Distinguished Fellow Katsuhito Iwai calls for a reject ion of the American model of capitalism, citing such epic failures as the subprime mortgage crisis and the election of President Donald Trump.

* * *

The “Japanese capitalism debate” was a ferocious political struggle that divided Japan’s Marxists for decades, from the 1930s right up until the 1960s.

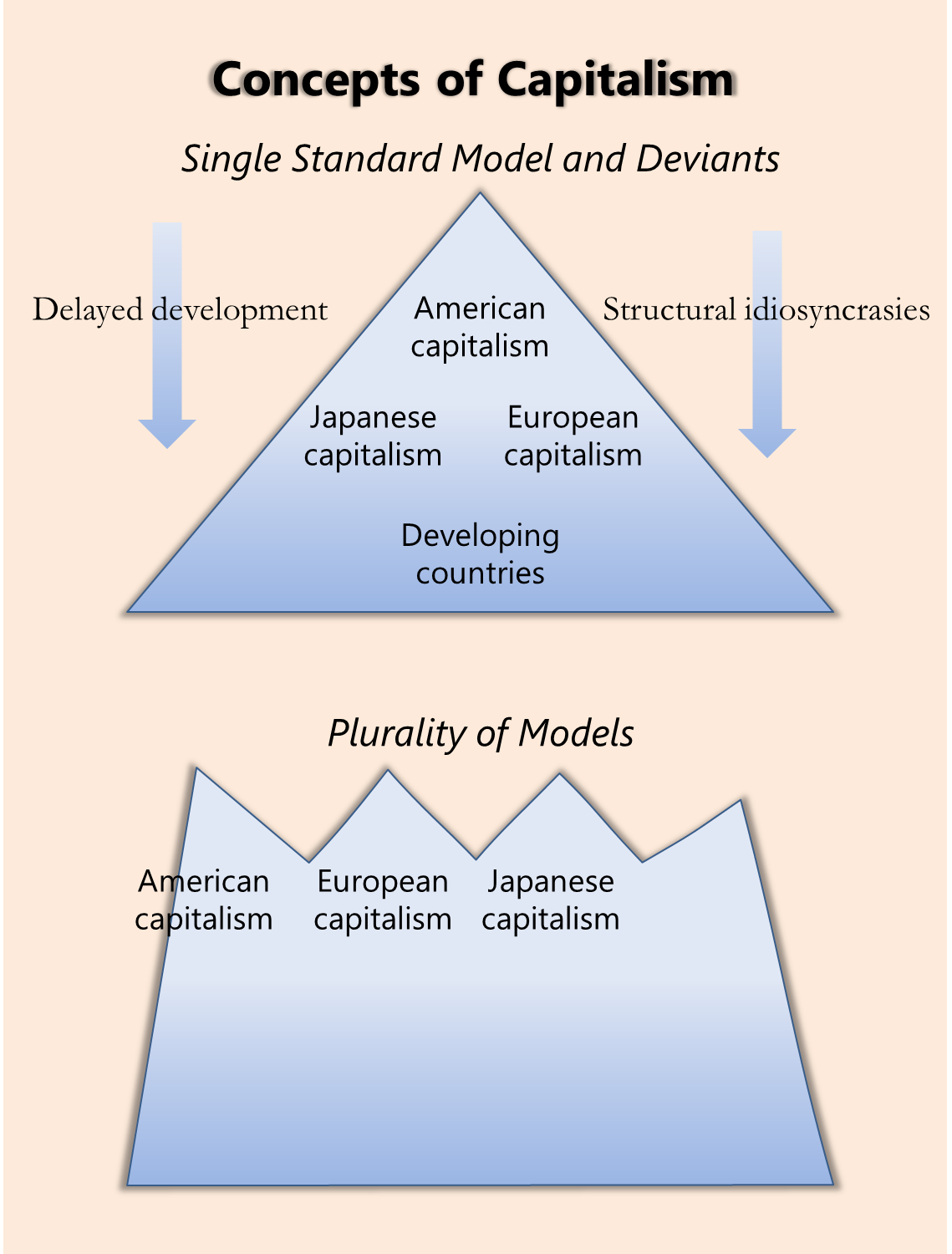

It started before World War II as a disagreement over the general causes of poverty and inequality in prewar Japan. One camp, called the Koza faction, argued that Japanese society had deviated from the Western pattern of capitalistic development owing to structural idiosyncrasies rooted in the atypical feudalism that developed under the imperial monarchy. The other camp, called the Rono faction, argued that Japanese society had followed the standard historical pattern of capitalism but lagged far behind the West in its stage of development.

