- Article

- Tax & Social Security Reform

Fine-Tuning the Benchmarks for a Children-Friendly Society

July 15, 2021

Politicians are proposing the establishment of a new children’s agency and a big hike in child-related spending. While this may help allay Japan’s demographic concerns, social security expert Kazuhiko Nishizawa cautions that measuring progress toward these policy goals presents its own challenges.

* * *

A group of Liberal Democratic Party lawmakers is calling for the establishment of a new agency to centralize the administration of child-related policies. This would involve naming a cabinet-level minister to head the agency and expanding related expenditures. A report issued by the group on May 28, 2021, proposes the doubling of spending on childrearing support from 1.7% of gross domestic product in 2040 to around 3.5%—a level in line with many European countries.

The proposal to create a children-friendlier environment is to be greatly welcomed. But using such expenditures in setting policy targets can be complex because of the different ways in which childcare spending is measured. The LDP group’s report appears to view “social security benefits,” as measured by the standards of the International Labor Organization, to be roughly equivalent to the “social expenditure” index of the Organization for Economic Cooperation and Development.[1] My discussion below is premised on this assumption and will focus on social expenditures calculated using OECD standards.

What Are Family Expenditures?

The social expenditure database (SOCX) monitors trends in aggregate social security spending, as defined by the OECD. Japan’s social expenditures are estimated by the National Institute of Population and Social Security Research (NIPSSR) as part of its social security statistics (along with the ILO-based social security benefits). The figures are published annually by the NIPSSR and reported to the OECD.

