Failure to change course will put Japanese manufacturing at risk: Expedite the establishment of Japanese version of “mega-recyclers” to establish a circular economy

October 28, 2025

X-2025-027E

Amendment of the Act on the Promotion of Effective Utilization of Resources

On February 25, 2025, the Cabinet approved proposed amendments to the Act on the Promotion of Effective Utilization of Resources, which is an important part of Japan’s resource recycling policy. The Act on the Promotion of Effective Utilization of Resources came into effect in 2001 with the objective of comprehensively promoting the “3Rs” (Reduce, Reuse, Recycle) as measures necessary for establishing a sound material-cycle society.

In the rest of the world, including Europe, there is a move to shift away from the previous economic system of one-way extraction of resources to manufacture, consume, and dispose of products (a linear economy) and toward the creation of a circular economy in which resources are utilized to the maximum extent within the supply chain through continuous sharing, reuse, and recycling at all levels rather than being used and discarded.

Japan’s Fifth Fundamental Plan for Establishing a Sound Material-Cycle Society, which was announced in August 2024, added new provisions to specifically encourage the transition to a circular economy through such measures as mandating the use of recycled raw materials and environmentally friendly design in the recently amended Act on the Promotion of Effective Utilization of Resources, which occurred against the backdrop of the transition to the circular economy being designated as a national strategy.

Two global initiatives driving the shift to a circular economy

Although the transition to a circular economy is also being promoted as national strategy in Japan, why is the world working to establish a circular economy? The two main background drivers of this are climate change and economic security.

It is common knowledge that the world is facing a serious climate change problem. It goes without saying that addressing climate change requires preventing the global warming that is the cause of this problem. To achieve this goal requires significant reductions in greenhouse gases, typified by carbon dioxide, which involves the global promotion of a shift away from coal, oil, and other fossil fuels and towards the use of wind, solar, and other forms of renewable energy in order to decarbonize the electricity generation sector that is the main source of emissions.

The 28th United Nations Conference of the Parties of the UNFCCC held in 2023 (COP28) resulted in a declaration of new targets that included a tripling of renewable energy capacity worldwide, and a doubling of the global average annual rate of growth in energy efficiency improvements, both to be achieved by 2030. However, achieving these targets will require a variety of mineral resources to manufacture power generation facilities for renewable energy as well as the equipment to save energy and use it more efficiently.

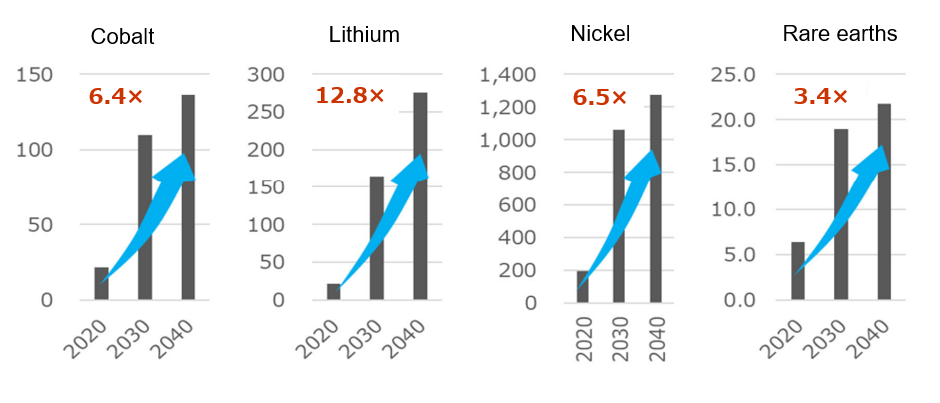

For example, power generation facilities for renewable energies such as wind and solar power require copper, aluminum, rare earths, indium, gallium, selenium and other resources. Meanwhile, lithium, cobalt, nickel, manganese, copper, and other elements are essential for the manufacture of the lithium-ion batteries that will play an important role in the shift to more efficient uses of energy. It is forecast that demand in 2040 for mineral resources used in such clean energy technology applications will increase significantly from 2020 levels, rising by 6.4× for cobalt, 12.8× for lithium, 6.5× for nickel, and 3.4× for rare earths (Fig. 1)[1].

