Japan’s social security system is too generous, and current benefit levels cannot realistically be maintained. The system was created when Japan enjoyed relatively high growth and aging was not yet a serious problem. Asian countries are now in a situation similar to what Japan faced in the 1960s and 1970s. They are creating very generous social security systems for the aged, but this will not be sustainable and could come back to haunt them in the future. This is something they can prevent, though, by learning from the Japanese example.

Aging in Asian Countries

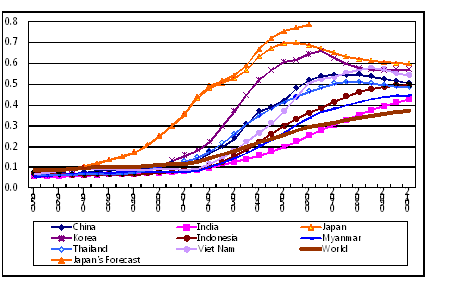

Population aging is a phenomenon seen in almost all Asian countries. Figure 1 shows the age dependency ratio (ratio of the population 65 or over to the population between 15 and 64) in various Asian countries. In 2060, the ratio is projected to be 0.464 in Thailand, 0.508 in Viet Nam, 0.518 in China, 0.643 in Korea, and 0.784 in Japan.

The data was taken from the UN’s “World Population Prospects” except for “Japan’s Forecast,” which came from the National Institute of Population and Social Security Research of Japan’s Ministry of Health, Labor, and Welfare. As the figure shows, the Japanese government’s data projects a higher ratio than the UN data, but both are serious.

Figure 1. Age Dependency Ratios of Asian Countries

What It Will Take to Maintain Benefit Levels

Aging and social security is a very serious issue in Japan. If the government were to use consumption tax revenues to maintain the present level of social security benefits, the rate would have to be raised to anywhere between 70% and 80% by 2060.

This is based on a simple calculation. In 2010, Japan spent 81 trillion yen for social security (pensions, medical treatment, nursing care, etc.) for the aged. This means that Japan spent 2.76 million yen per senior citizen. If this expenditure level is maintained, total social security expenditures would rise with the increase in the number of the aged. Using the future population projections by age group released by the National Institute of Population and Social Security Research, I calculated total social security expenditures by multiplying per capita expenditures by the projected number of the elderly.

Will the economy be able to support such expenditures? I estimated future gross domestic product by multiplying the projected working-age population by the per capita working-age GDP in 2010. Then, I calculated the future ratio of social security expenditures to GDP.

One must, of course, consider productivity increases and inflation, but per capita social security expenditures generally also rise when productivity and prices increase. This is because when productivity increases, real wages tend to increase as well. As prices rise, so do nominal wages. The government, then, needs to increase insurance payments to doctors, nurses, and care workers as well as pension benefits. When the denominator increases, the numerator also increases. So productivity and inflation are not essential factors in the long run.

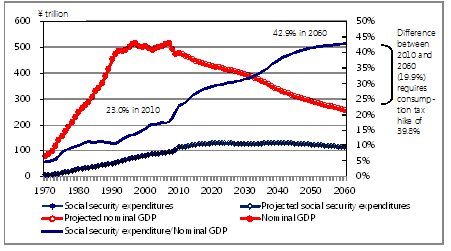

Figure 2 shows the results of these calculations. The ratio of social security expenditures to nominal GDP was 23.0% in 2010, but it is estimated to rise to 42.9% in 2060. This is a 19.9-percentage-point jump in social security expenditures. A 1% hike in the consumption tax produces revenues equivalent to 0.5% of GDP. Financing a 19.9-point jump would thus require an additional 39.8% rise in the consumption tax.

This is not the end of the story. Until today, the aged did not bear a full burden of social welfare costs. In 1989, when the consumption tax was introduced, and in 1997, when the rate was raised from 3% to 5%, pension benefits were also raised to offset the higher costs for pensioners. This effectively meant that those living on pensions did not have to bear the burden of the tax hike; it was borne by the rest of the population. Since working-age people will make up only 60.1% of the population in 2060, the 39.8% hike in the consumption tax rate will need to be divided by 0.601, resulting in an equivalent of a 66% increase for people not receiving pensions. The consumption tax rate in 2060, therefore, will be the current 5%, plus 66%, plus the 5% hike that was recently enacted to defray rising social security costs, resulting in a total of 76%.

