- Article

- Abandoned Land

Japan’s “Missing Landowners”: Legal Framework for Land Ownership Inadequate to Cope with Aging, Depopulation

May 23, 2016

Measures to enhance the collection of land ownership data are urgently needed, but this will entail decisions on who will spearhead such efforts and how the costs will be shared. Research fellow Shoko Yoshihara points out that the growing cases of “missing landowners” raise fundamental questions about how land will be passed on to future generations in an aging and depopulating society. A new legal framework for land ownership is an urgent priority.

* * *

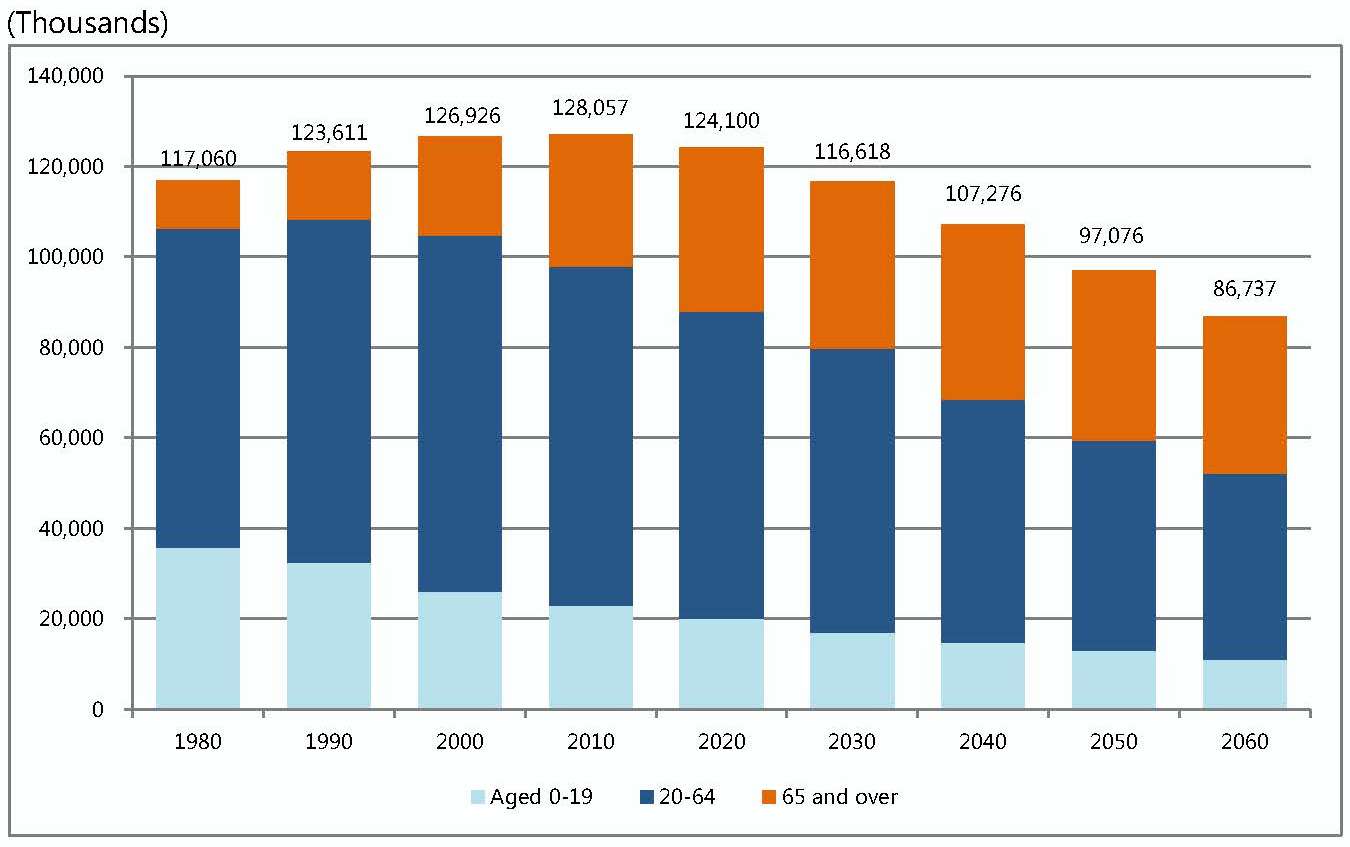

Japan is the world’s most aged country, according to the World Bank, with 26% of the population being 65 or older as of 2014. Italy and Germany are next with 22% and 21%, respectively. Japanese government projections see the share of the elderly in Japan rising even further—to as high as 40% by 2060—and the general population shrinking by one-third (Figure 1).

