Japan’s political parties have released their manifestos for the upcoming general election. Their platforms all offer some form of minimum-guaranteed pension benefits, from the standpoint of protecting low-income workers and those without pension coverage. The differences lie in how the minimum benefits are provided. While they will inevitably be financed by taxes, the manifestos leave this aspect unclear.

Proposals for Pension Reform

What needs to be done to solve the problems facing Japan’s pension systems? First of all, the answer must address the issue of how to ensure income security in old age. Pension systems should mitigate the risk of such factors as extended life span, first by providing income smoothing that maintains a standard of living equivalent to that during an individual’s working years and second by offering adequate security from the standpoint of society as a whole. The former is a principle of social insurance, and the latter is a principle of income redistribution. The question is how to design a system that combines these two principles; this depends upon the philosophy of what is fair and rational. The balance of public and private pension systems is critical and it is necessary to create a consistent system that is attuned to both public assistance and the tax system.

The problem, then, is the function of the Basic Pension scheme, and the major issue is how to integrate the three separate pension systems. Although many in Japan, including both the ruling and opposition parties, recognize that there are serious problems with the public pension system, no consensus has been reached on providing a solution.

At present, the government has no proposal for reforming the system; however, a report released by the Ministry of Health, Labor, and Welfare’s National Pension Council in November 2008 offer several proposals designed to assist individuals with low pensions and incomes. One of these is a premium remission; the reduced benefit this causes will be supplemented by taxes. Another proposal is a minimum-guaranteed pension system, whereby a certain amount (50,000 to 70,000 yen) is guaranteed even if paid premiums are not enough for the full pension; the difference in premium payments is covered by taxes. All these proposals assume that the structure of the present fragmented pension system is to be left unchanged and general tax revenues are needed.

The ruling Liberal Democratic Party’s election manifesto includes a statement that the party will tackle the issue of people without pension coverage and low-income earners, but gives no concrete details on how it will reform the system. The basic idea is one of adding some remedies to the existing pension systems; in this sense the LDP approach appears similar to that recommended by the National Pension Council. Proposals advanced by two national daily newspapers, the Yomiuri Shimbun and Asahi Shimbun , also fall into this category.

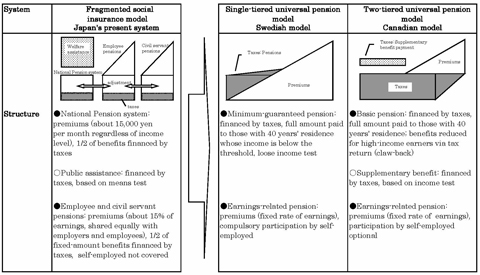

The leading opposition party, the Democratic Party of Japan, has responded with the idea of adopting the Swedish pension system (see chart). Sweden’s previous, two-tiered pension system combined a fixed universal benefit with an earnings-related supplement. However, confronted by the inefficiency of the first tier, which was financed by general tax revenues, as well as the recognition that the inequity of benefit payments among those of different generations was bound to expand, Sweden devised an innovative new system in the form of a notional defined contribution system. This combines a defined contribution plan financed on a pay-as-you-go basis with funded individual accounts, establishing a more direct linkage between contributions and benefits. In order to maintain universal pension coverage, a minimum-guaranteed pension was also introduced for low-income beneficiaries, with eligibility for those with residency in Sweden. As pointed out in the first half of this paper, public pensions throughout the world are generally divided into two types; Sweden, though, has emerged as an exception to this rule. The pension system founded on the country’s social insurance system, but it has also established a minimum-guaranteed pension financed entirely by tax revenues, realizing universal pension coverage for all citizens. Rather than simply creating a universal pension within its social insurance scheme, this system is better thought of as having successfully established two systems at once.

