Japanese agriculture is in a dire state, and misguided agricultural policies are partly to blame, states Senior Fellow Yutaka Harada. He sees promise, though, in that some sectors have demonstrated potential for growth even under such circumstances. Japan’s participation in the TPP should benefit many farming households, inasmuch as their income is reliant on a healthy economy as a whole.

Introduction*

Many Japanese industries are perceived to be strong, active, and competitive in the global market, but agriculture is usually considered an exception. For years, the farm sector has sought protection from international competition, subsidies, and favorable government treatment, and it has been largely successful in getting them until now. In spite of these privileges, Japanese agriculture is in a perilous state, and most farmers oppose any movements toward free trade.

Japan has free trade agreements (FTAs) and economic partnership agreements (EPAs) with many countries, but their ratios of trade liberalization are low—around 85% or 86%—with the unliberalized items basically being agricultural products. [1]

Japan decided to join the negotiations for the Trans-Pacific Partnership (TPP) in March 2013 and has been participating in the talks since July 2013. For the TPP, the United States and other member countries are believed to be seeking liberalization ratios of 96% or higher. [2]

The Japanese government is believed to be interested in protecting rice, wheat, beef and pork, milk products, and sugar, but if it protects them all, the liberalization ratio will only be around 90%. [3] This would mean that the goal of the TPP—to achieve high-level trade liberalization—will not be realized.

The Japanese government is now reportedly trying to persuade powerful agriculture lobbies to accept liberalization in exchange for new subsidies. The main lobbies, the Japan Agricultural Cooperatives, actively opposed joining the TPP negotiations until March 2013 and are now trying to reduce the liberalization ratio and to get more subsidies by arguing that Japanese agriculture has been seriously damaged and that Japan’s food self-sufficiency rate has drastically declined.

This paper will examine whether the arguments advanced by the agricultural lobbies are legitimate or not. I will first explain the dire state of Japanese agriculture. Second, I will illustrate that even under such circumstances there are some areas with potential for growth. Third, I will show how Japan’s agricultural policies have hindered the sector’s development. Fourth, I will propose alternative policies that should better promote its development. Fifth, I will explain that Japanese farming households already depend on sectors of the economy other than agriculture and that their income will not stabilize even if agriculture is protected; it will thus be important that the Japanese economy as a whole prospers. Finally, I will offer a conclusion.

The State of Japanese Agriculture

The annual value added in Japan’s agriculture sector is 4.6 trillion yen (about 46 billion dollars). Agricultural imports are 5.8 trillion yen, sales total 8.2 trillion yen, [4] and the agricultural budget (which can be thought of farm subsidies) is 2.2 trillion yen. [5] Domestic prices of agricultural products are 1.516 times higher than the international average, according to the OECD, [6] which can be likened to 51.6% tariff protection.

At a glance, the situation seems absurd. Agricultural consumption in Japan is 10.4 trillion yen (4.6 trillion yen in domestic production + 5.8 trillion yen in imports). Domestic farmers thus meet only 44% of total consumption, despite receiving 2.2 trillion yen in subsidies and benefitting from 51.6% tariff protection. The domestic value added would be only 3.0 trillion yen (4.6 trillion yen / 1.516), moreover, if calculated using international prices. Subtracting the 2.2 trillion yen in subsidies from this amount would then leave only 0.8 trillion yen in real value added by domestic producers—equivalent to just 0.17% of Japan’s 470 trillion yen GDP.

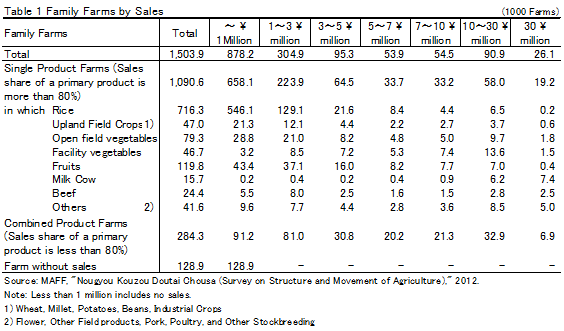

The plight of domestic agriculture can also be seen when we look at individual farming families. According to the Ministry of Agriculture, Forestry and Fisheries, the farming population in Japan is 2.53 million, and there are 1.50 million farms, but their agricultural sales are only 500,000 yen (approximately 5,000 dollars) on average. And as shown in Table 1, among the 1.50 million farms, 878,000 claim sales of less than 1 million yen per year; the average household income in Japan, incidentally, is 5.48 million yen. [7]

The number of family-owned farms ringing up annual sales of more than 7 million yen is just 171,500 (the sum of the three right-hand figures in the first row of Table 1). Since Japan’s average household income is 5.48 million yen, sales of 7 million yen may not be a lot, but it is a level at which a family can afford to be engaged in farming on a full-time basis. This means that there are only 171,500 full-time farming households, and the rest are farming only on a part-time basis.

