Amid moves to reboot an economy devastated by COVID-19, economist Motohiro Sato outlines a strategy to build resiliency by protecting the vulnerable and preparing a contingency tax plan.

* * *

The government of Prime Minister Shinzo Abe has lifted the coronavirus state of emergency for all of Japan, opening the door to a gradual reopening of the economy. The COVID-19 crisis is far from over, however, so our task now should be to design an “exit strategy” that balances public-health and economic concerns.

The government’s decision to end the state of emergency even in the hard-hit Tokyo area carries significant risks. Experts agree that a return to normal activity is bound to result in a new wave of infections, and that the pattern could continue until an effective vaccine or therapeutic drug is developed, approved, and made widely available.

The stay-at-home advisory and the resulting curtailing of business activity have had a devastating impact on the economy. A full 16% of small and medium-sized enterprises responding to a survey by Tokyo Shoko Research (released May 1) reported that April earnings were down by more than 50% from last year. Domestic bankruptcies attributed to the epidemic numbered 119 as of May 7. The International Monetary Fund estimates that the Japanese economy will contract by 5.2% in 2020.

A well-thought-out “exit strategy” is needed to support a smooth transition to economic normalcy while protecting the vulnerable and avoiding a crippling new wave of infections. In the following, I offer the basic outlines of such a strategy, along with a contingency plan to boost tax revenues in the event that Japan’s ballooning public debt becomes unsustainable.

Protecting High-Risk Groups

The first element of such a strategy must be a rigorous public-health policy that focuses on protecting groups at high risk for severe illness, including the elderly and those with underlying medical conditions.[1]

Communities must become more proactive in monitoring the health of high-risk individuals. Primary care physicians and designated healthcare facilities need to send push notifications to their high-risk patients and have them periodically complete online questionnaires. These individuals should be tested at the first signs of a possible infection, and those who test positive for COVID-19 should be isolated—in hospitals if the symptoms are sufficiently severe—to prevent the spread of infection.

The approximately 40% of elderly persons living in three-generation households, where they are at high risk of infection, should be encouraged to self-isolate, either in hotels (in the case of healthy individuals) or healthcare facilities (in the case of those receiving medical or nursing care at home). Needless to say, we must ensure that all nursing-care facilities are rigorously following the protocols for preventing the spread of infection, including restrictions on visitors. The central and local governments must provide funding to defray the costs of these measures.

Next, it is essential that we beef up our healthcare system by securing extra hospital beds, personnel, and equipment to prepare for a possible surge in COVID-19 cases, especially in the major cities. Now is the time to boost the capacity and efficiency of community healthcare via coordination and division of labor among local healthcare providers. For now, core hospitals and municipal or prefectural hospitals should be designated as centers for the treatment of COVID-19 and supplied with extra beds, equipment, and personnel for that purpose; non-COVID patients can be transferred to other facilities in the community as needed.

Merely targeting high-risk groups is not sufficient, however. Japanese society as a whole must maintain its vigilance and embrace a new lifestyle that makes optimum use of such contact-free options as online medical consultations and teleworking.[2] In cases where teleworking is not possible, employers should encourage flexible working arrangements to facilitate staggered commuting. Restaurants and bars should be allowed to reopen only if they institute policies to avoid the “three Cs”: closed spaces, crowded places, and close-contact settings. Companies must also do their part to detect COVID-19 infection in the workforce as quickly as possible and prevent its spread with the aid of occupational health professionals. Schools need to take the same precautions vis-a-vis their students and staff.

Japan must also expand both PCR and antibody testing. One issue that has limited the scale of testing until now is a shortage of personnel at community health centers. The answer is to upgrade our testing systems with a focus on automation. Testing should be carried out periodically on a large scale so that the government can gather the hard data it needs to review and evaluate its policies. Individuals that test positive for coronavirus antibodies might be issued certificates of immunity and given the green light to engage in face-to-face sales and other close-contact business activity.[3]

Income Security First

The Abe cabinet, intent on a rapid V-shaped economic recovery, appears to be favoring a large-scale fiscal stimulus designed to boost consumption. This kind of “bunker shot” might boost business activity over the short term, but it will not provide the kind of economic resilience needed to withstand subsequent waves of coronavirus infection; in fact, it could even exacerbate economic instability.