Proposals for Consolidating Japan's Pension System

What the DPJ is proposing, based on the Swedish system, is the integration of Japan’s three pension plans and the introduction of a minimum-guaranteed pension equivalent to 70,000 yen. In addition, they propose that the minimum-guaranteed pension be reduced for individuals in high-income group, for example, making more than 6 million yen per year, and eliminated completely for those taking in around 12 million yen a year or more. (This reduction appeared in the DPJ’s original proposal, but was not mentioned in the party’s election manifesto.) They also propose measures aimed at boosting the efficiency of pension administration, such as integrating the Social Insurance Agency and the National Tax Agency into a national revenue agency. Like the LDP’s proposal, however, the one put forward by the DPJ fails to identify any specific financial resource to pay for these reforms.

The Japanese Communist Party, People’s New Party, and Social Democratic Party are proposing a system that provides flat pension benefits of around 80,000 yen per month in addition to earnings-related occupational pensions. Funding for this would come from general tax: in short, it would shift Japan’s Basic Pension to a taxation basis, guaranteeing all citizens a defined portion of the income they need after retirement. Some Japanese think tanks, as well as the nationally circulated daily Nihon Keizai Shimbun , have also proposed this tax-funded approach.

Reforms based on the Canadian pension system are frequently proposed as one way to provide all Japanese with a basic pension financed by general taxes (see chart). Canada employs a three-tiered pension system consisting of a basic pension financed by general tax revenues, an earnings-related contribution, and private and employer-sponsored savings plans. The basic pension provides benefits equivalent to less than 60,000 yen per month to any individual who has resided in Canada for a certain amount of time. But because those without any earnings-related pension benefits cannot subsist on the basic pension benefits alone, a supplementary benefit, equivalent to Japan’s system of welfare benefits, has been provided for the elderly with an income test. Based on income tax returns, the so-called recovery tax reduces basic pension benefits for individuals whose incomes exceed 6 million yen per year, and those earning 10 million yen or more receive essentially no basic pension benefits. Since those in middle and upper income brackets will not be able to maintain their previous incomes through tiers one and two alone, it is important that they actively contribute to one of the third-tier schemes.

Though both the Swedish and Canadian pension schemes provide universal coverage, the mechanism by which they do so is different. Under the former, all residents enter into the same pension scheme regardless of occupation and contribute on an earnings-related basis (with the self-employed paying twice as much as salaried workers). The latter system provides a basic pension for all residents, with two higher tiers segregated by profession. Though both produce essentially the same result, as public pension systems they differ with respect to the scope of government responsibility.

The pension reform plans currently discussed and proposed by the political parties’ manifestos can be classified in three basic models. These are the model advanced by the LDP, MHLW, Yomiuri Shimbun , and Asahi Shimbun to incorporate some measures aimed at those in low-income brackets based on the present system (proposal A), the opposition DPJ’s version based on the Swedish model (proposal B), and that advanced by the other three parties and the Nihon Keizai Shimbun based on the Canadian model (proposal C). Following is a basic review of their respective pros and cons.

Pension Reform Pros and Cons

One of the advantages of proposal A is that it can be implemented without a fundamental restructuring of the current pension system. The other two proposals would entail some transitional problems, such as a lengthy transition period (for example, 40 years). While proposal A also requires financial outlays, the risks associated with reform are minimal.

On the other hand, reform would not enough to fix the current problems with the Basic Pension system. In particular, in the event that a minimum-guaranteed pension is introduced, features such as reductions and exemptions of insurance premiums and adjustments in benefits in accordance with individual incomes will need to be incorporated, causing the system to grow even more complex. More income checks would be needed within the pension system, incurring larger administrative costs. The proportion of funding from general tax revenues would be increased, thereby diluting one of the defining characteristics of the social insurance system, and the already blurred division between the social insurance and tax systems would continue as before.

In contrast, proposals B and C are universal pension systems in a true sense. Though it would take time for Japan to transition to such a system, both are suited to thoroughly resolving the various problems with the present system. By far the biggest advantage to these models is that they would make the presently vague and complex pension system easy to comprehend.