Figure 1. Japan’s Aging and Shrinking Population

Source: National Institute of Population and Social Security Research

This unprecedentedly rapid demographic change will have far-reaching implications for public finances, the pension and healthcare systems, and voting patterns. It is also expected to affect the current system of land ownership, as revealed by the gaping lapses in ownership records that seriously thwarted reconstruction efforts in the wake of the Great East Japan Earthquake of March 2011.

Recovery from the earthquake and tsunami was significantly delayed in some areas due to a lack of land-ownership and cadastral data. Local authorities were unable to purchase the land needed to rebuild communities on higher ground because they could not identify the owners. This is a direct consequence of Japan’s land registration system, under which the registration of land titles is not mandatory. In other words, if the registered owner dies, and the survivors never bother to transfer the title, the local records will continue to list the deceased person as the owner. If this continues for several generations, the number of direct descendants or other relations legally eligible to inherit the property can multiply geometrically.

In many rural areas, the price of land is so low that the cost of registering and maintaining the title is higher than what one would receive by selling the property. In outlying regions, therefore, there is no financial incentive to claim the land; it is cheaper to keep a deceased person’s name registered as the owner.

Interestingly, now that the myth of ever-rising land values in Japan has been shattered, this trend has begun to appear in more developed areas as well. This has hindered attempts to introduce large-scale farming by aggregating agricultural land, address the growing problem of abandoned homes, and advance reconstruction and public works projects, since approval from landowners cannot be obtained.

Broad Recognition of the Problem

To gain a quantitative understanding of the problem, in fiscal 2015 the Tokyo Foundation conducted a questionnaire survey targeting Japan’s 1,718 municipalities and the 23 wards of Tokyo; responses were received from 888 local governments.

Asked whether they had ever encountered a problem due to the unknown identity of the landowner, 557 municipalities, or 63% of all respondents, said that they had. The largest difficulty was being unable to collect property taxes (486 municipalities), while other problems included the dangerous dilapidation of vacant houses (253 municipalities) and the deterioration of abandoned farm- or forestland (238 municipalities).

They were then asked about levying taxes on deceased persons, which occurs when the survivors of a deceased landowner fail to transfer the title, and municipal tax officials are unable to track down the heir, as a result of which taxes continue to be levied under the dead person’s name. There were 146 municipalities (16% of the total) that reported having taken such a measure, and only 7 (1%) said that they had never come across such a case. The remaining 735 respondents (83%) said they did not know, suggesting how difficult it was even to ascertain whether or not landowners were alive.