The impact of the coronavirus on industry has varied from sector to sector. Restaurants, tourism-related businesses, and department stores have been hit very hard, while drugstores, convenience stores, and online merchants have seen an increase in sales. And while some dining and drinking establishments may revive once restrictions are lifted, businesses that rely on inbound tourism will be hurting for a long time to come, regardless of fiscal policy. What the economy needs most now is not a systemic stimulant to jack up consumption but targeted assistance to support income security.[4]

The government has taken a step in this direction with a new program that offers assistance to free-lancers and nonregular employers who are eligible for neither unemployment compensation nor cash subsidies for small businesses. Programs like this serve several purposes. They redistribute income at a time of growing economic inequality. They also function as a form of insurance, guaranteeing that the workers who support our society with their labor in ordinary times will have enough to live on during crises like this one. From a macroeconomic viewpoint, they can help stabilize the economy and aid recovery by maintaining household incomes at a level where people can keep paying their bills, so that money continues to change hands, as hypothesized by the Keynesian multiplier.

To keep small businesses afloat, the government should continue its current relief programs, including cash grants, rent subsidies, and zero-interest unsecured loans. It should also take the opportunity to encourage digital transformation among small and medium-sized businesses, possibly by making government assistance contingent on investment in digital technology. Japan has lagged far behind other industrially advanced countries in digitalization, which is one reason it has been so slow to embrace such contact-free modes of interaction as telework, distance learning, and video consultations. The COVID-19 crisis can serve as an impetus for a new government initiative to accelerate digital transformation, including the public sector (e-government).[5] Such a massive shift will involve major fiscal outlays up front, but it is an investment that must be made sooner or later, and it will pay off both in the short term, by stimulating demand, and in the long term, by improving productivity.

Strengthening the Safety Net

The current crisis has highlighted the challenge of providing both timely and appropriate emergency assistance to households struggling with a sudden drop in income. One option might be to disburse a uniform stipend (for example, ¥100,000 per month for up to one year) to all those who apply for it, on the understanding that those who end up making more than the specified income threshold will have to repay some or all of the stipend at the end of the tax year. People receiving paid leave and other employer benefits could still be eligible for the stipend, but all such income would be figured in when calculating annual income. If the total exceeded the threshold or surpassed the previous year’s income by more than a certain percentage, then the difference would be added to the individual’s tax bill.[6] Such a program would be in the nature of a hybrid between a cash benefit and a no-interest loan with repayment linked to income. For this to work efficiently, tax authorities would need to track each individual’s benefits and income using the My Number taxpayer ID system.

Over the medium and long term, we must also create a permanent safety net for the workers on whom our society depends. Other countries have long since instituted programs, such as the US earned income tax credit, to assist low-income workers. But Japan’s social safety net (including old-age pensions and public assistance) is designed almost exclusively with the unemployed in mind.[7]

Japan should integrate its tax and social security systems using My Number and institute a negative income tax, under which those earning less than the minimum taxable income receive payments in proportion to the difference. This would not only promote the redistribution of income over the long term but also help stabilize the economy in times of emergency by assisting households financially decimated by the crisis, regardless of their previous income levels.

Contingency Funding Plan

The Abe cabinet has already drawn up one supplementary budget amounting to about ¥25 trillion, all financed by government debt. The IMF has estimated that Japan’s gross public debt will hit 251.9% of gross domestic product in 2020, up from 237.4% in 2019. Meanwhile, the prime minister has indicated that a second supplementary budget is in the works. There are calls for a further ¥100 trillion in spending to cover additional cash handouts, rent relief, and assistance to college students. Of course, spending will have to be carefully audited to prevent waste and fraud, but for now there is no alternative but to finance the emergency expenditures with bond issues.

Eventually, of course, such debt must be repaid. If the government continues to issue debt in such large quantities, with no clear plan for paying it down, the market could eventually lose confidence in government bonds.[8] (The Japanese government could continue to rely on the Bank of Japan to finance the budget for the time being, but the increase in the money supply could eventually trigger runaway inflation.) Of course, moving too quickly to raise taxes could exacerbate the recession and put additional strain on household finances. Once the epidemic is over and the economic recovery well established, however, the government should assess the need for new taxes to repay the debt incurred by the coronavirus response, based on the size of the deficit and the strength of the economy. Any new taxes should target Japan’s wealthier taxpayers and be implemented step by step, as necessity dictates.