Figure 2. Projections of Social Security Expenditures and GDP

Note: Social security expenditures in 2010 were estimated from the social security budget of the Ministry of Health, Labor and Welfare. Projections of social security expenditures were made as follows: Social security expenditures were divided into medical care, pensions, and others in the Social Expenditure Database. Medical expenditures were divided by age group in accordance with the MHLW’s "Estimates of National Medical Care Expenditure." Future medical expenditures were estimated by age group by multiplying the projected populations for each age group. Future pensions were estimated using projections of the 65-and-over population. Others were estimated by the projected growth of the total population.

Obviously, a 70% or 80% consumption tax would be impossible. So social security expenditures would inevitably have to be cut, but politicians are reluctant to see this “inconvenient truth.” Instead, they want to believe that a small increase in the consumption tax would solve the problem. This was the gist of the Diet debate over a bill to raise the consumption tax hike by 5%. In the very near future, however, they will find that a 5% or even 10% rise would hardly be enough.

Future Tax Rates

The “inconvenient truth” is the product of an overly generous social security system created in the past. Why was such a system built? For answers, we will have to take a look at the past.

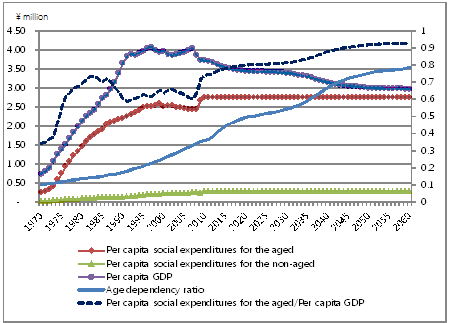

The Figure 3 shows social security expenditures for the aged, for the non-aged, as per capita GDP, and the age dependency the ratio. In 1970, the ratio of social security expenditures per elderly person to per capita GDP was only 34.3%, but this more than doubled to 74.1% in 2010. Such a high percentage suggests that social security benefits for the elderly are overly generous.

Additionally, the figure shows that social security expenditures for the non-aged have hardly increased at all. The ratio of social security expenditure for the non-aged to per capita GDP was 2.4% in 1970 and was still hovering around 7.7% in 2010. This indicates that Japan’s social security expenditures have largely been made for the elderly.

Figure 3. Projections of Social Security Expenditures

At the same time, the age dependency ratio increased from 0.102 in 1970 to 0.361 in 2010, and consequently the ratio of per capita social security expenditures for the aged to per capita GDP increased by 34.9 points, from 34.3% in 1970 to 69.2% in 1980.

Recognizing this problem, the Japanese government has been trying to reduce this percentage since the early 1980s. After climbing to 73.6% in 1983, it fell to 60.3% in 2007—a drop of 13.3 points. It made a noticeable jump in 2009, though, so the government obviously needs to do more. One way of meeting rising social security costs is to increase the consumption tax, and the government did recently succeed in passing a tax hike bill. But this will not solve the problem, since the rates needed to meet projected costs will be unrealistic. The government will have no choice but to cut expenditures.

The decline in the ratio through 2008 was, I believe, a reflection of government policy. Some might argue that a bigger factor was an increase in nominal and real GDP, but I do not think this is correct. It is true that both the late 1980s and the 2003–07 period were boom years, but with the rise in revenues, pressure mounted to expand the budget. It was against these pressures that politicians in both periods reduced the ratio.

The highest reasonable rate for the consumption tax would probably be around 20%. To meet social security expenditures with this rate, the government would have to cut spending by 30% from 2.76 million yen per aged person. Total social security expenditures would then fall to 1.91 million yen, the level in 1985, and the projected ratio of social security expenditures to nominal GDP in 2060 would become 30%—only 7 points higher than the 23% in 2010. Since a 1% hike in the consumption tax produces revenues equivalent to 0.5% of GDP, as noted above, financing a 7-point increase in expenses would require a 14% hike. Assuming that the aged are asked this time to bear the burden of the higher rate—allowing the government to cut other expenses to reduce the budget deficit—the higher expenses could realistically be covered with a 20% consumption tax: the current 5% plus a 14% hike and an additional 1% to allow for leeway.

Lessons for Asia

The source of Japan’s skyrocketing social security costs was created in the 1970s. At that time, while the high-growth era had come to an end, Japan’s growth rate was still higher than those of other developed countries. The age dependency ratio was as yet relatively low, allowing Japan to increase social security expenditures. This is a lesson from which Asian countries can learn. Many are now trying to create overall social security systems, while growth rates are high and aging is not yet a serious issue. They can therefore afford to create generous social security systems for the aged. They must realize, though, that this will not be sustainable over the long run and that such a system could come back to haunt them in the future.