- Article

- American Politics

US Economic and Foreign Policy under the New Administration

January 30, 2017

Scholars from Stanford University with illustrious US government backgrounds joined Japanese researchers at a Tokyo Foundation Forum on “US Economic and Foreign Policy under the New Administration” on November 17, just a week after Republic nominee Donald Trump’s stunning upset in the US presidential election.

Organized jointly with Stanford University’s Walter H. Shorenstein Asia-Pacific Research Center, the public Forum attracted a full house, as many in Japan were eager to gain a glimpse into the likely course of the incoming administration’s economic and foreign policy.

The following is a slightly edited transcript of the symposium, including the English translation of the remarks made in Japanese.

* * *

MODERATOR: Welcome to the Tokyo Foundation–Stanford APARC Joint Symposium on US economic and foreign policy under the new administration. I’m Mikiko Fujiwara, public communications officer at the Tokyo Foundation, and I’ll be serving as your emcee. As for simultaneous interpretation, channel 1 on your receiver is for Japanese, and channel 2 is for English. Please be sure to return the receivers on your way out. We are making a video recording of our symposium today, and it will be made public on the website of the Tokyo Foundation at a later date.

The results of the US presidential election surprised many people, including myself. Some have called it a defeat for the East Coast establishment. The course America is likely to take is the topic of discussion of today’s symposium, which is being jointly organized by the Tokyo Foundation and the Asia-Pacific Research Center of Stanford University—a West Coast institution. We will be discussing the policies that are likely to be pursued by Donald Trump and how Japan should work with the new administration, particularly with regard to economic and foreign policy.

I would now like to invite Takeo Hoshi, chair of the board of the Tokyo Foundation, to give the opening remarks.

TAKEO HOSHI: As the chair of the board of Tokyo Foundation, I would like to welcome everybody to the symposium on “US Economic and Foreign Policy under the New Administration.” I am also the director of the Japan program at the Asia-Pacific Research Center of Stanford University. So, I’m very happy to have my colleagues from both the Tokyo Foundation and Stanford University here to talk about important issues for the US, Japan, and the rest of the world.

Since many of you in the attendance in the audience understand Japanese, I would like to switch to Japanese at this point. I will come back to English later, but I would like to make my remark in Japanese for now.

Ladies and gentlemen, thank you very much for coming to this symposium. We began planning for this symposium about two months ago. At that time, of course, we didn’t know who was going to win and become the next president. And as Ms. Fujiwara just said, the results went against the expectations of many, including you perhaps. So, we didn’t realize this symposium would be so timely. We have invited experts for this symposium with whom I’m looking forward to having a very active and animated discussion. Now I would like to ask Dr. Gi-Wook Shin, director of our co-organizer APARC, to say a few words.

GI-WOOK SHIN: Good morning. My name is Gi-Wook Shin. I am the director of the Shorenstein Asia-Pacific Research Center at Stanford University. On behalf of the center and the US delegation, it’s my great honor and pleasure to welcome you all to this symposium. I would also like to thank the Tokyo Foundation in working with us to organize this timely and very important symposium.

As you know, this year there has been frustration, fear, and even anger as we have seen a dramatic presidential campaign season and one of the most unpredictable and divisive elections in American history. I live in Palo Alto in California. California is basically a Democratic state, so we don’t really see candidates coming to our area, other than for fund raising. But even there, we watched the elections very cautiously. And then the outcome was not totally unexpected but still quite surprising for many of us. In fact when we were planning this symposium, we kind of expected to discuss the Asia policy of the Clinton administration, but now we have to change our remarks at the last minute.

So even though we expect the US-Japan alliance to remain very strong, we are likely to face a number of new challenges in economic and security areas. So today we will have two panels to discuss these challenges and how to deal with them, hopefully turning those challenges into good opportunities.

I sincerely hope that you will find the discussions productive and enjoyable. I also hope that we can do more events like these in Japan in the coming years. Once again, thank you very much, and please enjoy the conference. Arigato gozai mashita .

HOSHI: Thank you very much we would like to move on to the keynote address. Let me introduce the speaker. Dr. Edward Lazear is a professor at Stanford University’s Business School and a fellow at the Hoover Institution. His area of specialty is labor economics. He has gone far beyond the normal boundaries of the discipline, though, and his research activities cover very broad ground, including employee incentive mechanisms within companies, entrepreneurship, and macroeconomic implications of corporate policies. From 2006 to 2009 he served as chairman of the President’s Council of Economic Advisors in the George W. Bush administration. Today, Professor Lazear will talk about the new Trump administration’s economic policy using a number of slides. The title of the presentation is, “New President, New Economy?”

EDWARD LAZEAR: Thank you very much for you kind introduction and also for inviting me to speak here today. My gratitude to all the organizers, especially Dr. Hoshi and Dr. Gi-Wook Shin, for organizing this conference. What I’m going to do is stick to what I think of as my comparative advantage, and that is to talk primarily about the United States. When we get into the panel discussion, we’ll broaden it a bit and focus more on some of the more international aspects of it. But let me start initially at least, by talking about the US.

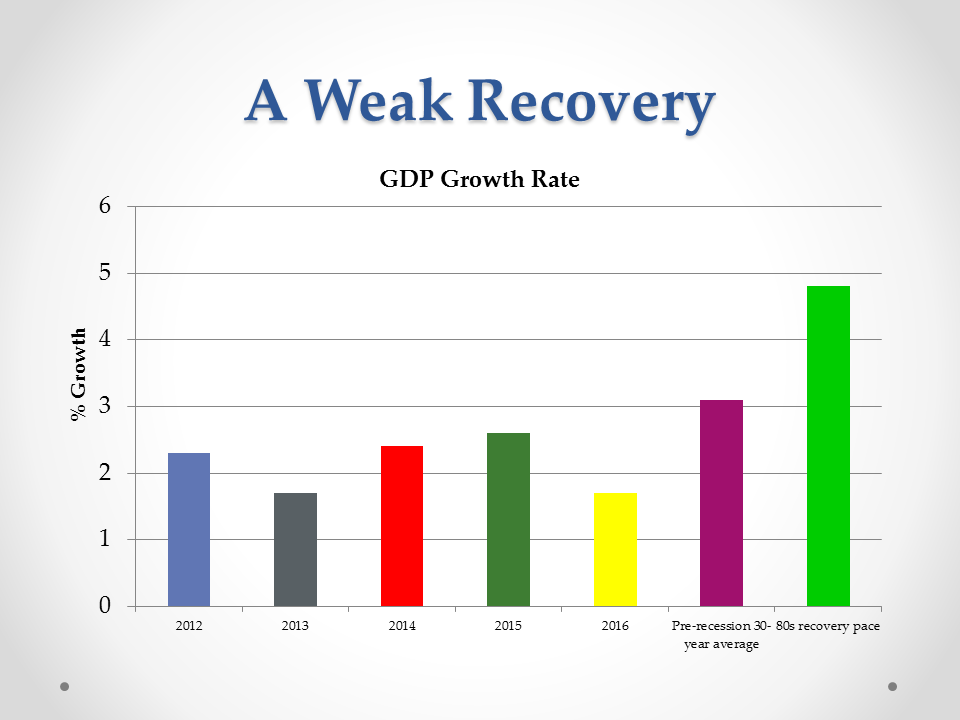

Currently we have recovered from the recession. We are at about 5 percent unemployment, which most economists in the United States think of as being full employment. Unfortunately we are not at full employment in the sense of being back to where we were pre-2007. The GDP growth rate has been anemic, and I’ll show you that just by looking at the chart here. If you look at this recovery, compared to previous recoveries, we are in the 2 percent range. A normal recovery would have a growth rate of over 4 percent; if you look at the recovery in the 1980s, it was close to 5 percent, and pre-2007, the long-term growth rate was about 3 percent. So this has not been a great recovery. On the other hand, it has been a recovery, and so we are considerably better off than we were during the recession.

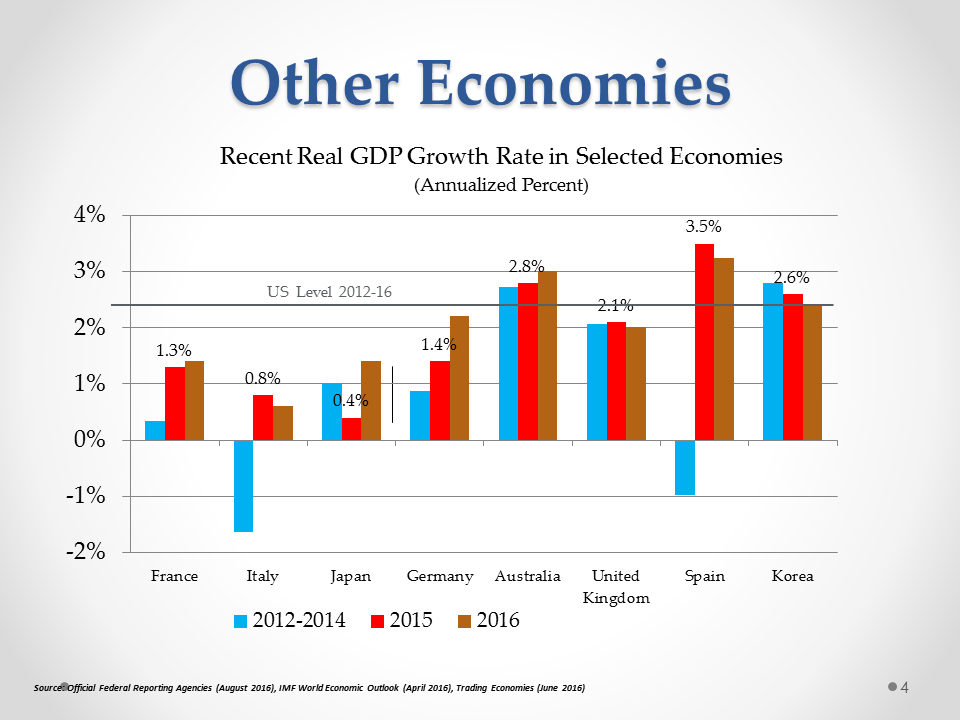

Going forward, let me just give you a little perspective. If we put this in the context of other countries and look at how we have done, we haven’t done that badly. South Korea has done better, but Japan has done considerably worse, most of the European countries have done worse, and so the US, while not having a spectacular growth rate, does look reasonably good as compared with the other economies in the world.

