Building a Carbon Neutral Future through Energy Transition and a Circular Economy

May 16, 2022

C-2021-001-4-WE

The world has been pursuing energy transition policies designed to promote the spread of renewable energy and achieve carbon neutrality. With the European Green Deal, the EU is not only promoting an energy transition but is also working on establishing a circular economy, wherein economic growth and environmental protection are regarded not as tradeoffs but compatible goals, as recycling and reuse lead to increased resource efficiency. What impact will these developments have on Japan’s resource and energy trends and on corporate activities? In the following, I examine the global trend toward carbon neutrality and discuss its implications for Japan.

Acceleration of the Energy Transition

Energy Transition among Developed Countries

The Paris Agreement adopted in 2015 was already in force the following year, and many developed countries and regions have been promoting energy transition policies centered on the use of renewable energy to achieve its goals. Among the countries and regions with highest shares of renewable electricity in 2019 were the state of California (53%), Germany (42%), Spain (37%), Italy (35%), New York State (29%), and France (20%). Share targets for 2030, moreover, are as high as 74% for Spain, 70% for New York State, 65% for Germany, 60% for the state of California, 55% for Italy, and 40% for France.[1]

Until now, it has been considered difficult to integrate renewable sources into the power system, as output fluctuates depending on weather conditions. But innovative uses of AI, IoT, and big data are enabling the development of what is called the “Internet of Energy” (IoE), which analyzes weather conditions and supply-demand projections to optimize power grid operations.

Some have pointed to the advantages that countries of Europe enjoy in being able to source their energy from land-bordering countries in case of a shortage. Spain, though, is isolated from neighboring France by the Pyrenees Mountains, yet it has become a renewable energy leader through the proactive use of IoE. Iberdrola, a major Spanish power company, has even started a business in 2019 that uses blockchains to guarantee that customers receive 100% renewable electricity.

Thanks to technological advances and policies to promote the widespread use of renewable energy, costs have fallen dramatically. In terms of the annual levelized cost of energy (LCOE) in 2018, wind was 4.2 cents per kWh, solar was 4.3 cents, gas 5.8 cents, coal 10.2 cents, and nuclear 15.1 cents, making renewables the cheapest sources of electricity.[2]

An Expanding Clean Energy Market

The clean energy market for power-generation facilities and high-efficiency, energy-saving equipment is expanding, as can be gauged from ESG investment trends. Global ESG investment in 2020 was approximately $35.3 trillion, more than 1.5 times the value in 2016.[3] In addition, the International Energy Agency estimates that investments of about $58 trillion to $71 trillion will be needed globally by 2040 to achieve the goals of the Paris Agreement,[4] making the clean energy market a promising investment area.

This development has also brought about changes at many private companies, who are the prime consumers of energy. To attract ESG funds, they are having to manage their businesses in an environmentally friendly manner, such as by using renewable energy. The RE100 initiative was launched in 2014, under which businesses commit to using 100% renewable electricity in their operations. As of September 2021, 330 companies were participating in RE100 worldwide, and 53 companies (including Google, Apple, and Microsoft) have announced that they have already achieved their 100% renewable electricity goal.[5]

There were 62 Japanese companies among RE100 members as of September 2021.[6] These firms will need to establish an energy mix based mainly on renewable energy to maintain their competitiveness.

Promoting Green New Deals

The global commitment to the energy transition is not only about combating climate change. According to the International Renewable Energy Agency (IRENA), the cost of the energy transition is $19 trillion, but the benefits can be as high as $50 trillion to $142 trillion.[7] In other words, the energy transition is also good economic policy.

