- Article

- Tax & Social Security Reform

Tapping into Senior Power: A More Balanced Approach to Fiscal Sustainability

May 1, 2017

An economist and social security expert questions the economic orthodoxy of boosting taxes and cutting benefits as the key to fiscal sustainability in a rapidly graying society.

* * *

To be perfectly honest, I must confess to harboring doubts about the doctrine of “fiscal consolidation” that I myself have been wont to endorse—that is, the need to reduce the deficit to lighten the burden on future generations and, more specifically, to raise the consumption tax to cover the rising costs of social security. I do not deny that Japan is facing a very serious fiscal challenge, one that we certainly cannot hope to solve just by pumping up the economy with public spending and waiting for tax revenues to rise. But I do find myself questioning whether “fiscal consolidation” in the conventional sense is the answer.

Surely the single biggest problem confronting the Japanese economy is the rapid aging of our population, a trend that continues to accelerate as the birthrate falls. Japan’s dilemma boils down to the fact that the number of elderly people is rising as the number of working-age people to support them is falling. At heart, this is a problem of population biology. A society cannot sustain itself unless there is a balance between the dependent part of the population and the productive part that supports the dependents. (In macroeconomic terms, this can be seen as an imbalance between production and consumption.) How can we correct this imbalance? An intuitively obvious solution would be to shift as many people as possible from the dependent category to that of the productive. In the following, I would like to suggest that such a shift is both possible and essential to achieving sustainability.

Fiscal Rehabilitation Misses the Point

Confronted with massive public debt and the prospect of ever-increasing government outlays for social security as our population ages, many analysts have, quite naturally, stressed the need for higher taxes and social insurance premiums to cover costs and reduce the fiscal deficit. Of course, from a short-term viewpoint, higher taxes and premiums will help reduce the deficit. But what then?

In Japan, we have tended to resist raising taxes and social insurance premiums to finance government services directly. Instead, we have chosen to place our surplus earnings in savings accounts and have the banks use those savings to buy government bonds. This, of course, has led to deficit spending and growing public debt, which places the burden on generations to come. To rehabilitate government finances, we are told, we need to shift from this indirect spend-and-borrow mode of financing government services to the more direct tax-and-spend approach. Unfortunately, there is no proof that the latter method is inherently superior. No one can say with confidence that fiscal consolidation via higher taxes on the current generation will strengthen our economy or make the world a better place to live in.

The other basic approach to restoring fiscal health is to cut spending on social security benefits and other government services. I agree that no effort should be spared to trim waste and use our limited resources as effectively as possible. But reducing social security spending appreciably would require substantial cuts in benefits. In fact, even now government policymakers have begun deliberating a proposal to restrict nursing care benefits under Japan’s Long-term Care Insurance system to those requiring services at “care level 3” or above.

Such a drastic cut in benefits would certainly reduce government expenditures on long-term care. But how would it correct our fundamental imbalance? What happens to the families of elderly people in need of care? If government benefits are cut off, they will have no choice but to shoulder the burden themselves. Seniors with no families to depend on will have to fend for themselves. A switch from dependence on government outlays to dependence on private funds will not improve people’s living standards or quality of life. However one tinkers with the social insurance and welfare system, those who require support will still require it.

Untapped Potential

If fiscal consolidation cannot solve our dilemma, must we abandon all hope? Not in the least. I believe our society has a vast reservoir of untapped capacity for dealing with this problem.

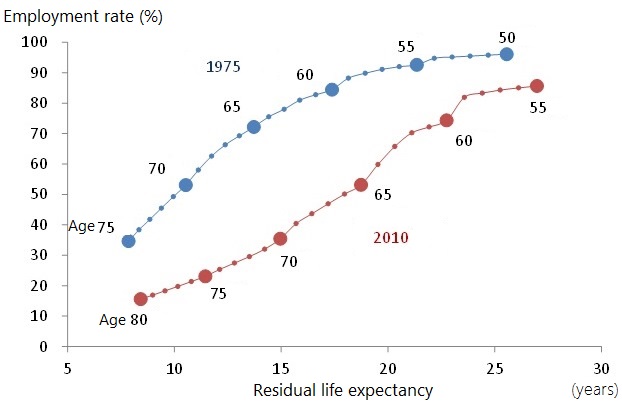

The graph below plots the residual life expectancy (RLE) of older Japanese men against employment rates at two points in time, 1975 and 2010. RLE is a calculation of the mean number of years of life remaining for a group of people of a given age, using the most recent census data. It is commonly used to summarize the current health status of a population. In the chart below, we see that both the 1975 curve and the 2010 curve rise from lower left to upper right, indicating a positive correlation between RLE and the employment rate. This is to be expected, inasmuch as younger people (with longer RLEs) are generally healthier and thus more likely to work. However, by 2010, the entire curve has shifted substantially to the lower right, revealing that people of roughly the same RLE (health status) are less likely to be working than in the past. To me, this speaks of considerable untapped capacity to solve our social and fiscal dilemma.

Residual Life Expectancy and Employment in Japan, 1955 and 2010 (men)

To illustrate, if one draws a vertical line straight up from the point corresponding to age 65 on the 2010 curve, one arrives at a point somewhere between 57 and 58 on the 1975 curve. This suggests that the average 65-year-old in 2010 had more or less the same health status as the average 57- or 58-year-old did in 1975. And yet, the employment rate for 65-year-olds in 2010 is 36 percentage points lower.

Of course, this is not in itself a bad thing. It tells us that our social security system—specifically, our universal health insurance and pension coverage—has been a success in the sense of permitting people to stay healthier longer and to enjoy a relatively carefree old age. But might we not have taken things a bit too far, given the fiscal plight in which we find ourselves? The truth is that a large chunk of our older population has the capacity to be productive yet remains stuck in the “dependent” category. It seems a great waste of resources.

Work-Style Reforms that Tap Senior Power

The “work-style reform” plan recently released by the government of Prime Minister Shinzo Abe gives lip service to more active participation by seniors in the workforce. But the government seems unwilling to take decisive action to that end. The reasons are not hard to identify. The business community is dead set against raising the retirement age, and a hike in the eligibility age for public pension benefits would involve a large expenditure of political capital.

In addition, significantly increasing workforce participation by seniors would entail a wholesale revamping of Japan’s long-term employment practices and wage structures. We need to tackle the larger challenge of shifting from the current membership-based model of regular employment to a job-based model if we are to open up meaningful job opportunities for citizens in their late sixties. Tapping into senior power will require a much more sweeping approach to work-style reform than the government has chosen to contemplate thus far.

The demographic forces bearing down on our society and economy are biological and inexorable. The traditional tools of fiscal consolidation—painful as they are—are unequal to these forces. What we need is wholesale work-style reform to shift as much of the dependent population as possible into the working population.