Figure 1 Demand forecasts for cobalt, lithium, nickel, and rare earths

Source: Ministry of Economy, Trade and Industry, “Summary of Discussions Held to Date in the Resources and Fuel Subcommittee,” December 2024.

Demand for such mineral resources has been expanded by the promotion of digital transformation (DX) that has taken place globally over the past few years, and will be further increased by the need to address the issue of climate change. However, some forecasts[2] suggest that cumulative demand for various minerals up to 2050 will exceed actual reserves, leading to a serious risk of resource depletion.

To address this risk and the problem of climate change, it is necessary to establish a circular economy that promotes the recycling of resources recovered from waste, and to avoid dependence on underground resources.

In terms of the problem of climate change, it is also vital that a circular economy is established from the perspective of facilitating the decarbonization of corporate entities. Achieving carbon neutrality requires the decarbonization of corporate supply chains in their entirety, as well as the manufacture and procurement of raw materials located in the upper reaches of the supply chain to be decarbonized, but the use of recycled materials recovered from waste is essential.

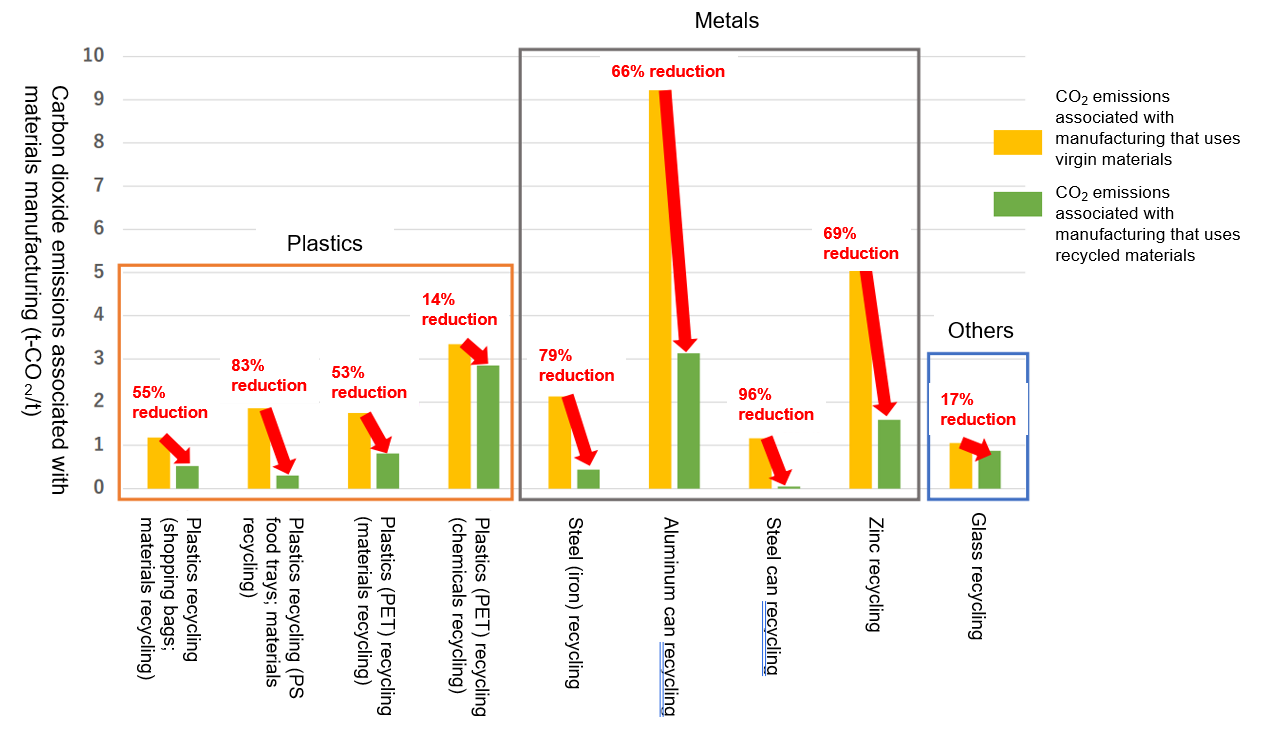

For example, while aluminum is a vital raw material for industry, the manufacture of virgin aluminum generates a significant amount of carbon dioxide during production as it passes through the processes of extraction, and then through dressing, smelting, and refining. Conversely, the use of recycled aluminum raw materials recovered from waste can result in a reduction in carbon dioxide emissions of approximately 66% compared to those of virgin raw materials (Fig. 2).

Figure 2 Comparison of CO2 emissions associated with virgin/recycled raw material manufacture

Source: Ministry of Economy, Trade and Industry, "Current Status and Issues of Resource Circulation Economy Policy," September 2023

Recently, companies are being requested to disclose initiatives for their own decarbonization under various corporate decarbonization management frameworks, including the Task Force on Climate-related Financial Disclosures (TCFD), and the recycled materials that are required for the decarbonization of the upper reaches of the supply chain cannot be secured without the establishment of a circular economy.

These changes in the environment in which corporations operate also affect economic security. As part of its European Green Deal that seeks to balance decarbonization with economic growth, the European Union (EU) introduced a Carbon Border Adjustment Mechanism (CBAM) on May 17, 2023. This trade measure imposes carbon emissions border tariffs on goods imported from other countries in which the rate of carbon reductions is low compared to that of countries within the EU. Payments to reflect carbon costs will finally become mandatory under this scheme in January 2026, and there are concerns that if Japan is unable to meet European standards it could result in disadvantageous trading conditions, thus also becoming a problem of economic security.

