- Article

- Macroeconomics, Economic Policy

Transition Risk and the Japanese Economy: A Net Zero Reality Check

June 28, 2021

With financial regulators worldwide spotlighting the economic risks of climate change, the Japanese government has pledged to achieve carbon neutrality by 2050. But a headlong rush to “net zero” could pose serious risks in itself.

* * *

The drive to decarbonize the global economy is picking up speed, and Japan is attempting to position itself as a leader in that effort. But difficult choices await Japan on the road to a carbon-neutral society, even as ESG (environmental, social, and governance) investing accelerates the shift to a low-carbon economy and indirect green finance is mobilized at the national and international levels.

A Green Light for Green Finance

In recent years, financial authorities have begun to stress the need to grapple with climate-related risks in the context of micro- and macro-prudential policy—that is, regulatory and other measures aimed at ensuring the stability of financial institutions and the financial system as a whole. In 2015, the Financial Stability Board launched the Task Force on Climate-Related Financial Disclosures (TCFD), which issued its final recommendations in June 2017. In December 2017, a group of central banks and financial supervisors established the Network for Greening the Financial System (NGFS) to draw up strategies and guidelines for addressing the risks of climate change and other environmental threats. The network, originally a European initiative, has expanded globally and now includes the Japanese Financial Services Agency and the Bank of Japan, as well as the US Federal Reserve Board.

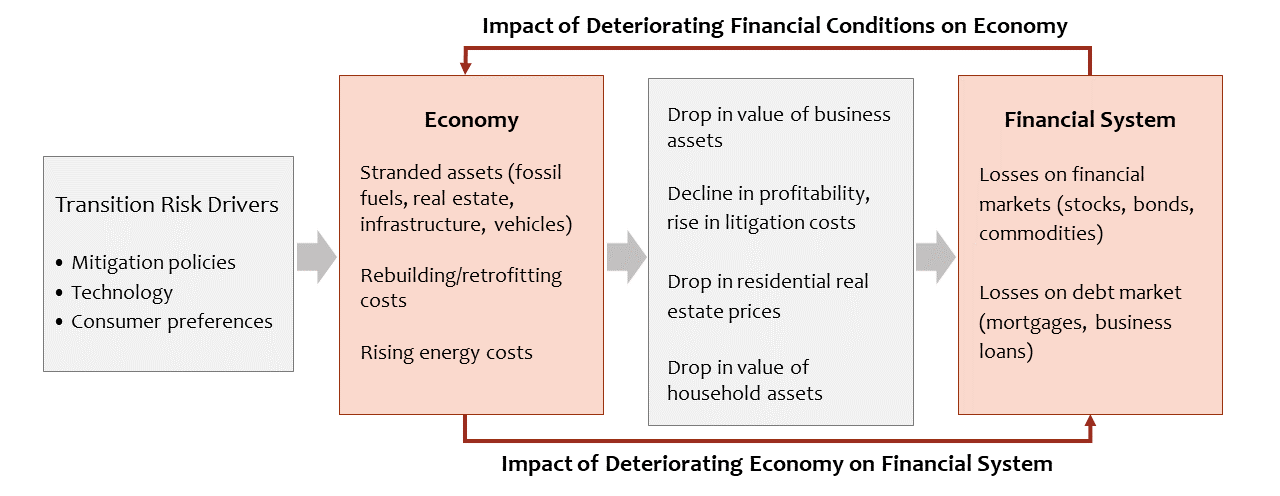

Central to the NGFS’s approach is the notion that climate-related financial risk encompasses not only physical risks from such well-known drivers as extreme weather and rising sea levels but also “transition risks” driven by the anticipated shift to climate-friendly policies (such as carbon pricing) and consumption patterns. Businesses that are slow to adapt to such changes face the risk of plummeting corporate value as a result of stranded or devalued assets and falling profits, and those impacts have the potential to destabilize the financial system (Figure 1). Both nonfinancial companies and the lending institutions that support them need to take such transition risks into account when making their business decisions.