What do we need to do to move the economy forward? This is the task that will face the new president. The first will be to reduce taxes, and particular taxes on capital, and I’ll come back to that. We need to control deficits by constraining growth in entitlements. We need to restore what I think of as the more sensible view to regulation, meaning that we go back to standard cost-benefit analysis of the regulation. We are going to have to deal with the Affordable Care Act—sometimes called Obamacare—that seems to be in pretty bad shape right now on a number of different fronts. We have to enhance trade, and that’s going to be a controversial issue that I will return to in a couple of minutes, and, finally, address income inequalities. So, those are the main points that the new president will have to think about when he comes into the White House in January.

Let me just give you a little bit of background on Trump as a candidate and what he has talked about and compare him to Republicans and to Democrats. So, what I have done here is I have used the traditional colors that we use in the United States, blue is Democrat and red is Republican, and if you look at what Republicans favor and if you look at what Trump favors, you’ll see that most of the things on this chart are actually in blue rather than in red. That is, he looks in many respects more like a Democrat than he does like a Republican. For example, the one that Japan is thinking about right now is trade. Trump has been probably the premier protectionist as a candidate—the most protectionist candidate that I can recall. That’s a Democrat policy. When trade bills get passed, when you see free trade occurring, it’s primarily a Republican coalition with a few Democrats, not the other way around.

Impediments to business overseas are one of the things that Republicans like to talk about, hoping to put businesses where they are more efficient. Trump has explicitly said, though, that he will tax businesses 35 percent for locating plants overseas. That’s a Democrat policy. The Obama administration has worked particularly hard to prevent businesses from going overseas. The notion of inversions, where a large company locates its headquarters overseas, has been a topic that the Obama administration has gone after aggressively.

Trump the candidate has said that he would not touch entitlements. This has been a big theme for Republicans, saying we’ve got to slow entitlement growth. Democrats tend to either like entitlements to stay as is or want to see them grow. Infrastructure is not a big campaign issue for most typical Republicans, but it has been for President-elect Trump. He says he will put in a trillion dollars of new infrastructure spending. Again, that is primarily a Democrat policy.

Republicans are budget hawks. President-elect Trump has not made deficits a priority, and that’s generally the same policy that Democrats accept as well. Republicans usually oppose increases in the minimum wage. President-elect Trump has said he favors an increase in the minimum wage, which again aligns him with the Democrats.

Where he does look like a Republican is that he favors lower taxes. The Republican policy for stimulating the economy is almost always to cut taxes. Trump is on board with that. That is the opposite of what the Democrats would be encouraging right now. Republicans also like light regulation. President-elect Trump has at least stated explicitly during campaign that he is going to go after regulation, aggressively rolling back Obamacare; Dodd-Frank, which is the legislation that governs our financial sector; our Environmental Protection Agency, and other executive orders put into place by President Obama.

Finally, he says that he will repeal—and recently he said, repeal, amend, or replace—Obamacare. We’ll have to see exactly how that plays out, but that is not obviously something favored by Democrats, and Mrs. Clinton was talking about going in the opposite direction there.

So what about tax policy? What do we think that he will do with respect to tax policy? Well, this is what he says, and this has been on his website actually for quite a long time now. I’ve been following his website, and it’s been one of the few things, that I would say has stayed stable throughout the campaign period. He has been quite firm in terms of these tax policies, and they would involve lowering personal income tax rates, lowering corporate tax rates from 35 percent to 15 percent—that’s a big one—instituting a repatriation tax policy, which would mean lower taxes to bring capital back into the United States, and a number of other small details that are not significant in terms of economic growth.

Most people, when they look at Trump’s plan, nonpartisan foundations and institutes score Trump’s plan as being positive for economic growth. Perhaps that’s what is being reflected in the US stock market and markets around the world. It does seem to be positive, and so in general that would be good, but obviously some companies will be affected. Look at Tesla’s stock, for example; it’s taken a beating since his election, about a 10 percent fall in value. Tesla gets large subsidies from the government in terms of the implicit cap and trade policy that was put into effect by the Obama administration.

The one big problem with the Trump plan is it implies very large increases in the deficit. So, the Trump plan, as it’s scored now, would mean about $4 trillion of increased deficit over the next 10 years. That’s really a lot of money. And so, whether Congress would be willing to go along with this is something I hope we will get to chat about during the panel, because I think that’s something we’ll need to consider seriously.

Trump has not been a big fan of the Federal Reserve Central Bank policy, although it’s not clear what he would actually like. He hasn’t articulated coherently what he would like to see the Fed do. As you know the US Federal Reserve is independent from the White House, at least theoretically independent, and for the most part, in practice it has been independent. And so, it’s not obvious that he will have a lot of control over that. The one area in which he will have control is that Chair [Janet] Yellen’s term is up in about a year and half, and she would be up for reappointment at that time, and he, the president, makes the decision on who is appointed to that position. So, that would be his major influence.

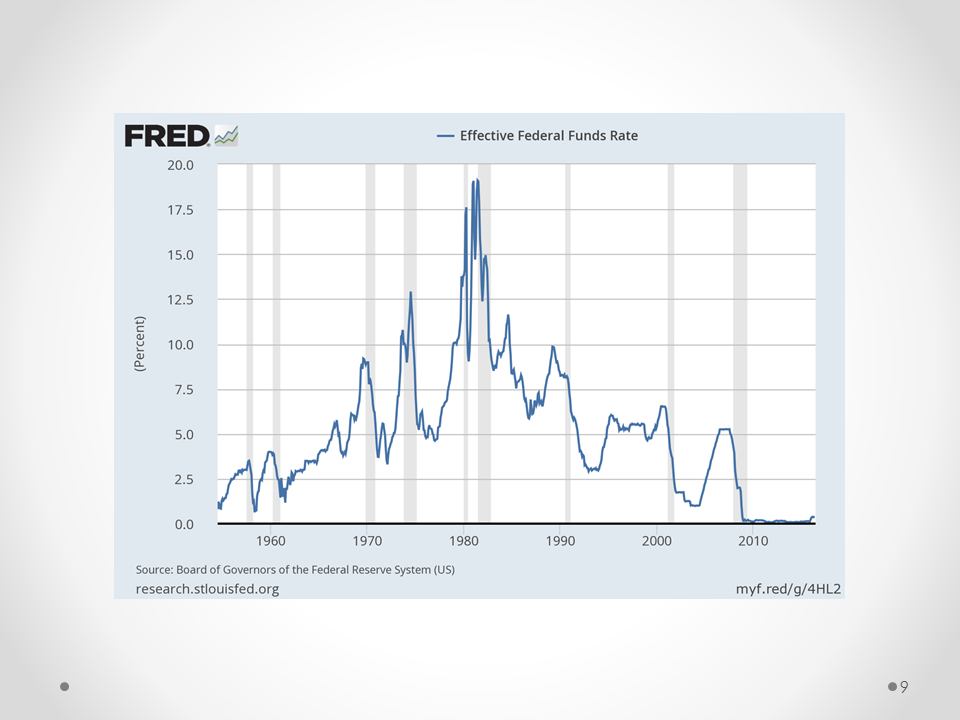

The Fed actually, just to show you a graph, has been in kind of an odd position over this recovery. If you look historically at the Fed, the Fed tends to raise interest rates two to three years after a recovery begins. We are now 7 years past the recovery, and interest rates have remained flat throughout this period. So, we are in the odd situation of being close to what we might think of as the peak of the recovery, peak of the business cycle, and now, the Fed is thinking about raising interest rates. That’s kind of backwards from what we usually have. Normally, we would see them raising rates on the way up, and when you get to the peak, you’re holding rates constant or even thinking about lowering the rates. So they are in a somewhat difficult position there, and the Fed will have to deal with that.

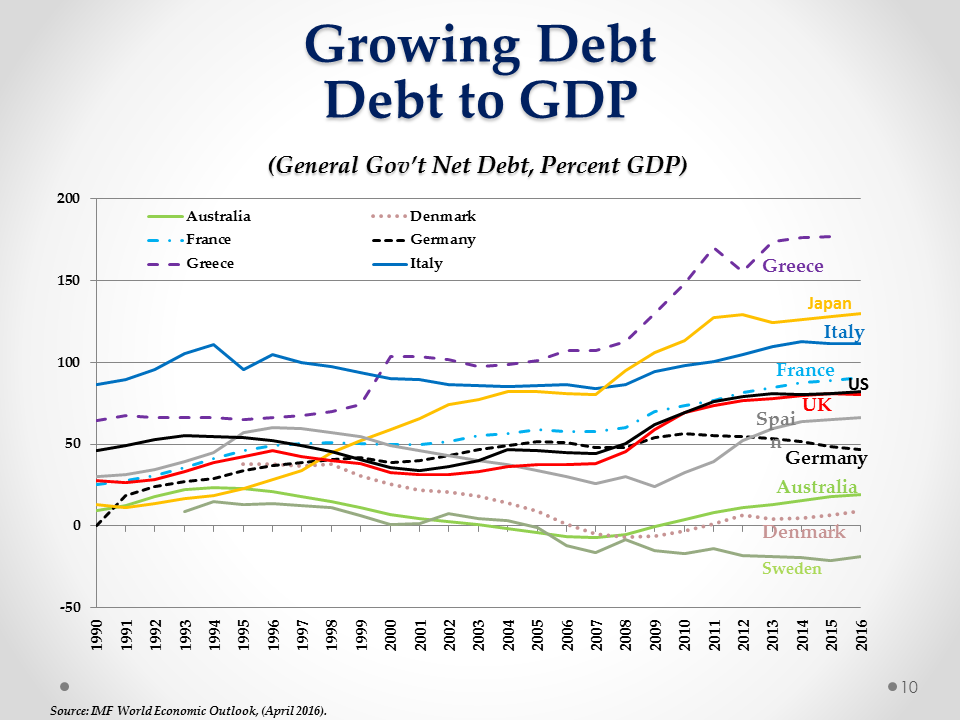

Debt has grown quite dramatically over the past recovery period. We’ve doubled our debt during this period. We are not alone, other countries have as well. Japan is certainly used to having high levels of debt. But even if we use the Obama administration’s projection of debt into the future, we’re talking about having Japan-like debt-to-GDP ratios within a couple of decades, primarily because of our healthcare costs, social security, Medicare, and Medicaid. So that will be another thing that President Trump will have to be thinking about if he wants to build a more stable future.

