These days everyone seems to be weighing in on government plans for post-disaster reconstruction, yet for some reason the discussion has failed to address a number of crucial points concerning the economics of recovery. In the following, I attempt to clear the air by asking and answering five key questions.

1. Will it really take that much money?

In a statement issued March 23, 2011, the Cabinet Office tentatively valued the loss of tangible assets from the Great East Japan Earthquake at between 16 trillion and 25 trillion yen. It seems to me, however, that the price tag for reconstruction should be considerably lower.

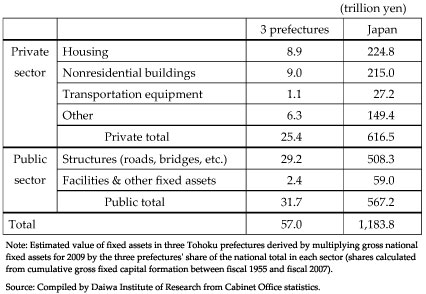

The accompanying table shows the estimated capital stock of the three hardest-hit prefectures in the Tohoku district (Iwate, Miyagi, and Fukushima) as of the end of 2009.

Pre-Quake Capital Stock in Iwate, Miyagi, and Fukushima Prefectures (year-end 2009)

Capital stock in the three prefectures prior to the March 11 earthquake and tsunami is estimated at 57 trillion yen. In a region with a population of 57.1 million and with 2.37 million housing units ( Housing and Land Survey , 2008, Ministry of Internal Affairs and Communications), the disaster resulted in 157,122 victims—including 14,622 dead, 11,019 missing, and 127,076 displaced—and damaged or destroyed 366,731 buildings (National Police Agency Emergency Disaster Headquarters figures, April 30, 2011).

Physical damage from the quake and tsunami has been estimated at 10%–20% of the region's total fixed assets (57 trillion yen). If we take the upper figure, 20%, this yields losses of 5 trillion yen in the private sector and 6 trillion yen in the public sector. Even if the government were to cover half of private-sector losses, it would need to spend only 2.5 trillion yen for the private-sector losses in addition to the 6 trillion yen in public-sector losses, yielding a total recovery cost of 8.5 trillion yen. (Costs will be higher, though, if damage from the Fukushima nuclear accident is included.)

There are two closely interrelated reasons for inflated reconstruction costs: inefficient use of funds and over-reliance on public works. To illustrate the first point, I need only cite some of the (impracticable) schemes that are already being floated—rebuilding shopping districts that were largely shuttered before the tsunami hit; removing the tops of mountains to create high ground for new housing; and building super-high tsunami walls off the coast.

Supporters of such projects point to Japan's shortage of usable land. But like most rural areas of the country, the Tohoku district has been plagued by demographic aging and depopulation over the years. As a result, abandoned farmland and empty farmhouses abound just a few kilometers inland from the ravaged coast. They can be offered to displaced victims quickly, at low cost, and without destroying the natural environment. For workers in the fishing industry, this would mean commuting to the coast by car; but those relocating to high ground would have to drive to work anyway; it might take slightly longer from an inland farm, but a few more kilometers for such a commute would make little difference. The real issue, according to some sources, is that the villagers want to be able to see their boats from their homes.

Another inefficient use of public funds is the construction of tens of thousands of temporary homes for the evacuees. Winters are cold and snowy in northern Japan, so a single 32-square-meter unit capable of withstanding the elements costs close to 5 million yen. Under the circumstances, might it not be cheaper just to offer each displaced household a subsidy for the down-payment on a new home? Providing people with permanent places to live gives them hope for the future and helps them resume normal, productive lives. Furthermore, the construction of all those new homes would provide a huge boost to industry in northern Japan and create thousands of jobs—jobs that displaced farmers and fishermen could fill in many instances. Of course, construction of permanent housing takes time, and fairness must be ensured. To this end, the government could also extend grants to those who put up friends or relatives for a certain period of time, say two years. Instead of making temporary housing available all at once, people can then take their time building their own homes.

