In the latest World Economic Outlook, released on September 20, the International Monetary Fund revised its previous forecast for the Chinese economy downward. The new estimate for 2011 is 9.5%, marginally lower than the June estimate of 9.6%. The change in the 2012 forecast was more significant: down to 9.0% from the earlier prediction of 9.5%.

In fact, growth in China's gross domestic product has been declining for three consecutive quarters. While GDP grew at an annual rate of 9.7% in the first three months of 2011, the rate eased to 9.5% in the second quarter and to 9.1% in the third.

Any major decline in China's growth rate would be a serious blow to the struggling world economy. In the following, I attempt to assess the risk of such a slowdown between mid-2011 and the end of 2012 by examining trends on the demands side, namely, consumption, investment, and exports.

Consumption

In the first eight months of 2011, China's personal consumption grew at a fairly steady clip, maintaining year-on-year increases in the vicinity of 17%.

Growth in Personal Consumption, 2011 (year-on-year percent change)

The consumer price index had been on an upward trajectory as well, but after hitting 6.5% in July, the inflation rate fell to 6.1% in September. Most experts seem to be echoing the assessment of Jing Ulrich, head of China equities at JP Morgan, that inflation has crested. [1]

Notwithstanding these positive signs, flagging demand for big-ticket items could be cause for concern. In April, following the expiration of the government's incentives for vehicle purchases, year-on-year growth in auto sales dipped into negative territory for the first time in 27 months, according to the China Association of Automobile Manufacturers. In August, sales were up again, but only by 4.2%, and for the period from January though August growth was only 3.3%. After surging 32% in 2010, auto sales have essentially plateaued.

This situation seems likely to continue at least through the second half of 2011, dimming prospects for stronger growth in personal consumption.

Investment

Investment in fixed assets continues to act as a powerful growth engine for the Chinese economy. Fixed investment has continued to grow at an especially fast pace in the manufacturing and real estate sectors—which account for more than half of all fixed investment.

Growth in Fixed Investment, 2011 (year-on-year percent change)

But there are signs that the government's continued clampdown on the real estate market is dampening investment growth. The building materials industry is already showing signs of a slowdown in the form of falling prices and rising inventories. In the third week of September (September 13–16), total inventory for building materials in China's major cities rose to 6.979 million tons, up 204,700 tons from the previous week. It was the fourth consecutive week of inventory growth. [2]

Another concern is the tough environment facing small and medium enterprises. At a business forum sponsored by the Chinese government on September 16, Gu Shengzu, a member of the Chinese National People's Congress Standing Committee and vice-chairman of the Democratic National Construction Association Central Committee, testified that 60%–70% of China's SMEs are facing serious difficulties, citing tight credit as the single most important factor.

Gu stressed that the actual number of business failures far exceeds the official figures; because owners frequently neglect to complete the required paperwork, many failed companies continue to exist on paper long after they have collapsed. [3]

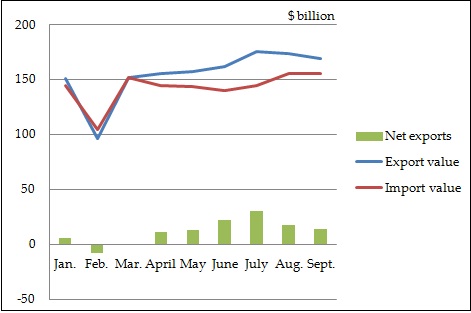

Exports

As we have seen consumption and investment have continued strong despite signs of incipient weakness, but with the economies of the West threatened by one debt crisis after another, the outlook for Chinese exports is decidedly bleak. After net exports fell in February and March, the single biggest uncertainty surrounding China's continued economic growth is demand for Chinese goods and services in foreign markets.

Net Exports, 2011

This situation is reflected in the relative contribution of exports to China's economic growth in the first half of 2011. While fixed asset formation accounted for 5.1 percentage points and final consumption expenditure for 4.6 points, exports were a negative factor, dragging the growth rate down by 0.1 point. Exports appear to have become the economy's weak link.

China's new export orders index fell for the fifth straight month in August, according to the China Federation of Logistics and Purchasing. The index registered 48.3 in August, down 2.1 points from July. Since the index functions as a leading indicator, the odds are that the pace of Chinese exports will continue to decelerate over the coming months.

Conclusion

While consumption, investment, and exports all show signs of weakness from late 2011 through 2012, growth in consumption and investment can be expected to remain relatively robust in the coming months. Taken together, these demand-side trends support the IMF's forecast of 9.5% overall growth for 2011 and 9.0% growth in 2012.

While these projections have been downwardly revised from the IMF's previous forecast, they still dwarf the projected growth rates for Europe and the United States, which remain precariously poised between recovery and a double-dip recession. Under these circumstances, China's importance as a driver of the world economy can only grow.

[1] China Securities Journal , August 31, 2011.

[2] China Securities Journal , September 20, 2011.

[3] Caijin.com.cn, September 19, 2011.