long-term impact of the government’s generous relief programs for businesses. In the spring of 2020, the cabinet adopted a raft of emergency measures, including zero-interest unsecured loans and broad mobilization of the employment adjustment subsidy. These steps undoubtedly played an important role keeping smaller businesses afloat and their workers on the payrolls, even as consumption plunged; indeed, in fiscal 2020, a year of sharp economic contraction, the number of bankruptcies in Japan hit a 30-year low.

However, with a V-shaped recovery on the horizon, it is time to start thinking about terminating those programs. The zero-interest unsecured business loan program introduced in May 2020 was, in fact, closed to new applicants at the end of March this year, and that was probably the right decision, given the overall drop in demand for loanable funds. (After a year-on-year increase peaking at 6.7% in August 2020, lending from commercial and shinkin banks combined fell 1.4% in June 2021.)

Even so, the moral hazard accompanying such emergency relief may be hard to avoid. A recent study has shown that the businesses most apt to take advantage of pandemic programs like subsidies and low-interest guaranteed loans were those that were on uncertain financial footing even before the pandemic hit.[3] The concern is that pandemic relief could turn into artificial life support for businesses that lack the fundamentals to operate at a profit in normal times, and that such “zombie companies” could drag down overall productivity, just as they did after the collapse of the asset bubble in the early 1990s.[4] Moreover, many of the “zero-zero” loans were disbursed through small regional banks, whose financial health could suffer if their business borrowers are unable to bounce back while the public loan guarantees are still available.

Digital Non-Transformation

The next two issues I would raise in connection with the health of the post-pandemic Japanese economy concern the efficacy of the government’s growth strategy, which centers on digital transformation and “green growth” to achieve zero carbon emissions by 2050. Of course, it makes sense for the government to highlight digital transformation and sustainable development; after all, the pandemic threw into harsh relief the slow pace of digitalization in Japan, and slashing carbon emissions is clearly the global wave of the future. My question is whether digitalization and decarbonization are likely to fuel significant economic growth anytime soon. Viewing the issues dispassionately, I see little cause for optimism.

Everyone seems to agree that Japanese industry is a lap behind the leading group when it comes to exploiting digital technology. Given that agreement, is it fair to anticipate a great leap forward?

At this point, the signs are not encouraging. Responses to recent questionnaire surveys referring expressly to DX, or digital transformation, suggest that the two major obstacles to meaningful progress are (1) lack of a clear vision and business strategy, and (2) a shortage of qualified human resources.[5] Where the first factor is concerned, the basic problem seems to be a persistent focus on the use of digital technology to streamline existing business processes, as opposed to structurally transforming those processes. Multiple studies have asked why Japanese industry’s investments in information technology have failed to yield gains in labor productivity, and one point they have stressed is management’s emphasis on cutting costs while leaving existing organizational structures intact.[6] Taken together, these findings suggest that the general thrust of digitalization has changed very little in Japan, even if the term IT has given way to the trendier DX.[7]

Holes in the Green Growth Strategy

What, then, of the government’s green growth strategy?

In an earlier article, I argued for a broader national discussion of Prime Minister Yoshihide Suga’s ambitious new targets for decarbonization and the means for meeting them, bearing in mind the likely economic toll of a rapid shift toward renewables and electric vehicles. On July 21, the Ministry of Economy, Trade, and Industry released a draft of the 2021 Basic Energy Plan, including a new 2030 energy mix tailored to the government’s latest emission reduction targets. Under the draft plan, renewables’ share in Japan’s electricity generation mix would rise from 18% (in 2019) to 36%–38% in 2030, while nuclear power’s share would soar from 6% to 20%–22%, resulting in a 46% reduction in greenhouse gas emissions (Figure 2).

As I have stated previously, boosting the share of renewables to this level would require a massive upgrade of Japan’s electricity transmission and storage systems, and there is no indication that policymakers have fully confronted that challenge. The target for nuclear power would entail restarting all the operable nuclear reactors that have been idled since the 2011 Fukushima nuclear accident while either building new facilities or relying on superannuated ones, matters on which the government has remained mum. Small wonder that so many have dismissed the plan as a mathematical exercise predicated on wishful thinking.

Figure 2. Energy Targets Under Japan’s 2021 Basic Energy Plan (draft)

Source: Agency for Natural Resources and Energy, Overview of Basic Energy Plan (draft), July 2021, https://www.enecho.meti.go.jp/committee/council/basic_policy_subcommittee/2021/046/046_004.pdf

The Japanese government has given no indication of a major policy shift on automobiles. The EU, however, has proposed a ban on the sale of new gasoline- and diesel-powered cars by 2035. Such a ban would apply to the hybrid vehicles that Japanese automakers have been so successful at designing, producing, and marketing. Globally speaking, the net seems to be tightening around Japanese HVs, and the nation’s all-important auto industry stands to suffer as a result.