Preemptively setting rules to protect its own economy and establishing a business environment that is advantageous to itself is Europe’s standard approach. The CBAM is designed to levy costs in proportion to carbon emissions, but one can easily imagine a situation in which Europe uses similar techniques to introduce future measures in the form of a “recycled materials border adjustment mechanism” that levies costs on imported goods from countries that do not meet European standards.

If Europe were to take the lead in preemptively introducing such regulations, this could impact manufacturing in countries that cannot procure recycled materials from within their own borders due to delays in establishing a circular economy, thereby leading to economic security risks.

While countries worldwide are hastening their move towards a circular economy in response to the two main background drivers of climate change and economic security, Europe has already begun introducing specific standards for the use of recycled materials.

Countries promoting the establishment of a circular economy

As early as August 2023, Europe had enacted battery regulations specifying the minimum usage ratios of recycled material for all battery manufacture, including those used in electric vehicles (EVs). In terms of battery regulations, as well as mandating minimum recycled material usage ratios for battery manufacturing of 16% for cobalt, 6% for lithium, and 6% for nickel from August 2031 onward, the EU is moving forward to establish rules within the region by introducing usage ratio regulations for recycled materials for automotive plastics and the plastics used in containers and packaging.

Europe has also taken the lead not only in establishing rules within its own region, but also in the creation of international standards for their circular economy. In 2018, France led moves to establish a technical committee at the International Standards Organization (ISO) for standardization in the area of circular economies and is steadily promoting the expansion of Europe's ability to influence matters in this field.

Europe has also left no gaps in terms of participants in the circular economy. What is essential for the establishment of a circular economy is for participants known as “recyclers” to actually collect waste and recycle it as resources. In Europe there exist formidable players (“mega-recyclers”) such as VEOLIA, which has developed an integrated business ranging from collection, recycling and global sales of recycled materials, with annual sales reaching several trillion yen, and these mega-recyclers are fulfilling a central role in the construction of a circular economy in Europe.