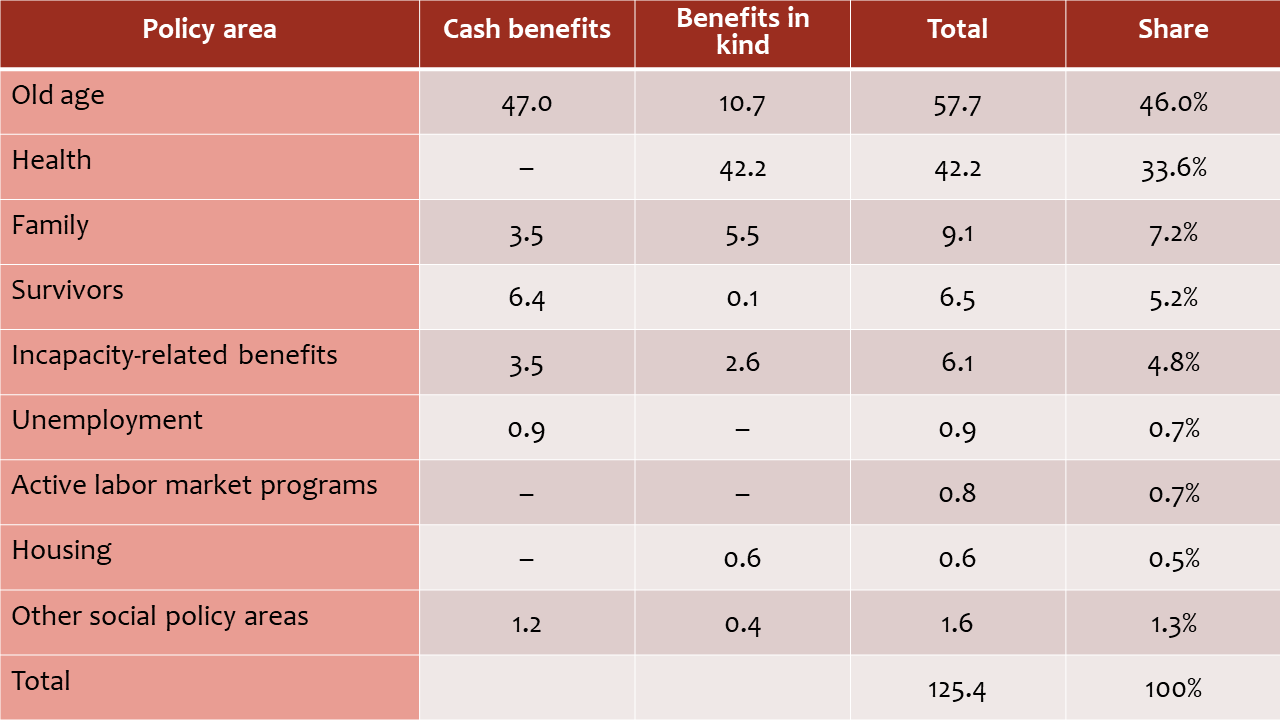

One of the NIPSSR’s social expenditure items is “family expenditures,” which refers to cash benefits for children and single-parent households, compensation for pre- and postnatal leave, and benefits-in-kind for daycare, preschool education, and foster care. While its name suggests a broad range of family-related services, it is, in essence, childrearing support. In fiscal 2018, such spending reached ¥9.1 trillion, making up an estimated 7.2% of the ¥125.4 trillion in total social expenditures (Figure 1).

Figure 1. Social Expenditures in Fiscal 2018

(¥ trillion)

Source: Created by the author based on the NIPSSR’s “Financial Statistics of Social Security in Japan,” FY 2018.

According to reference material submitted to the October 28, 2014, meeting of an expert panel established by the Council on Economic and Fiscal Policy to explore Japan’s future choices, there is a moderate positive correlation between increased government spending on family-related items vis-à-vis old-age expenditures and a higher total fertility rate. This suggests that expanding family expenditures can raise the share of the juvenile population (and slow the rate of aging), gradually creating a virtuous cycle of spending comparatively more on the family and less for elderly care.

What the Numbers Mean

While the attention being given to child-related policies is heartening, heed must be paid to three points when setting policy targets for family expenditures. The first is the need to improve the accuracy of such spending estimates. Approximately 60% of family expenditures are provided as in-kind benefits, as indicated in Figure 1. Unlike healthcare and nursing care, whose service fees are fixed as part of social insurance, there is no official price list for childcare. Estimation methods are thus reviewed on an ongoing basis, with data frequently being revised retroactively.

