- Article

- Macroeconomics, Economic Policy

What Abenomics Is Missing: Structural Reforms Needed for Economic Revival

October 11, 2016

The BOJ’s quantitative and qualitative easing policy has helped to lift the Japanese economy out of deflation, but unless wages rise further, the bank’s target of 2% inflation will remain elusive. Noting that Abenomics has made little progress on its third arrow, financial expert Takeo Hoshi calls for full-fledged efforts to advance structural reforms.

* * *

On September 21, 2016, the Bank of Japan announced a “comprehensive assessment” of its quantitative and qualitative monetary easing (QQE) policy, concluding that the decline in real interest rates over the three years since QQE was introduced in 2013 has lifted the Japanese economy out of deflation.

At the same time, the BOJ noted that its “price stability target” of 2%, which was to have been achieved in two years, is still not in sight. Inflation failed to materialize, the bank said, due to a fall in crude oil prices and other exogenous factors, as well as the fact that inflation expectations—which rose at the start of QQE—subsequently went flat and have recently weakened.

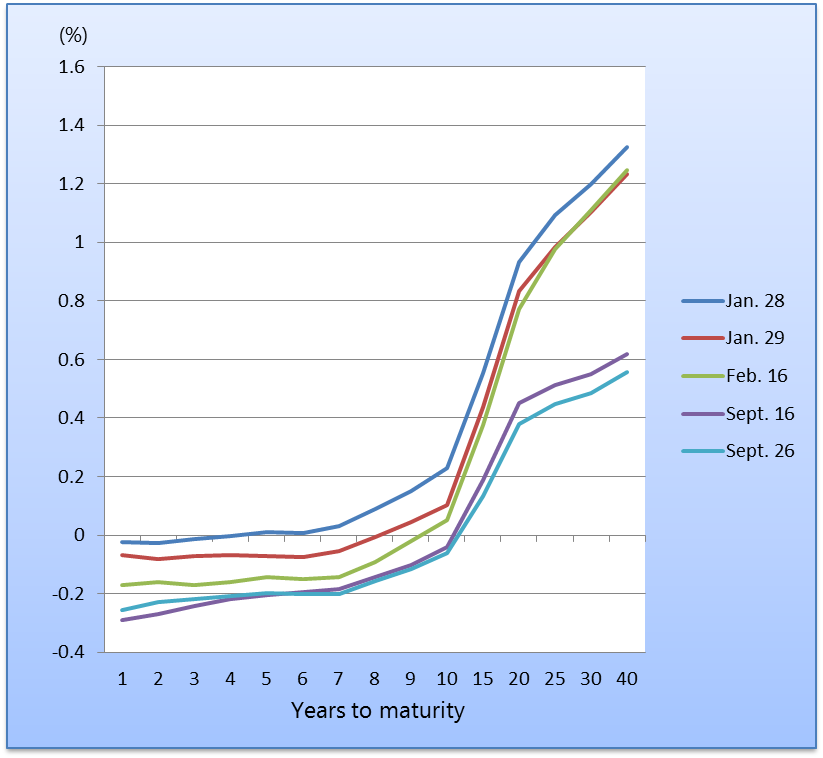

The negative interest rate policy that was introduced in January, the BOJ added, has substantially pushed down interest rates “across the entire yield curve,” affecting not only short-term but also long-term interest rates. But it also referred to the policy’s “negative consequences for financial institutions’ profits.” As the figure illustrates, the yield curve declined immediately after the January 29 announcement, and even 10-year Japanese government bond yields have now fallen into negative territory.

Changes in the Japanese Government Bond Yield Curve (2016)

Valid Assessment

Based on the conclusions of its assessment, the BOJ also announced a new policy framework calling for “QQE with yield curve control,” establishing a target (of around 0% for now) for 10-year JGB yields and making an “inflation-overshooting commitment” to continue with QQE even after the price stability target of 2% has been attained.

On the whole, the bank’s assessment presents a level-headed analysis of the impact of its monetary policy, and its conclusions are quite valid. The focus it gave to the importance of inflation expectations is also correct, as the initial success of QQE was precisely the result of the impact it had on market expectations. Inflation expectations rose before QQE had any impact on actual price levels, leading to lower real interest rates (nominal rate minus expected rate of inflation), higher stock prices, a weaker yen, and a boost in economic activity.

For many years, the BOJ had frowned on nontraditional monetary policies, and this hindered Japan’s efforts to overcome deflation. Since the appointment of Haruhiko Kuroda as governor, though, the BOJ has dramatically shifted course, acting with firm conviction that deflation can be defeated through QQE.