In contrast to these moves made by Europe as a leader in the field, there is a view that the second Trump administration is putting the brakes on addressing the problem of climate change in the United States, and that this in turn will lead to stagnation in the development of a circular economy. The first Trump administration, however, took the view that America's dependence on other countries for the supply of important minerals is a security problem both economically and militarily, and in June 2019 published[3] a report under the title “A Federal Strategy to Ensure Secure and Reliable Supplies of Critical Minerals,” which included recommendations on the recycling of important minerals, showing even then a high awareness of the need for resource recycling. This approach has not changed in the second Trump administration. In January 2025, not long after the presidential election, the Export–Import Bank of the United States approved a new Supply Chain Resiliency Initiative (SCRI)[4] that takes into account rising trade friction between the United States and China, and pursues a policy of reducing dependence on China for the procurement of important minerals and rare earths, while bolstering their domestic production in the United States.

Not only are there mega-recyclers that are players in the circular economy in America (such as Waste Management, Inc.), but also Google, Apple, and other leading U.S. companies are actively working to establish a circular economy, thereby attracting attention to the country’s efforts in this area going forward.

With Europe and the United States moving ahead with the development of circular economies, it is also necessary to monitor China’s movements. China has been expanding its influence by acquiring one leading European resource recycling company after another, including Spain’s Urbaser and Germany’s Energy from Waste (EEW). China is also developing its diplomatic relationship with Europe, and at the 20th EU-China summit held in Beijing on July 16, 2018, the EU and China agreed to pursue dialogue and cooperation in the area of circular economies as part of efforts to promote a comprehensive strategic partnership between the two countries.[5]

In response to moves by Europe and the United States to develop circular economies, China is following a hardnosed strategy of expanding its influence through the acquisition of European companies while at the same time securing EU agreement for cooperative relationships.

October 2024 saw the holding of the founding ceremony of the China Resources Recycling Group, which was established in Tianjin as a state-owned enterprise with the backing of Xi Jinping, the General Secretary of the Chinese Communist Party. The group was established with the aim[6] of creating a world-leading recycling company to secure state resources under conditions of trade hostility between the United States and China, and will probably become a central player as a mega-recycler in the development of a Chinese circular economy. Currently, though the recycling ratio in China is not that high, it is possible that the establishing of the China Resources Recycling Group and similar initiatives will lead to a further acceleration of the development of a circular economy going forward.

Japan's situation: a lap behind

How does the situation in Japan compare to those of Europe, the United States, and China in terms of establishing a circular economy? While the spirit of avoiding waste is a longstanding element of Japanese culture and the country has an image of being a leader in resource recycling and related areas, the unfortunate reality is that it lags behind the rest of the world.