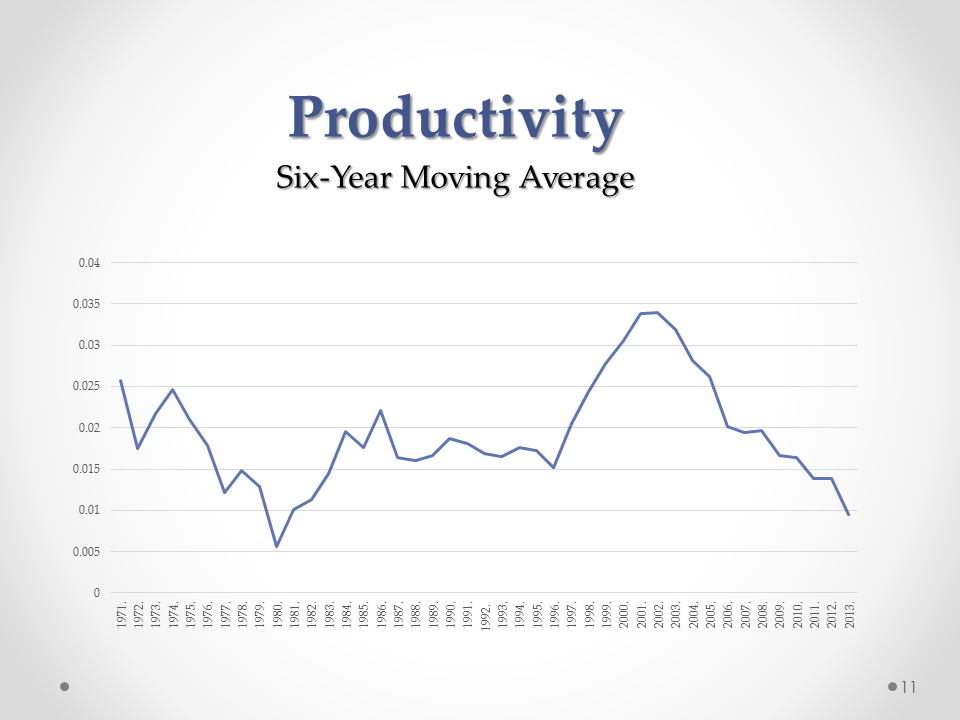

Another problem that we face—it’s not unique to the United States but it’s certainly an important one—is that productivity has lagged. So, in the past eight years or so, productivity has declined and declined significantly. We are now at levels that we haven’t seen for quite a while. So, the late 1990s was a good period for productivity, the early 2000s was a good period for productivity, but the post-recession period has not been good for productivity, and that will have to be something that the new president considers as well.

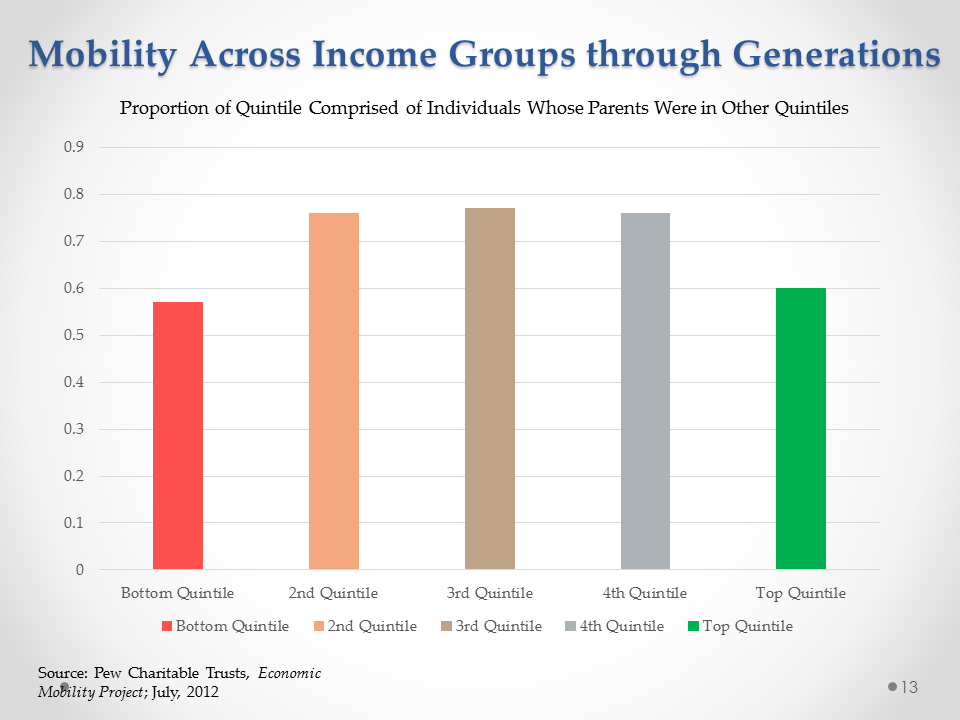

Let me just briefly mention inequality, which was a theme not so much of the Trump campaign but certainly launched Bernie Sanders as a candidate into the headlines and almost won him the nomination. Mrs. Clinton picked up on the issue during her campaign as well. The growth in inequality is not unique to the United States. We’ve seen that in most major countries in the world, where we’ve seen an expansion in the difference between the earnings of say the top 10 percent versus the bottom 10 percent, and it’s true throughout the income distribution. I’ll argue just briefly that most of this is about low human capital workers having problems. It’s not so much the rich stealing from the poor, which is the way I think Sanders characterized it, but it’s rather a function of high human capital people doing very well in a technologically advanced society and low human capital people doing not so well, and so the question is what do you do about that? We still do have mobility, and I’ll show you a chart that suggests that the mobility is not confined to the high income groups, although the high income groups have benefited more than the low income groups.

This chart is a kind of standard thing that most countries could boast about, it’s not unique to the United States, but it is a feature of the American economy. And that is, that there is a great deal of mobility across generations. So, if you look at the green bar at the top that gives you the proportion of people in the top quintile who were not born into the top quintile, that is, their parents were not in the top quintile. And what that tells you is that 60 percent of the people, who are in the top quintile, were from families that were not in the top 20 percent of earners. So, those people are in some sense the nouveau riche, and that’s quite prevalent in the United States, and it’s also prevalent in other economies. We can say it’s not unique to us, but we certainly exemplify that. It’s true by the way, at the other end also. If you look at the bottom quintile and you say, let’s look at the lowest 20 percent, almost 60 percent of those people as well were not born into the lowest quintile but fell into that quintile, as a result of events that occurred during their lifetime. So, there’s a considerable amount of mobility within society.

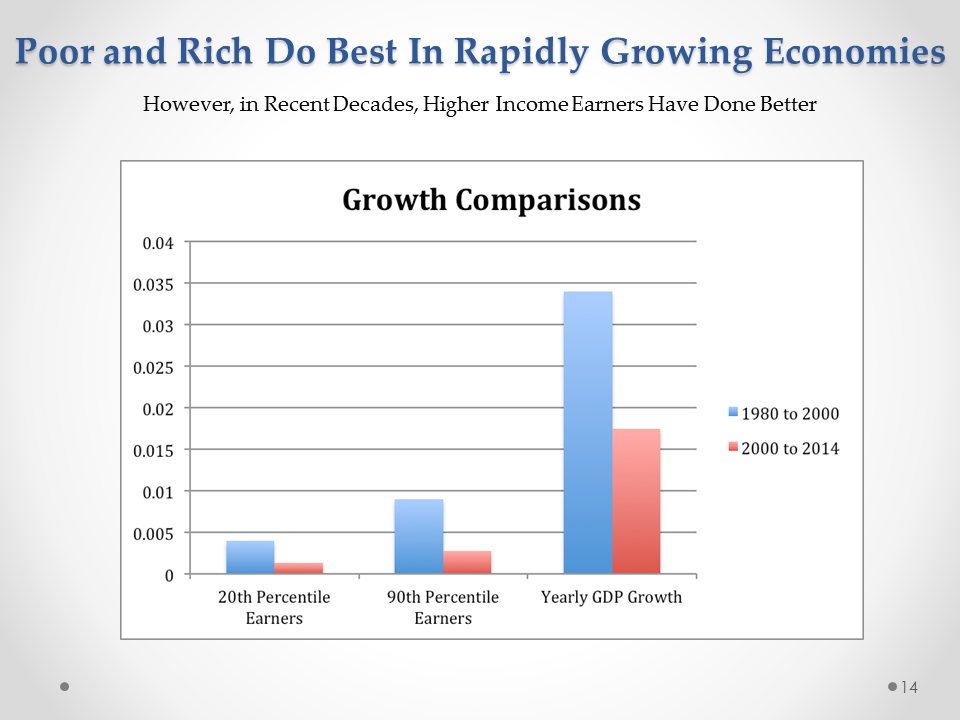

The one thing that I would like to point out, and I think this is an important thing not only for the United States but also a very important theme here in Japan, and that is that you don’t want to think of the rich getting rich at the expense of the poor. That’s just not an accurate statement empirically. It’s not that the rich get rich because they take from the poor. What tends to happen is the rich incomes grow in good economies, as do the incomes of the poor, but they don’t always grow at the same rate. So, President Kennedy in the 1960s coined a term, “Rising tide lifts all boats,” and that does tends to be true empirically. What is not true about that statement is that when we think of the rising tide, we think of all boats going up by the same amount, because the tide goes up and all the boats float by the same amount. Unfortunately that hasn’t been true, and in the recent decades, the reality is that the low income earners, while they have grown better during good times than during bad times, have not grown at the same rate as the high income earners.