The first step would be a surtax on income beyond a certain threshold. A 15% tax on employment, business, and investment income in excess of ¥20 million would yield revenues of about ¥1.4 trillion annually (calculating from 2018 tax information), or ¥14 trillion over 10 years.[9] (The consumption tax would continue to be collected for its original purpose of financing healthcare and pension benefits.)

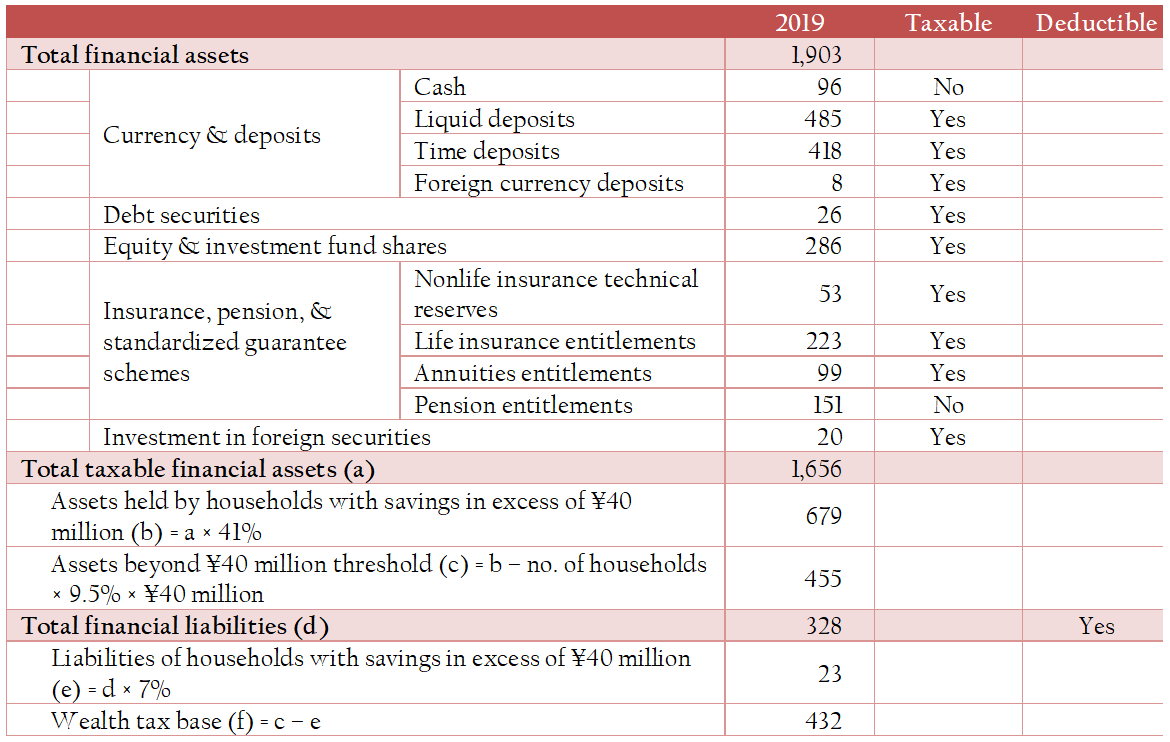

It should be remembered that in Japan a vast amount of wealth is concentrated in the savings of senior citizens with relatively low annual incomes. The next step would be to tap into that wealth. Japan currently has an inheritance tax and a gift tax, but simply raising the rates on these asset taxes might not yield the kind of revenues needed to restore confidence to the market in a rapidly deteriorating environment. In a recent paper, Camille Landais, Emmanuel Saez, and Gabriel Zucman have called for a progressive European wealth tax to repay the COVID-19 debt, arguing that the crisis has hit the most vulnerable the hardest.[10] As a contingency plan in the event of a looming fiscal crisis, Japan should consider a one-time wealth tax on financial assets (savings, securities, etc.) in excess of ¥40 million. A 10% tax applied to such assets would yield roughly ¥43 trillion (assuming taxable assets on the order of ¥432 trillion.[11]

With the foregoing in mind, I propose a three-step strategy for funding the coronavirus debt. Our first option should be to rely on growing tax revenues (from a recovering economy) and fiscal discipline to pay down the additional public debt generated by the coronavirus. Failing that, we should raise income tax rates on high-income households, as explained above. Finally, if a ballooning deficit threatens to undermine confidence in Japanese government bonds, we should resort to a one-time wealth tax as a contingency response. Such a three-tiered strategy should be sufficient to reassure markets and ensure that the coronavirus crisis does not lead to a debt crisis as well.