Figure 1. Climate-Related Transition Risk Drivers and the Chain of Impact

Source: Reiko Shinohara, “Kasoku suru shuyokoku chuo ginko/kin’yu kantoku tokyoku no kiko hendo mondai e no taio,” Kokusai Kinyu, April 2021.

The central banks and financial regulation authorities involved in the NGFS are working in collaboration with academics and others to develop methodologies for measuring the various risks that climate change poses to the financial system, as through the development and refinement of climate stress tests. One way or another, the results of this research are bound to be reflected in the regulation and oversight of financial institutions going forward. For example, a risk-based capital surcharge could be imposed on banks that finance businesses facing a higher transition risk owing to the vulnerability of their business model or assets. If so, the cost of borrowing would go up for such “climate unfriendly” businesses.

The influence of ESG investing, while significant, is limited to direct finance and thus does not extend much beyond institutional investors and the listed corporations in which they buy stocks or corporate bonds. By contrast, moves to incorporate climate-related risk—particularly transition risk—into financial regulations is likely to shape the lending behavior of banks and other financial intermediaries, thereby accelerating the trend toward decarbonization among small and medium-sized businesses as well.[1]

Uncertain Prospects for “Green QE”

Another frontier of green finance that has received considerable attention of late is the concept of “green quantitative easing.” Green QE would marshal monetary resources in support of environmental programs, as through the purchase of green bonds by central banks. Certainly, such investment would fuel a faster transition to a low-carbon society, but it is unclear whether central bankers are willing to take that step.

The consensus among the major central banks, as articulated by the NGFS, is that prudential financial policies must take into account climate-related risks. But there is no consensus on the proactive use of monetary tools to fight climate change, and thus far, no central bank has embraced such a policy outright. The BOJ has endorsed the idea of addressing climate-related risks in the context of prudential policy but has avoided any active consideration of green QE. Similarly, FRB Chairman Jerome Powell has indicated that the Fed’s role in fighting climate change is limited to oversight of banks and the financial system. While some central bankers, particularly in Europe, have expressed support for a more activist approach, the jury is still out where green QE is concerned.

In industrial countries where inflation is no longer a major concern, it could certainly be argued that the central banks should wield their resources to fight climate change, given the huge risk it poses to the economy over the medium and long term. In a speech delivered in September 2020, Isabel Schnabel, a member of the Executive Board of the European Central Bank, sent a clear signal in support of green QE, arguing that the ECB has “an obligation to appropriately reflect climate risks on [its] balance sheet.” But Bundesbank President Jens Weidman, a member of the ECB’s Governing Council, has expressed opposition in the name of market neutrality (the principle that central banks, which are not democratically elected bodies, should refrain from any interference in micro-level resource allocation) and effective macroeconomic policy (which, according to Tinbergen’s rule, is compromised if policy instruments are assigned multiple objectives).[2] Avoiding the politicization of monetary policy is another consideration at a time when climate change has emerged as a contentious political issue in Europe and the United States. This is doubtless one reason, along with a desire to preserve internal unity, that ECB President Christine Lagarde has refrained from taking a stand on green QE, even though she is widely believed to favor it personally.

Amidst such developments and attending speculation surrounding the ECB, Britain took the markets by surprise in March this year, when Chancellor of the Exchequer Rishi Sunak suddenly announced that the British government would add “transition to a net zero economy” to the Bank of England’s mandates, a change welcomed by the BOE leadership. This raised the possibility that the BOE could become the first central bank to venture into the realm of green QE. On the other hand, it may simply signal an adjustment to the bank’s prudential policies.

Checking the Brakes

Notwithstanding green QE’s uncertain prospects, current global trends appear to be accelerating the push toward a carbon-neutral economy. US President Joe Biden has made clear that his administration wants to work with other countries to fight climate change. Opinion polls in Germany show the Green Party poised to take the leading role in that country’s federal government after the September elections. Public opinion, politics, and finance all seem to be lining up behind decarbonization.