In addition, IRENA points out that the energy transition promoted under the Global Green New Deal is an effective way to achieve economic recovery through international cooperation after the COVID-19 crisis.[8]

The European Union plans to invest an equivalent of ¥120 trillion over the next 10 years in the European Green Deal, which will promote the spread of renewable energy, the achievement of sustainable mobility, and the establishment of a circular economy. The United States also plans to invest about ¥200 trillion in decarbonization, including the expansion of renewable energy and electric vehicles, over the next four years, according to President Joe Biden’s campaign pledge.[9] Of course, investment plans may not be implemented fully, but international green deal policies toward carbon neutrality no doubt represent a boon for renewable energy firms.

Delays in Japan’s Response

Amid the global trend toward Green New Deals centered on energy transition and achieving carbon neutrality, in October 2020 then Prime Minister Yoshihide Suga announced a policy to achieve the goal of a carbon-neutral, decarbonized society by 2050.

Japan’s Fifth Basic Energy Plan, announced in July 2018, stipulates that renewable energy will become Japan’s main power source, and Suga reiterated this point in his carbon-neutrality declaration. But the actual rate of renewable energy in Japan’s electricity mix in 2019 was quite low at approximately 18%. In addition, the 2030 renewable energy target announced in July 2015 was just 22%–24%, lower than that of many other developed countries and clearly at odds with the policy of making renewables Japan’s main power source.

To resolve this discrepancy, in December 2020 the government announced the Green Growth Strategy by Achieving Carbon Neutrality in 2050, under which approximately 50%–60% of electricity is expected to be generated through renewable energy by 2050. At the US Climate Change Summit in April 2021, moreover, Prime Minister Suga announced a new goal of reducing greenhouse gas emissions by 46% from 2013 levels by 2030 and committed to taking on the challenge of achieving a 50% reduction. In line with these new reduction targets, the Sixth Basic Energy Plan, approved by the cabinet in October 2021, raised the renewable energy target for 2030 to 36%–38%.

Thus, Japan has finally begun to make up for the delay in its energy transition, but the situation is far from adequate, and there have been calls from the private sector for expanded uses of renewable energy. The Japan Climate Leaders’ Partnership, comprising 195 member companies and serving as Japan’s RE100 contact point, released its Statement on the Draft of the Sixth Basic Energy Plan in September 2021, calling for a renewable energy share of 50% by 2030. And the Japan Climate Initiative, consisting of 490 companies involved in decarbonization, and the Japan Association of Corporate Executives have sought a 40%–50% share of renewable energy by 2030. Private companies, which are the primary consumers of energy, are seeking higher ratios of renewable energy sources not just because they are cheaper and can attract ESG investment but because countries with advanced climate change measures are considering introducing a Carbon Border Adjustment Mechanism on imports from countries with insufficient measures.[10] The introduction of such measures around the world would mean that Japanese exports might become subject to additional taxes if the share of renewables in Japan’s energy mix is not expanded. For Japanese businesses, climate change initiatives are not only a CSR issue but are crucial to maintaining their competitiveness.

Europe’s Shift toward a Circular Economy

Coping with Mineral Resource Risk

While Japan is now making renewed efforts toward energy transition, Europe has begun implementing initiatives for its next green shift.

The energy transition will reduce CO2 emissions, but there are concerns that increased demand for the mineral resources required to manufacture renewable-power-generating facilities and energy-saving devices could destabilize the market for such resources. For example, about 2,000 tons of dysprosium—a rare earth element needed to manufacture wind turbines—may be required if wind power is promoted in achieving the goals of the Paris Agreement. Considering that global production of dysprosium in 2017 was just 1,500 tons, the demand for this metal from wind turbines alone could exceed annual production.[11] The EU projects demand for the mineral resources needed in the production of solar panels, wind turbines, electric vehicles, and other tools to combat climate change will increase twentyfold by 2030.[12]

Conventional stockpiling policies and the excavation of new mines will not be enough to meet burgeoning demand. This is particularly so if we are to achieve Goal 12 of the Sustainable Development Goals—“ensure sustainable consumption and production patterns”—by 2030. Europe has thus embarked on promoting resource recycling under a circular economy.