Alright, so that’s the situation. What positives can President Trump build on? What does he have going forward? Well, let me give you some data. The first thing I can show you is that the US remains the country of choice. And what I mean by that is that the market is telling us there’s a huge queue of people wanting to get into the United States right now. If we look at how many green cards, how many immigration permits, we issue each year, it’s about a million. That’s been true historically for a long time. While we issue a million, at any point in time, there are about four and a half million people who have formally applied to obtain green cards and are waiting in a queue. And for some countries, if you are from the Philippines, for example, that wait could be 20 years. So, depending on the country that you come from, you could essentially wait throughout your entire lifetime before you get issued a green card. So, that’s good for us, in terms of our ability to attract good people. It may not be good for people trying to get in.

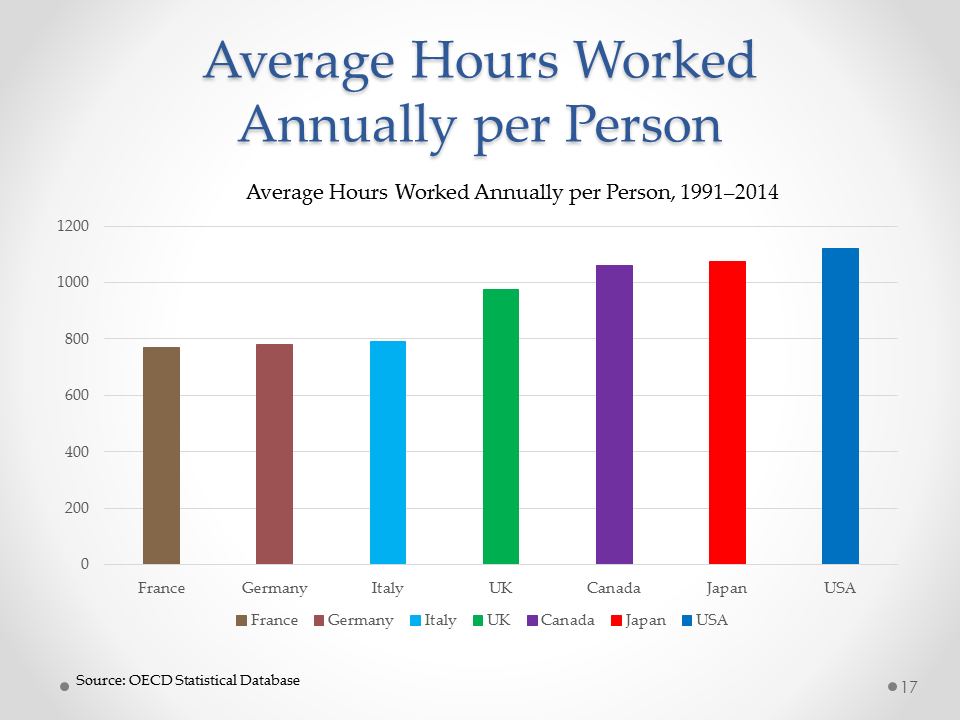

The other thing that I would say is that we are industrious, as are the Japanese. In fact the Japanese used to be too industrious and kind of dialed it back a bit. So if you look at this chart, what you see in the ratio of average hours worked per person in the working age population, and the US leads in that, primarily for two reasons. One is, we work long hours, and second we have very high rates of labor force participation, particularly among women. So, our women work at high rates and we work long hours. The Japanese actually used to lead on this; if you looked at this maybe 15 years ago, Japan would be leading, but in the recent decades the US has taken the leadership.

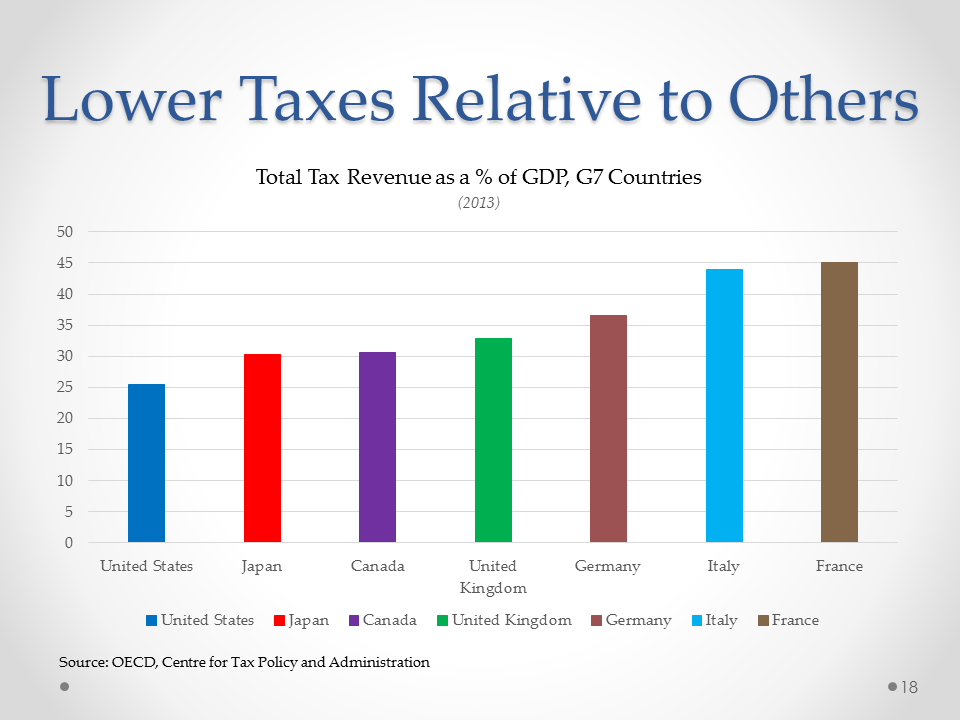

We also have low taxes relative to others. While people on my side of the political spectrum tend to bemoan the fact that the taxes in the United States are high, and certainly some taxes are, corporate taxes are, but relative to the other countries we still are a very low-taxed country. Our ratio of tax to GDP is 25 percent. If you look at countries like France at the other end of that, that’s 45 percent. So we do have a low tax rate, and that tends to be positive for economic growth, particularly low tax on capital, and I think, that’s where President Trump has to make his biggest mark if he wants to grow the US economy.

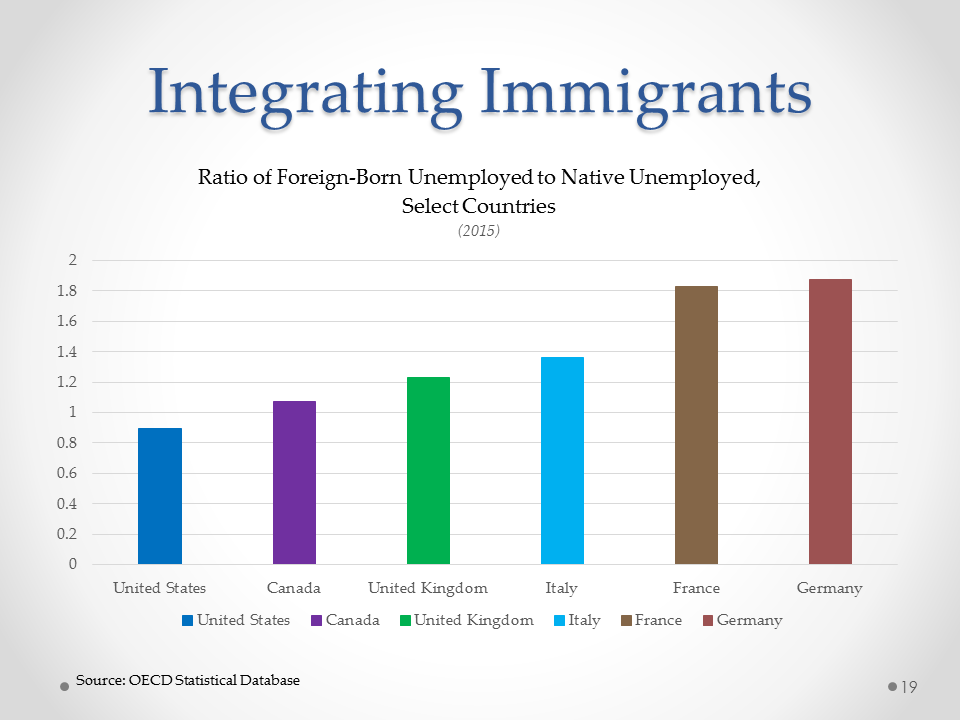

And finally, we do well at integrating immigrants. When I say we do well, and of course this is the irony because much of the Trump campaign was anti-immigration, but one of the things we do very well is integrate them. This chart shows you the ratio of unemployment rates among immigrants relative to the native born. So, if you look at Germany, it’s a little above 1.8; that says that unemployment rates for immigrants is just about twice the unemployment rates that we have for the native born in Germany. But in the US, immigrants actually have lower unemployment rates than the native born. Well, that’s a little bit of a tricky statistic; you have to look who the immigrants are and so forth, but it still indicates that we do a very good job at integrating our immigrants into the labor market.

Let me conclude that the highest priority, I would say, for President Trump would be changing the taxation of capital and, in particular, changing taxation on new capital, rather than old capital, to encourage the highest growth rates. He will absolutely need to repair or replace Obamacare, or the Affordable Care Act, that’s right now essentially in chaos. Premiums are rising at very rapid rates, insurance companies are pulling out of the exchanges, and it is no longer viable because of adverse selection, so that will need to be fixed. Mrs. Clinton said the same thing by the way, she was going to fix it in a different way, but she also would have had to deal with that.

And then finally, go back to a cost-benefit approach to regulation, the most obvious one being the financial sector. The Dodd-Frank bill, which revives the financial sector in some significant ways, will need to be looked at. In my view, probably the Consumer Finance Protection Bureau would be number one, and then what we call SIFI—Systemically Important Financial Institutions—is not a good way to go. When you have a systemic problem, you need to deal with it in a systemic way and not deal with it on institution by institution basis. Let me stop there, and we can consider more of these points in the panel. Thanks very much.

HOSHI: Thank you Professor Lazear. We’ll move right into the first panel discussion. So, if I can invite the panelists on the podium, on the stage. Okay, so the first panel will explore the economic and the trade policies of the new administration. You can find the bios of the panelists in the program, so I won’t go into the details. I’ll just briefly introduce the panel, starting from my immediate left. Kathleen Stephens is a distinguished fellow at the Asia-Pacific Research Center at Stanford. She is also a former US Ambassador to the Republic of South Korea from 2008 to 2011.