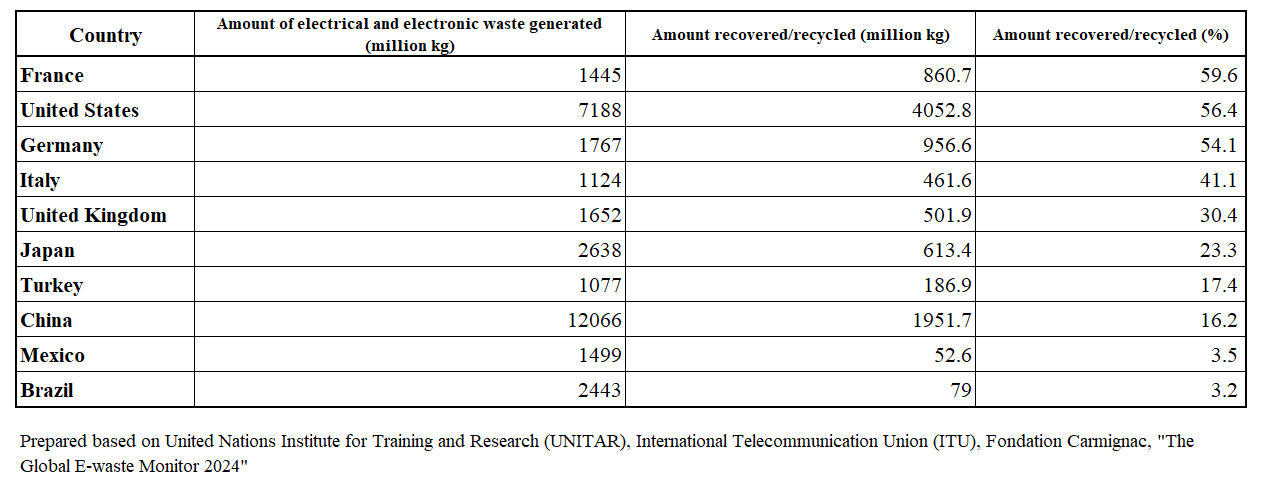

For example, the collection/recycling ratio for e-waste (waste consisting of electrical and electronic devices, e.g. discarded televisions and computers) in countries where the amount is at least 1,000 million kg was greater than 50% for the United States, France, Germany, and many other developed nations in 2022. Conversely, the ratio for Japan was significantly lower at just 23% (Fig. 3).

Figure 3 Collection/recycling in countries generating at least 1,000 million kg of electrical and electronic device waste (2022)

For municipal waste management in 2021, while Europe achieved recycling ratios of approximately 50%, the recycling ratio for municipal garbage in Japan was around 20%, of which at least 70% was managed through incineration[7]. Although this method has been used in Japan to capture the heat that is generated from waste incineration, thermal recycling is given a low priority in circular economy movements worldwide and thus diverges from global practice.

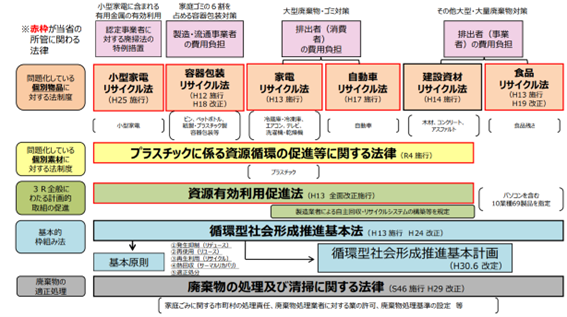

In terms of the legal system as it relates to resource recycling in Japan, the higher law is the Basic Act on Establishing a Sound Material-Cycle Society, which came into effect in 2001. This mentions the promotion of reduce, reuse, and recycle, and in that sense is roughly consistent with initiatives to promote circular economies worldwide (Fig. 4).

Figure 4 Japan’s legal system as it relates to resource recycling

|

Figure 4 |

|

|

※赤枠が当省の所管に関わる法律 |

*Red border indicates laws related to the jurisdiction of the Ministry |

|

問題化している個別物品に対する法制度 |

Legal system to address individual items considered problematic |

|

問題化している個別素材に対する法制度 |

Legal system to address individual materials considered problematic |

|

3 R全般にわたる計画的取組の促進 |

Promotion of systematic initiatives across the 3Rs as a whole |

|

基本的枠組み法 |

Basic framework provided by basic framework law |

|

廃棄物の適正処理 |

Appropriate management of waste |

|

小型家電に含まれる有用金属の有効利用 |

Effective use of valuable metals contained in small home appliances |

|

認定事業者に対する廃掃法の特例措置 |

Special measures in Waste Management Act for certified contractors |

|

小型家電リサイクル法(H25 施行) |

Small Home Appliance Recycling Act (came into effect in 2013) |

|

小型家電 |

Small home appliances |

|

家庭ゴミの6割を占める容器包装対策 |

Measures to address packaging that accounts for 60% of household waste |

|

製造・流通事業者の費用負担 |

Expenses incurred by manufacturers and distributors |

|

容器包装リサイクル法 |

Containers and Packaging Recycling Act |

|

(H12 施行H18 改正) |

(came into effect in 2000, amended in 2006) |

|

ビン、ペットボトル、紙製・プラスチック製容器包装等 |

Bottles, PET bottles, paper/plastic containers and packaging, etc. |

|

大型廃棄物・ゴミ対策 |

Measures for large waste/garbage items |

|

排出者(消費者)の費用負担 |

Expenses incurred by producers of waste (consumers) |

|

家電リサイクル法 |

Home Appliance Recycling Act |

|

(H13 施行) |

(came into effect in 2001) |

|

冷蔵庫・冷凍庫、エアコン、テレビ、洗濯機・乾燥機 |

Refrigerators, freezers, air conditioners, televisions, washing machines, tumble dryers |