The average age of famers is 65.8 years old, and the ratio of 65-and-over workers to the total agricultural population is 61.8%. Fields and rice paddies that have been abandoned and are no longer cultivated total 400,000 hectares (Japan’s arable land is 4.5 million hectares), while another 1,100,000 hectares lie unused owing to the government’s gentan policy of reducing rice cultivation acreage. Japanese agriculture is in a state of collapse. One is led to conclude that Japan’s agriculture and agricultural policies are extremely inefficient and peculiar.

Potential for Growth

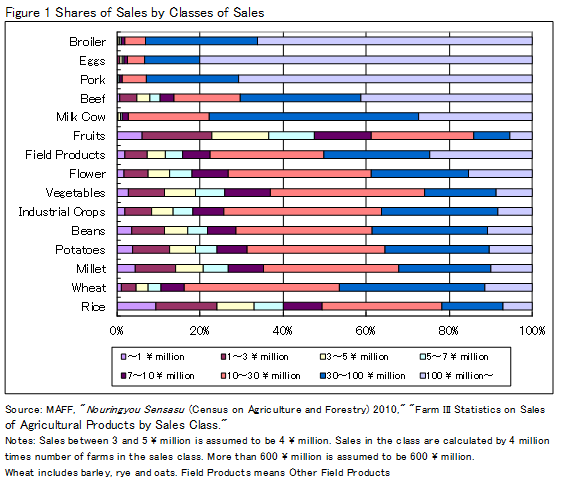

Despite these dire conditions, there are some areas with potential for growth in Japanese agriculture. Figure 1 shows the shares of sales by scale of farm. In the case of broilers (chicken), farms with sales of more than 10 million yen (100,000 dollars) accounted for 98% of total sales. Similarly, the shares claimed by farms with sales of more than 10 million yen were 97% or higher for eggs, pork, and milk cows.

By contrast, the shares were 39%, 51%, and 63%, respectively, for fruits, rice, and vegetables. Relatively low shares were also seen for beef, wheat, flowers, beans, and potatoes.

The figures suggest that large farms were dominant for those agricultural products—like broilers, eggs, pork, and milk cows—that lend themselves to large-scale production. There is less economy of scale for fruits, vegetables, and flowers, and the means of working around such disadvantages—such as using foreign workers or hiring workers only during the harvest season—are currently unavailable. There are considerable potential economies of scale for rice, wheat, beans, and potatoes, but such potential is not realized at present.

Wrong Policies

Why has Japanese agriculture been unable to develop? One possible culprit is government policy that has discouraged farmers from taking advantage of economies of scale.

For example, agricultural cooperatives sell seeds, seedlings, pesticides, and fertilizers in small sizes and lots, provide financing for agricultural machines, and purchase the harvested products. In short, it is thanks to Japan’s agricultural policy and the availability of such services that farming can be performed on a part-time basis.

Additionally, pooling a number of lots to achieve economies of scale and decrease production costs is difficult because farmers are reluctant to lend their land. This has to do with the fact that Japanese farmland, if certain conditions are met, can be converted to other uses. Once converted, houses, supermarkets, and infrastructure—such as roads, railroads, and public facilities—may be built on the farmland, pushing up land prices tenfold or more. Another reason for the reluctance is that tenant rights are strongly protected in Japan.

MAFF has sought to concentrate farmland by providing subsidies to land owners, but enticing them to lend, when they might get a much higher price by converting the land for other uses, would require too much money. Such a policy would also be problematic from the viewpoint of ensuring equity between land owners and people without land.

Instead of providing subsidies, MAFF should increase the landholding tax. The real estate tax on farmland is currently very cheap, practically zero. This prompts landowners to hold on to their farmland even if they do not farm, waiting for market values to rise before selling it. If the real estate tax is raised at the same time that tenant rights are weakened, lending would become a more attractive option, and landowners might become more willing to lend.

MAFF should also stop its gentan policy of reducing the acreage under rice cultivation. Farmland concentration would be hindered if farmers have to reduce their acreage. It is contradictory for MAFF to argue that agriculture must be protected to increase the food self-sufficiency rate while at the same time guiding domestic production lower with its acreage reduction policy.

