- Article

- Tax & Social Security Reform

A Critique of Japanese Tax Policy in the Heisei Era

July 4, 2019

Tax expert Shigeki Morinobu delivers a blunt assessment of Japanese tax policy over the past three decades, together with some fresh ideas for boosting revenue and mitigating economic inequality in the new Reiwa era.

* * *

The basic functions of a tax system are (in order of importance) raising revenue, redistributing income, and stabilizing the economy. With these functions in mind, let us evaluate the efficacy of Japan’s tax policies during the three decades of the Heisei era (1989–2019).

Faltering Revenues

The most important function of taxation is that of raising revenue, and the revenue-raising capacity of the Japanese tax system has declined significantly over the past three decades. Figure 1 plots Japan’s general-account tax revenue (blue line) and budget expenditures (red line) using the left axis; gross domestic product (yellow dotted line) and government bonds outstanding (gray line) are plotted using the right axis. The scales of the right and left axes are calibrated in such a way that the trend lines for tax revenues and GDP intersect at the first year of Heisei, 1989, when the government did not issue any new deficit-financing bonds.

Figure 1. Japanese Government Finances, 1989–2018

Source: Ministry of Finance statistics.

Spending has risen relative to GDP over the past three decades, while tax revenue has declined. Given the progressivity of income and inheritance taxes, tax revenue would ordinarily be expected to grow at a higher rate than GDP. However, during the Heisei era, this natural buoyancy was undercut by three policies: (1) the “special tax cuts” of 1994, 1995, and 1996, which lowered income tax rates in anticipation of the 1997 consumption tax hike; (2) the 1999 tax cut passed by the cabinet of Keizo Obuchi to jump-start the economy; and (3) the 2006 transfer of tax revenue sources (totaling about ¥3 trillion) from the national government to local jurisdictions under the cabinet of Jun’ichiro Koizumi.

It is possible to view this loss of revenue as a consequence of the prioritization of economic adjustment over revenue raising in the government’s tax policy. But the use of tax cuts as an economic adjustment mechanism assumes a return to previous revenue levels once the economy rebounds. In Japan’s case this did not occur, owing to the economy’s ongoing stagnation and a reluctance to restore income tax rates to their previous levels.

The trend toward shrinking revenue reversed itself recently under the second cabinet of Prime Minister Shinzo Abe (2012 to present). In fact, in the fiscal 2019 budget, tax revenue is projected to reach ¥62.5 trillion, surpassing the ¥60.1 trillion recorded in 1990, before the collapse of the asset bubble. However, this estimate assumes that the Abe government will finally raise the consumption tax hike from 8% to 10% in October 2019 (after twice postponing the increase).

What accounts for the recent revenue increases? Some of the growth can be attributed to a rise in business revenue from export industries as the government’s policy of unprecedented monetary easing brought down the value of the yen. But the biggest factor behind the growth in tax revenue was the 2014 hike in the consumption tax rate (see Figure 2). As the statistics show, the devotees of reflation were incorrect in their prediction that a consumption tax hike would lead to a net decline in tax revenue owing to the erosion of personal and business income.

Figure 2. Trends in General-Account Tax Revenue, 1987–2019

Source: Ministry of Finance statistics.

That said, other indicators raise serious questions about the long-term revenue-raising capacity of Japan’s tax system. Between fiscal 1990 and 2018, the tax burden (tax revenue as a percentage of national income) fell from 27.7% to 24.9% (Figure 3). At the same time, the share of total general-account revenue supplied by taxes fell from 86.8% in fiscal 1990 to 61.6% in the fiscal 2019 budget.

The average taxpayer may have difficulty digesting the fact that the burden declined during the Heisei era. This is probably because the combined burden of taxes and social security contributions rose, from 38.4% in 1990 to 42.5% in 2018, as the burden of social insurance premiums jumped from 10.6% to 17.6%. Because of this, disposable income dwindled during the Heisei era despite the overall reduction in taxes.