|

自動車リサイクル法 |

Automobile Recycling Act |

|

(H17 施行) |

(came into effect in 2005) |

|

自動車 |

Automobiles |

|

その他大型・大量廃棄物対策 |

Other measures for large waste/garbage items |

|

排出者(事業者)の費用負担 |

Expenses incurred by producers of waste (businesses) |

|

建設資材リサイクル法 |

Act on Recycling of Construction Materials |

|

(H14施行) |

(came into effect in 2002) |

|

木材、コンクリート、アスファルト |

Lumber, concrete, asphalt |

|

食品リサイクル法 |

Food Recycling Act |

|

(H13 施行H19 改正) |

(came into effect in 2001, amended in 2007) |

|

食品残さ |

Left-over food |

|

プラスチックに係る資源循環の促進等に関する法律(R4施行) |

Act on Promotion of Resource Circulation for Plastics (came into effect in 2022) |

|

プラスチック |

Plastics |

|

資源有効利用促進法(H13 全面改正施行) |

Full amendment of the Act on the Promotion of Effective Utilization of Resources came into effect in 2001 |

|

製造業者による自主回収・リサイクルシステムの構築等を規定 |

Establishes construction, etc. of systems for voluntary collection/recycling by manufacturers |

|

パソコンを含む10業種69製品を指定 |

Designates 69 products in 10 industries including PC industry |

|

循環型社会形成推進基本法(H13施行 H24改正) |

Basic Act on Establishing a Sound Material-Cycle Society (came into effect in 2001, amended in 2012) |

|

基本原則 |

Basic rules |

|

1発生抑制(リデュース) |

1 Reduce |

|

2再使用(リユース) |

2 Reuse |

|

3再生利用(リサイクル) |

3 Recycle |

|

4熱回収(サーマルリカバリ) |

4 Thermal recovery |

|

5適正処分 |

5 Appropriate disposal |

|

循環型社会形成推進基本計画 |

Fundamental Plan for Establishing a Sound Material-Cycle Society |

|

(H30.6 改定) |

(revised June 2018) |

|

廃棄物の処理及び清掃に関する法律 |

Act on Waste Management and Public Cleaning |

|

(S46 施行 H29改正) |

(came into effect in 1971, amended in 2017) |

|

家庭ごみに関する市町村の処理責任、廃棄物処理業者に対する業の許可、廃棄物処理基準の設定 等 |

Specifies responsibilities of municipalities for management of household rubbish, permissions for waste management business operators, setting of waste management standards, etc. |

Source: METI, “Current Status and Challenges of the Circular Economy,” September 2023

The above notwithstanding, the reality is that lack of progress in recycling in Japan can be attributed to inadequacies in the functioning of the legal system. For example, under the Basic Act on Establishing a Sound Material-Cycle Society are six laws for the implementation of recycling for automobiles, home appliances, containers and packaging, food, construction materials, and small home appliances. This classification has led to the issue of items that do not fall under any of the above categories being excluded from the recycling network.

In 2022, the Act on Promotion of Resource Circulation for Plastics came into effect in response to the problem of buckets, hangers, and other plastics that did not fall under any of the various recycling laws being discarded without being recycled, an issue that the Act was intended to address by driving the collection and recycling of such items. This finally came into effect more than 20 years after the Basic Act on Establishing a Sound Material-Cycle Society, indicating that large quantities of plastic products had been discharged without being caught by the network of the legal system.

Furthermore, despite the Act on Promotion of Resource Circulation for Plastics coming into effect, the reality is that recycling has not made much progress on the front line. It has been reported that in Chiba Prefecture, the burden of costs associated with collection and recycling is so heavy that recycling of plastics as a resource has only been implemented in the five municipalities of Katsuura, Yotsukaido, Yachimata, Minami-Boso, and Onjuku[8]. It goes without saying that it is vital that the appropriate legal systems are established, but if there are no players to work in accordance with such systems, recycling will not progress regardless of how many such mechanisms are put in place, in turn likely preventing the development of a circular economy.