Then we have Professor Shujiro Urata. He is a dean and professor of economics at the Graduate School of Asia-Pacific Studies at Waseda University, and he is an expert on trade policy, among other things.

And finally, Kenji Kushida is an research associate at the Asia-Pacific Research Center at Stanford. He is a political scientist working on many issues, and his research areas include information technology, Japan’s political economy, IT-enabled transformation of services, and cloud computing.

So, first I would like to start by asking the panelists, other than Ed who just spoke, to make a short remark. You can expand on a point Ed made or talk about something he didn’t have time to cover. So, let’s start with Kathleen.

KATHLEEN STEPHENS: Hello, good morning. I want to thank the Tokyo Foundation for their work in putting this together today and for all they have done over the years. I’m very moved to see so much interest today. It seems very significant to me that we are having this discussion, just as Prime Minister Abe, as I understand, is flying to New York to have his first meeting with President-elect Trump. I think it’s a symbol of the great importance and indeed of some concern that we all attach to this transition, an inflection point in our great relationship and alliance.

I want to thank Professor Lazear for his excellent presentation. I thought I would focus a little bit on the issue of trade. I’m not an economist or a trade expert, but I have a long history as an American diplomat, including working on some trade relationships and trade deals. As an American citizen living in the United States after a long diplomatic career, I’ve watched this rather extraordinary—and I don’t mean that in an entirely positive way—period of campaigning that we’ve just been through. And one thing, as Ed has already alluded to, is that in this campaign, there were really no voices for free trade, or for trade agreements. The TPP, the Trans-Pacific Partnership, is a signature effort of President Obama to strengthen the US-Japan relationship and the overall US presence in Asia and the framework of trade rules that allow our prosperity. This was opposed by all the candidates. First, on the Democratic side, including by Mrs. Clinton who had supported it as the Secretary of State, and also, as Professor Lazear alluded to, perhaps more vociferously by Mr. Trump, who ultimately prevailed, criticizing not only that deal, which of course has not yet come into effect, but also NAFTA, the Korea-US Free Trade Agreement, our trading relationship with China, and a host of other issues.

I thought I would briefly make one historical note about how trade deals have tended to get through the system, if you like, in the United States. First there’s NAFTA, negotiated by President George H.W. Bush—Bush I—not ratified. Of course, we have, just as you do, two steps: the signature by the executive branch of our government and the ratification by our legislative branch. NAFTA, negotiated and signed by the first President Bush, who then lost the election to Bill Clinton, and then Bill Clinton, as a Democrat, put out some political capital and got it passed through Congress. Similarly in some ways, interestingly, the US-Korea Free Trade Agreement, negotiated under Bush II, and then ratified after a delay of a couple of years, under President Obama. I think there were many who thought that the TPP might go the same way, whether it was under President Hillary Clinton or now, we know, under President Trump, but it’s not looking very promising. And what’s also clearly now not on the table is the hope that the TPP might be ratified in the so called lame duck session of Congress, before the inauguration of the new president.

So it’s going to be very difficult, and I don’t have a prediction for you. I think the best case, we talked a little bit about this last night, for those who hope that TPP will be ratified is that, it sits for a while and then the new president, President Trump, will get back to TTP after some of his other priorities, after improving NAFTA as he has promised to do, and perhaps taking some steps to deal with the US trade relationship with China. I do think, and I know, that one reason it is more difficult this time is because the issue of inequality is seen as salient not only on the left in the Democratic Party but also in the American electorate when it comes to trade. So, I think there is still some discussion and education to do about the impact of trade to get it through.

So, what are the alternatives for Japan and the US? I have already mentioned one, which is just to kind of wait and see. I think another, and I know this has been discussed to some extent in Japan and elsewhere, is that TPP goes ahead without the United States. It’s 12 countries, US being one of them, but would Japan be willing to take the lead in a Trans-Pacific Partnership absent the US?

Another alternative, I don’t think a very desirable one from my point of view or perhaps Japan’s, is that Chinese-led efforts gain more salience in this environment. Another, and these are not mutually exclusive, we see some signs that new President Trump may turn to negotiating bilateral trade deals; there are definitely hints that they are out there.

Finally, I would say that the strategic argument about why the TPP or why setting the rules for free trade is so important has not yet really been made by President-elect Trump in his campaign nor in his transition. And perhaps when we get to the strategic discussion in the next panel it’s something that we might discuss, thank you.

HOSHI: Thank you. Let’s move on to Shu.

SHUJIRO URATA: Okay, thank you very much. Thanks everyone here for inviting me to participate in this very important discussion. Thank you very much Professor Lazear for an excellent presentation. Since time is limited I would like to focus on two, not comments, but two questions. One is on the market reaction to the new president, and the second one is related to what we just heard, state policy.

If I understand correctly, the first reaction of the market was negative in the sense that stock prices went down and the dollar depreciated. But very quickly, the dollar recovered, and now the yen is about 109 yen to the dollar. I would like to know the factors that led to the very quick recovery of the market in favor of the US economy. Related to this is—I know it’s not fair because if anybody knew the answer they wouldn’t be sitting here but making investments and making big capital gains—what are the prospects for the stock market and the US-dollar exchange rate?

The second set of questions is related to trade policy. If I understand correctly, Mr. Trump was arguing in favor of a protectionist policy to protect US workers but at the same time to revitalize US manufacturing. Two questions, what can he actually do? In other words, he talked about increasing tariffs on imports from Mexico, from China, maybe from Japan. Can he do that without congressional approval, for example? What about NAFTA? He talks about renegotiating or withdrawing from NAFTA. He also talked about withdrawing from the TPP. Can he do this? And the second question is, suppose these policies he’s in favor of are enacted, do you think they will help USmanufacturing to recover? I’m just curious to know what the possible impacts of these protectionist policies are.

Somewhat related to this last question—if TPP survives, I’m quite optimistic, I hope that will be the case, what do you think Mr. Trump will ask Japan to do? Does he want agricultural protections removed or new deals for US car exports? What do you think he wants Japan to do if TPP survives?

Since I still have one minute left, I’d like to ask one more question, about the consistency of his policy and the equality issue. To me, providing entitlements, providing subsidies to the poor improves the living standards of the poor, but at the same time he talks about reducing income taxes for all groups. Won’t that lead to an increase in inequality? Related to this question is, won’t increasing tariffs hurt low-income people? If that is the case, I don’t think his policies are very consistent. I would like to hear your views on this. Thank you very much.

HOSHI: Okay, Kenji.

KENJI KUSHIDA: Thank you very much. It’s a pleasure to be here. I would like to focus on two areas that are related to innovation and competition policy. And for this, actually, Professor Lazear’s slides about US’s low productivity is a nice starting point. In order to get higher productivity, often you need more competition. So how do you get more competition? Is deregulation the best way to increase theamount of competition? Second, does that equal increase in competition? Or do you often need an increase in the number of rules, in thenumber of good rules, reregulation plus deregulation. Deregulate bad rules plus make new rules to make competitive markets more competitive. And so then, this is a framework for us to look at, what the new president will do, is the rhetoric of, often used by politicians, we need to deregulate to make things more competitive. To make more competition, therefore we need deregulation. This often overlooks the need to make smarter and sometimes more regulations, and more organizations to manage competition.

So, for example, anything that uses infrastructure networks, like broadband or Internet-related things, and in Japan we had the recent development of mobile, virtual network operators, making very cheap cell phones. Because there are new rules imposed on theinfrastructure owning carriers to lease out their infrastructure at low prices, an increase in regulations, led to more competition, leading to lower prices, and more diversity.

So if we look at stock market reactions, are they reacting to an increase of competition, or decrease—a potential decrease—of competition? A lot of firms will make more money if there are fewer competitors, but then they are less likely to be innovative, which then leads to a productivity question. So, in the rhetoric I would urge you because sometimes they say its deregulation, but they actually are putting in good new regulations, but that is not a very good political selling point saying we are going to increase regulations. However, I would urge you to look at—and this applies to Japan too—this equation of increase in competition often requires both deregulation plusreregulation done very well, one trajectory to look at.

The second trajectory I would like to look at, and this is relevant for Japan as well, is in a particular type of innovation policy in the US, which is network neutrality. So, as we know, Silicon Valley has produced wave upon wave of the US’s most innovative and now most wealthy companies. Apple, Google, they have the highest market capitalization, and the largest cash holdings. Lots of wealth was created, and they have been innovative. A lot of these Silicon Valley companies owe their wealth to the ability to use the Internet as an open platform.

In other words, the network carriers who own the infrastructure have been forced to lease out their lines at the same price, no matter who the user is. They have been forced to not have pricing that discriminates between, say, their own services or other firm’s services. So, Netflix, for example, if network carriers like Verizon or Comcast were able to say, okay, we will raise the prices for Netflix once it becomes popular and raise the prices very high, and instead offer our own service at internal prices very low, this would kill off a lot of innovation.

So the bottom line is that a lot of Silicon Valley innovations that we look at as the outcome of lots of startups were actually protected by a consistent and persistent orientation by the FCC, Federal Communications Commission, to make sure that the infrastructure players were not able to overwhelm and dominate content providers. This is the network neutrality political debate, and this has surfaced several times over the past 20 years, and the debates have been fairly fierce. Recently it was just settled that the infrastructure carriers are not allowed to suffocate them. But as we move towards the world of internet of things—where cheap sensors connected to networks can lead potentially to a vast array of new types of innovations to raise productivity—if network neutrality is lost, and the infrastructure owners are allowed to charge differential pricing, there is a potential for a lot of innovation to be choked off, because startups might not be able to get a good pricing to access the networks. This debate has happened in Japan as well, and to look at this we will look at who the next president will put in as the head of the FCC and what the orientation coming out of that is. That’s not a usual area that people look for innovation policy, but I would argue that that’s absolutely critical for competition policy and innovation policy.

HOSHI: Thank you Kenji. I would like to give some time back to Ed as well, but before I do that, I would like to add my question to the list of questions raised by the panelists.

Looking at the current election, the last election in the US, the most important thing, I think, I have learned, is how deep the division in USsociety is, between the haves and have-nots, or high-income people and low-income people. And I was totally surprised to find out how deep that is and many of the people in the establishment, including, I think many of us, were ignorant of how deep that division is. So, Ed, you had an interesting slide on income inequality, the movement between the income classes, and the US still has high mobility across the income classes. But in one sense, another important question is, what happened to the incomes of each class over the last 30 years?