Even including social security contributions, Japan ranks fairly low in terms of the overall public burden—just above the United States. But not many people in Japan are aware of this.

Growing Inequality

The income-redistribution function of the Japanese tax system has also declined over the past three decades. One reason is that the relative contribution of the income tax, which is progressive, has dwindled, while that of the consumption tax has grown. This occurred as a consequence of two successive tax reforms aimed at “improving the balance between direct and indirect taxes,” followed by a further consumption tax hike passed in 2012 under the “comprehensive reform of taxes and social security.”

In 1990, immediately following the implementation of a new 3% consumption tax, direct (income) taxes still accounted for 79% of tax revenue, while indirect taxes constituted just 21%. The consumption tax rate rose to 5% in 1997 and 8% in 2014, and by 2018 the ratio of direct to indirect taxes was 68:32 (58:42 if we exclude local taxes). The weight of indirect taxes will increase further if the government follows through with its plan to raise the consumption tax to 10% in October 2019. In terms of the share of tax revenue generated by indirect taxes, Japan may soon rival France (45% as of 2016) and Germany (46%), both known for their high dependence on indirect taxation.

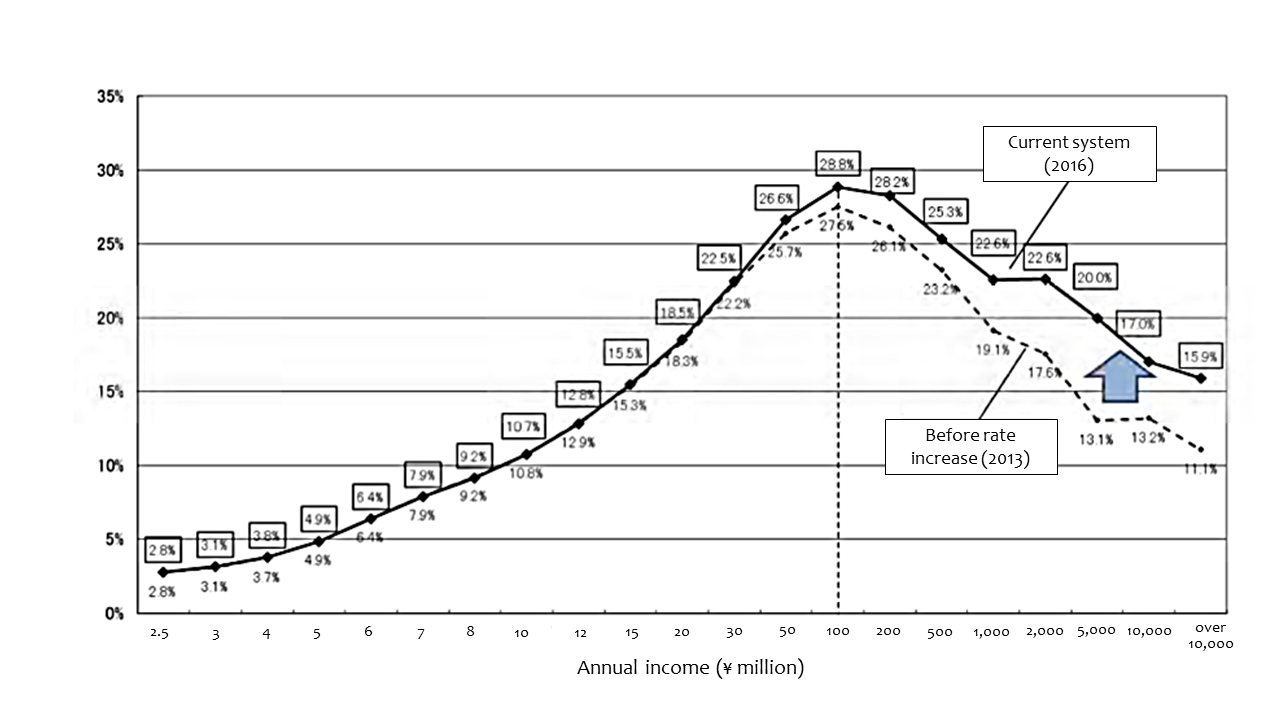

The second reason for the decline in the redistributive function of the Japanese tax system is that successive income cuts have had the effect of flattening of the tax’s “progressivity curve.” The progressivity curve is derived by charting the effective tax rate against income; the steeper the rise, the more progressive the tax. Figure 3 shows the progressivity curve of Japan’s personal income taxes (national and local combined) at various junctures during the Heisei era, thus revealing the impact of successive tax reforms. The result highlights the regressive effect of the income tax cuts.

Figure 3. Progressivity of Income Tax in Japan (effective tax rate for individual wage earners with dependent spouse and two children)

Source: Ministry of Finance statistics.

The chart also reveals the relatively low effective rate of taxation for Japan’s middle class earning less than ¥10 million. Under Japan’s current income tax schedule, about 58% of taxpayers fall into the bottom tax bracket of 5%, while another 25% pay just 10%.

A less progressive tax system generally translates into greater income inequality. Let us see how this applies to the Heisei era.

Figure 4 charts changes in Japan’s Gini coefficient, a measure of income inequality, using the results of the Income Redistribution Survey conducted by the Ministry of Health, Labor, and Welfare. It reveals a marked increase in initial income inequality and a smaller, though still significant, trend toward inequality of redistributed income. Over the same period, we see a sharp increase in the redistributive impact of social security, while the impact of taxation increases only marginally.