Both these models have some drawbacks. The biggest problem with proposal B is whether, with the integration of separate pension plans, insurance premiums can be levied effectively using the same standard for both company employees and the self-employed. Even if income for the self-employed can be determined precisely, differences between the nature of business income and employment income pose problems in terms of fairness.

The difficulties that many countries are now experiencing in maintaining their pension systems also raise the question of whether it is wise to integrate previously separate pension plans into one large, earnings-related system. The Swedish system is based on the principle that all people will be able to find jobs that allow them to receive earnings-related benefits, thanks to that country’s aggressive employment measures; indeed, wages for women are on average 80% those of men. If Japan failed to take similarly aggressive measures to ensure that all its residents are generating incomes, there would eventually be an increase in the number of elderly individuals needing the minimum-guaranteed pension benefit. This is a distinct possibility in light of the recent increase in non-permanent employment. In Sweden, on the other hand, the number of individuals receiving this benefit is anticipated to fall as residents earn higher incomes.

Meanwhile, proposal C eliminates the need to combine separate occupational systems. At present general tax revenues cover half the Basic Pension; therefore, financing difficulties aside, there are no particular structural barriers to increasing this proportion to 100%.

One problem with adopting proposal C is how to handle the portion of insurance premiums borne by employers. Introducing such a system to Japan would mean separating pensions into a flat-amount portion and an earnings-related component. Since the former would be covered by taxes, the corresponding premiums borne by workers and employers would be unnecessary. If this reduction were not somehow returned to insured individuals, the increase in taxes to cover the flat amount would simply end up a net increase in the people's burden. This problem could be avoided by adding the premiums borne by employers to a basic component of employees’ wages, and thereby something to be returned to those employees at a later date; depending on the relations between workers and employers, however, this may not go over well. It is also conceivable that, as is the case in some countries, the proportion carried by employers could be kept the same and the policy of splitting premiums equally between employers and employees be abandoned; but this may prove an unpopular idea among employers. On the other hand, since premiums—which have thus far been exempted from taxation—would no longer be levied as fixed amounts, taxable income would rise, constituting a source of additional revenue.

Theoretically speaking, proposals B and C are both of high quality. In terms of feasibility for Japan, the latter seems easier than the former, as it requires restructuring only the first tier, but the former addresses the first and second tiers and should strengthen the social insurance system. Regardless of whether proposal B or C is adopted, the problem of financing remains a sizeable one. Proposal A would require fewer direct additional resources than proposals B and C, but as long as the minimum-guaranteed income would need to be addressed via the welfare safety net, proposal A is not necessarily cheaper than proposals B and C, as it would be supplemented by a public assistance program based on means testing.

Conclusion

Each of these pension reform proposals has its own advantages and disadvantages, and it is necessary to compare figures and other data for each and conduct serious and objective debate on which is most appropriate. The most important aspect of this debate will be answering the basic question of how old-age income security is ensured. As mentioned before, the country faces a choice between a social insurance system and universal pension coverage (or tax-funded system). If Japan opts for a social insurance system and abandons universal pension coverage, those with low incomes will be need to be dealt with through public assistance. Universal pensions, on the other hand, would be funded by taxes. Neither option represents a free lunch. Citizens and residents will have to shoulder the burden in some way or another in order to provide individuals with a dignified retirement, whether this burden takes the form of premiums, taxes, or pay-as-you-go or funded pension schemes. Thought will need to be given to designing a more effective pension system in accord with social and economic changes. One of the difficulties of pension reform, moreover, is that it is impossible to discuss starting over with a completely new system.

There has been a great deal of emotional debate surrounding pension reforms, such as whether to increase taxes, and not enough in the way of objective and detailed analyses. Both the ruling and opposition parties should present the public with concrete proposals for pension reform that include proposed sources of financing.