If the real estate tax on farmland is raised, tenant rights are weakened, and the policy of reducing acreage under cultivation is abolished, there is no question that farmland would become more concentrated. As mentioned above, there are only 171,500 farmers in Japan who sell more than 7 million yen of agricultural produce each year. With total farmland in Japan being 4.5 million hectares, the size of the average farm is about 26 hectares.

This is less than one-sixth the US average of 160 hectares. Large-scale farming is not always suitable for vegetables and flowers, while poultry, pork, and beef production is not land-intensive. This suggests that rice fields would be slightly larger than average, probably in excess of 30 hectares.

According to MAFF, the cost of rice production is 22,185 yen per 60 kilograms for farms between 0.5 and 1 hectare, but 13,086 yen when farms are between 3 and 5 hectares, 11,848 yen for 10 hectare farms, and 11,080 yen for farms of 15 hectares or more. [8] The price of imported high-quality rice produced in California has been estimated to be 9,631 yen per 60 kilograms by Professor Shoichi Ito of Kyushu University. [9] The price differential is thus no longer a crucial issue.

Many Japanese argue that crop production in Japan has a disadvantage compared to such countries as the United States, Canada, and Australia, where land is more abundant, but the important thing is not the area of arable land but the area of arable land per farmer. The area per farmer will increase if the number of farmers decreases. The area is 160 hectares in the United States now, but it was 60 hectares in 1930 [10] —including ranches, where a few cowboys could manage huge areas of land. The increase in the area per farmer is the result of children and grandchildren moving to the cities.

In the case of Japan, the government has tried to keep farmers from moving to the cities and to have them continue farming for political reasons. Japan’s leftist parties are very weak now, but they once presented a formidable opposition force, with the chance that they might take power in the 1970s and early 1980s; indeed, they did take power in several large cities in the 1970s. Rural areas are the power base for the Liberal Democratic Party of Japan, and they tried to keep farmers in those areas and to continue farming, even if the farms were on a small scale.

What Can Be Done?

In order to correct the shortcomings of Japan’s agricultural policy, it is important to have an understanding of MAFF’s distorted system of protection for agricultural products. Tariff rates for flowers are zero, those for vegetables range from 3% to 9%, and those for fruits are between 10% and 20%. By contrast, tariffs are extremely high for konjak (devil’s tongue) potatoes, rice, tapioca starch, butter, sugar, wheat, potato starch, and skimmed milk, being 1700%, 778%, 583%, 360%, 328%, 252%, 234%, and 218%, respectively. Between the two extremes are processed tomatoes, beef, and oranges, which, respectively, are 20%, 38.5%, and 20% (40% during the seasons when mikan , or Japanese tangerines, are harvested). The tariff rate for pork is 4.3% when the import price is under the break-even price of 393 yen per kilogram, while the difference between the import price and break-even price becomes the tariff rate when the import price is higher than the break-even price. As you can easily imagine, many importers falsely claim import prices that are higher than the break-even price, and some of them are caught by custom tax offices.

Why should the tariff rate for konjak—which has very few or no calories—be higher than that for high-calorie potato starch? From a food self-sufficiency viewpoint, these rates make little sense.

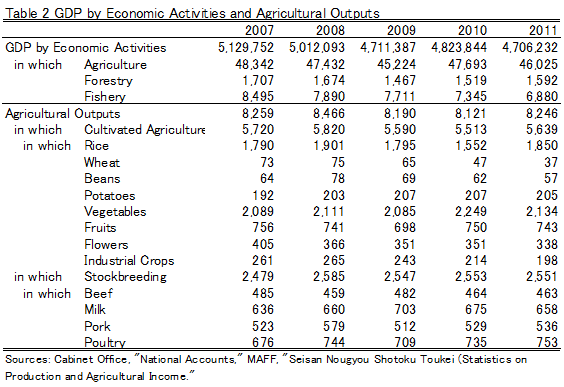

Additionally, many unprotected agricultural sectors have been growing while heavily protected ones have not. As shown in Table 2, sales of vegetables, fruits, and flowers are 2.1 trillion yen, 0.7 trillion yen, and 0.3 trillion yen, respectively. Sales of rice, wheat, and potatoes, meanwhile, are only 1.8 trillion yen, 0.04 trillion yen, and 0.06 trillion yen, with sales in unprotected sectors now being larger than in protected ones. Unprotected sectors are those that can stand on their own feet, increase sales, and make profits, while the protected sectors have been losing sales and continue to depend on protection from the government.