Figure 4. Redistribution and the Gini Coefficient

Source: Ministry of Health, Labor, and Welfare, Income Redistribution Survey, 2000–2014.

The results of the Japanese government’s Family Income and Expenditure Survey, meanwhile, provide tools for comparing the distribution of income before and after the adoption of the economic revitalization policies collectively known as Abenomics. The data from these surveys indicate a growing concentration of households near the top and bottom of the ¥4 million–¥7 million income bracket. A similar trend can be seen in the distribution of assets, as reflected in household savings. This income polarization within the middle class—which plays such an important role in the formation of public opinion on tax policy—is a development that deserves close attention.

When we compare income inequality in Japan and other industrially advanced countries, we see that Japan has a relatively low Gini coefficient vis-à-vis initial income, yet ranks fairly high in terms of inequality of income after redistribution. This speaks to the low distributive impact of its tax and social security systems.

As the foregoing attests, both the revenue-raising capacity and the income-redistribution effect of Japan’s tax system declined markedly during the three decades of the Heisei era. What steps can be taken to restore these functions to health in the new Reiwa era?

Four Recommendations for Redistributing Income

In the following, I outline my ideas for strengthening the tax system, beginning with four recommendations for restoring the redistributive impact of Japanese taxes.

Recommendation 1: Replace employment-income deduction with a tax credit

Japan has two basic options for enhancing the income-redistribution effect of income taxes. One is to introduce more steeply progressive tax rates. The other is to rethink the employment-income deduction.

Japan’s top income tax rate of 55% (national and local combined) is the third highest among the countries of the Organization for Economic Cooperation and Development. From the standpoint of averting a brain drain and attracting highly qualified personnel to Japan, imposing even higher rates on the top income tax brackets does not seem like a realistic option.

A better approach would be to replace the current employment-income deduction with an across-the-board tax credit. Under the current scheme, those with higher incomes receive a bigger deduction than those in lower brackets. In 2015, the government’s Tax Commission acknowledged the need to replace this regressive system with one that offers a uniform credit to all taxpayers. There will also be a need to integrate the problematical spousal deduction into such a tax-credit scheme.

