- Article

- Macroeconomics, Economic Policy

Moving the ROE “Mountain”: A Framework for Capital Market Reform

May 27, 2014

Despite a slew of corporate governance reforms undertaken over the past two decades, Japanese companies remain extraordinarily immune to shareholder pressure. Keiichiro Kobayashi argues that reforms must begin targeting the investors in order to transform and revitalize Japan’s business culture.

* * *

About two years ago, I assembled a group of financial experts to identify the problems in Japan’s equity market and propose directions for reform. We named our group the Yama o Ugokasu Kenkyukai (Yamaken) or “Moving the Mountain” Study Group. The name, explained in greater detail below, reflects our perception of the task facing policymakers if they wish to revitalize the Japanese economy through meaningful capital market reforms.

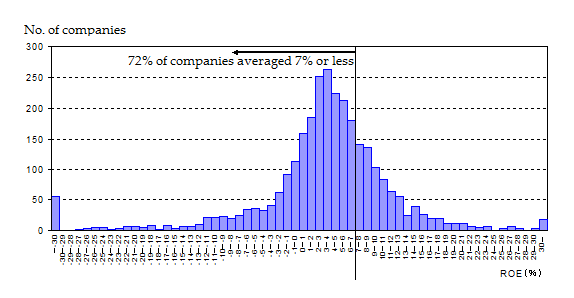

The need for reform is clear. Despite recent improvements, Japanese companies in the Topix index averaged a return on equity (ROE) of only 6% during the 10 years from 2004 through 2013, as compared with 12.6% for the companies in the MSCI World Index. If we focus not on the mean value but on the mode—that is, the ROE levels occurring with the highest frequency—the difference is even more striking. Figure 1 illustrates the frequency distribution of ROE values among listed Japanese firms.

Frequency Distribution of ROE in Japan (10-year average)

The peak in this histogram represents the ROE range most frequently seen among Japanese companies: roughly 3%, as compared with a global figure of 13%. In other words, to place Japan’s equity market on an equal footing with that of other countries, we need to move this “mountain” a full 10 points to the right—hence the name of our study group. Convinced that moving this mountain would require a wholesale restructuring of corporate governance through multi-level reforms, the group spent two years deliberating the kinds of policies that could help bring about such a transformation.

Toward a Shareholder-Centered Model

In the 1970s, corporate financing in Japan was basically controlled by a handful of large banks that maintained close, long-term relationships with their corporate clients. In their dual role as shareholders and creditors, these “main banks,” as they are known, imposed a considerable measure of long-term discipline on corporate governance.

In fact, the average ROE of Japanese corporations during this period was roughly comparable to that of US companies. In the booming 1980s, however, Japanese corporations were able to raise cash by tapping into inflated asset prices, and the banks ceased to perform their traditional role. The ROE of Japanese companies began to plunge around this time, and even today—20 years after the collapse of the asset bubble—it remains far below the global average.

This suggests that a major factor behind the low ROE of Japanese corporations is the loss of discipline formerly imposed by the main bank system. To restore discipline and boost ROE, Japan needs to complete the transition from a bank-centered model of corporate governance—embodied in the now-dysfunctional main bank system—to a shareholder-centered model.

To achieve this, it is not sufficient to focus reform efforts on the corporations alone. What we need are consistent, integrated reforms along the entire investment chain, injecting greater vitality at three stages: (1) the institutional investors, such as pension funds and life insurance companies, that hold assets to be invested; (2) the asset management companies that invest funds on their behalf; and (3) the private companies in whose stock a portion of those funds are invested.

At stage 3, the key goal is to encourage a greater awareness of the cost of capital in corporate management. This is also the goal of the corporate governance reforms Japan has implemented over the past two decades with a view to boosting the vitality and competitiveness of Japanese business. To achieve this, reforms are needed for stage 2—the asset management companies (AMCs) that invest in these corporations on behalf of institutional investors.

The goal here is to get professional investors more actively engaged in the management of investee companies so as to contribute to their long-term growth. As things stand now, Japanese AMCs exert almost no influence over corporate management. Asset managers in Japan focus their efforts either on passive index-based investing, in which case they have no shareholder role in individual businesses, or on quick profits from short-term trading, meaning they have almost no interest in businesses’ long-term growth.

There is a need to change this culture and to encourage the kind of investor engagement that can impose discipline on corporate management, much the way banks did during the heyday of the main bank system. This requires leveraging their position as shareholders and providing management with timely and constructive ideas for reform—ideas that management would welcome and value.

Institutional investors (stage 1) have a key role to play as well. In addition to seeking maximum long-term performance from their investments, they have a social responsibility to help inject vitality into the asset management industry through the kinds of long-term investor agreements that encourage engagement-oriented investment.

Japan’s Aberrant Asset Managers

Japanese economists and policymakers have been talking about corporate governance reform for decades now. The problem is that hardly anyone has bothered to address the other half of the equation, namely, institutional investors and the asset managers that invest on their behalf—or, if the issue has been raised, no one has paid much attention. It seems to me that the reason the corporate governance reforms of the past 20 years have yielded so few tangible results is that efforts have not extended to institutional investors and AMCs. If we want to see real progress in Japanese corporate governance, we need to take a comprehensive, integrated approach that deals simultaneously with the corporations, the institutional investors, and the AMCs together as closely interacting players in the investment chain.

It is no secret that Japan’s asset management business has serious and deep-rooted problems. Surely one reason returns on Japanese equities have stagnated at half the global average is the passive behavior of Japan’s asset managers, who do little more than pour their clients’ assets into the most popular index-linked funds, knowing that their clients will be satisfied as long as their returns keep pace with the domestic market overall. This situation minimizes incentives to boost corporate ROE.