Tax Base for a Hypothetical Japanese Wealth Tax

Unit: ¥ trillion

Source: Compiled by the author based on Bank of Japan, “Flow of Funds” (2019 figures) and Statistics Bureau, “National Survey of Family Income and Expenditure,” 2016.

Notes: The share of households whose financial assets exceeded ¥40 million was 9.5%. They held 41% of total assets and 7% total liabilities, according to the “savings and liabilities” data for households of two or more persons, published in the National Survey of Family Income and Expenditure, 2016. The total number of households in Japan as of January 1, 2019, was approximately 59 million.

Supplementary Notes on the Japanese Wealth Tax

A contingency plan: The proposed wealth tax is a contingency plan whose primary purpose would be to reassure the markets about the future. It does this by mapping out a clear escape route (that is, a means of paying off the debt) that can be used in the event that unrestrained deficit spending undermines confidence in Japanese government bonds. The plan need never be implemented if fiscal discipline reins in spending or if a robust recovery yields sufficient growth in tax revenues to pay off the debt.

MMT and the wealth tax: It is a common misconception that tax increases are unnecessary under Modern Monetary Theory. The position of MMT is not that tax increases are never required but that the government can raise taxes whenever it chooses (which means that it need not do so now). According to MMT, the reason people hold cash balances is that they expect to be taxed. The proposed wealth tax conforms to that expectation.

A wealth tax versus hyperinflation: If the government continues to rely on unlimited bond purchases by the Bank of Japan to finance its budget deficits, the increase in the money supply could trigger high inflation. While inflation has the effect of reducing the public debt, it is notoriously difficult to control and can lead to immense suffering. Ultimately, the government may have to decide whether to take control of the debt through a rational tax plan or leave the job to the unpredictable forces of inflation.

[1] Daron Acemoglu and others have argued for a lockdown targeting the elderly. The risks of infection among the working-age population could thereby rise, but their rate of hospitalization will be lower, preventing medical facilities from becoming overburdened. Daron Acemoglu, Victor Chernozhukov, Iván Werning, and Michael D. Whinston, “Optimally Targeted Lockdowns in a Multi-Group SIR Model,” NBER Working Paper Series 27102, May 2020.

[2] One priority should be reform of administrative and clerical processes to eliminate the need for hanko, or personal seals.

[3] As indicated by the World Health Organization, more work needs to be done to determine whether the presence of antibodies guarantees immunity. Even so, antibody testing should be expanded immediately to facilitate comparative risk assessment.

[4] The International Monetary Fund has stressed the role of income support in stabilizing economies during the pandemic. See IMF, Fiscal Monitor, April 2020: Chapter 1: Policies to Support People During the COVID-19 Pandemic, https://www.imf.org/en/Publications/FM/Issues/2020/04/17/Fiscal-Monitor-April-2020-Chapter-1-Policies-to-Support-People-During-the-COVID-19-Pandemic-49278.

[5] The government should promote and support a wholesale shift to electronic invoicing, along with digitalization of the distribution and retail sectors.

[6] While such a benefit can function as a disincentive to work, income security should outweigh such considerations in emergencies like the present situation.

[7] See “Using Refundable Tax Credits to Offer Sustained Pandemic Relief” by Shigeki Morinobu on this website, https://www.tkfd.or.jp/en/research/detail.php?id=740.

[8] A temporary increase in spending will not require a tax increase, according to tax equalization theory, but this assumes that the budget is balanced over the long term. Japan, however, has a structural deficit.

[9] Financial income, such as capital gains on the sale of shares (taxed at 20%), accounts for more than 90% of total income among the high-income group. Their tax rate thus remains at 35%, rather than 70% (55% + 15%) on aggregate income.

[10] Camille Landais et al., “A Progressive European Wealth Tax to Fund the European COVID Response,” Vox EU CEPR Policy Portal, April 3, 2020, https://voxeu.org/article/progressive-european-wealth-tax-fund-european-covid-response.

[11] This estimate excludes cash and private pensions. Measures would be required to prevent individuals from avoiding taxation by converting taxable financial assets into cash or fixed property.