- Article

- Comparative and Area Studies

Anatomy of Chinese Corruption: Can Xi’s Crackdown Work?

March 31, 2015

How have corruption and economic growth continued to flourish side by side in today’s China? Combining his own insights with the findings of other scholars, China expert and economist Hiroyuki Kato sheds light on this seeming paradox and its relationship to the current crackdown.

* * *

Since 2013 Chinese President Xi Jinping has been waging a massive campaign against corruption, vowing to “strike at both tigers and flies.” At a meeting on June 30, 2014, the Politburo expelled four officials from the party for accepting bribes, among them Xu Caihou, former vice-chairman of the Central Military Commission and a general in the People’s Liberation Army. In July 2014 the media revealed that Zhou Yongkang, a high-ranking member of the Politburo Standing Committee Party prior to his retirement in 2012, was under investigation on suspicion of “serious disciplinary violations.” Such reports suggest that the government is serious about cracking down on corruption and will not hesitate to target high-profile party and military cadres.

That said, the efficacy of the campaign remains unclear. On January 10, 2014, the CPC’s Central Commission for Discipline Inspection announced that in 2013 government agencies had investigated about 173,000 corruption cases (up 11.2% from 2012) and disciplined about 182,000 officials (up 13.3%). These figures can be adduced as evidence of results. Conversely, they can be seen as an indication that graft is as prevalent as ever. Can the current campaign really halt the epidemic of corruption?

Corruption and Growth

The government’s focus on corruption stems from concerns that the problem could trigger social unrest and ultimately impact economic growth. So far, however, China has managed to defy conventional wisdom with respect to the impact of corruption on growth, having maintained a rapid rate of economic expansion amid a rising tide of corruption.

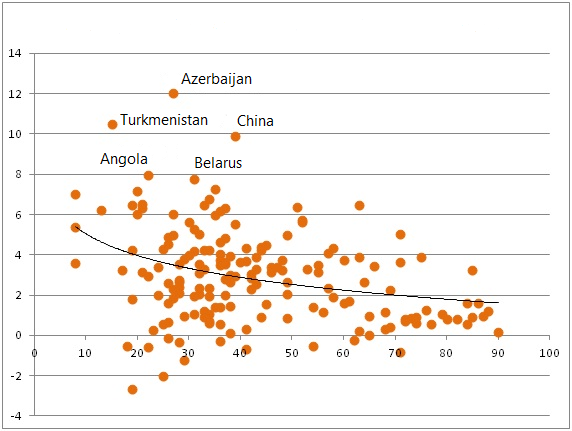

The figure below plots the perceived severity of public sector corruption (as gauged by Transparency International’s 2012 Corruption Perceptions Index ) against average annual growth in gross domestic product between 2000 and 2012. The horizontal axis represents the CPI score, which rises as perceptions of public sector honesty improve; the higher the score, in other words, the lower the perceived level of corruption. At first glance, the graph appears to suggest that a low level of corruption depresses growth. But this is a misreading of the data. The significant correlation is between per-capita income and corruption. In general, high-income nations, which inevitably grow at a slower pace, tend to have lower levels of corruption.

If we focus on countries in the low- to mid-income bracket with high levels of corruption, we see considerable disparities in the growth rate. A handful of countries, seen in the upper left quadrant, display very high levels corruption in combination with some of the world’s fastest growth rates. However, with the exception of China, all of these are low- or middle-income economies that owe their dramatic growth to the export of natural resources like oil, natural gas, or diamonds (Azerbaijan, Turkmenistan, Angola, and Belarus). China is clearly in a different category in terms of scale and development.

Corruption Perception Index and Economic Growth

Average GDP growth, 2000–2012 (%)

Sources: Transparency International, 2012 Corruption Perceptions Index ( http://www.transparency.org/cpi2012/ ), and International Monetary Fund, World Economic Outlook Database ( http://www.imf.org/external/pubs/ft/weo/2014/02/weodata/index.aspx ).

China as an East Asian Exception

Economics textbooks will tell you that public-sector corruption hinders economic growth by diverting resources for nonproductive purposes and inhibiting the development of a healthy business and investment environment. Empirical studies have, for the most part, confirmed a negative correlation between corruption and growth, other factors being equal. But there are well-known exceptions to the rule. In the larger emerging economies of East Asia (China, Indonesia, and Thailand), high levels of corruption have persisted alongside brisk economic growth, suggesting that a certain brand of corruption common in Asia is not a significant barrier to business and investment. [1]

Does this generalization, then, apply to China? Andrew Wedeman, who has made a detailed study of corruption in China, argues that there is a need to differentiate China’s experience from that of other Asian countries. [2] Wedeman distinguishes between “developmental corruption” and “predatory corruption.” Developmental corruption is a kind of government-business partnership, or political-economic “machine,” in which the party in power secures the support of the economic elite through measures that favor business. Predatory corruption refers to the kind of economic plunder embodied by officials who rake in huge sums through graft and spend the money on their mistresses or hide it in overseas accounts. During periods of industrialization, developmental corruption can actually promote growth by maintaining political stability amid pro-business policies, as previously seen in South Korea and Taiwan. Predatory corruption is by most accounts incompatible with the health and sustained growth of the economy.