Sustainable Use of Resources in a Circular Economy

The circular economy is a key element of the European Green Deal and is a resource-recycling policy for building a sustainable society. The economic model we have today is “linear” in that natural resources are extracted and used to build products, which are then consumed and discarded at the end of their life.

A circular economy, on the other hand, forms a cycle in which discarded resources are reclaimed and reused to build new products, thus enabling the prolonged and sustainable use of finite resources.

Figure 1: Resource Recycling System of the “Circular Economy Package”

Source: Created by the author.

The shift to a circular economy is not simply an environmental policy but also designed to promote innovation and improve the EU’s competitiveness, create 180,000 new jobs, and boost the region’s GDP by 7% by 2030.[13]

In December 2015, the EU published a “circular economy package,”[14] an action plan for “closing the loop.” Figure 1 shows the items that must be addressed at each stage of the cycle, from mining to resource reclamation. The proposal calls for recycling resources in accordance with EU initiatives and establishing new markets for recycled resources and products made from such resources. Europe’s strategy is to spearhead the transformation of the global economy into a circular one and export clean products to markets around the world.

To minimize environmental impact, reclaimed resources are prioritized over those that have been newly excavated in a circular economy, which could turn waste into a highly valuable commodity. China’s dominance as a producer of rare earths meant that manufacturers around the world had been exposed to substantial supply risks. Such risks could be mitigated in a circular economy, as the value of reclaimed resources exceed those of China’s natural resources.

Europe already requires the recycling of 27 minerals that are used in the manufacture of renewable-energy facilities and energy-saving equipment. This means that investments into excavation projects that place a burden on the environment could dry up, as has happened for coal. The world resource map may eventually be redrawn, with the most recycling-intensive countries becoming the resource-rich countries of the future.