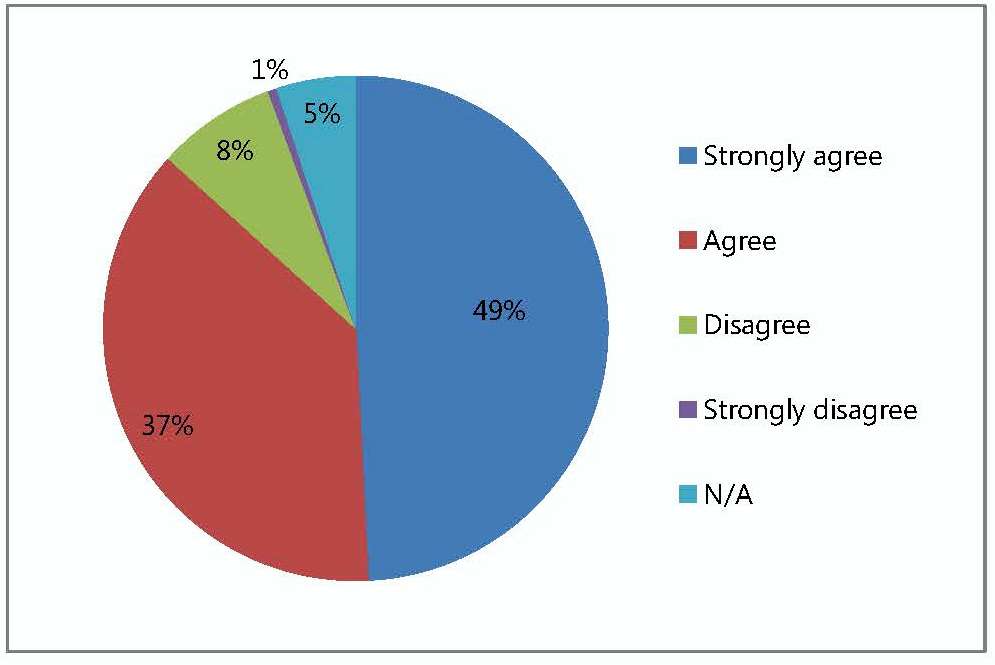

This was corroborated by the fact that 770 respondents, or 87% of the total, believed that levies on deceased persons were likely to increase in the future (Figure 2).

Figure 2. Do You Agree with the Statement, “Taxes on Deceased Persons Will Increase in the Future”?

Asked for their reasons, respondents pointed both to institutional factors (“prevalence of untransferred titles is not likely to decline,” “confirming the death of owners living in other municipalities is difficult”) and to changes in society (“people abandoning their inheritance claims will probably increase,” “attitudes toward the value of land are shifting”). Specific comments offered by respondents included: “Given the falloff in real estate transactions in recent years, the failure to register the rightful owner has not, for the time being, been very problematic.” “Many heirs of forestland and abandoned farms are beginning to feel that transferring the title is not worth the trouble.” “The descendants have moved out of town long ago, and they don’t even know the location of their own land.”

These comments not only point to why taxes on the deceased have been rising but also suggest how lapses in land ownership data could become increasingly pronounced in the years to come.

Measures Needed to Improve Data Governance

One structural factor behind this phenomenon is the weakness in Japan’s data governance regarding land ownership and utilization. A nationwide cadastral survey that was launched in 1951 has been significantly delayed, and today it covers barely 51% of the countryside. The most reliable data available is that based on the voluntary registering of claims under the Real Property Registration Act, but its limits have become increasingly obvious in recent years. Countermeasures for abandoned homes and efforts to keep the basic farmland register up-to-date, for example, now frequently need to refer to the inheritance records of the property tax register to make up for missing data.

But if more heirs henceforth neglect to register inherited real estate due to low land values or the hassle and cost of transferring the title, there would be no halting the expansion in the phenomenon of unknown landowners. The accuracy even of the property tax register would be affected, as already seen with the levying of taxes on deceased persons.

Poor governance of land ownership data will have ramifications not only for tax revenues but also for property rights, and it is not a problem that can be adequately addressed at the municipal level alone; measures, including legislative revisions, to improve the data governance infrastructure are needed under national leadership. At the same time, steps must provisionally be taken to reduce the cost of transferring the title—both for the owner and the government.

Steps are also needed to prevent the expansion of unidentified landowners, such as by allowing heirs to donate unused land to nonprofit, community groups at no cost and by transferring ownership to the local government after a property remains unregistered for several generations. Owners should also be provided with a broader array of options when they no longer have the will or ability to claim or manage the land.

The Tokyo Foundation survey found that, for the most part, the only cases in which local governments accepted land donations from residents were when the land in question could be expected to be used for public purposes, such as roads. One municipality wrote that the overriding reason cited for donations was that the owner had no use for the land and was unable to manage it properly. Local governments, on their part, were usually reluctant to acquire new land at a time when they were seeking to sell off or dispose of unused public assets. “Under the circumstances,” one respondent wrote, “there appears to be no alternative for landowners to safely relinquish their property other than to simply abandon it.” Serious debate must begin quickly on developing new options, such as donations to community and other nonprofit groups.