What this suggests is that Japanese agricultural policy has not been working well. MAFF spends a lot of money on agriculture, but the sector has not been growing; independent farmers who do not rely on this chaotic agricultural policy, though, have increased their sales and lowered costs. Some operate large farms, while others, by developing high-quality products, have managed to increase sales despite their small lots. It is individual initiative that is driving the growth of Japanese agriculture, so perhaps the government should stop intervening. Joining the TPP is the first step to eradicating this irrational agricultural policy.

There is a lot of political pressure to change the present policy, but the government can still use the income support system for individual farmers to ease the pressure. Many argue that this system of subsidies to small farms only delays the concentration of arable land, but a large portion of the subsidies goes to big farms. In rice production, for instance, 67% of the subsidies go to farms with annual sales of more than 5 million yen. For almost all other products, 80% are earmarked for relatively large farms. Still, some might criticize that the remaining 20% of the budget going to small farms hinders the expansion of economies of scale, but considering that the MAFF budget has generally been spent so ineffectively, this is a very small amount.

Government finances are very constrained right now, but agriculture in Japan is a small industry. The value of Japan’s agricultural production is only 4.6 trillion yen, with unprotected sectors accounting for approximately 60% of total sales. This means that production in the noncompetitive sector is 40% of the 4.6 trillion yen, or 1.8 trillion yen. Even if the prices of these noncompetitive products decline by half after the TPP comes into effect, the government can still afford to make up the 0.9 trillion yen shortfall in farmers’ revenues with fresh subsidies.

Additionally, while lower prices for agricultural products represent a loss for farmers, they would be a gain for consumers, so Japan as whole would lose nothing. But some would still argue that the government has no money for additional subsidies. I believe that the government can easily squeeze 0.9 trillion yen from its 100 trillion yen annual budget, but there may be a better way to finance such subsidies.

The consumption tax is scheduled to be raised from the present 5% to 8% in April 2014 and to 10% in October 2015. It has been argued that higher taxes should be exempted for daily necessities like food, but if Japan joins the TPP and liberalizes agricultural products, food prices can be expected to decrease, and so there would be no reason to exempt the hike for foodstuffs. Some argue that the consumption tax on food should be exempted for low-income families, but these same people seem strangely unconcerned about having to pay higher food prices to protect farmers.

If an exemption is made for foodstuffs, this would mean a 19% reduction in consumption tax revenues. [11] A 1-percentage-point increase in the consumption tax has been calculated to produce revenues of 2.5% of GDP, that is, about 2.5 trillion yen. Thus, a 2-point hike generates 5 trillion yen; since 19% of 5 trillion yen is 0.95 trillion yen, the government can secure the needed revenues for subsidies to affected farmers with a 2% hike in the consumption tax by simply avoiding an exemption on foods.

Farm Sector Depends on Japan’s Overall Prosperity

MAFF statistics show that there are 1.50 million family-operated farms, but they sell only an average of 500,000 yen’s worth of agricultural products each year, as I mentioned. Farmers in the Edo period may have led self-sufficient lifestyles, but farmers cannot live on such incomes in modern times. They need to sell their produce to purchase products for modern life. (Actually, commercial agriculture is said to have flourished even in the Edo period.)

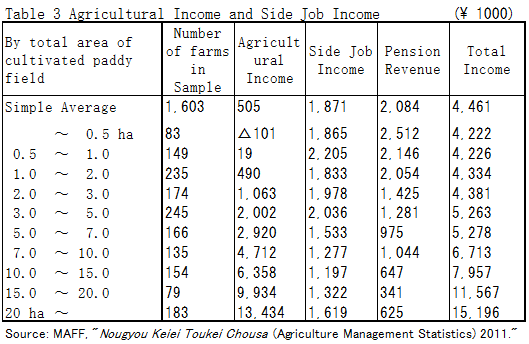

MAFF’s estimates of farmers’ incomes by size of field are summarized in Table 3. The ministry surveyed 1,603 agricultural households about their agricultural and subsidiary incomes and pension revenues. It selected relatively large farms for its sample because it wanted to know the situation of larger farms. Family-operated farms measuring more than 5 hectares account for only 5.5% of the total, [12] but they made up 44.7% of the MAFF sample; in short, the sample is not an accurate reflection of the overall situation, leading to an overestimation of agricultural income, but this is the only available survey of agricultural household incomes.

The table shows that the average agricultural income of Japanese farms is only 0.5 million yen per year. “Agricultural income” means sales minus costs. Half a million yen is only about 5,000 dollars. Obviously, this is not enough to live on in modern-day Japan, even if it is overestimated.

Then, how do they live? The table shows that the average income from side jobs is 1.9 million yen and average pension revenue is 2.1 million yen. Total income, including from agriculture, is 4.5 million yen. This is how they survive.