Loopholes in Japan’s Resource Recycling System

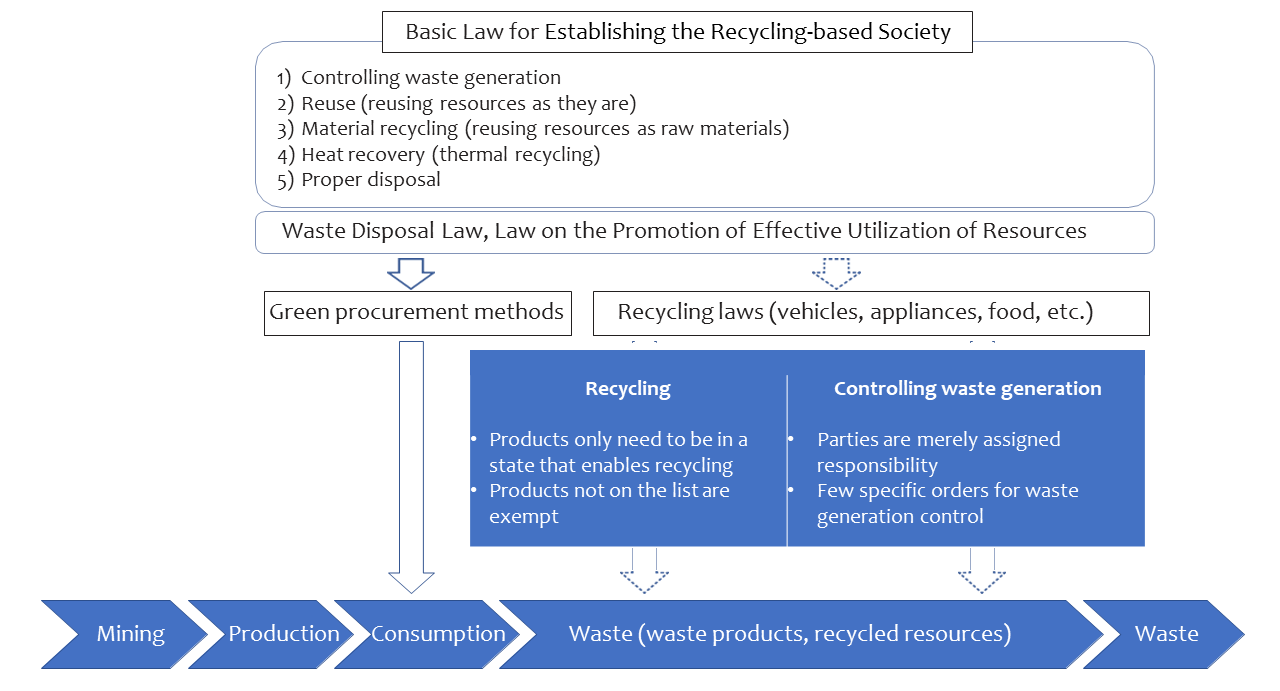

Meanwhile in Japan, efforts to build a recycling-oriented society is being promoted under the Basic Law for Establishing the Recycling-based Society and separate laws for the recycling of such specific items as containers and packaging, home appliances, food, construction materials, vehicles, and small home appliances (Figure 2).

These measures, like Europe’s transition to a circular economy, promotes recycling to turn waste into resources. But on closer inspection, the various recycling laws enacted to implement the Basic Law only call for waste products to be in a state that enables recycling. In other words, Japan’s resource recycling laws allow the continuation of a linear economy and the generation of waste, as shown in Figure 2, without actually “closing the loop,” as in Europe’s circular economy.

Figure 2: Japan’s Resource Recycling System

Source: Created by the author.

In 2018, France launched an initiative to set up a committee in the International Organization for Standardization (ISO) to establish standards for a circular economy. This can have a significant impact on Japan, as the World Trade Organization requires member states to adopt domestic standards based on those developed by bodies like the ISO. European-led standards for a circular economy will compel Japan to follow those rules on the production and quality of recycled resources and could affect the competitiveness of Japanese businesses.

In Europe, major French companies like Veolia and Suez are undertaking large-scale recycling projects using business models that incorporate waste collection, recycling, and the sale of recycled resources.

And in December 2020, the European Commission proposed a new Batteries Regulation aimed at ensuring that batteries placed on the EU market are sustainable throughout their entire lifecycle, from product design to recycling. Batteries, such as those for electric vehicles, are expected to play an essential role in achieving carbon neutrality in a circular economy. The commission’s proposal calls for the disclosure of the recycled resources the batteries contain and the introduction of minimum values for such resources. Should such regulations become international norms, Japanese manufacturers could find themselves at a disadvantage, especially if the EU adopts a border adjustment mechanism for recycling, imposing surcharges on imports from countries with low recycling rates, much like the Carbon Border Adjustment Mechanism currently under study.

Opportunities for Japan

Japan’s High Potential

While Japan has been slow to embark on the energy transition and build a circular economy, these global trends represent a golden opportunity for the country to reduce its dependence on foreign supplies of resources and energy. Japan has hitherto had no choice but to rely on imports and has been at the mercy of overseas producers, but it can henceforth shift to local, renewable sources of energy, rather than depending on imported fossil fuels, and tap recycled resources available domestically, rather than securing natural resources from abroad. If Japan can reduce its reliance on imported resources, it would find itself in a stronger economic position.

The Ministry of the Environment’s calculations show that Japan’s renewable energy potential, taking economic efficiency into account, may be as high as twice the country’s current annual electricity supply.[15] It should also be noted Japan claimed the highest number of patents for renewable-energy-related technologies between 2010 and 2019.[16]

Japan may not be endowed with underground resources but has a vast store of elements that have been extracted, processed, and used in various electric and electronic products. These “urban mines” can be exploited through recycling to help meet the country’s resource needs.[17]

Urban mining requires advanced technology, which Japan possesses. Hybrid vehicle batteries, for example, are already recycled to recover such metals as nickel, cobalt, and rare earths. The energy transition and the circular economy thus offer a great opportunity for Japan to take advantage of its enormous e-waste reserves and become a truly resource-rich country.