The foregoing helps illustrate why financing reconstruction solely through public investment results in higher costs. Traditionally, the Japanese government has made it a rule not to use tax money to pay for the recovery of personal property, such as private housing. While there is a certain logic to this principle, it makes little sense to insist on it if this results in higher expenditures. And the fact is that direct assistance to help people recover their personal assets is likely to end up costing the government and the taxpayers less.

2. What are the goals?

The basic goal of post-disaster reconstruction should be a return to normal living and working conditions for the residents. At the most basic level, this means homes and jobs. We have touched on housing; now let us consider jobs.

Returning the Tohoku district to normalcy means rebuilding the industrial base that provides jobs and income. The industrial base of this district long consisted of agriculture, fishing, and tourism, but since the second half of the 1990s, an important additional source of jobs has been created through investment in factories that supply parts for the automotive and electronics industries. Post-disaster reconstruction means rebuilding both the new and the old industries.

To revive the electronics and automotive parts industries, the government can rely on the big manufacturers, supporting the effort by assisting subcontracting firms as needed. Rebuilding the farming and fishing industries is a more complicated matter.

The fishing industry is supported not merely by the people who catch the fish but also by those working on and around the docks, at the fish market (including those catering to tourists), and at fish-processing facilities. To revive the industry, these people must agree on a common goal and cooperate to achieve it. This is a delicate process—since many older residents will be unable to make a significant contribute if they are placed in completely unfamiliar surroundings—and not something the government can orchestrate from Tokyo. But the government can give it a boost by providing individuals with the basic means to rebuild.

Given the means to buy new boats and homes, the people who make up the core of the fishing industry will do whatever else it takes to rebuild their lives and communities, and their determination will inspire others with the confidence and motivation to rebuild as well.

Fishermen, for instance, have skills that give them value as human capital: They know how to navigate fishing boats, choose the time and place to fish, haul in their catch, and keep the fish fresh until it they get it to market. However, without physical capital in the form of fishing boats, this human capital is wasted. So the most cost-effective way for the government to support the recovery of the fishing industry is to empower the people who work in it to recover their personal property.

If, on the other hand, the government insists on not assisting the recovery of personal property, the only alternative would be to provide new sources of income and jobs through massive and costly public works projects. Would a departure from this rule not be justified if it meant accomplishing recovery more efficiently and at lower cost to the taxpayer?

The truth is that the government has been moving in that direction for some time now. In the wake of the January 1995 Great Hanshin Earthquake, the government broke with precedent by providing direct financial assistance to those whose homes had been damaged or destroyed. Later the Act on Support for Livelihood Recovery of Disaster Victims instituted subsidies of up to 3 million yen per household for those who lose their home in a disaster. To cope with the March 11 disaster, the government now plans to increase those subsidies. In addition, it intends to reduce the burden of double mortgage payments for victims who want to buy a new home while paying off the mortgage on their destroyed home; raise to 4 million yen the maximum amount a person can retain in cash or bank deposits when filing for bankruptcy (according to March 31 newspaper reports); and provide debt relief to disaster-hit businesses with government loans ( Nihon Keizai Shimbun , April 5). The opposition Liberal Democratic Party is unlikely to resist these measures. In short, many administrators and politicians have already come to the realization that providing assistance to individual disaster victims is a more efficient use of public funds than public works.

3. How should we fund it?

A basic principle of public finance is that long-term spending increases should be covered by tax increases, while temporary expenditures can be met by issuing government bonds. Raising funds for temporary expenditures through bond issues encourages efficient spending, while establishing a permanent new revenue source by raising taxes increases the likelihood of wasteful spending. Since the post-quake reconstruction qualifies as a temporary expenditure, there should be no objection to financing it with government bonds.

Moreover, assuming that the total cost of reconstruction is 8.5 trillion yen, even if Japan were to experience a comparable disaster every 15 years, the annual cost would still amount to only 600 billion yen—scarcely enough to merit a permanent tax increase.

Furthermore, if the funds are used efficiently, the fiscal multiplier—that is, the ratio of additional GDP generated to additional government spending—should be substantial. Spending to repair or rebuild roads, for example, will have a dramatic effect on production, since factories are unlikely to resume production unless there are passable roads for transporting what they produce. Under the circumstances, every 100 million yen spent repairing roads is likely to yield several times that amount in increased production. In other words, the long-run multiplier effect of government spending on roads could be as high as 5 or even 10.