The problem is that public opinion, politics, and finance have been known to succumb to dangerous mood swings. A headlong rush toward decarbonization is not necessarily cause for rejoicing. For Japan, at least, pursuing the goal of net zero emissions by 2050 would be a high-risk undertaking.

At the April 2021 Leaders Summit on Climate, Prime Minister Yoshihide Suga announced an ambitious new target of reducing Japan’s greenhouse gas emissions by 46% from 2013 levels by fiscal year 2030, in keeping with the government’s previously announced goal of net-zero emissions by 2050. In support of its goals, the government has set forth a whole array of strategies centered on a shift to renewables and hydrogen power. But the 46% target was not derived by adding up the impacts—realistically calculated—of specific measures. Indeed, the prevalent opinion among energy experts is that the latest target will be virtually impossible for Japan to achieve.[3]

The obstacles are numerous, but the two key issues are as follows.

The High Cost of Renewables

The first problem concerns Japan’s energy mix and the difficulty of rapidly reducing carbon emissions from electric power generation, which accounts for 40% of the greenhouse gases emitted in Japan.

From the 1970s on, the Japanese government pursued an ambitious nuclear power program. In 2010, just prior to the Fukushima nuclear accident triggered by the 2011 Great East Japan Earthquake, nuclear power accounted for 25% of all the electricity generated in Japan. After the accident, that figure plunged into single digits owing to temporary and permanent shutdowns. (In fiscal 2018, it stood at just 6%.)

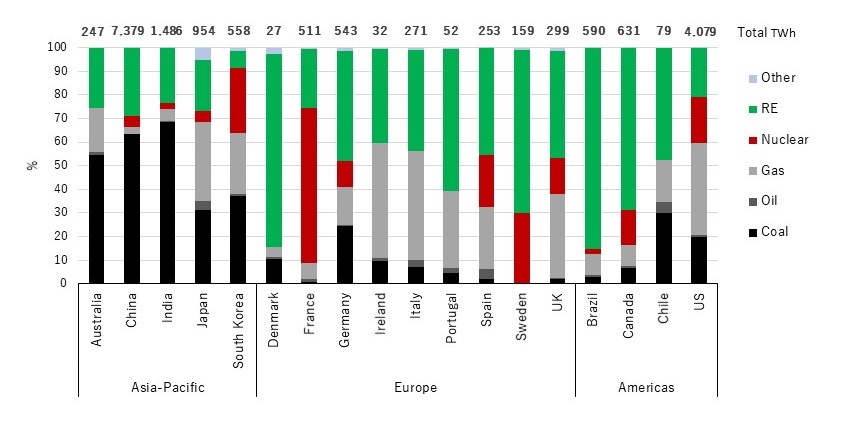

This has posed a major challenge in terms of meeting domestic electricity needs without increasing carbon emissions. The government has instituted a number of programs, including a feed-in tariff, designed to encourage the adoption of renewable energy, and these have had some impact, helping to almost double the nation’s reliance on renewables since 2010. Even so, renewables’ share still stands at just 17%, owing in part to local geographical and environmental constraints (for example, the dearth of locations suited to the construction of wind farms).[4] Inevitably, Japan was forced to fall back on fossil fuels. With the construction of new coal-fired plants, the share of coal in Japan’s energy mix rose from 28% in 2010 to 32% in 2018. As a consequence, Japan lags far behind Europe and Canada, for example, in the use of clean, renewable energy for electric power (Figure 2).

Figure 2. Electricity Generation Mix by Country (2020)

Source: Renewable Energy Institute, https://www.renewable-ei.org/en/statistics/international/.

Prior to last April’s announcement, Japan had committed itself to a 26% reduction in GHG emissions from 2013 levels by 2030. The plan for achieving this target involved boosting the contribution of renewable energy to between 22% and 24% and that of nuclear power to 20%–22%. Leaving aside the first target for now, the second was almost universally deemed unrealistic, since it would mean securing local approval to restart all of the operable nuclear reactors that have been idled since the 2011 Fukushima accident, and further, relying on reactors after they have been in operation more than 50 years (inasmuch as no new plants could be completed for another 10 years).