Expedite the creation of a Japanese-style mega-recycler

As described earlier, European policy mandates minimum recycled material usage ratios of 16% for cobalt, 6% for lithium, and 6% for nickel for battery manufacturing from August 2031 onward. The recent amendment of the Act on the Promotion of Effective Utilization of Resources added new provisions related to the mandatory use of recycled materials, but these additions mandate the use of recycled raw material in Japan in a copycat manner with an eye on the European policy. In any case, battery manufacturing nonconformance to European standards would cause difficulties for the operation of battery businesses in Europe, with a correspondingly significant impact on the battery industry in Japan. And this could very well apply not only to batteries, but also to many other industries, leading to a crisis for Japanese manufacturing.

It was against this backdrop that the Act on the Promotion of Effective Utilization of Resources was amended, but as explained earlier, even if the legal systems are put in place, a circular economy cannot be established without the presence of players to work in accordance with these mechanisms. In the U.S. and Europe, which are the leaders in this area, mega-recyclers are playing a central role in their circular economies, and China has also established a formidable player in the form of the state-backed China Resources Recycling Group.

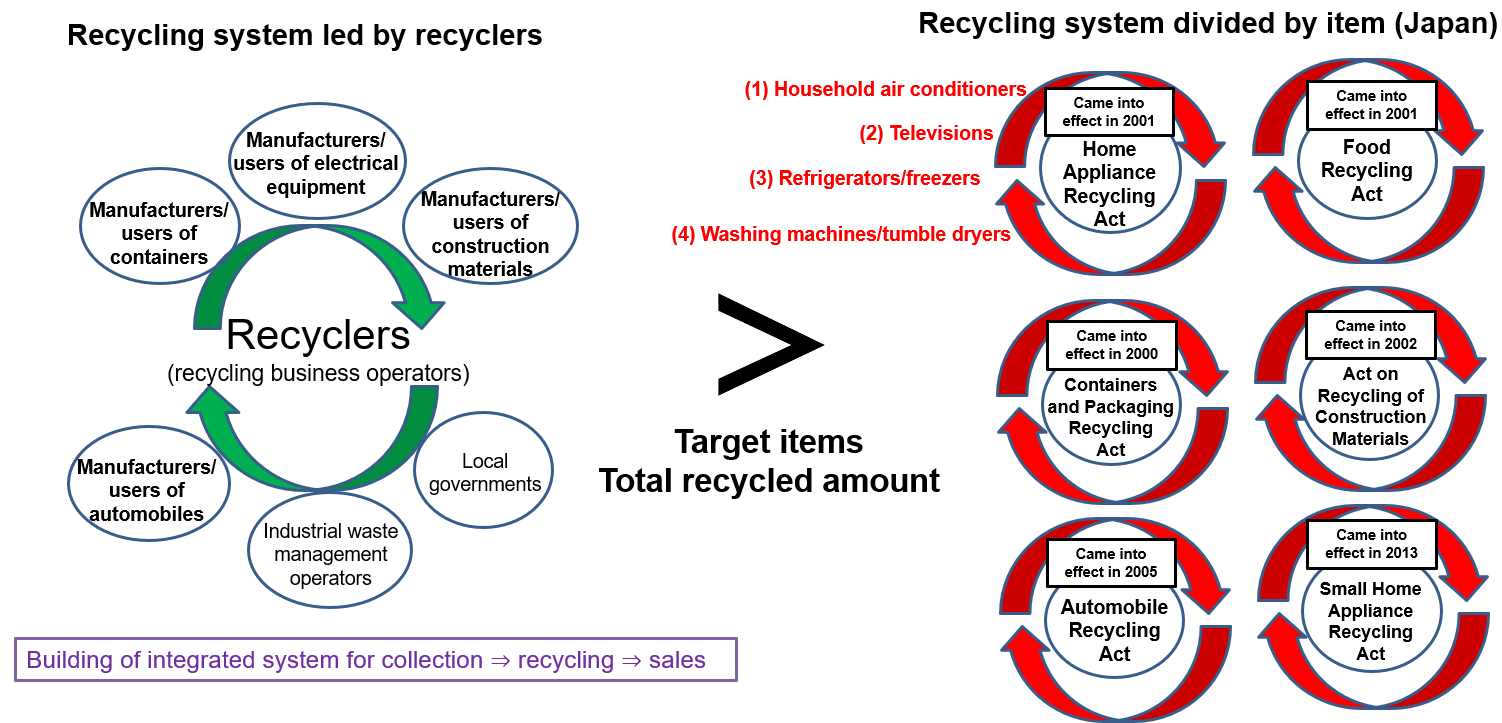

On the other hand, although recyclers do exist in Japan, their lack of scale compared with their European and U.S. counterparts makes it difficult for them to compete effectively. Moreover, items eligible for recycling are divided into six categories by the various recycling laws, and because individual producers play the main role in the recycling of each item based on the principle of extended producer responsibility, the amounts of items eligible for recycling are unavoidably reduced, making economies of scale difficult to achieve.

In order to mitigate this situation and develop a circular economy, it is necessary for Japan to swiftly develop a resource recycling system centered on recyclers, like those of the United States and Europe, rather than a system divided into individual item categories (Fig. 5).

Figure 5 “Recycling system led by recyclers” vs. “Recycling system divided by item”

Source: Prepared by the author