The average age of Japanese farmers is 65.9 years old, as I mentioned above, so they are more often than not pensioners.

For small farms, the share of pension benefits to total income is quite large. The average pension income for households with farms measuring less than half a hectare is 2.5 million yen, and their agricultural income is minus 0.1 million yen. So, one might say that small farmers are basically pensioners who cultivate their land as a hobby.

The figures suggest that for the average farmer, the most important consideration in making a living is to secure a steady income from a side job and to receive pension benefits. Getting a stable side job will become easier if the Japanese economy is growing, and for this, Japan’s best option would be to open its doors wider to the global market and to seek further trade liberalization.

And what are the most important considerations in receiving pension benefits? Since benefits are paid from the contributions of the working-age population, then it follows that Japan needs to be prosperous with many job opportunities. For this, too, Japan should seek liberalized global trade. In short, Japan needs the TPP to ensure its own prosperity.

Large farms seeking to expand will not be hurt by the TPP, so the trade pact might be effective in rectifying just those aspects of Japan’s agricultural policy that have plagued the country to date.

Inasmuch as the lives of agricultural households also depend on a prosperous Japanese economy as a whole, it is not enough to limit imports of certain products if one is serious about protecting the country’s farmers.

Conclusion

In this paper, I have tried to show that Japanese agriculture is in a perilous state. Despite this, a small number of farms have become big producers claiming a major share of total production. If the government does not hinder their activities, agricultural productivity could rise, and Japanese agriculture can be competitive. In fact, around 60% of the farm sector is already internationally competitive. Misguided agricultural policies have been in place for years aimed at preventing the number of agricultural families from declining, and I have made a number of proposals that could improve the situation. Finally, I noted that the financial stability of many farming households depends on Japan’s overall prosperity. In short, Japan needs the TPP to ensure its own prosperity.

References

Harada, Yutaka, and the Tokyo Foundation. 2013. TPP de sarani tsuyokunaru Nihon (Turning TPP to Japan’s Advantage). Tokyo: PHP Institute.

Yamashita, Kazuhito. 2013. Nihon nogyo o hakai shita no wa dareka (Who Destroyed Japanese Agriculture?). Tokyo: Kodansha.

* This manuscript was prepared for the Chicago Council on Global Affairs conference on ”Frontiers of Economic Integration,” in Chicago, Illinois, on October 29–30, 2013.

[1] See Harada and the Tokyo Foundation (2013), p.18, Charts 2.

[2] Liberalization rates of FTAs between the United States and other countries are higher than 96%. See Harada and the Tokyo Foundation (2013), p.18, Chart 2.

[3] The number of tariff items for rice, wheat, beef and pork, milk products, and sugar (including starch) are, respectively, 58, 109, 100, 188, and 131, or a total of 586 items. In addition, Japan has not liberalized fishery products and plywood (248 items) and footwear and leather products (95 items), bringing the total to 929. The total number of tariff items would be about 9,000, giving a liberalization rate of about 90%. See “TPP jiyukaritsu 90% cho” (TPP Liberalization Rate to Be 90% or Higher),” Nihon Keizai Shimbun , October 4, 2013.

[4] Figures in this section for 2011 and 2012 are from the “Basic Statistics” page of the MAFF website (http://www.maff.go.jp/j/tokei/sihyo/index.html) unless otherwise stated.

[5] MAFF, “Norinsuisan Yosan no Kosshi, Heisei 24 Nendo” (Outline of the MAFF Budget FY 2012), http://www.maff.go.jp/j/budget/2013/pdf/00_01_kettei.pdf.

[6] OECD, Producer Support Estimate by Country, http://stats.oecd.org/Index.aspx?DataSetCode=MON20123_1.

[7] Ministry of Health, Labor, and Welfare, “Kokumin Seikatu Kiso Chosa” (Basic Survey on National Life), 2012.

[8] MAFF, “Nosanbutsu Seisanhi Tokei (Statistics of Agricultural Production Costs),” 2011.

[9] Quoted from Yamashita (2013), p. 236.

[10] US Census Bureau, “Statistical Abstract of the United States, Bicentennial Edition,” various years.

[11] Harada and the Tokyo Foundation (2013), pp. 127–30.

[12] MAFF’s ”Nogyo Kozo Dotai Chosa” (Survey on the Structure and Dynamics of Agriculture), 2013. Sum of Hokkaido and other prefectures in “Keiei Kochi Menseki Kibobetsu Noka Su” (Number of Agricultural Families by Size of Cultivated Field).