But what about concerns over the national debt? Japan's cumulative debt as of the end of fiscal year 2010 was 637 trillion yen, while its nominal GDP in fiscal 2010 was 474 trillion yen—a debt-to-GDP ratio of 134.4 %. Let us suppose that the government issues 10 trillion yen in bonds to finance a recovery program. The bond issue causes the debt to rise to 647 trillion yen. On the other hand, the government spending boosts the GDP. Assuming the multiplier is 1, then GDP rises to 484 trillion yen, and the resulting debt-to-GDP ratio is 133.7%—an improvement, albeit a minimal one. The higher the multiplier, the greater the drop in debt-to-GDP ratio.

Now, some will doubtless wonder how Japan's debt-to-GDP ratio ever got as high as it is if the ratio falls even when the fiscal multiplier is only 1. There are two ways to explain this. The first is that the fiscal multiplier has in fact been less than 1 over the long run, indicating that use of public funds has been inefficient. This is not hard to imagine. If the government were to spend funds to restore shuttered shopping strips to their pre-quake state, for example, the costs of construction would add to that year's GDP, but the growth effect would stop after that, and the long-run multiplier would be less than 1. On the other hand, if the same amount of money were used to restore roads, making it possible for factories to resume production, the contribution to GDP would include not merely construction costs but also the volume of factory production—a contribution that would continue year after year.

Another explanation for the ballooning debt is offered by the Mundell-Fleming model. Under this model, when government expenditures increase under a system of floating exchange rates (which is what we have now), interest rates rise relative to those of other countries, causing capital to flow in, which strengthens the local currency. A stronger local currency leads to a drop in net exports, which cancels out the positive effect of government spending. This means that government spending does not lead to higher GDP unless accompanied by an expansionary monetary policy.

In either case, it follows that government must use public funds efficiently and loosen credit at the same time. Higher taxes, on the other hand, would create new, permanent sources of revenue that could lead to wasteful infrastructure investments.

4. Do we need a central agency to plan reconstruction?

Some people are of the opinion that a new agency should be set up within the government to plan and oversee post-quake reconstruction. It is true that the Imperial Capital Reconstruction Agency—formed and headed by Home Minister Shinpei Goto, a highly able statesman—successfully oversaw Tokyo's reconstruction following the Great Kanto Earthquake of 1923. But that does not mean that a comparable agency would be a good idea today.

Recovery from the Great Kanto Earthquake centered on Tokyo, the nation's capital. There was no doubt regarding Tokyo's potential to develop and emerge as a world-class modern city. But its infrastructure was woefully inadequate. The Imperial Capital Reconstruction Agency's task, therefore, was not merely to rebuild the city but also to equip it with the modern urban infrastructure it lacked. The officials and staff of the agency, from Goto on down, all lived in the city they were rebuilding, and the key planners were experts who understood Tokyo and its requirements as the Japanese capital far better than ordinary residents did. Under these special circumstances, top-down centralized planning by a small, elite group functioned effectively.

The situation today is very different. The region hit by the March 11 disaster is scarcely an area with high growth potential and inadequate infrastructure; in fact, its population has been aging and dwindling for years. And people in Tokyo are not in a better position to know how reconstruction should proceed.

The idea of creating a separate, centralized administrative organ to take charge of reconstruction is predicated on two fallacies: the notion that reconstruction requires intensive investment in large-scale projects, and the idea that a Tokyo-based group of experts is best qualified to plan Tohoku's reconstruction. In fact, such a group would have little idea how to proceed. We have already seen that intensive spending on big-ticket public-works projects may not be the most cost-effective way of helping people get back on their feet.

Indeed, centralized planning agencies of this sort are all too apt to draft grandiose civil engineering schemes—such as projects to remove mountaintops to create new tableland, use the rubble as landfill to create more high ground, and relocate whole communities to these artificial plateaus.