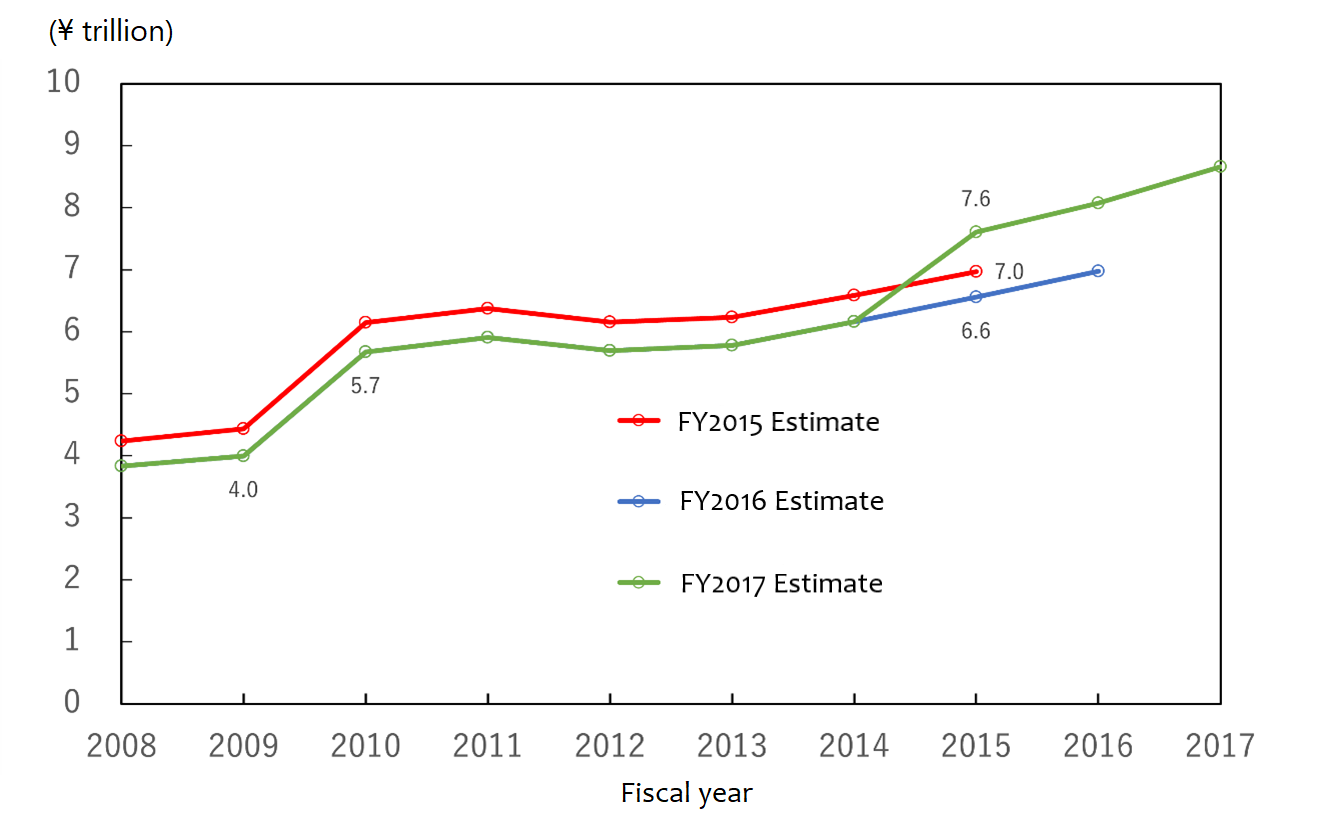

For example, family expenditures in fiscal 2015 were initially estimated to be about ¥7.0 trillion. This was revised downward to ¥6.6 trillion the following year but amended again—this time up to ¥7.6 trillion—two years later (Figure 2). The downward revision of ¥0.4 trillion was due to a change in how the lump-sum allowance for childbirth and childcare was classified; it had traditionally been itemized as a family expenditure but was transferred to the category of health. The revision does not indicate that families actually received less in benefits.

Figure 2. Family Expenditures, 2008–17

Source: Created by the author based on NIPSSR social expenditure statistics for fiscal 2015, 2016, and 2017.

The subsequent upward revision of about ¥1 trillion resulted from better estimates of programs undertaken at the local level. Local authorities play a major role in a variety of child-related policy areas, including child allowance, foster care, maternal and child health, and childcare services. These programs can be broadly classified into those that are subsidized by the central government and those financed solely by local authorities. As for the former, the amount disbursed by local governments can be calculated from national expenditures by using the subsidy rate.

Detailed information on the latter, on the other hand, had been more difficult to obtain; as a result, spending for child consultation centers, public nursery schools, and many other local programs has either gone unreported or sometimes been overstated. In fiscal 2017, however, the Ministry of Internal Affairs and Communications began publishing the results of a survey on local government programs, thus increasing the accuracy of estimates for local government social expenditures. At the same time, the figures for fiscal 2015 and 2016 were retroactively revised. The takeaway here is that the figures available at any one time may not always be definitive.

The second point to keep in mind is that subsidies for households may not be itemized as social expenditures if they are provided in the form of tax deductions or exemptions/reductions in social insurance premiums. Related to this is the child allowance introduced in fiscal 2010 under the Democratic Party of Japan administration of Prime Minister Yukio Hatoyama. While family expenditures that year increased by about ¥1.7 trillion (Figure 2), this does not account for the roughly ¥1 trillion in higher income and resident taxes levied to offset the expense. These figures should properly be considered together.

Thirdly, higher family expenditures do not necessarily correspond to improvements in children’s welfare. The national and prefectural governments together spent about ¥250 billion in fiscal 2018 on measures to prevent child abuse. Obviously, a reduction in abuse cases would be better news than a growth in outlays.

Similarly, the 2016 amendment to the Child Welfare Act stipulates that priority should be given to finding foster or adoptive parents for children unable to receive proper care at home, rather than entrusting them to institutional care, such as orphanages.[2] Housing them in facilities will result in higher family expenditures in the form of personnel, property, and maintenance costs, but their welfare may be better served by foster and adoptive parents, whose spending will not push up government outlays.

Room for Improvement

Ameliorating the concerns raised above will require action in three main areas. First, we will need to attain better estimates of family expenditures, particularly of programs financed solely by local governments, such as operating public nursery schools and child consultation centers. Despite the improvements made in fiscal 2017, there are still areas that remain unaddressed. For example, the OECD SOCX Manual, 2019 Edition, calls for capital investment in social institutions to be included as social expenditures, but such data is not included from figures for Japan because it is not publicly available.