Posted land prices have long been declining, the only exception being a bump in average residential and commercial land prices of Japan’s three largest urban areas in 2014—the first rise in six years. A questionnaire survey on attitudes toward land conducted each year by the Ministry of Land, Infrastructure, Transport, and Tourism showed that in fiscal 2014, 40% of respondents—the highest on record—said that they did not consider land to be better assets than savings or stocks. The share is twice as high as the figure from 20 years ago, and it was notably higher among residents of outlying areas (44%) than those in the largest urban areas (33%). Given the long-term decline in land prices, people no longer seem to regard land as a valuable asset.

Even if cases of owners abandoning their land are isolated and limited in scale today, the lack of countermeasures and the pervasiveness of the phenomenon suggest that the problem could seriously hinder regional developments initiatives in the future. It could eventually wind up robbing the community—and even the country itself—of its dynamism and strength.

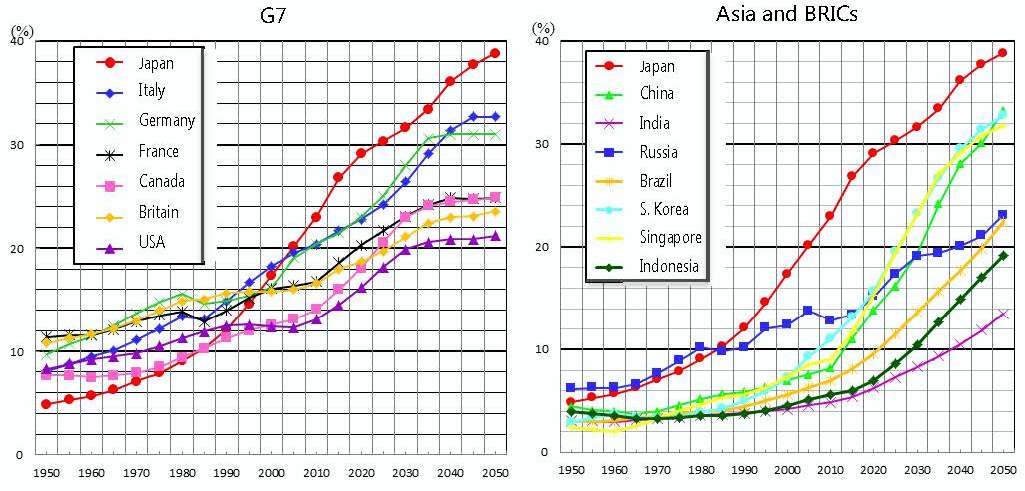

The Ministry of Internal Affairs and Communications notes that the aging of the population is a global phenomenon, with the 65-and-over population projected to reach 18.3% worldwide by 2060. Japan may have been the first to become a super-aged country, but many others, including emerging economies, are quickly following in its tracks (Figure 3). The number of years required for the elderly population to rise from 7% to 14% was 115 years for France, 40 years for Germany, and 47 years for Britain. Japan took only 24 years. Other Asian countries, though, now appear to be graying at an even faster pace, with the share in South Korea rising from 9.3% in 2005 to a projected 33.6% in 2060.

Figure 3. Aging of the Population in the G7 and in Asia/BRICs

Coping with an aging population is not an issue for individual countries to address alone; clearly, it is a growing, global concern. Japan was the first country to see the share of the elderly population reach 20%, and the world can draw many lessons from its experience, both its successes and failures.

In this context, the question of land inheritance is both a personal issue and one that has larger policy implications for industrial production and for disaster prevention and recovery. There is no doubt that measures to enhance the collection of ownership data are urgently needed, but this will entail decisions on who will spearhead such efforts and how the costs will be shared between the national, prefectural, and municipal governments. The growing cases of “missing landowners” raise fundamental questions about how land will be passed on to future generations in an aging and depopulating society. A new legal framework for land ownership is an urgent priority.