Shearing off the top 100 or so meters of a mountain and building up high land from the rubble is a monumental project. Furthermore, while hills built from landfills may have the advantage of height, they are inherently unstable. Many communities built on reclaimed land in the relatively gentle hills around Sendai were destroyed by landslides in the recent earthquake. Meanwhile, the cost of building homes on the rugged mountains of the Sanriku district could amount to several hundred thousand yen per square meter—and this in an area where a square meter of typical residential land sells for about 15,000 yen. This is scarcely a prudent investment.

The basic role of any reconstruction authority should be that of designing a system for the restoration of Tohoku's assets equitably and overseeing that system to ensure that it operates as designed. Surely this role can be performed by existing administrative organs.

5. How can we replace nuclear power?

One major reason for the slow recovery from the March 11 disaster is the accident at the Fukushima Daiichi Nuclear Power Station. I do not claim great expertise in the field of nuclear power, but I do believe people are fundamentally misguided when they call for drastic cuts in energy consumption and use of alternative energy as replacements for nuclear power.

The way to provide the power we need is to build conventional thermoelectric power plants. Yes, this will lead to an increase in carbon dioxide emissions. But Japan is responsible for only 4% of the world's CO 2 emissions. If we replaced our nuclear plants with conventional thermoelectric power facilities, our share would rise to 5%, and global emissions and fossil fuel consumption would rise 1%. This can be covered through reductions in other countries, with Japan providing technologies to enhance the energy efficiency of those countries with high CO 2 emissions. This, from Japan's perspective, would be the most cost-efficient way of reducing greenhouse gas emissions.

Switching from nuclear energy to fossil fuels might increase energy costs, but probably by less than people suppose. According to the March 2004 issue of the Genshiryoku hatsuden shikiho (Nuclear Power Quarterly), an industry publication, the cost of generating one kilowatt-hour of electricity with liquefied natural gas is only slightly higher than the cost of nuclear power, 6.3 yen as opposed to 5.3 yen (although recent increases in the price of LNG have probably increased the differential). Moreover, some have questioned these figures, citing dubious assumptions concerning capacity utilization rates and a failure to factor in the costs associated with the decommissioning of reactors, the reprocessing of spent fuel, incentives paid to local governments and communities, distribution, and pumped storage for load balancing, not to mention the budgets of Japan's nuclear regulatory bodies.

It seems to me that if nuclear power were as cheap as the industry claims, then the power companies would not have hesitated to invest in safety measures that would have prevented the Fukushima accident. While the plant itself cannot be moved, say, 20 meters higher, it should have been possible to situate crucial electric generators and pumps on higher ground, place critical equipment in waterproof buildings, and build ample freshwater storage tanks—all for not more than several billion yen.

Conclusions

1. Projected reconstruction costs are too high

The cost of recovery and reconstruction from the March 11 disaster should be no more than 8.5 trillion yen. The reasons for inflated costs are inefficient use of funds and over-reliance on public investment.

2. Supporting recovery of personal assets is an efficient use of reconstruction funds

Rebuilding from the Great East Japan Earthquake means restoring the industries that provide jobs and income. In the case of the fishing industry, the most cost-efficient way to do this is to support the restoration of lost personal property. It will cost far more to maintain income through public works.

3. Public bond issues are a legitimate way to fund the recovery

Since post-disaster reconstruction is a one-time expense, it is acceptable to finance it with government bonds. This will increase Japan's national debt, but if reconstruction funds are used efficiently, the debt-to-GDP ratio will fall.

4. A central reconstruction agency is a bad idea

No central government agency can adequately grasp the situation on the ground in Tohoku. Furthermore, central planning authorities are apt to embrace overly ambitious and costly reconstruction plans. The job of the reconstruction authority should be creating and overseeing a system for restoring personal assets lost in the disaster, and this role can be performed by existing agencies.

5. Replace nuclear energy with fossil fuels

The best way to make up for the loss of nuclear power in Japan is not to conserve energy or to use alternative energy sources but to build thermoelectric power plants that burn fossil fuels. Replacing nuclear energy with fossil fuels will only increase total global emissions by 1%, which can be covered by providing energy-saving technologies to countries with low energy efficiency.