For example, 30 years ago, it may have been okay to move from 50 percentile to 30 percentile, because the economy was growing, but now income has been going lower, especially in the lower income class. So, moving from the 50 percentile to 30 percentile is really tough. So, looking at the level seems to be a more important thing to do in some sense, and I would like again a response to that. And as many of you mentioned, income inequality will be a huge issue going forward, for the new administration for the US. So I would like to ask Ed and also other panelists, too, what would the Trump administration do and, more importantly, what should the US government do to solve this income inequality problem. And as you mentioned, protectionism doesn’t seem to be a solution for income inequality. Higher tariff tends to hurt low-income people.

And I would like to ask the questions to Kathy and Shu, actually can we go further and argue that globalization, if combined with a right kind of social safety net, can actually help low-income people, or can help reduce the income inequality in the US and in the society.

And finally to Kenji, you are an expert on Silicon Valley innovations, and in Silicon Valley there are lots of wonderful things happening with innovation, and as you mentioned, it’s important to have the right amount of regulation. But one problem happening in Silicon Valley has been also an increase in income inequality. So, do you see any technology-based solution or part of a solution for income-inequality issues? So, let’s get back to Ed and other panelists.

LAZEAR: Lots of questions and more questions than probably my whole talk put together. Let me try to go through a few of them quickly and tell you—give you some reactions to—what I think might be going on. Kathy started by talking about the benefits from trade and mentioned manufacturing. That came up in Shu’s comments as well. The one thing I would point out is, I just want to reiterate what she said and that is that the people who tend to be the biggest beneficiaries of trade are at the low end of the income distribution, and thereason for that is obvious: those are the people who buy primarily manufactured, traded goods that move across borders. The very high income people tend to buy services and as a result don’t benefit as much from trade.

Now, this has been an important aspect of this particular election because I think, as Hoshi-san just pointed out, when you think about thedivide between the rich and the poor, and how that showed up in this election, it wasn’t so much the rich and the poor, it was actually therich, and the middle, and the lower middle. And it was the middle and the lower middle that put Donald Trump in the White House. They are the ones that suffer most dramatically from changes in the structure that can be most reliably pinned on trade. Now, I’m not against trade, in fact I’m a free trader, but I don’t deny the fact that certain individuals and certain work groups have been put out of business primarily because of trade with China. If you look at the furniture manufacturing business, for example, in the southeastern United States, those firms are gone, and they are gone primarily because their business moved to Asia. So, there’s no denying that. The big problem is that those people don’t get back on their feet for a very long time, if ever, and there’s a good bit of data on that, and so, I think that’s been the big problem.

Let me just talk very briefly, I’ll come back to Shu, you asked four questions, I’m not sure I can get to all of them. Again, I’ll go quickly, apologies to the translators. I know I said I’d speak slowly, but there’s a lot to cover here, so let’s see if we can get through it. You said, what accounts for what happens in the stock market? And the answer is, I don’t’ know, but I have a guess.

If you look at Trump’s economic policies as compared with Clinton, there’s just no denying that his stated policies are more pro-growth than Clinton’s were. So, if you think about that rationale and you say, you know, is this good for the economy or bad for the economy, it’s probably good for the economy. The negative reaction to Trump, which you saw actually in the futures market, in the evening, when it looked like Trump was actually going to win and the futures just fell off a cliff and said, what’s going on there, I think what people were worried about was Trump as a destabilizing force in the world, not so much in terms of his economic policies. I don’t know what turned that around, but I will say one thing that probably helped was he gave a very good conciliatory acceptance speech, and if you look at thefutures right after his acceptance speech, that’s when it started to turn around and come back, and people said, well maybe this guy is not so crazy after all, and he will start to behave presidential. It’s a conjecture. Who knows, I hope it turns out to be true, he can surprise us in many ways, so we’ll just have to look to that in the future.

What can he do about NAFTA and other trade agreements? There are two ways that he can deal with that. One is benign neglect. Trade agreements are very hard to push. As Kathy documented I think very effectively, it’s not easy to get a trade agreement through our system. You have to have the president negotiate it, that’s tough. You have to then get it passed through Congress, and that’s tough, and all of those things require a lot of political capital. The only way these things happen is if the president is willing to put up his own personal reputation and push very hard to get it through. So, what I would think would happen first is that President Trump would not spend a lot of time on that, at least initially—certainly wouldn’t, it’s not the signature of his campaign, I don’t think he would do that initially.

The second thing he can do is he can create impediments to trade. When I was in the White House, we had a situation with trucks coming across the border from Mexico into United States, and our policies essentially created an inability for those trucks to come into the United States just by bureaucratic regulation. So that’s another thing the president can do. So, there are plenty of things that an executive can do in that respect.

Third, and I want to point out that our manufacturing is not declining, so, it’s just inaccurate to say that manufacturing in the United States has declined. In fact, manufacturing in the United States has gone up, and gone up dramatically since the 1950s. What has not gone up is the number of workers involved in manufacturing, and that’s primarily because we’ve had extremely high increases in productivity in manufacturing. Last few years have been an exception to that, but for the most part, we see very high increases in manufacturing. So, we’re still a manufacturing powerhouse. The problem is we do that without the kind of labor that we used to use, and so that brings me to another issue, on income and inequality, and the question is what do you do with people who used to have good paying jobs in manufacturing but no longer have those jobs?

And I think the answer is that—certainly in the United States and I don’t want to speak about Japan when I’m a guest in someone else’s country, and I don’t know much about it, I’m certainly not going to offer you advice, but in the US—we have not done a good job in taking care of the skills of people who don’t go to college, and that could be 50 percent to 60 percent of the US population. Those people’s productivity has not grown over time, and as a result their wages have not grown over time. If you compare us to, say, the German-speaking countries of Europe, which have very good vocational programs, we just do much, much worse in that respect. Now, those vocational programs have their own shortcomings, but if you look at the performance of the bottom half of the income distribution in Germany, Austria, and Switzerland, they are just dramatically different from where they are in the United States, and I think, that’s something that we at least have to think about.

Just finally coming to Kenji’s point on good regulation, I’m not going to touch net neutrality, that’s your area of expertise, but let me at least talk about the good regulations, because I think that’s a very important point. And the best example of that comes from the financial crisis. If you think about the regulation in the financial industry, that was done through these agreements referred to as Basel 1, 2, 3, and most of you who are in finance know what Basel 1, 2 and 3 is. The concept behind Basel 1, 2, and 3 is not wrong, it’s a good concept. Theconcept essentially says that you have to hold capital in proportion to your risk profile. That’s a sensible thing to think about. The problem is in implementation. So, it wasn’t that people were trying to do the wrong thing, but when we look at the financial crisis in 2008—and by the way, it struck everywhere in the world, countries with very different regulatory structures, you can’t basically blame regulation in theUS or the deregulation in the US. UK had a completely different system, they faced the same thing. Spain had a different system, faced the same thing. Ireland had a different system, faced the same thing. Even Iceland faced the same problem, so this is not about deregulation. But what it is about is that the Basel structure wasn’t implemented in a way that made it an effective impediment to seeing those kinds of problems arise. That wasn’t intentional, but we’re human, we’re fallible and when we think about these things in advance, we don’t think of everything that may come to pass, so that’s really the problem. So good regulation is really what we have to strive for, but unfortunately sometimes we learn only by our mistakes, and not by where we actually want to go.

Let me just, I want to come to one extremely important point that Takeo raised at the end, when he was talking about income inequality. There’s an important theme which I think we tend to forget, and that is, we tend to look too much at within country inequality and not world inequality. If we look at world income inequality, and we look at that over the past few decades, there is no question that world inequality has gone down and gone down dramatically. In fact, I would argue that the most dramatic change in the standard of living in the history of humankind has occurred in the last two decades. We have raised over half a billion people from extreme poverty to the middle class, and we have done that in a period of twenty years. That has never ever happened in the history of humankind. How did that happen? Well we know how it happened. It was primarily China and India, moving away from their command economy structure, and India, very strong socialist influence, and moving more in the direction of markets and allowing markets to take over.

Now, what happened of course, is within China, you saw very large increases in inequality, so inequality grew dramatically within China, but what’s also true is you had, again, about 400 billion people moving into the middle class, and if you ask, what should be our goal, I would argue that the goal is to raise the standard of living of the poor, not to worry so much about the difference between the poor and therich. So, I think, when we focus on inequality we have to be careful not to kill the goose that laid the golden egg. In particular, what we have to do is we have to understand what are those policies that are most likely to raise the incomes of the poor and focus on those primarily. Let me stop there.

HOSHI: Thanks Ed. Shu do you want to add?

URATA: Before adding my comments to the very important question of inequality, let me repeat my question once again. Suppose TPP survives, what will Mr. Trump want Japan to do? To reduce agriculture protection or to limit the amount of export to the US? What does he want to do?

About this income inequality, I think, a very important point is development gaps between developing countries and developed countries over many years. One factor which I don’t think you mentioned is globalization. Globalization contributed to this. Look at China, how they have grown so rapidly, thanks to incoming foreign direct investment, taking the opportunity of foreign trade, by joining the WTO and so on.

So globalization has contributed in narrowing the development gap between countries. But at the same time, it is true that globalization has contributed to increasing income gaps within countries, in developed countries like the United States. For developing countries, it’s not quite clear whether globalization contributed to growing or narrowing income gaps. So what I’d like to argue is that we should not stop globalization since we can expect to further narrow the gap between developed versus developing countries. And what should we do is address growing income gaps in the developed countries like United States, which Takeo-san mentioned.

In my view, the obvious thing is income redistribution, apply more progressive income tax and inheritance tax, maybe property tax, which I’m sure there are some obstacles to do so, but in order to improve the income gap or narrow the income gap between income groups, these policies can be very effective. But at the same time I’d like to argue for providing education and training to low-income people who have been negatively hurt, or negatively affected, by globalization. In addition I would like to talk about competition policy here. Small and the medium-sized enterprises—in Japan, low income earners are generally employed by SMEs—so, if SMEs can grow fast, that will contribute to increasing the incomes of low-income people. What we need to do is to apply competition policy, try to remove, say, oligopolistic behavior by applying competition policy, so I think that is very important to have a level playing field for all the firms involved.