Why would such a seemingly academic, hairsplitting difference of opinion turn into a bitter political struggle? The reason is that, under Marxist theory, the correct strategy for pursuing a socialist revolution depends on a society’s stage of development. If Japan was still fundamentally a feudal society, then a bourgeois revolution had to occur before a socialist revolution could succeed. If Japan was already a full-fledged capitalist society, then it could proceed straight to a socialist revolution.

Since the collapse of the Berlin Wall, this antiquated Marxist dispute as to the proper road to socialism in Japan will doubtless strike many as rather comical. However, I find it hard to dismiss it with a chuckle. The reason is that the fundamental questionーwhether the characteristics of Japanese capitalism are a function of some “structural” idiosyncrasy or of developmental “delay”ーhas continued to be debated in a variety of contexts down to the recent times, and it points to an underlying worldview that calls for reexamination.

Defining the Capitalist Norm

A similar disagreement arose in the 1990s, as the Japanese economy slid into what was to become a 20-year slump following the bubble of the 1980s. Because the United States was just then enjoying a period of unprecedented growth as it led the way in information technology and financial deregulation, a consensus emerged that American-style capitalism was the global standard against which the rest of the world was to be measured. Opinion differed mainly as to whether Japan’s persistent economic stagnation was the result of a structural idiosyncrasy deeply rooted in Japanese culture or simply a delay in catching up with American-style free-market reforms. In fact, a similar debate emerged in other non-Western countries and even among the countries of continental Europe, such as Germany.

At the bottom of this basic dispute, which has broken out time and again all over the globe, is a shared and enduring belief in a single universal model of development, represented originally by Western society in general and more recently by American society in particular. This leads to the inevitable view of non-Western societiesーand, more recently, even the societies of continental Europeーas deviations from the universal norm.

Despite the ferocity of their dispute, the Koza and Rono factions subscribed to the same basic view that Japan deviated from the standard model of capitalism. They merely disagreed as to whether this deviation should be blamed on structural idiosyncrasies or developmental delay.

The time has come to consign this assumption, which has dominated our thinking and behavior for so long, to the trash heap. To my mind, the clearest proof yet of the fallacy of American capitalism is the rise of US President Donald Trump under the banner of “Making America Great Again.”

The Fallacy of the Laissez -Fa ire Doctrine

At the core of American capitalism is the doctrine of laissez faire, a basic faith in the “invisible hand” of the market mechanism and a belief that the less our conventions, laws, policies, and regulations interfere with the natural workings of the market, the more efficient and stable our economy and society will be.

But laissez-faire doctrine errs theoretically in ignoring the fact that a market economy is inherently a money economy. When people accept money in exchange for goods and services, they do so not for the inherent utility of the currency but in the belief that others will later also accept it as money. Thus, whenever people participate in money transactions, they are actually engaging in a kind of speculation, that is , buying a thing not for its utility but for its sale later to others, whether they know it or not. Speculation leads to bubbles, and bubbles eventually break. What we call a recession is, in essence, a money bubble when people would rather hold money than actual goods and services, resulting in insufficient aggregate demand. What we call inflation is, in essence, the bursting of the money bubble, when people start dumping money to acquire actual goods and services. Recessions that deepen are called depressions, and inflation can escalate to hyperinflation.

In short, a pure laissez-faire market system, being a monetary economy, is always at risk of a depression or hyperinflation.