Recommendation 2: Taxation of investment income

According to a Ministry of Finance survey, the effective tax rate for those paying the self-assessed (as opposed to withholding) income tax rises continuously until their income hits ¥100 million, at which point it begins to decline (see Figure 5). The reason is that investment income, such as capital gains and dividends, are taxed separately from employment income at a rate of 15%. Since the contribution of investment income increases in the higher tax brackets, this 15% rate pulls down the effective tax rate for high-income households.

The simplest answer is to raise the tax rate on investment income. However, this would penalize middle-income taxpayers (especially those saving for retirement), who currently pay only 5% or 10% on their employment income. To avoid such a penalty and minimize the impact on the stock market, the increase should be introduced in conjunction with an expansion and extension of the exemptions for small investors introduced under the NISA (Nippon Individual Savings Account) program.

Figure 5. Effective Income Tax Rates for Self-Assessed Income Tax

Source: National Tax Agency.

Recommendation 3: Taxation of pension benefits

Japan’s current pension-income deduction is problematic from the standpoint of equity as well as tax revenue, and it has been an ongoing topic of debate in top tax-policy circles. Even after changes introduced in the 2018 revision of the tax code, the deduction will cost the government about ¥1.8 trillion annually.

Most industrial countries tax either pension contributions or benefits. In Japan, neither pension contributions nor the gains from pension management are taxable, and while pension benefits are legally subject to taxation, they go largely untaxed as well, thanks to generous pension-income allowances. Moreover, people who continue to earn wages while receiving pension benefits get to claim a double deduction (from both employment income and pension income). This treatment of pension income is an anomaly that Japan needs to remedy.

The biggest obstacle to reform is doubtless the fear of a political backlash from older voters. One option to make the change more palatable to pensioners would be to earmark the additional tax revenue for the purpose of shoring up the Government Pension Investment Fund (see discussion of earmarked taxes, below).

Recommendation 4: A refundable tax credit

In terms of economic inequality, Japan cannot be compared to countries like the United States, where the richest 1% owns almost half the nation’s wealth. Nonetheless, economic disparities are growing, especially among the elderly and the young, and the poverty rate has risen sharply. Child poverty is a particularly worrisome trend.

Instituting a tax credit in place of the employment-income deduction can only accomplish so much, given that the income tax currently accounts for just 20% of government revenue. To mitigate economic inequality, we need to approach taxes and social security benefits as components of an integrated system of income redistribution. From this standpoint, a refundable tax credit linking earned income with benefits and tax relief is one of the best options available.*

Generating Revenue: Issues and Options

The need for new tax revenue in the age of AI

How will the rise of artificial intelligence impact our society and economy? Will it release more people from the need to work or consign more to unemployment and poverty? In his 2017 book Homo Deus, Yuval Noah Harari warns that the concentration of massive amounts of data and powerful algorithms in the hands of a privileged few could usher in an age of extreme social and economic inequality.

Anticipating the replacement of human labor by automation and artificial intelligence, some public policy experts have called for a “universal basic income,” that is, a minimum living stipend that the government would provide to all citizens, with no work requirement or means testing. In Switzerland, a proposal for a universal basic income was put to a vote (and rejected) by national referendum. Experimental programs have been launched in Finland and other countries.

Of course, any realistic proposal for a universal basic income must address the daunting challenges of financing such a costly policy. But with or without a basic income, we will still face new social costs in an AI-dominated economy, including expanded social security benefits to mitigate growing economic inequality and sweeping educational reforms to equip our citizens to function in the new economy. This means securing the revenue to finance spending increases above and beyond the anticipated surge in social security expenditures resulting from demographic aging.

How, then, do we raise this revenue?

Further consumption tax hikes?

The three available sources of tax revenue are income, consumption, and assets. Each type of tax has its advantages and disadvantages. On balance, however, a hike in the consumption tax rate is the most rational option for raising substantial new revenues without placing undue strain on the economy, imposing a lopsided burden, or undercutting the competitiveness of Japanese industry.