Finally, I’d like to talk about this, not income inequality but the inequality of opportunity. That is quite different. What I think is important is people are not given fair opportunity, say, for education and so on, and this inter-generational problem is very important. If you’re parents are college graduate, you’re likely to be a college graduate. If you’re parents are high school graduates, they don’t send you to college. So, we have to deal with this problem now, in order to deal with this problem in the future. So, what I’d like to argue again is to provide education opportunity by maybe scholarships and so on. And hopefully these will help to narrow the income gap. Thank you

HOSHI: Thank you Shu. Kathy, do you want to answer his TPP question? If TPP survives, what would the US ask Japan to do?

STEPHENS: I have no idea, actually. I guess, again, I would fall back on my experience with the Korea-US Free Trade Agreement, which during the 2008 campaign, the then candidate Obama campaigned against. So, it was a bad deal for American workers, especially in theauto industry. He was quite specific about it. And when it came time, when he became president and he visited the agreement, he did look for some very specific changes in the agreement. Interestingly enough, in Korea it was never talked about as a renegotiation. Of course, for the US it was a renegotiation, but it was some adjustments. And the adjustments were primarily in postponing, I think, some of the lowering of tariffs on animal imports, for example. I haven’t heard anything nearly that specific in terms of TPP.

Secondly, I mean the other obvious point about TPP is that this is not a bilateral trade agreement, it’s among twelve countries. So, presumably, whatever is changed needs to be changed across the board, and it does make it considerably more complicated. I guess, you’re not asking me for advice, but nonetheless I guess it’s a good time for Japan to think about this, to think about what adjustments—maybe we can call them adjustments—might make sense when you look at the TPP and the change in the political atmosphere in a slightly longer time frame. I think Japan could be a leader on this.

I was going to dive slightly into the trade and inequality discussion, we keep circling around to it. It really is a fascinating thing to watch in my own country as well as in Japan and Korea, developed economies all of which have benefited so much from trade and globalization. I would observe that in the United States, notwithstanding the anti-trade rhetoric and positions of all the candidates in this last election campaign, polling shows that support for trade and understanding of trade in the United States is at an all-time high. This is not “back to the 1980s,” when American workers took sledgehammers to Japanese cars. People, including people from less educated backgrounds and from manufacturing states, understand that trade is a part of the landscape and that it will remain so. But I think we are in a situation where the impact of globalization, in a way, the consequences of success and of creating great new wealth, has created, I think, in each of our countries and certainly the United States at least in appearance an impression of lost opportunity, of less mobility. And I think that does extend, if I may say, I don’t see this primarily as a rich versus poor. I see it as a more broad loss of confidence and even of some optimism.

Mr. Trump campaigned on everything is bad, and it wasn’t just the uneducated who voted for that. It was a sense that maybe the doors of opportunity, which we still pride ourselves on, have closed a bit, even for those who have done all the right things. And I think there is a challenge for the new leadership. I’m optimistic that we can live up to it, but I think, when we look at the things that get blamed on trade by Preside-elect Trump in his rhetoric, it does go back to a sense that for the middle class—those trying to be upwardly mobile—things like education, access to healthcare, a good infrastructure, the kinds of public goods that in many of our minds used to be more accessible have become much more expensive and have become somewhat privatized. So, I think, that’s the other part of the debate that’s happening in the United States.

HOSHI: Kenji, I’ll give you two minutes before we open up for floor discussion.

KUSHIDA: Okay, since I have two minutes I’m not going to advertise my book, but most of the points I’m going to say came from a book in Japanese called, The Disruption of the Algorithmic Revolution. There are two main points that apply to the inequality discussion. Thefirst is, Silicon Valley innovation, a lot of it has been applying software to human activities and making them more productive and then eventually automating them, ranging from finance, like fintech, to automated driving, everything that you ever hear about artificial intelligence, and several other areas, and other areas we don’t know about. Therefore, automating people’s activities has been the source of a lot of productivity growth, innovation, etcetera.

So, for example, in the Tesla factory, if you go inside, there are very few people, it’s all automated. All these manufacturing plants can be rebuilt in the US, but they will employ very few people. So, what do we do? That’s the question because the trade rhetoric to me never made sense, because the factories come back, but jobs do not. And everything is going at exponential speed in accordance to processing power, increase in availability and decrease in price, never bet against the exponential.

The second point is about AI, artificial intelligence. The usual debate is that artificial intelligence will automate low-end jobs and high-end skill jobs will be okay. However, there’s also a branch of AI called IA, intelligence augmentation, where you can have low-skilled people doing high-skilled jobs. So, Komatsu, actually right across the street from here, is a wonderful Japanese example of that. The diggers, very low-skilled people can actually do the processes that used to require 10 years of experience because the machine has a lot of sensors, and they will stop you before you make a mistake. So, therefore, we’ve just converted high-skill work into low-skill-potential work. So, instead of counting the number of jobs that will be automated by AI, we should figure out, what kind of jobs are now high-end that can be done by low-skilled people and what those high-end people can do next, how do we count this? We don’t know yet, so I do not believe the consulting experts when they say this many jobs will be automated with AI.

However, IA, this might be the way forward, how do you deal with a large number of people that don’t have a lot of skills. Well, if you get them to do higher skilled jobs, this can actually free up the higher end people to do other things, so that’s what I’ll leave you with.

LAZEAR: One minute on this because I have to apologize for not answering your question, and Kathy took a shot at it, let me take a shot at it as well. I guess, what I would say if I were President Trump and what would I want from the Japanese, what I would want is free trade and services. And the reason for that, is that, remember all modern economies are primarily services. In the US it’s about 80 percent. And most of the restrictions on trade are restrictions on services right now. If you look at where low-income people are going, so kind of coming back to the inequality issue and I’m thinking, where are those people going to be employed, they are going to be employed in services, and so to the extent that President Trump is going to push the Japanese, or to the extent that you are pushing us on this, I would say, focus on the services side.

That also feeds into his pitch on inequality in opportunity, which I think is an important point. One of the things that he tried to do during the campaign was to try to get more African-Americans involved in supporting him than have traditionally been the case with Republicans. He succeeded a little bit. But basically his pitch was, what do you have to lose? Looking of decades of a terrible situation, inequality in opportunity, we need to turn that around. So, I think we have to hold his feet to the fire on that, let’s see what he can do.

HOSHI: So, let’s open up for questions, and I will take two or three questions. Microphone over here.

FEMALE QUESTIONER: Thank you for taking my question and thank you for this stimulating discussion. My name is Kaori Iida with NHK public television. I have a question to Professor Lazear. You briefly touched upon it in your short remarks, the difference between Preside-elect Trump and the traditional Republicans, especially with regard to spending. Last week in Japan, CEOs were in a state of shock saying that, oh my gosh, what’s going to happen to trade? But this week everybody is focusing on infrastructure spending, and is more positive that the Republicans and Congress will prevail. But as I was wondering, well, as you said, traditional Republicans being deficit hawks, budget hawks, will they go through with these big infrastructural programs. Just quickly, who do you think would be a good candidate for treasure secretary, commerce secretary?

HOSHI: There’s a question back there, so let’s move there.

MALE QUESTIONER: Good morning, my name is Takaaki Asano. I’m a research fellow here at the Tokyo Foundation. I have a question for Ambassador Stephens, two questions. One, how much do you think the issue of free trade has affected the outcome of thepresidential elections? When I say this, I’m talking specifically about three states, Wisconsin, Michigan, and Pennsylvania, which we know have consistently voted Democratic in the past six or seven presidential elections. But this time they voted Republican, that’s one.

And the second question would be the strategic aspect of TPP. Here in Tokyo, you invoke China and say that it’s not China, it’s us who should write the next rules for the economy. It works very well, as you know, but suppose TPP survives January 20th, as Dr. Urata put it, do you think stressing the strategic side would be a positive way to persuade Mr. Trump and his supporters in terms of TPP, thank you.

HOSHI: Let me take one more question. And I guess you can ask questions in Japanese too, yes.

MALE QUESTIONER: I’m from a policy research group. TPP is opposed by Mr. Trump, but with respect to Japan, the bill passed thelower house, and it’s been sent to the upper house. So, if things go as they are likely to go, the US may move out from TPP, we can join hands with China and South Korea in moving the TPP forward. What will be the attitude of the United States regarding the possible combination of Japan, China, and South Korea, without the US in promoting or concluding TPP? Regarding such a possible move, what will be the reaction of United States?

HOSHI: Ed first, and then Kathy, and then anyone else can join.

LAZEAR: Let me address the first set of questions quickly. With respect to infrastructure, you’re right that Republicans generally oppose spending. They don’t necessarily oppose infrastructure. In fact, the greatest infrastructure project in the United States in the second half of the twentieth century was the building of the inter-state highway, which was under Eisenhower. That was his idea, so it’s not necessarily the case. The issue is thinking of infrastructure as a stimulus versus infrastructure for long-term growth, and I think that, as a distinction, is important.

Infrastructure is a terrible way to stimulate an economy, and the reason is that it takes too long. I remember when I was in the White House, on Thanksgiving weekend of 2008, I called my team in. The then Preside-elect Obama was already talking about what he was going to do in terms of stimulus. I said, hey, should we do it? Why don’t we get going on this, we’re already in recession, why not do it? We looked at it, and we discovered that if we gave a dollar to the department of transportation, they would spend 25 cents in the first year and the other 75 cents would trickle out over the next 11 years. So, the point is, it’s just not very fast, it’s just not a very effective way to get an economy growing out of recession. But that does not mean it’s not good for the long run. So, I think, we always have to think about that. But then you have to think about the infrastructure and trade it off against all the other things that we would spend money on, like education and technology, and there are many, many things that you can think of.

If you’ve been to LaGuardia recently, that’s like landing in a third-world country. It’s unbelievable that that would be a premier airport in thebiggest city in the United States. But if you said, gee, suppose we cleaned it up, how much would that affect growth in the United States, or even in the New York, it’s not so clear that you get a whole lot out of it. So, the point is if you’re just thinking about growth, you may want to be thinking about the kinds of things that Shu is pushing in terms of more education, equality, and other programs like that, and that’s the tradeoff I think, that you have to think about.