In 1933, in the midst of the Great Depression, the United States passed the Glass-Steagall Act, imposing strict regulations on activities of commercial banks. In 1999, as the wave of laissez-faire fundamentalism peaked, Congress yielded to pressure from the finance industryーwhich insisted that finance was the management of risks and that the industry could manage its own risksーand repealed that law. It took less than 10 years for US financial markets to succumb to a subprime mortgage crisis, which precipitated a global recession. In the United States, unemployment soared to more than 10% during the Great Recession, and the blame for that lies with the laissez-faire doctrine.

The Fallacy of Shareholder Sovereignty

The other theoretical fallacy in American-style capitalism is its insistence on absolute shareholder sovereignty and the notion that a business corporation is simply a tool for enriching its shareholders.

Shareholder sovereignty errs by ignoring that a corporation is also a legal person. It is not the shareholders but the corporation itself as a legal person that owns the offices and factories and concludes contracts with employees, customers, suppliers, and banks. And it is not the shareholders but the corporate executives who act as the representatives of the corporation and make business decisions on its behalf.

Unlike shareholders who can unload their stock any time they choose, corporate executives owe the duty of loyalty toward their corporation. Anyone who accepts the task of making decisions on behalf of a corporation that is legally a person but is not an actual person must accept a duty to put the purpose of the corporation before his or her own interests, as opposed to using it for personal gain.

However, US corporate governance practices place shareholder profits first, and the best way to ensure executives place shareholder profits first in their management decisions is to make the executives shareholders as well. With this in mind, American corporations have made stock options a central component of their compensation packages. This system, however, has the effect of releasing executives from the duty of loyalty and encouraging them to treat their corporations as tools for the pursuit of their own gain.

As a result, average executive compensation has ballooned to about 350 times average worker salaries, and the United States has rapidly outpaced the rest of the developed world in income inequality. The top 1% of American income earners now account for a full 20% of all income. And a surprisingly small portion of that 20% consists of capital income. To be sure, entrepreneurial income constitutes a substantial share, but executive compensation accounts for even more. The real culprit behind the extreme economic inequality of US society today is the theoretical fallacy of shareholder sovereignty.

Trump and the Failure of the American Model

Underlying the election of Donald Trump in 2016 was the anxiety and dissatisfaction that have festered amid the economic instability and growing inequality of recent years. This American president, who acts like a petty tyrant, presents a cartoonish image of American capitalism’s failure as a global standard.

If laissez-faire doctrine is a theoretical fallacy, this means that a market economy needs more than a free market to function properly. A market economy also needs a combination of government regulation, central bank intervention, and a variety of social-security and mutual-aid systems to avoid instability and gross inequality. Diverse forms of a market economy are possible, depending on how one weaves these systems together.

If shareholder sovereignty is a theoretical fallacy, this means that a corporation is more than just the tool of the shareholders. It has autonomy as an organization made up of human beings and may therefore consider the interests of its employees and other stakeholders as integral to its purpose. Corporate systems can also take various forms, depending on how corporations define their purpose.

Developing Our Own Standard

The idea that capitalism can assume a variety of forms, including some that reject laissez-faire doctrine and shareholder sovereignty, is scarcely new. This, after all, is the way capitalism has evolved in postwar Japan and continental Europe. But it is high time that we abandon the notion of Japanese and continental European capitalism as deviations from the universal US model.

The time has come to redefine Japanese capitalism as one among many possible forms that capitalism can takeーor rather “a universal” model in its own right among a plurality of universal models.

This view neither accepts Japanese capitalism as a structurally idiosyncratic form rigidly rooted in Japanese culture nor regards it as a developmentally delayed form that is slow to catch up with free-market reforms. It reconsiders Japanese capitalism as a universal model that Japanese society is free to choose among many possible universal models. And how we choose to apply and develop that model henceforth is completely up to us.

Is this not a fitting theme for debate in 2018, as we mark the 150th year since the Meiji Restoration launched Japan on the road to Westernization?

Translated from “Nihon no shihon-shugi saiko no toki,” Keizai Kyoshitsu, Nihon Keizai Shimbun , January 4, 2018. Courtesy of Nikkei Inc.

Read the original article in Japanese: https://www.tkfd.or.jp/research/detail.php?id=2033