The rate of inflation failed to rise as anticipated, however; consumer prices are no longer declining, as they had been under deflation, but the inflation rate remains stubbornly low, having long hovered below 1% and recently once again approaching 0%. And while there was an initial jump in inflation expectations, they, too, have begun to decline without ever having pushed up the actual inflation rate.

Why has this been the case? The BOJ’s assessment points to the fact that in Japan, realized past inflation has a larger impact on wage negotiations than expected inflation, while medium- to long-term inflation expectations are more important determinants of wages in the Unites States and Germany. To test such an assertion more rigorously, it would have been helpful if the BOJ had offered a regression analysis using short-term inflation expectations as a variable as well. That said, one can still probably conclude that the biggest reason for the failure to reach the 2% inflation target was that inflation expectations were not fully incorporated in wages.

Doubts about Effectiveness

While the conclusions of the BOJ’s comprehensive assessment may be valid, I am skeptical about the effectiveness of the newly announced framework for yield curve control. The new policy is not an attempt at further monetary relaxation. As the figure shows, the yield on 10-year JGBs is already below the target of 0%. The effort to reinforce the BOJ’s commitment by announcing that QQE will continue even after the 2% price stability target is reached is not effective, either. We might even say it is misguided.

There were times in the past when the bank’s commitment was called into question. For example, the zero-interest-rate policy that was first introduced in 1999 was quickly terminated a year later, despite the fact that deflationary conditions still persisted. Various attempts at monetary easing undertaken over the ensuing decade achieved a certain degree of success, but they came to an end each time as soon as inflation returned to around 0%. There is no doubting the BOJ’s commitment under Governor Kuroda, though, as the bank has repeatedly and unequivocally affirmed its intention to take all necessary policy steps to achieve 2% inflation.

What remains dubious is whether the policies taken to date, including negative interest rates, are effective. The most important conclusion of the BOJ’s comprehensive assessment is that inflation expectations have failed to trigger higher wages and a surge in prices. The new framework for yield curve control, unfortunately, does nothing to address this issue.

One way of getting around this disconnect is to adopt measures that would lead directly to higher wages. Noting that Japan “needs meaningful positive inflation for reasons of fiscal stability,” Olivier Blanchard and Adam S. Posen of the Peterson Institute for International Economics proposed in a December 2015 Financial Times op-ed that nominal wages in Japan be boosted by 10% across the board ( ”Japan’s Solution Is to Raise Wages by 10 Percent ”). While such measures are beyond the scope of monetary policy, the BOJ can certainly encourage the government to take action along these lines, as it would help the bank achieve its inflation target.

Need for Sweeping Reforms

Achieving the inflation target is not the most important goal for Japan. What the Japanese economy needs more is real economic growth. Abenomics may have helped to halt a downtrend in prices and end deflation in the narrow sense of the term, but a more important test is whether it can more broadly lift the country out of the deflationary state in which it has been stuck for decades. This, though, as the BOJ has maintained all along, is not a task for the bank to tackle alone.

Lack of demand is not the only cause of the decades-long stagnation. If it were, and if Japan’s potential growth rate had not declined, the economy would have been hit by a runaway deflationary spiral—not the gradual lowering of prices that it actually experienced. This suggests that there were problems on the supply side as well.

Monetary and fiscal policy tools can be mobilized to prop up faltering demand and pull the economy out of deflation, narrowly defined. But unless supply-side issues are also addressed, there will be no return to robust growth. Such a path will require sweeping reforms to restructure the economy into a shape befitting its level of maturity.

The initial success of QQE substantially alleviated weaknesses in demand. The output gap (the difference between the potential output and actual output of an economy) has recently been hovering around 0%, according to BOJ estimates, suggesting that further monetary and fiscal expansion to boost demand would not promote growth. Of greater importance—now more than ever—are structural reforms to expand potential output.

The third of the “three arrows” of Abenomics is a growth strategy consisting of various reforms to boost potential output. Compared to the first arrow of monetary easing, though, very little progress has been made in this area. What we need is a comprehensive assessment not only of monetary policy but of Abenomics as a whole, particularly its growth strategy.

Twenty-one years ago, in September 1995, with telltale signs of deflation on the horizon, the BOJ took the preventive step of lowering the official discount rate to 0.5%. The statement released by the bank at that time concluded that the problems confronting the Japanese economy could not be solved with monetary measures alone and that drastic deregulation and other structural reforms were also needed to ensure the effectiveness of looser credit.

This has been the BOJ’s position over the two decades since then. The BOJ has been doing more than its share, at least in the past few years. It is high time for the Japanese government to heed this call and advance full-fledged structural reforms, lest another valuable opportunity for economic revival be squandered.

Translated from “Abenomikusu no sotenken o,” Nihon Keizai Shimbun (Keizai Kyoshitu section), September 30, 2016. (Courtesy of Nikkei Inc.)