The new energy plan geared to the even loftier goal of a 46% cut will inevitably require a much bigger increase in renewables’ share, even assuming that nuclear power can contribute at least 20%. To sustain that 20% contribution in order to reach the 2050 goal of net zero, moreover, would involve the construction of new nuclear power plants, a politically difficult decision at best. The alternative of an even more rapid shift to renewables—for example, 40% renewable energy by 2030—would mean sharp increases in Japan’s already-high electricity rates, and that would deal a major blow to the nation’s manufacturing industries. Some have speculated on the possibility of cushioning the impact with a “carbon border tax” on imports from countries or industries that fall short of Japan’s own standards on carbon emissions. But even if that such a policy were implemented, it could not shield Japanese industry from the damage wrought by soaring energy costs.

The Electric Vehicle Quandary

Japan’s commitment to net zero emissions also poses a dilemma in respect to the Japanese automobile industry, which has been the backbone of the nation’s manufacturing sector since its consumer electronics industry fell on hard times. Japanese automakers have invested heavily in hybrid vehicles and have long dominated the global market for HVs and other fuel-efficient vehicles. However, with the goal shifting from energy efficiency to carbon neutrality, calls for a transition to electric vehicles are growing louder.

At present, the United States and China both produce more EVs than Japan. One could argue that in China, where the power generation mix is even dirtier than in Japan, a Japanese HV is actually cleaner than a Chinese EV. But nowadays the standard retort to that argument is that we must all shift to cleaner power generation.

Of course, Japanese automakers are perfectly capable of manufacturing EVs. But a shift may not work to their advantage. HVs, like conventional vehicles, have an integral product architecture, which has long been the strength of Japanese automakers. EVs, by contrast, have a modular architecture, which promises to simplify production to the point where anyone with the requisite battery can assemble an EV, much like a homemade PC (with software largely accounting for differences in performance).

In short, if Japan opts to go the EV route in keeping with its commitment to carbon neutrality, it risks undermining the competitiveness of its own all-important auto industry.

From the standpoint of global trends over the next 30 to 50 years, a rapid push toward carbon neutrality may seem like the only viable option for Japan. But that option also poses serious risks to the nation. The government owes it to the Japanese people to acknowledge those risks and encourage open debate of the pros and cons before embracing numerical targets grounded in wishful thinking instead of scientific and economic reality.

[1] In terms of indirect green finance, some Japanese megabanks have decided to halt financing of coal-fired power stations, but these decisions were taken under pressure from investors, not financial regulators, and could thus be considered examples of ESG investing.

[2] In my article “Reimagining the Central Bank: New Frontiers in Monetary Policy,” I discussed the idea of green quantitative easing not as a strategy for fighting climate change but as a possible means of boosting the potential growth rate in order to achieve the central banks’ inflation targets. While unorthodox, such a policy would arguably fall within the traditional mandates of monetary policy. In response to the “market neutrality” objection, it can be argued that central banks already engage in micro-level resource allocation when they purchase private assets as a means of easing credit during economic crises, such as the COVID-19 pandemic. One might also question whether QE as currently practiced is neutral with regard to the allocation of resources.

[3] See, for example, Takayuki Mase et al., “2030-nen onshitsu koka gasu 46% shogen mokuhyo no tassei wa kano ka” (Can the Target of a 46% Reduction in Greenhouse Gases by 2030 Be Achieved?), SERC Discussion Paper 201001 (May 14, 2021), https://criepi.denken.or.jp/jp/serc/discussion/21001.html.

[4] Japan’s ability to shift to renewables is also hobbled by its fragmented power grid, which limits transmission from areas that generate surplus power to areas with inadequate capacity. Japan will have to upgrade its electricity transmission and storage systems to dramatically increase its reliance on solar, wind, and other renewables.