This being said, with the rapid development of a circular economy a requirement of the current environment, creating a giant corporation like the mega-recyclers of the U.S. and Europe from scratch would be challenging in terms of both costs and time required. It would be more realistic to instead build a consortium-type mega-recycler through organic collaboration between the various stakeholders involved in the circular economy, such as the various Japanese recyclers and producers that currently operate independently, and local governments.

In order to promote the development of a circular economy, the government launched an Industry-Government-Academia Partnership on Circular Economy in December 2023 that brings together related parties. The goal of this partnership is to "encourage organic collaboration between the state, local governments, universities, companies and industrial associations, relevant agencies and bodies, and other related entities in order to consider measures required to achieve a circular economy.[9]" However, there is a tendency for such groups to fail to link specific measures to action, becoming nothing more than talk shops.

Failure to develop a circular economy could have a significant impact on manufacturing in Japan, and lead to a crisis for industry as a whole. We should rapidly move to develop a consortium-type mega-recycler by building organic links between various stakeholders, and prevent discussions about establishing a circular economy becoming no more than talk.

[1] Ministry of Economy, Trade and Industry, “Summary of Discussions Held to Date in the Resources and Fuel Subcommittee,” December 2024.

[2] Ministry of Economy, Trade and Industry, “Circular Economy in the GX Era,” February 2023.

[3] U.S. Department of Commerce HP “A Federal Strategy to Ensure Secure and Reliable Supplies of Critical Minerals” June 4, 2019 (https://www.commerce.gov/data-and-reports/reports/2019/06/federal-strategy-ensure-secure-and-reliable-supplies-critical-minerals) (5/27/2025 last accessed).

[4] Japan External Trade Organization, “U.S. Environmental and Energy Policy Trends Monthly Report Vol. 7: U.S. Export-Import Bank Approves Initiative to Strengthen U.S. Mineral Supply Chains to Decouple from China,” January 2025.

[5] Hiranuma Hikaru, A Global History of the Struggle for Resources (Nikkei Publishing Inc., 2021).

[6] “A Recycling Company Under the Auspices of China’s Xi Jinping Prioritizes Resource Security,” The Nikkei (online edition), October 18, 2024.

[7] Resource and Recycling Promotion Center, Japan Environmental Management Association for Industry, “Recycling Data Book 2024,” July 2024.

[8] “Mandatory Effort for Plastic Product Collection Only in Five Municipalities Due to High Recycling Costs: Chiba,” The Yomiuri Shimbun, May 16, 2025.

[9] Ministry of Economy, Trade and Industry, “Industry-Government-Academia Partnership on Circular Economy,” December 2023.