Second, when arranging or quoting estimated figures for family expenditures, we need to keep in mind that they are subject to adjustment. The accuracy of published data is improving, but the figures may not be final. Another shortcoming is that they do not include tax-related measures, despite the importance of considering social security and taxation in an integrated fashion.

Third, child-related policies should be assessed not just in terms of inputs (that is, government spending) but also actual outcomes. In healthcare, the incremental cost-effectiveness ratio (ICER) is used as a matter of course to measure the costs and benefits of a healthcare intervention. The effectiveness of a policy in improving children’s well-being may be more difficult to gauge, but effort should nonetheless be made to develop an index to monitor progress with such measures.

References

Hoshino, Nahoko. 2020. “Chiho tandoku jigyo no tokei ni kakawaru seiri: Shakai hosho kankei no chiho tandoku jigyo o chushin ni” (A Statistical Overview of Locally Financed Projects: With a Focus on Social-Security-Related Projects). Chiho Zaisei. July 2020.

Ministry of Health, Labor, and Welfare. 2020. “Shakai hosho hiyo tokei ni okeru chiho tandoku jigyo no keijo to kongo no kadai” (Incorporating Locally Financed Projects in Social Security Expenditures and Future Issues). January 29, 2020. https://www.kantei.go.jp/jp/singi/toukeikaikaku/kaikaku_chousa_kanji/dai3/siryou2-1.pdf.

National Institute of Population and Social Security Research. 2018. “Shakai hosho hiyo o makuro-teki ni haaku suru tokei no kojo ni kansuru kenkyu” (Research on the Improvement of Statistics to Understand Social Insurance Finances Macroscopically).

National Institute of Population and Social Security Research, Social Security Expenditures Project. 2018. “Heisei 28-nendo shakai hosho hiyo tokei: Gaiyo to kaisetsu” (Fiscal 2016 Social Security Expenditures: Overview and Commentary). Shakai Hosho Kenkyu. Vol 3, No. 3, pp. 416–28. http://www ipss.go.jp/syoushika/bunken/data/pdf/sh18030308.pdf.

National Institute of Population and Social Security Research, Social Security Expenditures Project. 2019. “Heisei 29-nendo shakai hosho hiyo tokei: Gaiyo to kaisetsu” (Fiscal 2017 Social Security Expenditures: Overview and Commentary). Shakai Hosho Kenkyu. Vol 4, No. 3, pp. 387–402. http://www. ipss.go.jp/ss-cost/j/journal/sh19040312_seigo.pdf.

Organization for Economic Cooperation and Development. 2019. The OECD SOCX Manual, 2019 Edition: A Guide to the OECD Social Expenditure Database.

Shiozaki, Yasuhisa. 2020. Shinni kodomo ni yasashii kuni o mezashite: Jido-fukushi-ho-to kaisei o meguru jikki (Toward a Truly Child-Friendly Nation: An Inside Account of the Revision of the Child Welfare Act). Mirai Sosho.

[1] According to a projection of social security costs and benefits in 2040, published on May 21, 2018, by the Cabinet Secretariat, Cabinet Office, Ministry of Finance, and Ministry of Health, Labor and Welfare, childcare and childrearing expenditures will rise from 1.4% of GDP in fiscal 2018 to 1.7% in fiscal 2040. This, presumably, is what LDP legislators mean when they refer to child-rearing support. The NIPSSR, meanwhile, annually publishes the receipts and expenditures of social security schemes in Japan on the basis of both ILO and OECD standards, but the ILO-based “social security benefits” are not internationally comparable. The goal of increasing social expenditures to around 3.5% on a par with European countries is thus seen as referring to the OECD-based figures for “social expenditures.”

[2] In his 2020 book detailing the revision of the Child Welfare Act, former Health, Labor, and Welfare Minister Yasuhisa Shiozaki notes that the gist of the amendment was to provide, as far as possible, a home environment for children unable to be cared for by his or her biological parents. He strongly advocates finding foster parents, including at the stage of temporary protection, while also making full-fledged efforts to achieve a permanent solution through plenary adoption.