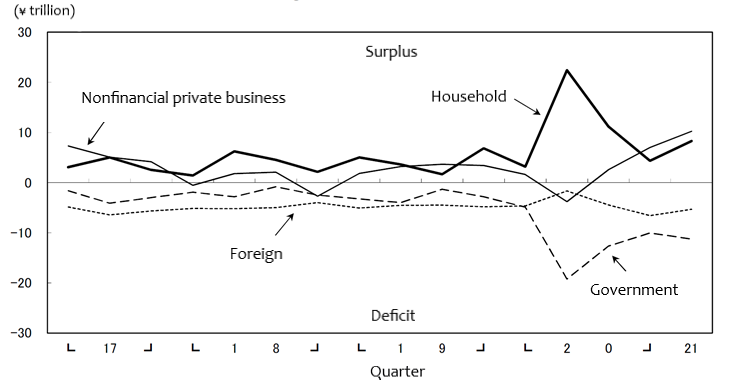

Ballooning Corporate Cash Holdings

My third concern is that the pandemic will end up exacerbating the tendency of Japanese businesses to retain their earnings, contributing to the current corporate savings glut. Economist Kyoji Fukao has argued convincingly that Japan’s huge private savings surplus has been a key factor behind the nation’s economic stagnation since the East Asian financial crisis of 1997–98.[8] That ordeal and the fallout from the subprime mortgage crisis of 2008 impressed on Japanese management the need to accumulate cash to ensure liquidity in the event of a severe credit crunch. The result has been a compulsion to hoard revenue during profitable periods instead of channeling it into capital investment or higher wages.[9] Since many businesses faced a similar liquidity crisis during the early stages of the COVID-19 pandemic, it would not be surprising if this cash-hoarding behavior returned with a vengeance in the post-recovery phase. In fact, recent statistics from the Bank of Japan (Figure 3) reveal a ballooning financial surplus in the nonfinancial business sector since early 2021.[10]

Figure 3. Quarterly Financial Balances by Sector (seasonally adjusted)

Source: Bank of Japan, Flow of Funds for the First Quarter of 2021 (preliminary report), https://www.boj.or.jp/en/statistics/sj/sjexp.pdf.

Furthermore, it seems that large corporations have been enjoying surprisingly strong earnings despite the overall economic contraction. According to the BOJ’s Tankan, although major manufacturers posted a 7.8% drop in sales in fiscal year 2020, their ordinary income fell a mere 1.4% from the previous year.[11] The main factor was a huge decrease in selling and administrative costs, particularly travel, dining, and entertainment expenses. Those outlays are likely to remain well below pre-pandemic levels even after the economy reopens, further padding business revenues. Those gains will merely inflate corporate savings further unless accompanied by a commensurate increase in investment and personnel expenditures, and such an increase is unlikely.

To be sure, Japanese industry has begun to step up capital spending in the current fiscal year, but barely enough to compensate for last year’s negative growth. As for wage increases, the spring 2021 labor negotiations at major firms yielded an average hike of only 1.81% after seven straight years above the 2% mark. All of this points strongly to a further increase in corporate savings and a continuation of the pattern that has depressed Japanese economic growth for a quarter century.

With a general election in the offing, the government is widely expected to bow to political pressure and adopt new economic stimulus measures. But it seems pointless for lawmakers to vie over the size of another stimulus with a cyclic recovery just over the horizon. It would make better sense to tackle the challenges awaiting the economy after the recovery, as by taking steps to minimize the after-effects of relief programs and fleshing out the government’s flimsy strategy for digital transformation and green growth.

[1] See Nikkei.com, Charting coronavirus vaccinations around the world, https://vdata.nikkei.com/en/newsgraphics/coronavirus-vaccine-status/.

[2] Meanwhile, the pace of vaccination has slowed dramatically in many Western countries owing to vaccine avoidance among large segments of the population. Because Japan has fewer anti-vaxxers, it now seems likely to reach the goal of fully immunizing 70%–80% of its population ahead of the United States and other Western countries.

[3] See Takeo Hoshi et al., “The Return of the Dead? The COVID-19 Business Support Programs in Japan,” CARF Working Paper, April 2021, https://www.carf.e.u-tokyo.ac.jp/research/5919/.

[4] See Richard Caballero et al. “Zombie Lending and Depressed Restructuring in Japan,” American Economic Review, December 2008.

[5] See, for example, Japan Management Association, Nihon kigyo no keiei kadai (Management Challenges Survey), 2020, https://www.jma.or.jp/img/pdf-report/keieikadai_2020_report.pdf.

[6] See, for example, Kyoji Fukao, “Ushinawareta 20 nen” to Nihon keizai (The Japanese Economy and the “Lost Two Decades”), Nihon Keizai Shimbun Shuppansha, 2012.

[7] With the pandemic highlighting the government’s failings in the area of digitalization, Prime Minister Yoshihide Suga established a new “digital agency” in September 2020. However, given the glacial pace of efforts to expand uses of the My Number taxpayer ID system, realization of efficient, integrated e-government appears a long way off.

[8] Kyoji Fukao, Sekai keizai shi kara mita Nihon no seicho to teitai (Japanese Growth and Stagnation in the Context of World Economic History), Iwanami Shoten, 2020.

[9] For a detailed explanation of this “learned pessimism,” see Hideo Hayakawa, Kin’yu seisaku no “gokai” (“Misunderstandings” in Monetary Policy), Keio University Press, 2016.

[10] Household savings, meanwhile, rose conspicuously during the second half of 2020, as seen in Figure 3, thanks to the combined effect of government stimulus payments and depressed consumption. It is hoped that this financial surplus in the household sector will fuel a vigorous rebound in consumption once the worst of the pandemic is past.

[11] Profits during the period grew by an annualized 23.1%. The surprising increase in fiscal 2020 corporate tax revenues reflected a strong performance by Japan’s big manufacturers, which account for the bulk of corporate taxes collected at the national level. The hard-hit restaurant and hospitality sectors, by contrast, are dominated by smaller companies that operate on narrow profit margins and thus generate relatively little tax revenue even in good times.