Of course, each company’s ROE is basically a function of its productivity, but pressure from the asset management industry can have a major impact on companies’ productivity. Japan’s lagging ROE is a testimony to the relatively backward practices of our asset management industry. The relationship between Japanese investors and investees has settled into an insular form of stagnation that may be regarded as a manifestation of Japan’s “Galapagos syndrome.”

Our group believes that the only way to alter the hidebound behavior of institutional investors and AMCs in Japan is to modify the market environment and governance structures that encourage it. Since it is beyond the purview of this article to cover all the policy ideas discussed within our study group, I will limit myself to offering three examples of the kinds of proposals that could play a pivotal role in the reform of Japan’s capital markets.

Proposal 1: Supporting Emerging Managers

One way to help Japanese AMCs’ break free of their herd mentality and passive approach to investing is to encourage market entry by newcomers. Although Japan’s asset management industry has relatively few institutional barriers to entry, even the most able newcomers face daunting obstacles owing to the reluctance of institutional investors to entrust their funds to a company with no previous record of performance.

This problem could be addressed by a kind of “affirmative action” system under which institutional investors would be required to allocate a certain portion of their assets (for example, 1%) to up-and-coming AMCs, or “emerging managers.” Many US states have adopted such quotas for their public pension funds via so-called emerging manager programs. A well-known example is CalPERS, the California State Employees’ Retirement System. CalPERS pioneered the emerging manager concept in 1999 with the launch of a $3 billion Global Equity Manager Development Program, and it has been increasing the quota ever since. Similarly, the State Employees’ Retirement System of Illinois is required by law to utilize emerging managers for approximately 10% of its equity portfolio. In 2012, this amounted to about $720 million.

In the United States, emerging manager programs of this sort were originally adopted with the political aim of supporting minority-owned investment firms, but they are now regarded as a tool for boosting overall performance by augmenting the contribution of small, up-and-coming management companies that can respond flexibly to changing market conditions. In Japan, this kind of affirmative action could perform an important public policy function. By mandating the utilization of AMCs that would otherwise find it virtually impossible to attract institutional investors, such a program would serve the laudable purpose of injecting vitality into Japan’s hidebound and stagnating asset management industry.

Proposal 2: Promoting Engaged Investment

To encourage these emerging managers to adopt an engagement-oriented approach, we also need to ensure that they have assets allocated for long-term investment.

Start-ups in this industry face especially steep hurdles when it comes to long-term investing, as Japanese institutional investors are extremely reluctant—more so than their Western counterparts—to entrust their assets to untested AMCs over longer investment horizons. This places stiff constraints on the investment strategies of emerging asset managers. If entrusted with funds under a three-year agreement, an AMC can develop its own strategies for long-term asset building. As a long-term corporate shareholder, it can engage with management to encourage positive changes that increase the value of its shares. When limited to short-term investment, however, they fall into the habit of short-term trading and never develop the capacity to for anything beyond a passive, short-term investor relationship. This vicious circle needs to be broken.

We believe that nurturing AMCs oriented to long-term investment is an important key to reform of the Japanese economic system. Assuming that this is a worthwhile public endeavor, it makes sense, as a matter of public policy, to make long-term funds available to fledgling AMCs. One way to do this would be to institute a requirement that public institutional investors (the Government Pension Investment Fund, Japan Post Bank, etc.) entrust a certain minimum share of their investment assets to emerging managers under long-term asset-management agreements (three years or more). Another possibility would be for public institutional investors (such as the Innovation Network Corporation) to invest directly in these fledgling AMCs, thereby providing them with sufficient capitalization to embark on long-term investing.

Proposal 3: Creating an Investors’ Lobby

Finally, we believe it is essential for the investment industry to come together to formulate its own long-term vision and become actively involved in the rule-making process (including statutory regulation and the establishment of a framework for dialogue with investee corporations) if it is to make the transition to engaged, long-term investing.

Japan does have the Investment Trusts Association, but this is a passive entity devoted to industry self-regulation under existing Japanese law. To my knowledge, this country has no active, independent trade group that can advocate for the industry on laws and statutory regulations and lead the way on reform of business practices. To fill this gap, we recommend establishing a loose trade association built around a nonprofit organization and open to professional investors across the business spectrum. The functions of such a group—which we shall tentatively name the Investors’ Forum—might be as follows.

1. Ascertaining the views of the professional investment community on laws and regulations governing its activities and lobbying the government on its behalf through proposals, opinion papers, etc.

2. Developing standards for engagement with investees and representing the professional investment community in wide-ranging dialogue with business.

3. Acting as a counterpart to professional investor associations overseas; cultivating contacts and exchange with overseas associations to learn about best practices of overseas investment professionals and promote their adoption in Japan.

Conclusion

The goal should be to create a market environment conducive to long-term improvement in corporate productivity. To change the market environment, it is necessary to change the behavior of the institutional investors and asset management firms that account for the lion’s share of equity investment. The Japanese economic system must be reformed as a whole to promote the shift to a shareholder-centered model, in which investors assume the role formerly played by the main banks and become actively engaged in the business policies of investee firms to promote their long-term growth and development.

The proposals outlined here are but a sampling of the kinds of concrete policies needed to effect this shift. Further study is needed to develop a comprehensive, consistent policy package aimed at each stage in the investment chain: institutional investors, asset managers, and corporations. The future of the Japanese economy depends on it.