In China, as Wedeman points out, there was no need to build a pro-business political machine, since the CPC had no rivals to power. Accordingly, the corruption that has run rampant in China during the past few decades falls mainly into the predatory category. How, then, has China managed to sustain such high levels of growth amid rising levels of predatory corruption? Wedeman’s basic answer is that in China’s case, growth came first, with corruption emerging later as a byproduct of the reform and opening process and the immense wealth that it generated.

Boiling Water in Small Pots

With this analysis in mind, I would highlight the role of a special mechanism built into China’s present political-economic system defining the relationship between the central and local government—what one might describe as “heating water in small pots.” As political scientist Cao Zhenghan has explained it, the Chinese system differs from the conventional model of centralized power in that it incorporates an ingenious feature to disperse risk and automatically adjust the degree of centralized control. [3]

Let us use the process of heating water as an analogy for economic development. Supposing you want to heat 1,000 liters of water. You need to turn off the heat as soon as the water boils, as continued boiling, under this analogy, causes the pot to burst—that is, trigger social unrest, leading to mass demonstrations against the government and major enterprises. Lacking the technology to monitor and control the temperature precisely, you must rely on judgment gained from experience, which is assumed to be accurate 90% of the time, meaning that there is still a 10% chance the pot will burst. If you heat all the water in one large tank, this degree of risk would be unacceptable.

So one solution is to heat the water in 1,000 one-liter vessels, each one monitored and controlled separately, and then transfer the heated water back to the large tank. Given the abovementioned technological constraints, the odds are that about 100 of those 1,000 vessels will burst, but you would still be left with 900 liters of hot water.

China has relied heavily on this mechanism to promote economic development and growth. When China began introducing market-based reforms in the late 1970s, it lacked clear-cut rules governing market activity, and local officials, rather than private entrepreneurs, played the leading role in the development process. This created a huge gray area of economic activity and subjected officials to great temptation in terms of reaping personal profit through economic development. In this way, shifting economic leadership to local officials spawned corruption at the same time that it fueled rapid development and growth.

Crackdown versus Structural Reform

The analogy of “heating water in small pots” can help clarify the relationship between growth and corruption in China. As soon as graft surpasses a certain threshold (in terms of the sums of money involved and the social impact), the government cracks down. Of course, if officials refrained from all such activity, they would avoid the risk of prosecution, but in that case the regions and sectors under their control may not grow as quickly, and their own prospects for advancement and personal enrichment may diminish. Under these circumstances, officials will tend to keep a finger to the wind and engage in graft at a level they suppose will be permissible. Eventually, however, some unlucky official or officials will cross the line and be targeted for investigation and punishment. Here we see how the “small pot” system disperses the risk. Even if 10% of officials fall victim to the crackdown, the remaining 90% will survive, and the economy will continue to develop and grow in spite of an environment of widespread corruption.

The best way to truly root out corruption in China would be to eliminate the gray areas in China’s political-economic system (the very areas that have hitherto supported China’s rapid growth). This would mean curtailing government officials’ role in the economy and taking the privatization of state-owned enterprises to the next level. At this point, however, there is no indication that the government of Xi Jinping is prepared to undertake such reforms.

On January 14, 2014, at the third plenary session of the Central Commission for Discipline Inspection, President Xi called for an intensification of anticorruption efforts through stronger regulations, better oversight, and more public disclosure. He urged the party organization and the CCDI to hold officials accountable and not allow regulations to become “paper tigers.” If the current government hopes to prevent corruption from reaching the highest levels and spiraling out of control—but without resorting to basic structural reforms—then it has no choice but to crack down even harder. Assuming the crackdown succeeds in reining in predatory corruption and preventing it from engulfing the state, then the coexistence of corruption and growth will likely continue in China for the foreseeable future.

1. Indermit Gill and Homi Kharas, An East Asian Renaissance: Ideas for Economic Growth (World Bank, 2007), http://siteresources.worldbank.org/INTEASTASIAPACIFIC/Resources/226262-1158536715202/EA_Renaissance_full.pdf .

2. Andrew Wedeman, Double Paradox: Rapid Growth and Rising Corruption in China (Cornell University Press, 2012).

3. Cao Zhenghan, “Zouchu zhongyan zhiguan, difang zhimin jiu geju,” Nanfang Zhoumou , June 24, 2010.