That said, the idea of raising the rate beyond the 10% target agreed on in 2012 has thus far proved a political nonstarter. One major reason is that, under the Abe cabinet’s quantitative easing monetary policy, the Bank of Japan continues to purchase Japanese government bonds in massive quantities, allowing the government to borrow without triggering any alarms in the marketplace.

Another factor is the absence of any viable political party with a progressive domestic agenda. Other industrial countries have substantial “liberal” or social democratic forces advocating for bigger government and expanded social programs to minimize the risks borne by the individual. But Japan currently has no political party of significance speaking for the 30%–40% of voters who agree that a higher tax burden is the unavoidable cost of a sustainable social security system. In fact, the minority parties oppose any increase in the consumption tax. These circumstances make it virtually impossible to get an additional increase on the political agenda.

Balancing burden and benefits

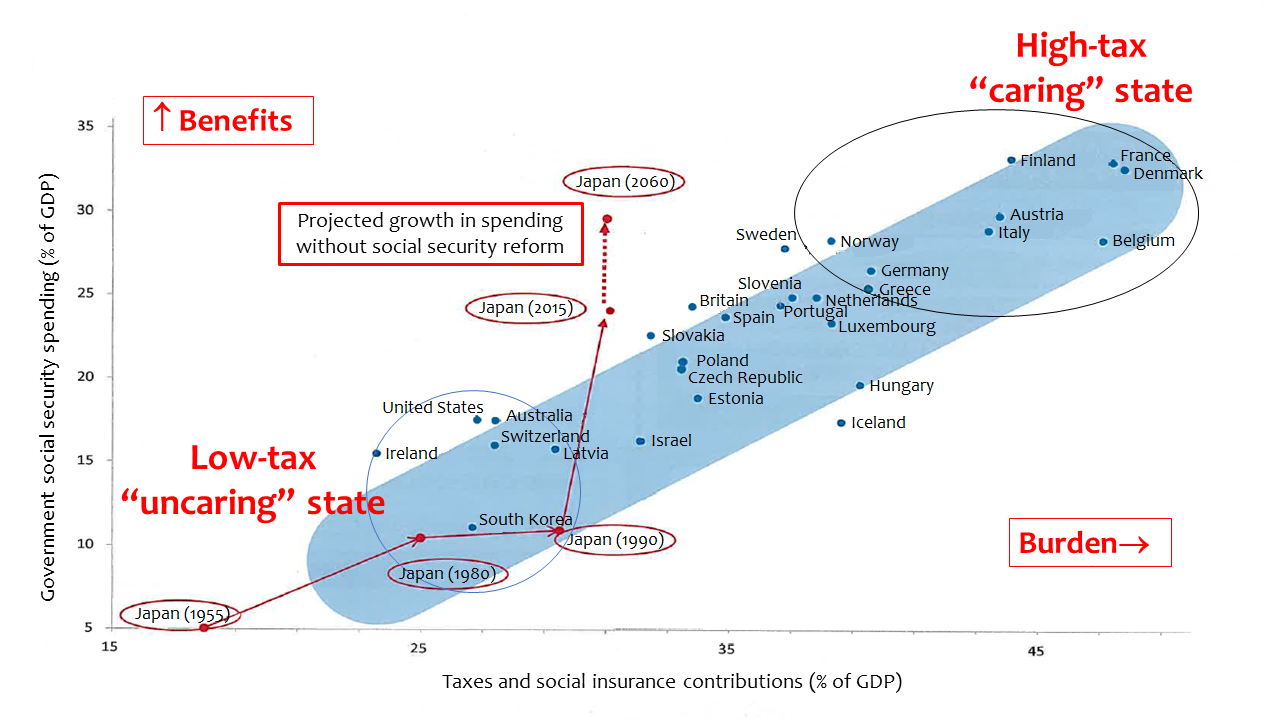

The late political scientist Masataka Kosaka argued that every industrial country ultimately faces a choice between higher taxes and a more caring government or lower taxes and a less caring government.