You asked me about secretaries. Before I go to that, I just want to say one thing, and that is that I think there’s going to be some tension between President Trump and the Republican Congress because Paul Ryan, who is the speaker of the House and is a very influential politician and Republican, is basically a budget hawk and a policy wonk. He is a guy who spends his whole life thinking about policy and economic policy and is more knowledgeable than anybody in the country on that. So, I don’t think it’s going to be easy for President Trump to convince him to do things that will not be beneficial to the country, and I think there may be some tension developing there over time. In fact, I could envision that President Trump will end up being good buddies with Senator Schumer, who is actually the Democratic majority leader in the Senate right now.

Finally on cabinet positions, boy, I’m not going take a guess on that. What I will say is that, at least at the Treasury level, we’ve had a couple of, we’ve had some different models, let’s put it that way. Certainly one of the more successful models for the treasury secretary has been to take a person from Wall Street, a very respected CEO on Wall Street, the guy I worked with, who was my colleague in theWhite House, at the Treasury, was Hank Paulson, a terrific guy. Before him was Steve Friedman, another terrific guy, before him was Bob Rubin under Clinton, another terrific guy. So, that would be a model that I think President Trump should at least look at, and look at seriously.

HOSHI: Kathy?

STEPHENS: Thank you. With respect to the question of up to what extent the trade issues or free trade agreements play into the election results, particularly in the Midwest, I don’t know. Again, since both candidates in the general election had to disavow the free trade agreements and express concern about them, clearly their point was showing that there was little support, and they just want to stay away from it. But I don’t think it was the decisive issue. I think, as I said, that there was an understanding that trade goes on, the US has benefitted from the free trade system. But more and more fundamentally, there’s a lack of confidence, maybe in some of our institutions and some of our desire for a different direction, I can’t be more coherent than that, I guess. With respect to stressing the strategic aspects of the Trans-Pacific Partnership, I think that that’s something that as the administration gets settled down, and begins to get to know theallies in the region, notably Japan and Korea and others, and hears from them, I think this will become part of the discussion. It simply just hasn’t seemed to be one yet.

And I think that also goes to the second question on the issue of trade about what would be the US response, should Japan work with other counties, including China, on trade regimes, trade rules for the region. I think in general terms, the US has taken the approach that substance is more important that who’s in them, but certainly they should be inclusive, and we want to play a role. Mr. Trump has been a little more ambivalent about what the US role is but I think that sort of discussion and participation by Japan would raise the issue, raise the salience of it, and I think help clarify our own views about US interest in remaining embedded in a very open and inclusive trading and economic architecture in this region.

HOSHI: Thank you Kathy and time is running out so I apologize to Shu and Kenji that I can’t give you the time. Let me close the panel here, and let’s give a big applause to the panel.

MODERATOR: Thank you very much to the panelists. Here we would like to break for 10 minutes and then restart a panel discussion on foreign policy. We would like to have the next panel discussion in 10 minutes, so please make sure to come back by that time. Regarding the translation receivers, please keep it with you. If you are leaving this event, then please return it to the reception desk. Thank you very much.

* * *

MODERATOR: May we begin? Ladies and gentlemen, we would like to move to the second part of the panel discussion, a panel on foreign and security policy. The session will be moderated by Dr. Shin, director of Stanford University’ APARC.

GI-WOOK SHIN: We’d like to continue our discussion, this time on issues of security and foreign policy. There are many issues, but I think the central one is how important Asia will be in the new administration. As you know, the Obama government promoted the pivot to Asia. So, a lot of people are wondering whether the new government will continue this, the pivot to Asia, or change, given Trump’s isolationist rhetoric in the campaign. Here also, in the questions, the current status of the alliance with Japan and South Korea, so what will happen to the alliance? What about his policy in China or North Korea? So, I think there are many issues that we want to discuss.

I’m very happy to have three panelists today. The first one is Ambassador Michael Armacost. I don’t think he needs an introduction in Japan, but I’ll still mention a few things. He had a distinguished career in the US foreign service. As you know, he was the American ambassador to Tokyo in the early 1990s, I believe. And then after that he led the Brookings Institution, before joining our center in 2002, I believe. Since then he has been working with us at APARC.

The second speaker is also an ambassador, Ambassador Karl Eikenberry. He has a distinguished background in the military. He was commander of the American forces in Afghanistan and then served as an American ambassador to that country as well. He now leads theUS-Asia Security Institute at our center.

And last but not least is Dr. Bonji Ohara. I understand he also has a background in the military and intelligence affairs. He is now director of policy research at the Tokyo Foundation. So, let me start with Michael Armacost.

MICHAEL ARMACOST: Thank you very much. It’s a pleasure always to be back in Tokyo, and I congratulate the Tokyo Foundation on hosting this very important event. My task is to shed some light on how President Trump may conduct policy towards Asia. This requires much speculation because there’s not very much to go on yet.

This is the first time in 227 years that America has chosen as president someone who has never previously served in elected office or been a member of the cabinet. Donald Trump is a very successful businessman, but he has little experience in dealing with public policyissues. He has not served in the military. He has said or written relatively little on foreign and national security policy, nor is there anyone, I believe, within his personal entourage who is known as an expert in this field.

On the other hand, successful presidents are not remembered for the plans they brought with them to office, they are remembered for theway in which they responded to events which were largely unanticipated. But it’s difficult given the relative lack of experience to infer exactly how President Trump will react to unexpected events.

He has, to be sure, begun to announce some appointments, but the appointments announced publicly to date are domestic appointments in the White House. I think the appointment of Mr. Bannon as chief strategist and senior White House counselor was picking a man with a long association who has very strong views, not necessarily mainstream views either but is a nationalist and a populist who has been close to Mr. Trump for some time. We’ve yet to learn who will run the State Department, Defense Department, the National Security Council, and the Trade Representative’s Office, so we don’t really know who will be advising the president on a daily basis on these national security issues.

You recall that Mr. Trump basically ran against the Republican establishment and the gap between the views of the Republican establishment and the white, working-class base of the party was largely resolved in the favor of the views of the voters. And one of theresults is that many of the GOP experts in the field of foreign and national security policy expressed publicly doubts about Mr. Trump, and that has, I think, severely limited the recruiting pool for the administration.

During the campaign, Mr. Trump did obviously make a number of comments on foreign policy, but it’s important to remember that campaigning is different than governance, and what one says in the campaign is often moderated or modified once in office. During thestruggle for the nomination, candidates typically play to the base, and in playing to the base, the emphasis on criticism of trade and immigration policy, performance of some allies played to the base of resentful, angry, white working-class constituency. During thegeneral election campaigns, the party nominees typically pivot to the center to gathering votes from center and independents, but I would say, this year there was very little pivoting to the center either by Ms. Clinton or by Donald Trump.

And during the general election campaigns, it is normal for our candidates to throw out quite a number of aspirational goals in order to appeal to a wide variety of constituents. It is not typical to formulate a strategy, because strategy requires consideration of costs and risks and tactics and timing, and it’s on those matters that one can alienate the constituencies. Therefore, we know a bit about Mr. Trump’s goals. We don’t know exactly how he would proceed to implement them.

The campaign did reveal a couple of things about the mood of the American public. Free trade, as has been said, had no champion. Democracy promotion overseas was a dog that didn’t bark, and the central issue, atypically, was not the size of the government, which is often the central issue of the campaign, it was the openness of our borders. I don’t recall any other election in my adult life, even my whole life, where neither major party candidate promoted free trade. Mr. Trump’s protectionism, I think, is grounded in the conviction that trade is often the job killer. Mrs. Clinton’s protectionism was, I think, more tactical and was designed to accommodate the constituency with which she was competing with Bernie Sanders for votes, namely the labor unions.

As for democracy promotion, normally presidential candidates talk as though democracy is the solution for much of the world’s problems. This rhetoric was missing in the campaign, and I don’t think the reasons are particularly mysterious. For nearly 15 years, we fought long, costly, inconclusive wars in Afghanistan and Iraq. The public is war-weary, it’s war wary, and I think it perceives that we’re not especially adept in transforming the internal institutions of other societies.

I’ll say a bit more about Mr. Trump’s views on foreign policy. I don’t think he’s thought out philosophically about foreign policy. I think his knowledge of history is a bit thin. He is not a great reader. I think he gets his information mainly from colleagues and from the media, and it has struck me that in his conduct to date, he doesn’t seem to regard the balance of forces as a central concept in thinking about policy. Russia has been acting in Eastern Europe, in the Middle-East in ways that upset the balance, and yet Mr. Trump’s remarks about Putin or Russia did not reflect a perception of that reality or concern about it.

The TPP was designed as a trade agreement, but it was also a potential inhibitor of Chinese influence in Asia and the Pacific, yet Mr. Trump to date has rejected the deal without hinting that it had that kind of geopolitical significance. I suspect that will come.

Trump’s views on foreign policy strike me as primarily transactional. He is a negotiator, I think, and thinks of himself as making good deals. He has done a lot of deals in the real estate field. Whether that translates into negotiating skills on issues of sovereign states where many of the issues are shaded with heavy cultural, historic, political overtones, I don’t know. I suspect he will be rather good.

I wouldn’t say consistency is a major attribute of his views today, but there are some discernible themes. He has reservations about alliance systems that’s based, I think, on the suspicion that allies want our protection but are not disposed to pick up their fair share of theburden of mutual security, so I think that’s an area where he tends to do some renegotiating. I seriously doubt that when these comments were made, he had a detailed knowledge of the host nation’s support provided by Japan or other allies, and I expect Prime Minister Abe will devote a fair amount of time in his first meeting with Mr. Trump illuminating those things.

He has many reservations, as is being said, about trade. I think mainly this reflects the conviction that we’ve been out-negotiated on trade deals and that our negotiators haven’t been particularly attentive to the impact on our working class. And it’s true, I think, we’ve looked at trade agreements in the past, from the valid point that they open up to American consumers, the opportunity to buy the best prices available on the world, the most reasonable prices. And that’s good in hedging against inflation. It’s good for the freedom of Americans. But it looks at the winners, it doesn’t look so much at the losers, and in this election the losers caught the attention of our politicians more perhaps than our winners.