Making Full Use of Japan’s Advantages

For Japan to take advantage of the opportunities presented by the energy transition, the government needs to take greater leadership. IRENA has shown that the benefits of the energy transition outweigh the costs. One reason that the EU is forging ahead with the development of IoE and integrating renewable energy into its power grid is because it recognizes that this can be profitable.

In drafting its Sixth Basic Energy Plan, the Japanese government, by contrast, was bogged down by concerns about the cost of integrating renewable sources into the electric power system, with little attention being paid to its potential benefits. Costs must be carefully considered, of course, but the expected profits from such investments should be discussed at the same time to avoid sending private companies the wrong message and squandering opportunities for growth.

Another major consideration for companies seeking to transition to renewable energy is to work closely with the community. Unlike the large-scale and centralized features of traditional power generation, renewable energy is usually locally derived, and securing such supplies requires the cooperation of local residents. Projects that ignore local needs and concerns may be short-lived, inviting criticism over landscape impacts and other issues. Google, one of the first companies to achieve 100% electricity use with purchases of renewable energy, promotes procurement from regional energy cooperatives, which in turn contributes to local job creation. Japanese companies, too, would be wise to support locally based renewable energy projects and secure energy from them.

For Japan to make the most of the advantages it enjoys and transition to a circular economy, it needs to fundamentally reform existing recycling laws and create a supply chain of recycling companies offering reclaimed resources, as Europe has done. Manufacturers must also build products that are designed with recycling and reuse in mind—a feature that can create value for the company in a circular economy. Global leadership in this area should also give Japan a greater say in international discussions on establishing standards for the circular economy.

[1] Renewable Energy Institute website, “2030 Renewable Energy Introductory Targets for European Countries and US States” (January 15, 2021), https://www.renewable-ei.org/activities/statistics/trends/20210115.php (accessed September 16, 2021).

[2] Lazard, “Levelized Cost of Energy Analysis-Version 12.0,” November 2018.

[3] Global Sustainable Investment Alliance, “Global Sustainable Investment Review 2020.”

[4] International Energy Agency, “World Energy Outlook 2019.”

[5] RE100, “RE100 Annual Progress and Insights Report 2020,” December 2020.

[6] Japan Climate Leaders’ Partnership (JCLP) website (accessed September 21, 2021).

[7] International Renewable Energy Agency, “Global Renewables Outlook: Energy Transformation 2050,” April 2020.

[9] Ministry of Economy, Trade and Industry, “2050-nen kabon nyutoraru o meguru kokunaigai no ugoki” (Domestic and International Moves toward Carbon Neutrality in 2050), December 16, 2020.

[10] JCLP, “Policy Proposals on Carbon Tax and Emissions Trading Scheme,” July 28, 2021.

[11] Hikaru Hiranuma, Shigen sodatsu no sekaishi (World History of Resource Competition), Nikkei Publishing.

[12] European Union, “Report on Critical Raw Materials and the Circular Economy,” November 2018.

[13] Didier Bourguignon, “Closing the Loop: New Circular Economy Package,” European Parliamentary Research Service, January 2016.

[14] European Environment Agency, “Closing the Loop: An EU Action Plan for the Circular Economy,” December 2015.

[15] Ministry of the Environment, “Entrusted Work Concerning the Development and Disclosure of Basic Zoning Information Concerning Renewable Energies (FY 2019),” March 2020, (revised January 2021).

[16] World Intellectual Property Organization website, Patenting Trends in Renewable Energy, March 2020 (accessed September 23, 2021).

[17] Hikaru Hiranuma, Nihon wa sekai ichii no kinzoku shigen taikoku (Japan Has the World’s Biggest Reserves of Metals), Kodansha, 2011.