In Figure 6, I have plotted the position of various countries in respect to public benefits (vertical axis, measuring social security spending as a percentage of GDP) and public burden (horizontal axis, measuring taxes and social insurance contributions as a percentage of GDP). For the most part, the correlation between burden and benefits is fairly strong. But Japan emerges as a notable exception. The link that maintains a balance between burden and benefits has been broken.

It should be up to Japanese voters to decide whether to correct this growing imbalance (that is, the burden on future generations) by either raising the public burden or by curtailing social security benefits.

Figure 6. Public Burden and Benefits as a Percentage of GDP in OECD Countries

Source: Ministry of Finance statistics.

Japan’s challenge is further complicated by the need to reduce the country’s huge fiscal deficit, the largest in the industrial world. The deficit has swollen to this size because the government has continued to pump money into public services and other programs without securing the tax revenues to pay for them, postponing the task of fiscal rehabilitation.

How can the public be convinced of the necessity of higher taxes to meet society’s growing needs? The only option is to diligently inform voters about the huge and growing imbalance brought about by a combination of demographic aging, slow growth, and fiscal irresponsibility.

One way to gain acceptance for further increases in the consumption tax might be to use an incremental approach similar to that introduced by the pension reform of 2004, which raised pension contributions (for Employees’ Pension Insurance) by 0.354% every year from 2005 to 2017, after which it remained stationary at a fixed rate of 18.3%. Until now, it has been deemed necessary to limit the frequency of consumption tax hikes to minimize administrative expenses. But as part of its plan to cushion the impact of the upcoming tax increase, from which some items will be exempt, the government plans to support the installation of high-tech cash registers that facilitate application of multiple tax rates. In addition, an invoice system is set to take effect in 2023. These measures should make it possible to adopt small, incremental rate increases.

A new role for earmarked taxes

In January 2019, the government introduced the first new national levy in 27 years, the international tourist tax. This ¥1,000 departure tax, incorporated in the airfare of travelers leaving Japan, is expected to raise about ¥43 billion in a typical year. The proceeds will be applied to a wide range of measures for enhancing tourism resources, which means that the benefits should be clearly visible in the local communities where the tax revenue is invested. This is essentially an earmarked (or hypothecated) tax, since the use of its revenue is restricted by law.

The forest environment tax, scheduled to come into effect in 2024, is another earmarked tax. By adding a ¥1,000 surcharge to the individual residential tax, it will raise about ¥60 billion annually. This revenue is to be dedicated to programs to manage and conserve the nation's forests with the challenges of climate change in mind.

Earmarked taxes like these are coming back into favor worldwide. The reason is that they clarify the connection between burden and benefits, making them more palatable to the citizens who pay them. This is something to consider as we weigh the relative advantages of income, consumption, and assets as sources of new tax revenue.

I have already mentioned the idea of eliminating the double deductions on pension income to bolster Japan’s public pension funds. With demographic aging gradually eating away at the Government Pension Investment Fund, this new source of revenue—which we might frame as a special earmarked tax to shore up the pension system—could slow down this erosion and contribute to the system’s sustainability. At the same time, it would promote economic equality and fairness by targeting the pension income of those in higher income brackets. It would forge a link between today’s burden and tomorrow’s benefits by having the wealthiest pensioners pay their fair share to keep the system solvent for future generations. Such earmarked levies may well represent the new face of tax policy in the Reiwa era.

*Over the past decade the Tokyo Foundation for Policy Research has published multiple papers and policy proposals arguing the merits of refundable tax credits. See, for example, Morinobu, “A Rubric for Comprehensive Tax Reform” (2012) and Morinobu, “The False Promise of Reduced Consumption-Tax Rates: A Plea for Targeted Credits” (2016).